Chargebacks occur when a cardholder disputes a transaction, initiating a formal reversal through their bank, while refunds are initiated directly by the merchant to return funds to the customer. Chargebacks often involve investigation and potential fees, impacting the merchant's reputation and financial standing, whereas refunds provide a straightforward resolution to customer issues without third-party intervention. Understanding the differences between chargebacks and refunds helps businesses manage disputes effectively and maintain customer trust.

Table of Comparison

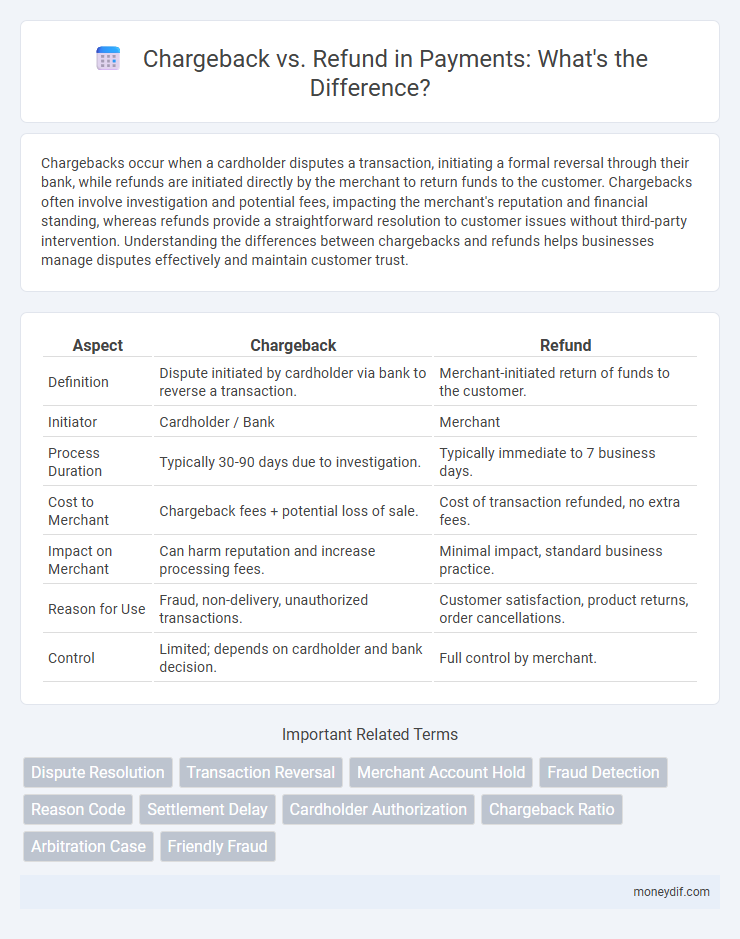

| Aspect | Chargeback | Refund |

|---|---|---|

| Definition | Dispute initiated by cardholder via bank to reverse a transaction. | Merchant-initiated return of funds to the customer. |

| Initiator | Cardholder / Bank | Merchant |

| Process Duration | Typically 30-90 days due to investigation. | Typically immediate to 7 business days. |

| Cost to Merchant | Chargeback fees + potential loss of sale. | Cost of transaction refunded, no extra fees. |

| Impact on Merchant | Can harm reputation and increase processing fees. | Minimal impact, standard business practice. |

| Reason for Use | Fraud, non-delivery, unauthorized transactions. | Customer satisfaction, product returns, order cancellations. |

| Control | Limited; depends on cardholder and bank decision. | Full control by merchant. |

Introduction to Chargebacks and Refunds

Chargebacks occur when a cardholder disputes a transaction, prompting the issuer to reverse the payment, often due to fraud or dissatisfaction. Refunds are initiated by the merchant to return funds to the customer voluntarily, typically after order cancellation or product returns. Understanding the distinction between chargebacks and refunds is critical for effective payment dispute management and minimizing financial losses.

Key Differences Between Chargebacks and Refunds

Chargebacks occur when a cardholder disputes a transaction with their bank, resulting in a temporary reversal of funds pending investigation, whereas refunds are initiated directly by the merchant to return money to the customer. Chargebacks often involve a formal dispute process, leading to potential financial penalties for merchants, while refunds are a voluntary resolution without third-party intervention. Understanding these key differences helps businesses manage payment risks and customer service more effectively.

How the Chargeback Process Works

The chargeback process begins when a cardholder disputes a transaction by contacting their issuing bank, which then investigates the claim for potential fraud or unauthorized activity. The issuing bank temporarily reverses the payment and requests evidence from the merchant to prove the transaction's legitimacy. If the merchant cannot provide sufficient proof, the bank finalizes the chargeback, returning the funds to the cardholder and debiting the merchant's account.

How the Refund Process Works

The refund process involves the merchant approving a return request and initiating a transaction to return funds directly to the customer's original payment method, typically within 5 to 10 business days. Unlike chargebacks, refunds are controlled by the merchant and avoid dispute escalation by resolving the issue voluntarily. Efficient refund management improves customer satisfaction and reduces the risk of chargebacks, which can impact merchant fees and account standing.

Reasons for Chargeback Requests

Chargeback requests often arise from unauthorized transactions, goods not received, or services not rendered as promised, reflecting customer disputes about the legitimacy or quality of a purchase. Fraudulent activity, billing errors, and merchant failure to comply with refund policies also contribute significantly to chargebacks. Understanding these specific reasons helps businesses implement effective risk management strategies and reduce potential financial losses.

Common Scenarios for Refunds

Refunds commonly occur in scenarios such as product returns due to defects, incorrect orders, or customer dissatisfaction with service quality. Businesses often process refunds when a payment was accidentally duplicated or when promotional terms were not met. These situations differ from chargebacks, which are typically initiated by the cardholder through their bank to dispute unauthorized or fraudulent transactions.

Impact of Chargebacks on Businesses

Chargebacks significantly impact businesses by causing direct financial losses, including the disputed transaction amount and additional chargeback fees averaging $20 to $100 per incident. High chargeback rates can harm merchant reputation, leading to increased processing fees, stricter bank scrutiny, and potential termination of payment processing accounts. Effective chargeback management is essential to minimize revenue loss and maintain healthy merchant standings with payment processors.

Pros and Cons: Chargebacks vs Refunds

Chargebacks provide strong consumer protection by allowing disputed transactions to be reversed through the payment processor, but they often result in higher fees and potential penalties for merchants. Refunds offer a straightforward resolution controlled by the merchant, fostering customer satisfaction and loyalty without additional charges, yet they require merchant approval and may not fully protect against fraudulent claims. Balancing chargebacks and refunds is essential for effective payment dispute management, minimizing financial losses while maintaining trust and compliance with payment network regulations.

Best Practices for Minimizing Chargebacks and Managing Refunds

Implement clear refund policies and provide easy access to customer service to address disputes before they escalate into chargebacks. Utilize fraud detection tools and maintain detailed transaction records to support dispute resolution effectively. Regularly analyze chargeback trends to identify and resolve root causes, improving customer satisfaction and reducing financial losses.

Choosing the Right Resolution: When to Issue a Refund or Accept a Chargeback

Issuing a refund is appropriate when the customer requests a return due to dissatisfaction or error, allowing merchants to maintain goodwill and avoid fees associated with chargebacks. Accepting a chargeback becomes necessary when unauthorized transactions or fraud claims arise, providing consumer protection under payment network rules. Evaluating transaction details, customer history, and evidence helps determine whether a refund preserves customer relationships or if accepting a chargeback safeguards business interests.

Important Terms

Dispute Resolution

Chargeback involves the cardholder disputing a transaction through their bank, often leading to a reversal of funds and potential merchant penalties, whereas a refund is a merchant-initiated return of funds to the customer without involving the payment processor or issuing bank. Understanding the distinction is crucial for e-commerce businesses to manage financial risk, maintain customer satisfaction, and comply with payment network regulations.

Transaction Reversal

Transaction reversal differs from chargeback and refund as it involves directly canceling a payment before settlement, whereas chargebacks are disputes initiated by cardholders after settlement and refunds are voluntary reimbursements issued by merchants.

Merchant Account Hold

Merchant account holds occur when chargebacks exceed refund transactions, signaling increased risk and temporarily restricting fund access.

Fraud Detection

Advanced fraud detection systems analyze transaction patterns to distinguish between chargebacks initiated due to fraudulent activity and legitimate refund requests, minimizing financial losses and enhancing customer trust.

Reason Code

Reason codes classify specific causes of chargebacks versus refunds to streamline dispute resolution and improve transaction processing accuracy.

Settlement Delay

Settlement delay often impacts chargeback resolution times more significantly than standard refund processes due to extended dispute investigations.

Cardholder Authorization

Cardholder authorization secures transaction approval directly from the cardholder, reducing chargeback risks by verifying consent, whereas refunds are merchant-initiated returns of funds without requiring cardholder approval.

Chargeback Ratio

A low chargeback ratio compared to refund rates indicates effective dispute resolution and customer satisfaction management.

Arbitration Case

Arbitration cases involving chargebacks versus refunds often hinge on the merchant's evidence of transaction authenticity and the consumer's adherence to refund policies.

Friendly Fraud

Friendly fraud occurs when a customer disputes a legitimate charge as a chargeback instead of requesting a refund, leading to increased financial losses and complications for merchants.

Chargeback vs Refund Infographic

moneydif.com

moneydif.com