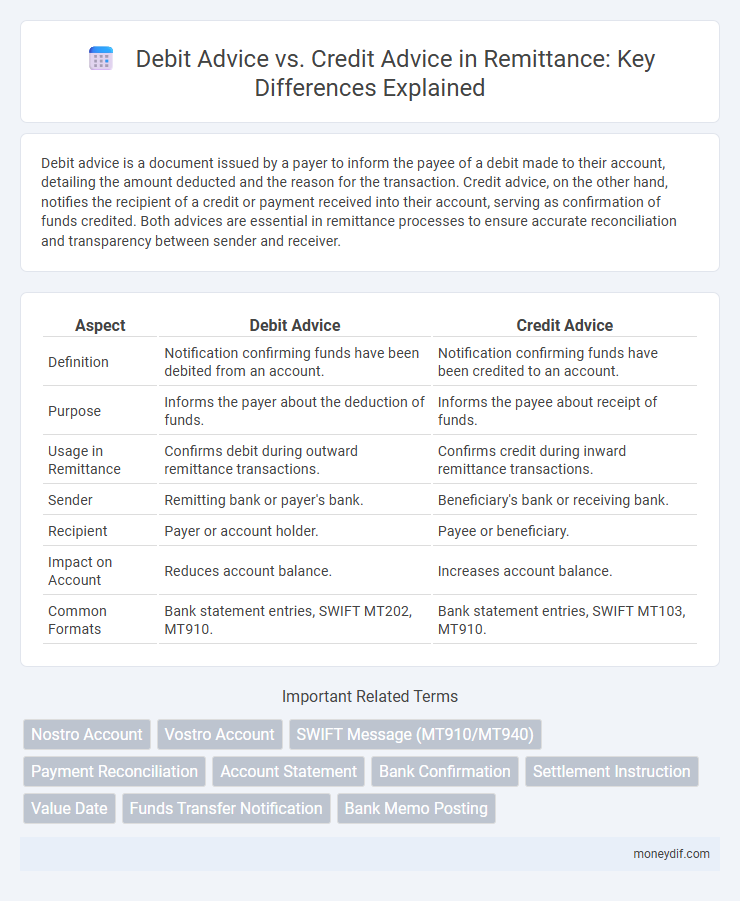

Debit advice is a document issued by a payer to inform the payee of a debit made to their account, detailing the amount deducted and the reason for the transaction. Credit advice, on the other hand, notifies the recipient of a credit or payment received into their account, serving as confirmation of funds credited. Both advices are essential in remittance processes to ensure accurate reconciliation and transparency between sender and receiver.

Table of Comparison

| Aspect | Debit Advice | Credit Advice |

|---|---|---|

| Definition | Notification confirming funds have been debited from an account. | Notification confirming funds have been credited to an account. |

| Purpose | Informs the payer about the deduction of funds. | Informs the payee about receipt of funds. |

| Usage in Remittance | Confirms debit during outward remittance transactions. | Confirms credit during inward remittance transactions. |

| Sender | Remitting bank or payer's bank. | Beneficiary's bank or receiving bank. |

| Recipient | Payer or account holder. | Payee or beneficiary. |

| Impact on Account | Reduces account balance. | Increases account balance. |

| Common Formats | Bank statement entries, SWIFT MT202, MT910. | Bank statement entries, SWIFT MT103, MT910. |

Understanding Debit Advice in Remittance

Debit advice in remittance serves as a formal notification detailing the deduction of funds from the sender's account during an international money transfer. This document provides crucial transaction specifics such as the debited amount, account numbers, date of debit, and purpose of the remittance, ensuring transparency and accurate record-keeping. Understanding debit advice helps both sender and receiver verify the legitimacy of the remittance process and promptly address discrepancies in cross-border financial transactions.

Exploring Credit Advice in Money Transfers

Credit advice in money transfers confirms receipt of funds by the beneficiary's bank, providing essential transaction details to the recipient and ensuring transparency. It serves as a formal notification that funds have been credited, aiding reconciliation and reducing disputes. This document is crucial for businesses to verify successful payments and maintain accurate financial records in remittance processes.

Key Differences Between Debit and Credit Advice

Debit advice notifies the recipient of a debit transaction, indicating funds have been withdrawn or charged to their account, whereas credit advice informs the recipient of a credit transaction, showing funds have been added to their account. Debit advice typically includes details such as the amount debited, transaction date, and account number, while credit advice highlights the amount credited, source of funds, and transaction reference. Understanding the distinction helps businesses and individuals reconcile their accounts accurately and manage cash flow effectively.

Importance of Debit Advice in Cross-Border Payments

Debit advice plays a crucial role in cross-border payments by providing detailed notification to the payer's bank about the exact amount debited from their account, ensuring transparency and accuracy in international fund transfers. This document helps reconcile accounts between correspondent banks and reduces disputes by clearly specifying transaction details, including currency conversion and fees. Its importance is amplified in complex cross-border transactions where multiple banking entities are involved, facilitating smoother settlement processes and compliance with regulatory requirements.

The Role of Credit Advice in Remittance Processing

Credit advice plays a critical role in remittance processing by confirming the receipt of funds in the beneficiary's account, ensuring transparency and accuracy in financial transactions. It provides detailed information about the credit transaction, including the sender's details, amount, and transaction reference, facilitating efficient reconciliation for both the payer and payee. This confirmation helps prevent discrepancies, supports compliance with regulatory standards, and enhances trust between remittance service providers and customers.

How Debit Advice Impacts Account Holders

Debit advice notifies account holders of a debit transaction, reducing their available balance and prompting immediate verification to prevent unauthorized withdrawals. The timely receipt of debit advice enhances financial transparency by allowing account holders to track expenses and reconcile bank statements accurately. Failure to acknowledge debit advisories may lead to overdraft fees or discrepancies in financial records, affecting cash flow management and financial planning.

Advantages of Credit Advice for Recipients

Credit Advice provides recipients with immediate notification of funds credited to their account, enhancing transparency and reducing uncertainty. It allows for quicker reconciliation of financial records, minimizing errors and improving cash flow management. Recipients benefit from real-time confirmation of incoming payments, enabling timely decision-making and operational efficiency.

Debit Advice vs Credit Advice: Use Cases in Remittance

Debit Advice is typically used in remittance to notify the sender about funds that have been deducted from their account, ensuring transparency in outgoing payments. Credit Advice, on the other hand, confirms the receipt of funds into the beneficiary's account, providing proof of successful transfer. These documents are essential for reconciliation, with Debit Advice focusing on the payer's account activity and Credit Advice verifying the recipient's credited amount.

Common Challenges with Debit and Credit Advice

Challenges with debit and credit advice often stem from discrepancies in transaction details, leading to reconciliation issues between sender and receiver accounts. Inaccurate or delayed advice can cause delays in processing payments, impacting cash flow management for businesses relying on timely remittances. Ensuring standardized formats and clear communication protocols helps mitigate errors and improve the accuracy of debit and credit advice in remittance operations.

Best Practices for Handling Debit and Credit Advice in Remittance

Accurate processing of debit advice and credit advice in remittance hinges on validating transaction details to prevent reconciliation errors and ensure timely fund allocation. Standardizing communication protocols between originating and beneficiary institutions enhances clarity and reduces disputes during fund settlements. Implementing automated reconciliation systems with real-time alerts optimizes handling efficiency and strengthens compliance with regulatory requirements.

Important Terms

Nostro Account

A Nostro account is maintained by a bank to hold foreign currency funds on behalf of its clients or correspondent banks, facilitating international transactions. Debit Advice notifies the account holder that funds have been withdrawn or debited from the Nostro account, whereas Credit Advice confirms that funds have been deposited or credited into the Nostro account, ensuring accurate reconciliation of cross-border payments.

Vostro Account

A Vostro Account is maintained by a correspondent bank on behalf of a foreign bank, typically reflecting liabilities owed to the foreign bank in the local currency. Debit Advice notifies the account holder of a debit entry, reducing the account balance, while Credit Advice confirms a credit entry, increasing the balance in the Vostro Account.

SWIFT Message (MT910/MT940)

SWIFT MT910 messages serve as Debit Advice notifications, confirming a debit entry on the sender's account, while MT940 messages function as Credit Advice, providing detailed end-of-day account statements for credit transactions. These standardized message types enable efficient and accurate communication between banks for transaction reconciliation and account management.

Payment Reconciliation

Payment reconciliation involves matching payments received with corresponding debit advice and credit advice documents to ensure accuracy in financial records. Debit advice notifies the recipient of funds debited from their account, while credit advice confirms amounts credited, both serving as essential references for validating transaction details during reconciliation.

Account Statement

Account statements detail all financial transactions, with debit advice indicating a withdrawal or deduction from an account, while credit advice confirms a deposit or addition of funds. Understanding the distinction between debit and credit advice is essential for accurate reconciliation and financial record-keeping.

Bank Confirmation

Bank Confirmation involves verifying transactions where Debit Advice records funds withdrawn from an account and Credit Advice documents deposits or incoming funds; accurate reconciliation of these advices ensures correct reflection of ledger balances and prevents discrepancies in financial statements. Leveraging electronic Bank Confirmations facilitates timely validation of Debit and Credit Advices, enhancing audit accuracy and internal control effectiveness.

Settlement Instruction

Settlement instruction specifies precise payment details ensuring accurate transaction execution between financial institutions. Debit advice notifies the payer of funds withdrawn, while credit advice confirms funds have been received by the beneficiary's account.

Value Date

Value date refers to the specific date on which funds related to Debit Advice or Credit Advice are made available or deducted in the beneficiary's account, directly impacting cash flow timing. Debit Advice notifies the payer of funds withdrawn from their account on the value date, while Credit Advice confirms the recipient's account credit on that same date, ensuring synchronized transaction settlement.

Funds Transfer Notification

Funds Transfer Notification distinguishes between Debit Advice, which informs the payer's bank about funds withdrawn from the account, and Credit Advice, which confirms the recipient's bank has received and credited the transferred amount. These notifications ensure accurate reconciliation of transactions, streamline interbank communication, and enhance transparency in electronic funds transfers.

Bank Memo Posting

Bank memo posting involves recording adjustments based on Debit Advice or Credit Advice issued by banks; Debit Advice indicates amounts deducted from the account, while Credit Advice reflects funds credited. Accurate interpretation of these advices ensures precise ledger entries, maintaining transaction integrity in financial accounting.

Debit Advice vs Credit Advice Infographic

moneydif.com

moneydif.com