MT103 is a standardized SWIFT message used primarily for sending detailed payment instructions in a single customer credit transfer, ensuring transparency and traceability in international remittances. MT940, on the other hand, serves as an end-of-day bank statement format, providing a comprehensive summary of all transactions in an account, which helps businesses reconcile their payments effectively. Understanding the distinct purposes of MT103 and MT940 enables more accurate tracking and management of cross-border payment flows.

Table of Comparison

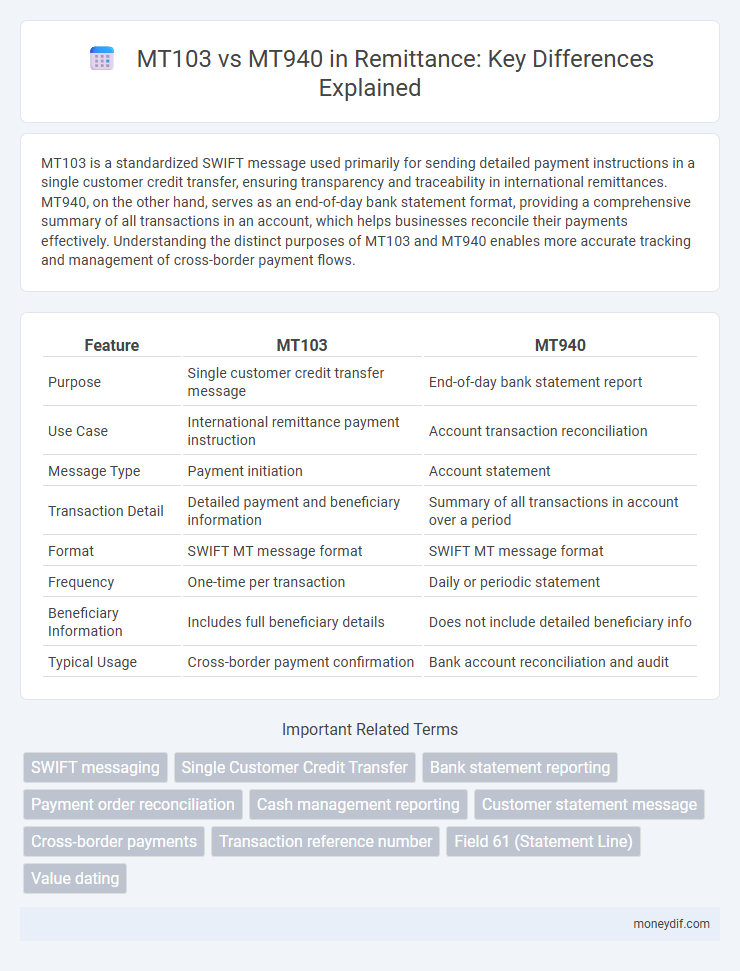

| Feature | MT103 | MT940 |

|---|---|---|

| Purpose | Single customer credit transfer message | End-of-day bank statement report |

| Use Case | International remittance payment instruction | Account transaction reconciliation |

| Message Type | Payment initiation | Account statement |

| Transaction Detail | Detailed payment and beneficiary information | Summary of all transactions in account over a period |

| Format | SWIFT MT message format | SWIFT MT message format |

| Frequency | One-time per transaction | Daily or periodic statement |

| Beneficiary Information | Includes full beneficiary details | Does not include detailed beneficiary info |

| Typical Usage | Cross-border payment confirmation | Bank account reconciliation and audit |

MT103 vs MT940: Key Differences Explained

MT103 and MT940 are SWIFT message types used in international banking, with MT103 serving as a detailed customer transfer confirmation and MT940 functioning as a bank statement report. MT103 provides transaction-specific details, including payment instructions and sender/receiver data, essential for tracking individual remittance payments. MT940 offers comprehensive account statement information, enabling reconciliation and monitoring of multiple transactions over a period rather than a single payment confirmation.

Understanding MT103 and MT940 in Remittance Transactions

MT103 is a standardized SWIFT message used for initiating and confirming individual cross-border remittance payments, providing detailed transaction information such as sender, receiver, and payment details. MT940 serves as a bank statement format delivering a comprehensive end-of-day report of all account transactions, allowing reconciliation and account monitoring. Understanding the distinction between MT103 and MT940 is crucial for efficient remittance transaction tracking, with MT103 facilitating payment instruction and MT940 enabling detailed post-transaction account statements.

Message Structure: MT103 vs MT940

MT103 messages are single customer credit transfer instructions used to initiate international wire transfers, structured with specific fields detailing payment information, ordering customer, and beneficiary. MT940 messages are end-of-day bank account statements summarizing all transactions, formatted to provide a comprehensive ledger of account activity, including balances and transaction details. The MT103 emphasizes payment instruction data, while the MT940 focuses on account statement data for reconciliation purposes.

Use Cases: When to Use MT103 or MT940

MT103 is used primarily for detailed payment instructions in international wire transfers, offering transaction-level data essential for payment tracking and reconciliation. MT940 functions as a bank statement format, ideal for account statement reconciliation and cash flow management by providing end-of-day balance and transaction summaries. Choose MT103 for sending precise payment details; opt for MT940 to obtain comprehensive account activity reports.

Compliance and Security: MT103 vs MT940

MT103 and MT940 are both SWIFT message types used in international banking, with MT103 providing detailed payment instructions for single customer credit transfers, enabling stringent compliance and anti-money laundering checks through transparent transaction data. MT940 serves as an end-of-day bank statement report, offering an overview of account activity but lacking the granular payment details necessary for comprehensive compliance verification. MT103's standardized information format supports enhanced security protocols and regulatory auditing, making it the preferred choice for secure and compliant remittance processing.

Processing Times: MT103 vs MT940

MT103 messages provide detailed individual customer payment information with predictable processing times, typically completed within one to two business days. MT940 statements offer end-of-day account transaction summaries, which are processed and available after the bank's daily cut-off time. Choosing MT103 ensures real-time tracking of single remittance payments, while MT940 delivers aggregated transaction data for reconciliation purposes.

Data Fields Comparison: MT103 and MT940

MT103 and MT940 are SWIFT message types used in international remittance, with MT103 primarily serving as a customer credit transfer message and MT940 acting as a bank statement message. MT103 includes detailed transaction fields such as ordering customer, beneficiary customer, and remittance information, enabling precise tracking of individual payments. In contrast, MT940 provides an end-of-day statement with consolidated balance information, statement number, and transaction details, focusing on comprehensive account reporting rather than individual payment specifics.

Benefits and Limitations: MT103 vs MT940

MT103 offers detailed, transaction-specific remittance information, enabling precise tracking and reconciliation of international payments with clear sender and beneficiary details. MT940 provides comprehensive end-of-day account statements suitable for bulk transaction analysis but lacks transaction-level visibility, making it less effective for real-time payment tracking. While MT103 ensures transparency and ease of dispute resolution in cross-border transfers, MT940 excels in account monitoring and financial reporting but requires additional processing to identify individual transactions.

MT103 vs MT940: Impact on Reconciliation

MT103 and MT940 are critical SWIFT message types used in international remittance, each influencing reconciliation processes differently. MT103 provides detailed payment instructions and beneficiary information, enabling precise transaction tracking and faster reconciliation between banks and businesses. In contrast, MT940 delivers end-of-day account statement data that summarizes multiple transactions, which can delay immediate reconciliation but offers comprehensive account activity insight for accurate financial reporting.

Choosing the Right SWIFT Message for Remittance

MT103 is a detailed SWIFT message format used specifically for single customer credit transfers, providing comprehensive information about the remittance transaction ideal for beneficiary confirmation. MT940 is a bank statement message designed to deliver end-of-day balance and transaction details, serving better for account reconciliation rather than direct remittance instructions. Selecting between MT103 and MT940 depends on whether the priority is on sending precise payment instructions or obtaining detailed transaction history for financial auditing.

Important Terms

SWIFT messaging

MT103 is a SWIFT payment instruction message used for customer credit transfers, enabling banks to process international wire payments with detailed beneficiary information. MT940 is a SWIFT statement message providing end-of-day account transaction reports, allowing clients and institutions to reconcile and track account activities efficiently.

Single Customer Credit Transfer

Single Customer Credit Transfer (SCT) leverages the MT103 message format for detailed, structured payment instructions between banks, ensuring precise customer credit transactions with comprehensive fields for remittance information. The MT940 format, by contrast, provides end-of-day bank statements detailing account activity, offering a summarized view rather than transaction-specific payment instructions.

Bank statement reporting

MT103 is a standardized SWIFT payment message used to confirm single customer credit transfers, essential for tracking international fund transfers, while MT940 is a comprehensive end-of-day bank statement format that provides detailed transaction listings for account reconciliation. Banks and corporates utilize MT940 for automated statement reporting, enabling precise cash management, whereas MT103 serves as a proof of payment and supports transaction transparency between financial institutions.

Payment order reconciliation

Payment order reconciliation involves matching MT103 transaction confirmations with MT940 bank statement reports to ensure accuracy and completeness of payment processing. MT103 provides detailed payment instruction data, while MT940 delivers comprehensive end-of-day bank statement information, enabling efficient detection of discrepancies and reconciliation of funds.

Cash management reporting

Cash management reporting leverages MT940 as a standardized SWIFT message format for detailed end-of-day bank statement reporting, enabling accurate reconciliation and liquidity tracking. In contrast, MT103 focuses on individual customer credit transfer instructions, providing transactional details that support payment tracking rather than aggregated cash position analysis.

Customer statement message

MT103 is a detailed SWIFT message format used for transmitting international customer payment instructions, ensuring clarity and traceability of funds, while MT940 serves as a bank statement format providing comprehensive end-of-day transaction summaries and account balances. Both formats facilitate efficient financial communication, with MT103 focusing on payment initiation and MT940 emphasizing account reconciliation and statement reporting.

Cross-border payments

MT103 is a standardized SWIFT payment message used to confirm cross-border wire transfers, providing detailed information about the payer, payee, and transaction specifics. MT940 serves as an electronic bank statement format that allows businesses to reconcile cross-border payments by providing detailed account activity and transaction status.

Transaction reference number

Transaction reference number uniquely identifies financial transactions within SWIFT messages, where MT103 carries the reference for individual customer credit transfers and MT940 uses it to reconcile end-of-day account statements. Utilizing the transaction reference number enables accurate tracking and matching of payments in both MT103 payment instructions and MT940 bank statement reports.

Field 61 (Statement Line)

Field 61 in an MT940 statement provides detailed transaction posting information including value date, entry date, amount, and transaction type, enabling precise reconciliation and cash flow analysis. In contrast, the MT103 message uses Field 61 data primarily to confirm individual payment instructions and statuses within the SWIFT payment processing network.

Value dating

Value dating in financial transactions determines the effective interest calculation and fund availability date, crucial for reconciliation between MT103 and MT940 messages; MT103 is a detailed customer credit transfer order, while MT940 is a statement message listing account transactions with value dates. Accurate synchronization of value dates in MT103 payment instructions and MT940 account statements ensures precise bank ledger updates and cash flow management.

MT103 vs MT940 Infographic

moneydif.com

moneydif.com