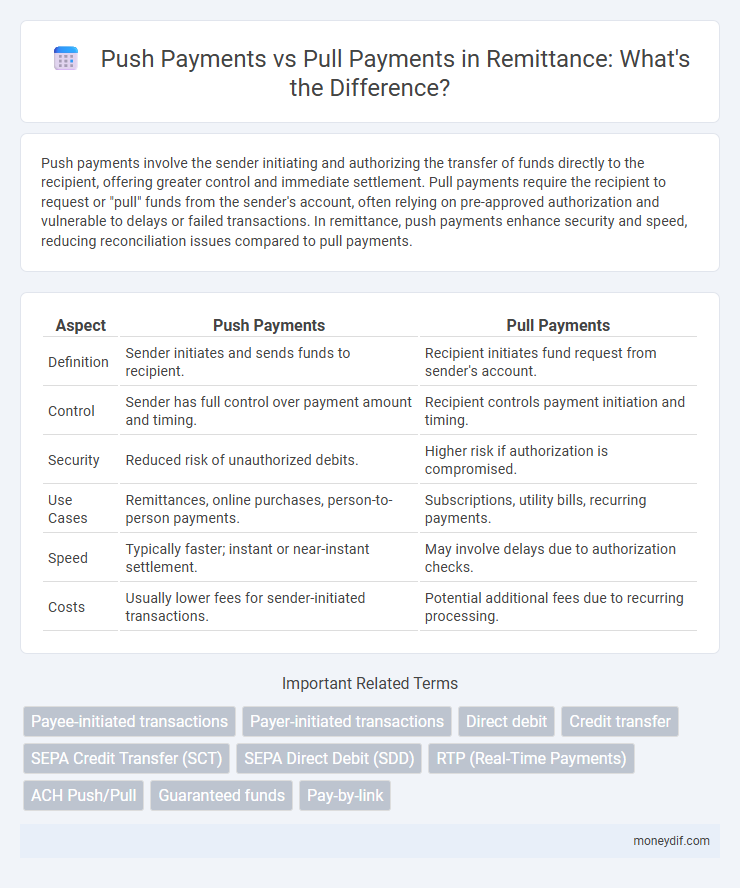

Push payments involve the sender initiating and authorizing the transfer of funds directly to the recipient, offering greater control and immediate settlement. Pull payments require the recipient to request or "pull" funds from the sender's account, often relying on pre-approved authorization and vulnerable to delays or failed transactions. In remittance, push payments enhance security and speed, reducing reconciliation issues compared to pull payments.

Table of Comparison

| Aspect | Push Payments | Pull Payments |

|---|---|---|

| Definition | Sender initiates and sends funds to recipient. | Recipient initiates fund request from sender's account. |

| Control | Sender has full control over payment amount and timing. | Recipient controls payment initiation and timing. |

| Security | Reduced risk of unauthorized debits. | Higher risk if authorization is compromised. |

| Use Cases | Remittances, online purchases, person-to-person payments. | Subscriptions, utility bills, recurring payments. |

| Speed | Typically faster; instant or near-instant settlement. | May involve delays due to authorization checks. |

| Costs | Usually lower fees for sender-initiated transactions. | Potential additional fees due to recurring processing. |

Understanding Push vs Pull Payments in Remittance

Push payments in remittance involve the sender initiating and transferring funds directly to the recipient, ensuring faster transaction times and enhanced control over transfers. Pull payments require the recipient to request or pull funds from the sender's account, often resulting in increased verification steps and potential delays. Understanding these mechanisms helps optimize cross-border money transfers by balancing security, convenience, and speed.

How Push Payments Work for Remittance Transfers

Push payments for remittance transfers involve the sender initiating the transaction by directly transferring funds from their bank account or digital wallet to the recipient's account. This method ensures faster processing times and reduced risk of payment failures compared to pull payments, which require the recipient to request and approve the transfer. Push payments leverage secure APIs and real-time payment networks, enabling seamless cross-border remittance with transparency and instant confirmation for both parties.

The Mechanism Behind Pull Payments in Remittance

Pull payments in remittance involve the payee initiating the transaction by requesting funds from the payer's account, which requires prior authorization and secure authentication to access the payer's financial data. This mechanism relies on APIs and banking protocols like OAuth to facilitate seamless, real-time access and fund transfer while minimizing fraud risks. Pull payments enhance control for recipients and improve cash flow management by enabling scheduled or on-demand collections without the payer's continuous involvement.

Key Differences Between Push and Pull Payments

Push payments require the sender to initiate and transfer funds directly to the recipient, enhancing control and reducing fraud risks. Pull payments allow merchants to request and withdraw funds from the payer's account with prior authorization, offering convenience for recurring transactions. Key differences include transaction initiation, control flow, and risk exposure, with push payments favored for security and pull payments for automation.

Advantages of Push Payments in Cross-Border Remittance

Push payments offer enhanced security by allowing the sender to initiate and control the transfer, reducing the risk of fraud in cross-border remittance. Real-time settlement capabilities enable faster fund availability for recipients, improving liquidity and financial inclusion. Lower transaction costs and increased transparency make push payments a preferred option for efficient international money transfers.

Drawbacks of Pull Payments in International Transfers

Pull payments in international transfers often expose payees to increased fraud risks due to the necessity of sharing sensitive banking credentials. These transactions can involve higher processing fees and longer settlement times caused by complex authorization procedures across different financial institutions. Currency fluctuations during the delay may also result in unintended financial losses for the payer, reducing overall transaction efficiency.

Security Features: Push vs Pull Payment Methods

Push payment methods enhance security by requiring the payer to initiate transactions, reducing the risk of unauthorized access or fraudulent charges. Pull payment systems rely on the payee to collect funds from the payer's account, increasing vulnerability to unauthorized withdrawals and potential account compromise. Advanced authentication protocols and tokenization are often integrated into push payments, offering superior control and protection for remittance transactions.

Cost Comparison: Push and Pull Payment Systems

Push payment systems generally incur lower transaction fees compared to pull payments, as they reduce the risk of fraud and chargeback costs for merchants. Pull payments often involve higher intermediary fees and increased processing times due to the authorization and verification steps required. Cost efficiency in push payments makes them preferable for remittance services seeking to minimize expenses and improve cash flow.

Customer Experience in Push vs Pull Remittance Payments

Push payments in remittance services enhance customer experience by granting senders full control over the transaction timing and amount, reducing delays and errors common in pull payments. Customers appreciate the transparency and immediate confirmation offered by push payments, fostering trust and satisfaction. Conversely, pull payments often introduce friction due to authorization requirements and potential failed transactions, negatively impacting user convenience and confidence.

Future Trends: Push and Pull Payments in the Remittance Industry

Push payments in the remittance industry enable senders to directly transfer funds to recipients' accounts, enhancing speed and security, while pull payments require recipients to initiate the withdrawal, offering greater control but potentially slower processing. Future trends indicate a growing adoption of push payment systems driven by blockchain technology and instant payment infrastructures, facilitating real-time cross-border transfers with reduced costs. Innovations such as biometric authentication and AI-driven fraud detection are set to improve the reliability and user experience of both push and pull payment methods in global remittances.

Important Terms

Payee-initiated transactions

Payee-initiated transactions primarily involve pull payments where the payee requests funds, contrasting with push payments initiated by the payer sending funds directly.

Payer-initiated transactions

Payer-initiated transactions, also known as push payments, involve the payer actively sending funds directly to the payee, contrasting with pull payments where the payee initiates the withdrawal from the payer's account.

Direct debit

Direct debit is a pull payment method where funds are electronically withdrawn from the payer's account by the payee, contrasting with push payments where the payer actively initiates the transfer.

Credit transfer

Credit transfer push payments initiate transactions directly from the payer's account to the payee, offering faster settlement compared to pull payments, which require authorization from the payer to debit their account.

SEPA Credit Transfer (SCT)

SEPA Credit Transfer (SCT) facilitates push payments where the payer initiates and authorizes the transfer of funds directly from their account to the payee's account within the Single Euro Payments Area. This contrasts with pull payments, which require the payee to request and pull funds from the payer's account, a method not supported by SCT but by SEPA Direct Debit (SDD) schemes.

SEPA Direct Debit (SDD)

SEPA Direct Debit (SDD) is a pull payment method that allows creditors to collect funds directly from debtors' bank accounts, contrasting push payments where payers initiate the transaction.

RTP (Real-Time Payments)

RTP (Real-Time Payments) enables instant push payments where payers initiate transfers directly, contrasting with pull payments that require payees to collect funds through authorization.

ACH Push/Pull

ACH Push payments involve the sender initiating a transfer of funds directly into the recipient's bank account, ensuring faster and more secure transactions by eliminating the need for recipient approval. In contrast, ACH Pull payments require the recipient to authorize a debit from the sender's account, commonly used for recurring bill payments and subscriptions, providing convenience but potentially increasing the risk of unauthorized withdrawals.

Guaranteed funds

Guaranteed funds in push payments ensure immediate transfer of funds directly from the payer to the payee, reducing the risk of payment failure or fraud. In contrast, pull payments rely on authorization from the payer's bank, which may delay confirmation and increase the potential for insufficient funds or chargebacks.

Pay-by-link

Pay-by-link enables push payments by allowing customers to directly send funds to merchants, contrasting with pull payments where merchants initiate fund withdrawals from customers' accounts.

push payments vs pull payments Infographic

moneydif.com

moneydif.com