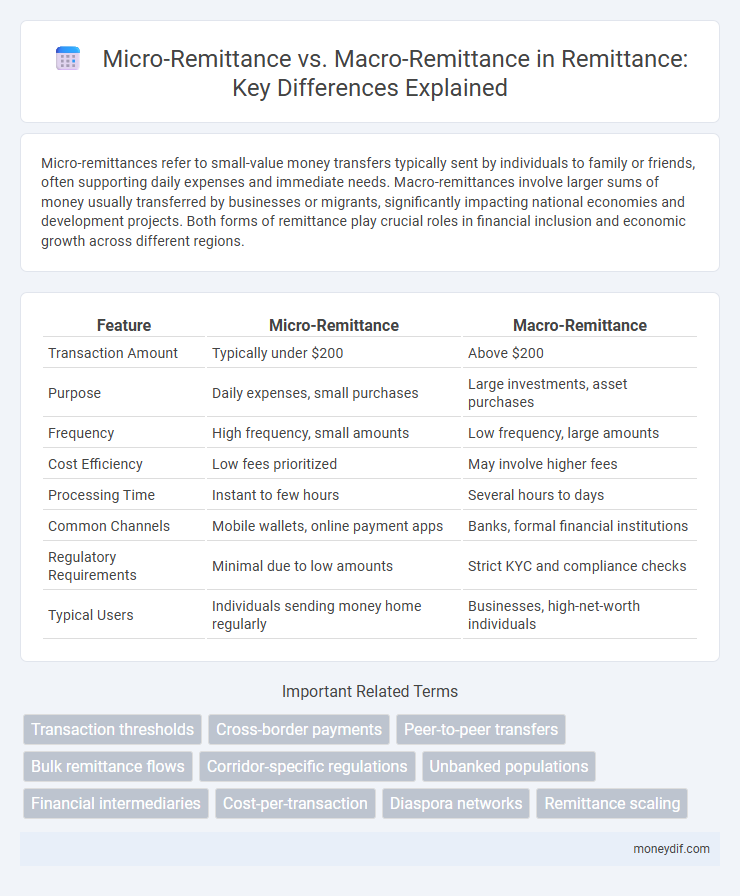

Micro-remittances refer to small-value money transfers typically sent by individuals to family or friends, often supporting daily expenses and immediate needs. Macro-remittances involve larger sums of money usually transferred by businesses or migrants, significantly impacting national economies and development projects. Both forms of remittance play crucial roles in financial inclusion and economic growth across different regions.

Table of Comparison

| Feature | Micro-Remittance | Macro-Remittance |

|---|---|---|

| Transaction Amount | Typically under $200 | Above $200 |

| Purpose | Daily expenses, small purchases | Large investments, asset purchases |

| Frequency | High frequency, small amounts | Low frequency, large amounts |

| Cost Efficiency | Low fees prioritized | May involve higher fees |

| Processing Time | Instant to few hours | Several hours to days |

| Common Channels | Mobile wallets, online payment apps | Banks, formal financial institutions |

| Regulatory Requirements | Minimal due to low amounts | Strict KYC and compliance checks |

| Typical Users | Individuals sending money home regularly | Businesses, high-net-worth individuals |

Defining Micro-Remittance and Macro-Remittance

Micro-remittances refer to small-value money transfers typically sent by individual migrants to support family members or cover daily expenses, often ranging from a few dollars to a few hundred dollars per transaction. Macro-remittances involve larger sums of money transferred across borders, usually by corporations, governments, or through official financial channels for investment, development projects, or large-scale economic activities. Both micro and macro-remittances play crucial roles in sustaining livelihoods and boosting economic growth in recipient countries, with micro-remittances directly impacting household welfare and macro-remittances influencing national economic stability.

Key Differences Between Micro-Remittance and Macro-Remittance

Micro-remittances refer to small-value money transfers typically sent by migrant workers to support daily expenses, while macro-remittances involve larger sums aimed at investments or business capital. The frequency of micro-remittances is higher with amounts often below $200, contrasting with infrequent but substantial macro-remittances exceeding $1,000. Micro-remittances primarily sustain household consumption, whereas macro-remittances significantly impact broader economic development and infrastructure.

The Role of Micro-Remittance in Financial Inclusion

Micro-remittances, typically small-value transfers sent by low-income migrants, play a crucial role in promoting financial inclusion by enabling access to formal financial services for underserved populations. These small transactions foster savings, credit access, and digital financial literacy among recipients, often women and rural households, contributing to poverty reduction and economic empowerment. Compared to macro-remittances, which are larger and frequently used for investment or consumption, micro-remittances emphasize everyday financial needs, making them essential for building resilient, inclusive financial ecosystems.

Macro-Remittance: Economic Impact on National Economies

Macro-remittances, typically large-scale fund transfers by migrant workers, significantly boost national economies by increasing foreign exchange reserves and supporting GDP growth. These inflows stimulate investment in infrastructure, healthcare, and education, fostering sustainable development and poverty reduction. Countries heavily reliant on macro-remittances benefit from enhanced economic stability and improved balance of payments.

Transaction Costs: Micro vs Macro-Remittance

Micro-remittances typically incur higher transaction costs per dollar sent due to lower transfer amounts and less favorable fee structures compared to macro-remittances. Bulk transfers in macro-remittances benefit from economies of scale, reducing fees and increasing cost-efficiency for senders. Optimizing digital platforms and leveraging fintech innovations can further lower transaction costs across both micro and macro-remittance channels.

Regulatory Challenges in Micro and Macro-Remittance

Micro-remittance transactions often face stringent regulatory challenges due to their small size, frequent nature, and the high volume of transactions, which can trigger anti-money laundering (AML) and know your customer (KYC) compliance requirements that are costly and complex for service providers. Macro-remittances, while involving larger amounts, also encounter regulatory scrutiny, especially concerning cross-border capital flow controls, tax reporting, and foreign exchange regulations imposed by governments and financial authorities. Both micro and macro-remittance sectors must navigate varying international regulatory frameworks, impacting transparency, transaction speed, and operational costs.

Technological Innovations Shaping Remittance Sizes

Technological innovations such as blockchain and mobile payment platforms drive the evolution of micro-remittances by enabling faster, cost-efficient, and secure transactions at a smaller scale, catering to low-income users and frequent, low-value transfers. In contrast, macro-remittances benefit from advanced data analytics and automated compliance tools that enhance transparency and regulatory adherence for large, cross-border capital movements. These technological advancements collectively reshape remittance sizes by optimizing transaction costs, speed, and accessibility across different transfer scales.

User Demographics: Who Sends Micro and Macro-Remittances?

Micro-remittances are predominantly sent by low-income migrant workers and individuals in informal employment seeking to support family members in developing countries, often involving small, frequent transfers. Macro-remittances typically come from highly skilled professionals and expatriates with higher disposable incomes, directing larger sums to their countries of origin for investment or business purposes. User demographics for micro-remittances skew younger and less economically stable, while macro-remittance senders tend to be older, economically secure, and residing in developed economies.

Security and Compliance in Remittance Transfers

Micro-remittance transfers typically emphasize enhanced security protocols due to their high transaction volume and smaller individual amounts, requiring robust fraud detection and anti-money laundering (AML) measures. Macro-remittances involve larger sums and demand stricter compliance with international financial regulations, including Know Your Customer (KYC) verification and cross-border transaction monitoring to prevent illicit activities. Both micro and macro-remittances must align with regulatory standards set by organizations like the Financial Action Task Force (FATF) to ensure secure and compliant transfer processes.

Future Trends: Evolving Micro-Remittance and Macro-Remittance Markets

Micro-remittance volumes are projected to surge due to increasing mobile money adoption and greater access to digital financial services in developing economies. Macro-remittance flows are expected to stabilize with enhanced cross-border payment infrastructures, improving transfer speed and lowering transaction costs. Innovations such as blockchain technology and regulatory harmonization will further drive efficiency and transparency across both micro and macro-remittance markets.

Important Terms

Transaction thresholds

Transaction thresholds differentiate micro-remittances, typically under $200, from macro-remittances exceeding $200, influencing processing fees and regulatory requirements.

Cross-border payments

Cross-border payments involve transferring funds between different countries, where micro-remittances typically consist of small, frequent transactions sent by individuals to support family members, often under $200, while macro-remittances refer to larger, less frequent transfers usually sent for business or investment purposes exceeding $1,000. Efficient processing of micro-remittances relies on low fees and rapid settlement through digital platforms, whereas macro-remittances prioritize security, compliance with regulatory frameworks, and higher transaction limits often facilitated by traditional banking channels.

Peer-to-peer transfers

Peer-to-peer transfers enable efficient micro-remittances by reducing fees and processing times compared to traditional macro-remittance channels used for larger cross-border transactions.

Bulk remittance flows

Bulk remittance flows, distinct from micro-remittances typically under $500, involve large-value transfers often exceeding $1,000, primarily driven by corporate payments and institutional transactions, whereas macro-remittances refer broadly to sizable cross-border transfers influencing national economies.

Corridor-specific regulations

Corridor-specific regulations distinguish micro-remittance limits typically under $500 from macro-remittance frameworks exceeding $10,000, impacting compliance, reporting, and transaction fees uniquely.

Unbanked populations

Unbanked populations disproportionately rely on micro-remittances, which involve small, frequent money transfers that are crucial for daily subsistence and local economic support. Macro-remittances, characterized by larger, less frequent transfers, tend to be less accessible to unbanked individuals due to limited formal financial infrastructure and higher transaction costs.

Financial intermediaries

Financial intermediaries streamline the transfer of micro-remittances under $200 by reducing costs and increasing accessibility, while facilitating macro-remittances greater than $200 through enhanced compliance and larger-scale transaction processing.

Cost-per-transaction

Cost-per-transaction for micro-remittances typically exceeds that of macro-remittances due to smaller transfer amounts and relatively fixed operational expenses.

Diaspora networks

Diaspora networks facilitate efficient micro-remittance flows by leveraging social ties and digital platforms, complementing traditional macro-remittance channels that involve larger, formal financial transfers.

Remittance scaling

Micro-remittances, typically small, frequent transfers under $200, drive remittance scaling by increasing financial inclusion and digital payment adoption compared to less frequent, larger macro-remittances.

micro-remittance vs macro-remittance Infographic

moneydif.com

moneydif.com