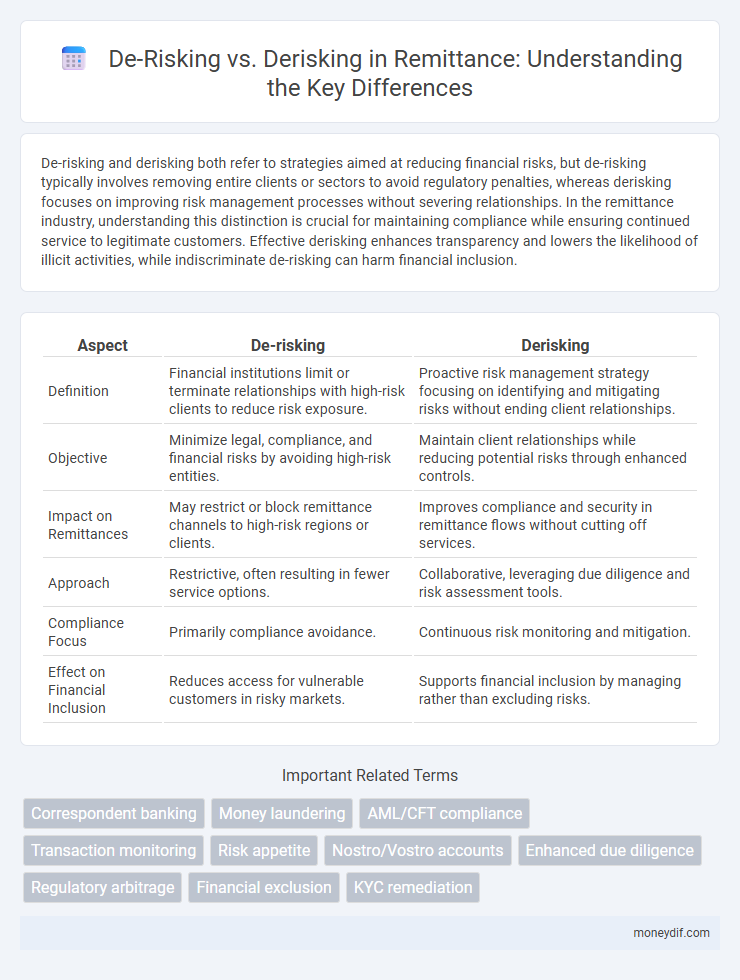

De-risking and derisking both refer to strategies aimed at reducing financial risks, but de-risking typically involves removing entire clients or sectors to avoid regulatory penalties, whereas derisking focuses on improving risk management processes without severing relationships. In the remittance industry, understanding this distinction is crucial for maintaining compliance while ensuring continued service to legitimate customers. Effective derisking enhances transparency and lowers the likelihood of illicit activities, while indiscriminate de-risking can harm financial inclusion.

Table of Comparison

| Aspect | De-risking | Derisking |

|---|---|---|

| Definition | Financial institutions limit or terminate relationships with high-risk clients to reduce risk exposure. | Proactive risk management strategy focusing on identifying and mitigating risks without ending client relationships. |

| Objective | Minimize legal, compliance, and financial risks by avoiding high-risk entities. | Maintain client relationships while reducing potential risks through enhanced controls. |

| Impact on Remittances | May restrict or block remittance channels to high-risk regions or clients. | Improves compliance and security in remittance flows without cutting off services. |

| Approach | Restrictive, often resulting in fewer service options. | Collaborative, leveraging due diligence and risk assessment tools. |

| Compliance Focus | Primarily compliance avoidance. | Continuous risk monitoring and mitigation. |

| Effect on Financial Inclusion | Reduces access for vulnerable customers in risky markets. | Supports financial inclusion by managing rather than excluding risks. |

Understanding De-risking in the Remittance Industry

De-risking in the remittance industry involves financial institutions reducing or eliminating services to clients perceived as high-risk to comply with regulatory standards and prevent money laundering. This practice impacts remittance operators by restricting access to correspondent banking, increasing transaction costs, and limiting service availability in certain regions. Understanding de-risking is essential for developing regulatory frameworks that balance financial security with the accessibility of remittance services for migrant communities.

Defining De-risking vs Derisking: Semantic and Practical Differences

De-risking refers to the strategic process financial institutions use to reduce exposure to high-risk customers or regions, often resulting in restricted access to remittance services for certain populations. Derisking, a less common term, is often used interchangeably but lacks formal recognition and precise definition in regulatory guidelines, leading to semantic confusion. Understanding the distinction is crucial for policy frameworks aimed at balancing financial security with inclusive remittance flows.

The Impact of De-risking on Money Transfer Operators

De-risking significantly affects money transfer operators (MTOs) by limiting their access to correspondent banking services, which disrupts cross-border transactions essential for remittances. This practice often forces MTOs to incur higher operational costs or cease operations in high-risk regions, directly impacting the flow of funds to vulnerable populations. Regulatory efforts to balance financial integrity and financial inclusion are crucial in mitigating the adverse effects of de-risking on global remittance channels.

Regulatory Drivers Behind De-risking in Remittances

Regulatory drivers behind de-risking in remittances stem primarily from increased anti-money laundering (AML) and counter-terrorism financing (CTF) compliance requirements imposed by global financial authorities such as the Financial Action Task Force (FATF). Banks and financial institutions often implement stringent Know Your Customer (KYC) procedures and risk assessment frameworks to mitigate potential legal and reputational risks associated with high-risk corridors. These regulatory pressures lead to selective withdrawal of services from remittance corridors perceived as non-compliant or high-risk, impacting the accessibility and cost of cross-border money transfers for migrant workers.

How De-risking Affects Financial Inclusion

De-risking in remittance refers to financial institutions terminating or restricting relationships with clients or countries perceived as high-risk to comply with anti-money laundering (AML) regulations. This practice significantly reduces access to formal financial services for vulnerable populations, hindering financial inclusion by pushing remittance flows into informal channels. As a result, millions of migrants and their families face increased transaction costs and reduced security in transferring funds globally.

Addressing AML/CFT Concerns Without Over-De-risking

Addressing AML/CFT concerns requires a balanced approach that mitigates risks without over-derisking remittance corridors, which can restrict financial inclusion and limit access to essential services. Financial institutions must implement robust transaction monitoring, customer due diligence, and risk-based frameworks to detect suspicious activities while maintaining service accessibility. Leveraging technology and data analytics enhances compliance efficiency, reducing the likelihood of excessive de-risking that disrupts the remittance ecosystem.

Global Remittance Flows: Challenges from De-risking

Global remittance flows face significant challenges due to de-risking, where financial institutions reduce exposure to certain regions or sectors to avoid regulatory risks linked to money laundering and terrorism financing. This practice disrupts access to formal financial services for migrant workers and their families, increasing reliance on informal channels that are less secure and more costly. Effective regulatory frameworks and enhanced due diligence are essential to balance risk mitigation with the facilitation of safe, affordable global remittance transfers.

Solutions and Alternatives to De-risking for Banks

Banks facing de-risking challenges can adopt comprehensive compliance technologies such as advanced transaction monitoring and AI-driven customer due diligence to improve risk assessment without severing relationships. Collaborations with fintech firms and leveraging blockchain for transparent, immutable transaction records offer secure alternatives that maintain correspondent banking links. Strengthening regulatory engagement and adopting tiered risk-based approaches enable banks to balance compliance with financial inclusion in remittance services.

The Future of Derisking in Cross-Border Payments

The future of derisking in cross-border payments focuses on enhancing regulatory compliance while maintaining financial inclusion for remittance senders and recipients. Advanced technologies like AI-powered transaction monitoring and blockchain enable more precise risk assessment, reducing the blanket exclusion of certain regions or customers. Financial institutions and regulators increasingly collaborate to create balanced frameworks that mitigate illicit activities without hindering the flow of remittances.

Policy Recommendations for Balanced De-risking in Remittances

Policy recommendations for balanced de-risking in remittances emphasize establishing clear regulatory frameworks that protect financial institutions from undue risk while ensuring inclusive access for migrant populations. Risk-based approaches should differentiate between legitimate remittance flows and illicit activities through enhanced due diligence and targeted compliance measures, without compromising service availability. Encouraging collaboration between regulators, financial institutions, and remittance service providers fosters transparency and innovation, mitigating financial crime risks while supporting the economic benefits of remittances.

Important Terms

Correspondent banking

Correspondent banking involves cross-border financial services where de-risking refers to reducing exposure to high-risk clients or regions by closing relationships, whereas derisking may indicate implementing comprehensive risk management strategies to maintain compliant correspondent relationships. Financial institutions increasingly prefer derisking practices to balance regulatory compliance and global connectivity, avoiding the blanket withdrawal seen in de-risking trends.

Money laundering

Money laundering involves disguising illicit funds as legitimate, often prompting financial institutions to engage in de-risking by terminating or restricting business relationships with high-risk clients to avoid regulatory penalties. De-risking reduces exposure to potential money laundering activities but can inadvertently exclude vulnerable populations from accessing essential financial services.

AML/CFT compliance

AML/CFT compliance requires financial institutions to implement robust risk assessment frameworks to identify and mitigate risks of money laundering and terrorist financing, where "de-risking" involves reducing or terminating relationships with high-risk clients, potentially impacting financial inclusion. Effective derisking strategies balance regulatory compliance with maintaining access to essential financial services, ensuring that institutions do not inadvertently exclude legitimate customers while managing risks prudently.

Transaction monitoring

Transaction monitoring is essential for identifying suspicious activities and minimizing financial crime risks, playing a crucial role in the de-risking process where institutions reduce exposure to high-risk clients or sectors. Effective derisking strategies balance risk mitigation with financial inclusion, ensuring compliance with regulatory frameworks such as AML (Anti-Money Laundering) and KYC (Know Your Customer) obligations while maintaining access to banking services.

Risk appetite

Risk appetite defines the level of risk an organization is willing to accept in pursuit of its objectives, influencing strategies on de-risking--actively reducing exposure to risk--and derisking, which often refers to discontinuing or avoiding high-risk activities altogether. Understanding an enterprise's risk appetite ensures a balanced approach, optimizing resource allocation between mitigating risks and maintaining operational resilience.

Nostro/Vostro accounts

Nostro and Vostro accounts facilitate cross-border banking transactions by holding foreign currency balances that reduce settlement risks, playing a critical role in financial institutions' risk management strategies. Effective derisking practices focus on compliance and transparency to mitigate exposure to money laundering and terrorist financing without disrupting vital Nostro/Vostro banking relationships.

Enhanced due diligence

Enhanced due diligence (EDD) involves a thorough investigation of high-risk clients to mitigate compliance risks, focusing on verifying identities, sources of funds, and transaction patterns. This process helps financial institutions balance the need for risk mitigation while avoiding blanket derisking practices that exclude legitimate customers and destabilize market access.

Regulatory arbitrage

Regulatory arbitrage occurs when financial institutions exploit differences in regulations across jurisdictions to reduce compliance costs or capital requirements, often influencing decisions around de-risking, which involves terminating or restricting business relationships to avoid regulatory scrutiny. Derisking aims to minimize exposure to regulatory risks, but excessive derisking can lead to unintended consequences such as reduced financial inclusion and pushback from affected communities.

Financial exclusion

Financial exclusion results from de-risking practices where banks limit services to clients perceived as high-risk, reducing access to essential financial products, especially for marginalized groups. This approach contrasts with derisking strategies aiming to balance risk management with inclusive policies that foster broader financial participation and economic empowerment.

KYC remediation

KYC remediation plays a critical role in de-risking by updating and validating customer information to identify and mitigate potential financial crimes and compliance risks. Effective remediation processes reduce the need for derisking, which involves terminating business relationships with high-risk clients to maintain regulatory compliance and safeguard institutional integrity.

de-risking vs derisking Infographic

moneydif.com

moneydif.com