A payment corridor refers to the specific geographic route through which funds are transferred between two countries, often influenced by regulatory frameworks and currency exchange policies. A payment rail, on the other hand, represents the underlying technology or network infrastructure that facilitates the actual movement of funds within that corridor, such as SWIFT, blockchain, or mobile money platforms. Understanding the distinction between payment corridors and payment rails is crucial for optimizing remittance speed, cost, and reliability.

Table of Comparison

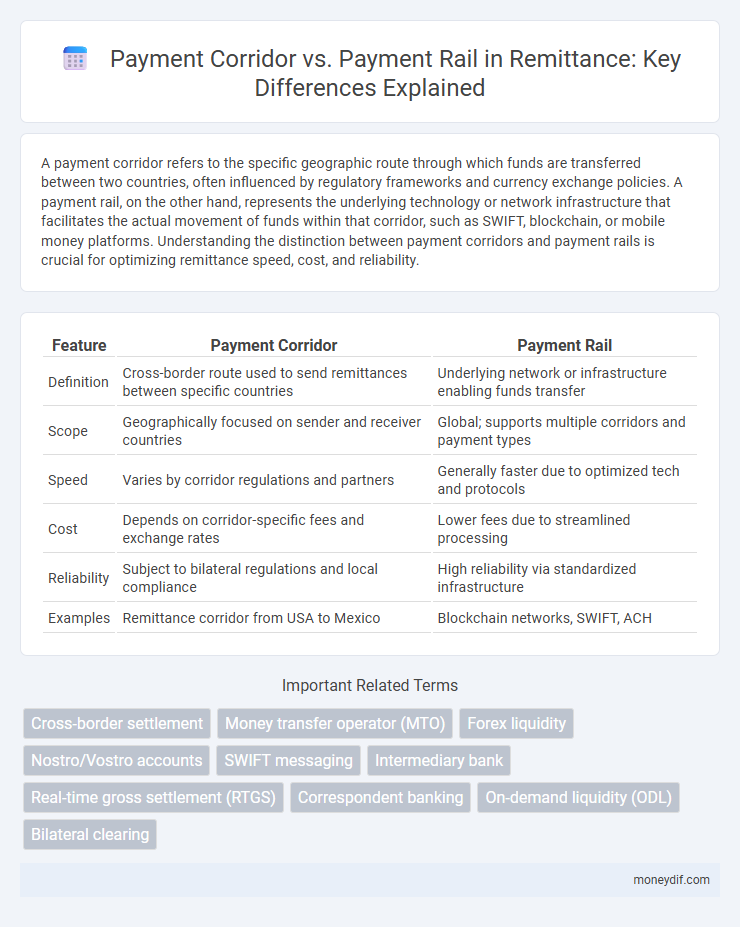

| Feature | Payment Corridor | Payment Rail |

|---|---|---|

| Definition | Cross-border route used to send remittances between specific countries | Underlying network or infrastructure enabling funds transfer |

| Scope | Geographically focused on sender and receiver countries | Global; supports multiple corridors and payment types |

| Speed | Varies by corridor regulations and partners | Generally faster due to optimized tech and protocols |

| Cost | Depends on corridor-specific fees and exchange rates | Lower fees due to streamlined processing |

| Reliability | Subject to bilateral regulations and local compliance | High reliability via standardized infrastructure |

| Examples | Remittance corridor from USA to Mexico | Blockchain networks, SWIFT, ACH |

Understanding Payment Corridors and Payment Rails

Payment corridors refer to the specific routes through which funds are transferred between countries, often involving multiple currencies and regulatory environments. Payment rails are the underlying infrastructures or networks, such as SWIFT, ACH, or blockchain, that facilitate these cross-border transactions efficiently and securely. Understanding the distinction helps optimize remittance processes by selecting the most cost-effective and timely pathways.

Key Differences Between Payment Corridors and Payment Rails

Payment corridors refer to specific international routes through which remittances are sent, emphasizing regulatory compliance, cost efficiency, and currency conversion factors. Payment rails are the underlying technological infrastructure enabling the actual transfer of funds, such as ACH networks, SWIFT, or blockchain systems, focusing on speed, security, and interoperability. Understanding the distinction between payment corridors and rails is crucial for optimizing cross-border payment strategies and reducing transaction costs.

The Role of Payment Corridors in Global Remittances

Payment corridors serve as crucial pathways for transferring remittances across countries, defining the geographical flow between sending and receiving nations. These corridors optimize transaction speed, cost, and compliance by leveraging specific payment rails tailored for cross-border money transfers. Efficient payment corridors reduce friction in remittance services, enhancing financial inclusion for migrant workers and their families worldwide.

How Payment Rails Facilitate Cross-Border Transfers

Payment rails are the underlying infrastructure that enables cross-border money transfers by securely transmitting funds between financial institutions and clearing networks. These rails leverage technologies such as SWIFT, blockchain, and real-time payment systems to ensure fast, transparent, and cost-effective remittance processes. Efficient payment rails reduce settlement times and fees, enhancing the overall speed and reliability of international remittance corridors.

Challenges of Traditional Payment Corridors

Traditional payment corridors face challenges such as high transaction costs, slow processing times, and limited transparency, which hinder efficient cross-border remittances. Legacy banking systems and intermediary involvement increase delays and fees, reducing the overall convenience for senders and receivers. Regulatory complexities and currency exchange issues further complicate the reliability and speed of traditional payment rails.

Innovations Transforming Payment Rails

Innovations transforming payment rails enhance remittance speed and security by leveraging blockchain technology and real-time clearing systems. Payment rails like the RTP network and cross-border APIs optimize transactions, reducing costs and improving accessibility for underserved regions. These advancements drive seamless global payment corridors, enabling instant currency conversion and transparent tracking.

Payment Corridor Efficiency: Speed, Cost, and Accessibility

Payment corridor efficiency in remittance hinges on optimizing speed, cost, and accessibility, ensuring funds transfer rapidly while minimizing fees for end users. Payment rails, as the underlying infrastructure, dictate transaction speed and security, but the broader payment corridor includes regulatory compliance and local banking partnerships, which collectively influence overall efficiency. Lowering operational costs through streamlined rails and expanding access points enhances user experience and promotes financial inclusion across international corridors.

Enhancing Security in Payment Rails for Remittances

Payment rails in remittance systems prioritize advanced encryption protocols and tokenization techniques to enhance transaction security, mitigating risks of fraud and data breaches. Unlike payment corridors that define the geographic pathways, payment rails focus on the underlying infrastructure, such as blockchain or real-time gross settlement (RTGS) systems, to ensure secure and instantaneous fund transfers. Integrating multi-factor authentication and regulatory compliance layers within payment rails strengthens trust and transparency for cross-border transactions.

Future Trends: Collapsing Corridors with Next-Gen Rails

Payment corridors traditionally define geographic routes for cross-border remittances, while next-generation payment rails leverage blockchain and real-time settlement technologies to dissolve these boundaries. Future trends in remittance focus on collapsing corridors through interoperable, instant payment networks that enable seamless transfers regardless of location. Enhanced security protocols and smart contracts embedded in next-gen rails further optimize cost efficiency and transparency in global money movement.

Choosing the Right Solution: Payment Corridor vs Payment Rail

Choosing the right solution in remittance hinges on understanding the differences between payment corridors and payment rails. Payment corridors refer to specific geographic routes optimized for efficient cross-border transfers, often tailored to regulatory and currency requirements. Payment rails represent the underlying technology infrastructure enabling these transfers, including blockchain, SWIFT, or real-time payment systems, which determine speed, cost, and security of transactions.

Important Terms

Cross-border settlement

Cross-border settlement leverages payment corridors to facilitate regional transactions while payment rails provide the underlying infrastructure enabling seamless cross-border fund transfers.

Money transfer operator (MTO)

Money transfer operators (MTOs) streamline cross-border remittances by leveraging specific payment corridors, which are the predefined country pairs and regulatory frameworks facilitating these transactions. These corridors interact with various payment rails--such as SWIFT, ACH, or blockchain networks--that serve as the underlying infrastructures enabling the secure and efficient transfer of funds.

Forex liquidity

Forex liquidity enhances payment corridor efficiency by enabling seamless currency exchange across diverse payment rails, reducing transaction costs and settlement times.

Nostro/Vostro accounts

Nostro/Vostro accounts enable efficient cross-border payment corridors by facilitating correspondent banking settlements across various payment rails, optimizing liquidity management and transaction accuracy.

SWIFT messaging

SWIFT messaging enables secure international payment corridors by facilitating standardized communication between financial institutions, distinct from payment rails which are the underlying networks that execute the actual fund transfers.

Intermediary bank

An intermediary bank facilitates cross-border transactions by providing liquidity and currency exchange between distinct payment rails within a payment corridor to ensure seamless fund transfers.

Real-time gross settlement (RTGS)

Real-time gross settlement (RTGS) systems provide instant, high-value payment settlement within payment corridors, functioning as critical payment rails that enable secure and efficient interbank fund transfers.

Correspondent banking

Correspondent banking facilitates cross-border payment corridors by enabling intermediary financial institutions to process transactions without relying on direct payment rails, enhancing global fund transfer efficiency and reach.

On-demand liquidity (ODL)

On-demand liquidity (ODL) leverages payment rails such as RippleNet to facilitate cross-border payment corridors, enabling real-time settlement by utilizing digital assets like XRP to bridge currencies instantly. This approach reduces reliance on traditional correspondent banking, decreases transaction costs, and enhances liquidity within global payment corridors.

Bilateral clearing

Bilateral clearing optimizes transaction efficiency within payment corridors by streamlining settlements between two financial institutions compared to broader payment rails that handle multiple counterparties.

payment corridor vs payment rail Infographic

moneydif.com

moneydif.com