Cash pick-up allows recipients to access funds quickly without needing a bank account, making it ideal for unbanked individuals or those in remote areas. Account credit sends money directly to the recipient's bank account, offering convenience and security for regular users with banking access. Choosing between cash pick-up and account credit depends on factors like accessibility, speed, and recipient preferences.

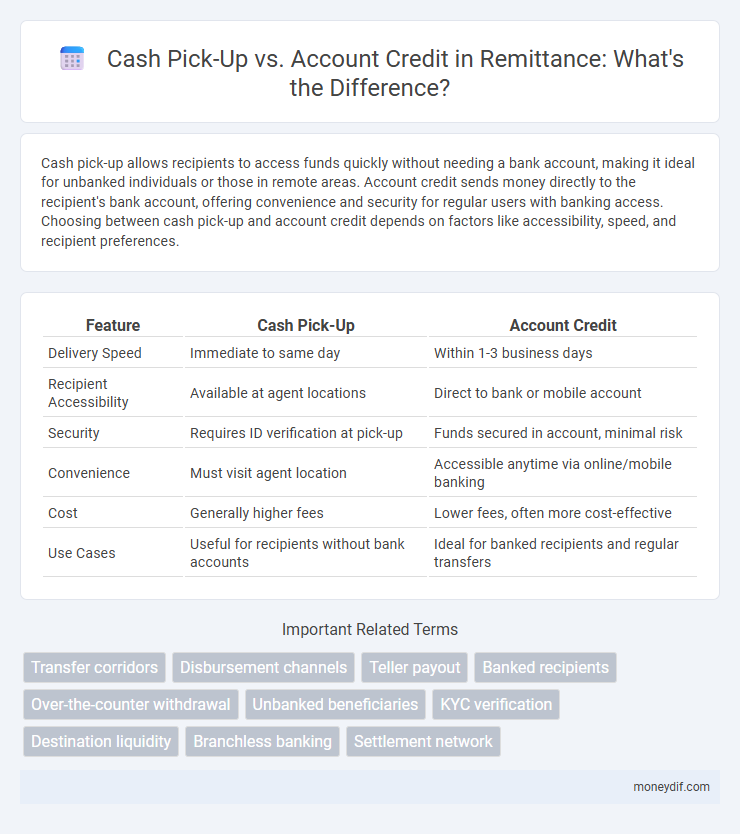

Table of Comparison

| Feature | Cash Pick-Up | Account Credit |

|---|---|---|

| Delivery Speed | Immediate to same day | Within 1-3 business days |

| Recipient Accessibility | Available at agent locations | Direct to bank or mobile account |

| Security | Requires ID verification at pick-up | Funds secured in account, minimal risk |

| Convenience | Must visit agent location | Accessible anytime via online/mobile banking |

| Cost | Generally higher fees | Lower fees, often more cost-effective |

| Use Cases | Useful for recipients without bank accounts | Ideal for banked recipients and regular transfers |

Overview of Cash Pick-Up and Account Credit Remittance

Cash pick-up remittance enables recipients to collect funds in cash from designated agent locations, offering immediate access without requiring a bank account. Account credit remittance transfers funds directly to the beneficiary's bank or mobile wallet, providing convenience and security through electronic access. Both methods optimize money transfer efficiency, with cash pick-up favoring unbanked recipients and account credit enhancing digital financial inclusion.

Key Differences Between Cash Pick-Up and Account Credit

Cash pick-up allows recipients to receive funds physically at designated locations, providing immediate access without needing a bank account. Account credit transfers funds directly into the beneficiary's bank or mobile wallet, offering convenience and security through electronic transactions. Key differences include accessibility, transaction speed, and reliance on banking infrastructure, with cash pick-up suited for those without bank access and account credit preferred for seamless digital transfers.

Advantages of Cash Pick-Up Services

Cash pick-up services offer immediate access to funds without the need for a bank account, providing convenience for recipients in remote or underbanked areas. With widespread agent networks in countries like the Philippines, Mexico, and India, cash pick-up ensures fast and flexible collection at numerous locations. This service reduces barriers for urgent financial needs and supports recipients who prefer physical cash over digital transfers.

Benefits of Account Credit Remittance

Account credit remittance offers enhanced convenience by allowing recipients to receive funds directly into their bank accounts, eliminating the need for physical cash pick-up locations. This method increases security by reducing risks associated with cash handling, such as loss or theft. Additionally, account credit enables faster access to funds, supporting seamless online transactions and bill payments for recipients globally.

Security Considerations: Cash vs. Account Transfers

Cash pick-up remittances involve physical handling of money, increasing risks of theft or loss during transit or at collection points, while account credit transfers utilize secure electronic banking systems with encryption and authentication protocols to protect funds. Account credits reduce the likelihood of fraud by directly depositing money into the recipient's bank account, minimizing cash exposure and enhancing transaction traceability. Security enhancements in digital transfers include multi-factor authentication and real-time transaction monitoring, which are less feasible in cash pick-up scenarios.

Speed of Transaction: Which is Faster?

Cash pick-up transactions typically offer faster access to funds, often allowing recipients to collect money within minutes at designated locations worldwide. Account credit transfers may take longer, depending on the recipient's bank processing times, ranging from a few minutes to several business days. Factors such as network efficiency, service provider partnerships, and local banking hours influence the overall speed of both cash pick-up and account credit remittances.

Cost Comparison: Fees and Exchange Rates

Cash pick-up services typically involve higher fees and less favorable exchange rates compared to account credit options, increasing the overall cost for recipients. Exchange rate markups in cash pick-up tend to be significantly greater, reducing the effective amount received after conversion. Account credit transfers benefit from lower transaction fees and more competitive exchange rates, resulting in better value for international remittances.

Accessibility for Recipients: Cash Pick-Up vs. Account Deposit

Cash pick-up services offer immediate physical access to funds at designated locations, making them ideal for recipients without bank accounts or those in remote areas. Account deposits provide seamless direct transfers to recipients' bank accounts, enhancing security and convenience, but require the recipient to have an active bank account. Accessibility is often determined by local banking infrastructure and recipient preferences, with cash pick-up favoring unbanked populations and account deposits suited for digitally connected users.

Use Cases: When to Choose Cash Pick-Up or Account Credit

Cash pick-up is ideal for recipients without bank accounts or immediate access to digital banking, ensuring quick liquidity in emergencies or rural areas. Account credit suits recipients with bank accounts who prefer secure, convenient deposit for future use or bill payments. Choosing between cash pick-up and account credit depends on recipient preferences, banking infrastructure, and urgency of funds access.

Future Trends in Remittance Methods

Future trends in remittance methods emphasize the growing preference for account credit over cash pick-up due to enhanced security, speed, and convenience. Digital wallets and mobile banking platforms are expected to dominate, enabling direct transfers to recipients' bank accounts or mobile money services. Integration of blockchain technology promises to further reduce fees and processing times, driving widespread adoption of account credit solutions globally.

Important Terms

Transfer corridors

Transfer corridors characterize remittance pathways between specific countries, influencing whether funds are delivered via cash pick-up or direct account credit; cash pick-up offers immediate physical access to money in designated locations, while account credit ensures secure and fast deposits into recipients' bank accounts. The choice depends on factors such as recipient banking infrastructure, transfer cost, convenience, and urgency of access to funds in the sender and receiver regions.

Disbursement channels

Disbursement channels such as cash pick-up provide immediate physical access to funds for recipients without bank accounts, while account credit directly deposits money into a beneficiary's bank or mobile wallet, offering greater security and convenience. Cash pick-up is preferred in regions with limited banking infrastructure, whereas account credit supports seamless digital transactions and reduces handling risks.

Teller payout

Teller payout offers immediate cash pick-up for customers seeking instant access to funds, while account credit deposits directly transfer money into recipients' bank accounts for secure, traceable transactions. Cash pick-up suits unbanked individuals needing physical cash, whereas account credit supports digital payment systems and enhances financial inclusion through seamless fund management.

Banked recipients

Banked recipients typically prefer account credit for cash disbursements as it provides direct deposit into their bank accounts, ensuring security and convenience. In contrast, cash pick-up services offer immediate liquidity without needing a bank account, which is essential for recipients without banking access or in urgent need of funds.

Over-the-counter withdrawal

Over-the-counter withdrawal allows customers to receive funds directly as cash pick-up at designated locations, providing immediate access without needing a bank account. Account credit, in contrast, deposits funds electronically into a recipient's bank account, offering convenience and security but requiring banking infrastructure.

Unbanked beneficiaries

Unbanked beneficiaries often prefer cash pick-up methods due to the lack of access to formal banking infrastructure, enabling immediate liquidity without the need for an account. In contrast, account credit transfers, while secure and cost-effective, remain inaccessible to unbanked individuals who do not hold bank accounts, limiting the reach of digital financial services.

KYC verification

KYC verification ensures customer identity and compliance in both cash pick-up and account credit transactions, reducing fraud risks and enhancing security. Cash pick-up requires stricter KYC checks at physical locations, whereas account credit allows seamless verification through digital channels.

Destination liquidity

Destination liquidity determines the immediacy and convenience of fund access, where cash pick-up allows recipients to receive money physically at agent locations, facilitating instant liquidity without requiring a bank account. In contrast, account credit deposits funds directly into the recipient's bank or mobile wallet, promoting secured storage and potentially longer-term financial management but may delay immediate cash availability.

Branchless banking

Branchless banking enables cash pick-up services that offer immediate liquidity without requiring a bank account, while account credit deposits provide secure, direct access to funds within a digital or traditional banking platform. Cash pick-up suits unbanked populations seeking quick cash, whereas account credit enhances financial inclusion by integrating users into the formal banking ecosystem through mobile wallets or bank accounts.

Settlement network

Settlement networks facilitate efficient cash pick-up services by enabling recipients to collect funds directly from designated locations without needing a bank account, whereas account credit settlements transfer money electronically to the recipient's bank account, offering faster access and transaction records. Cash pick-up is ideal in regions with low banking penetration, while account credit suits users prioritizing convenience and digital financial inclusion.

cash pick-up vs account credit Infographic

moneydif.com

moneydif.com