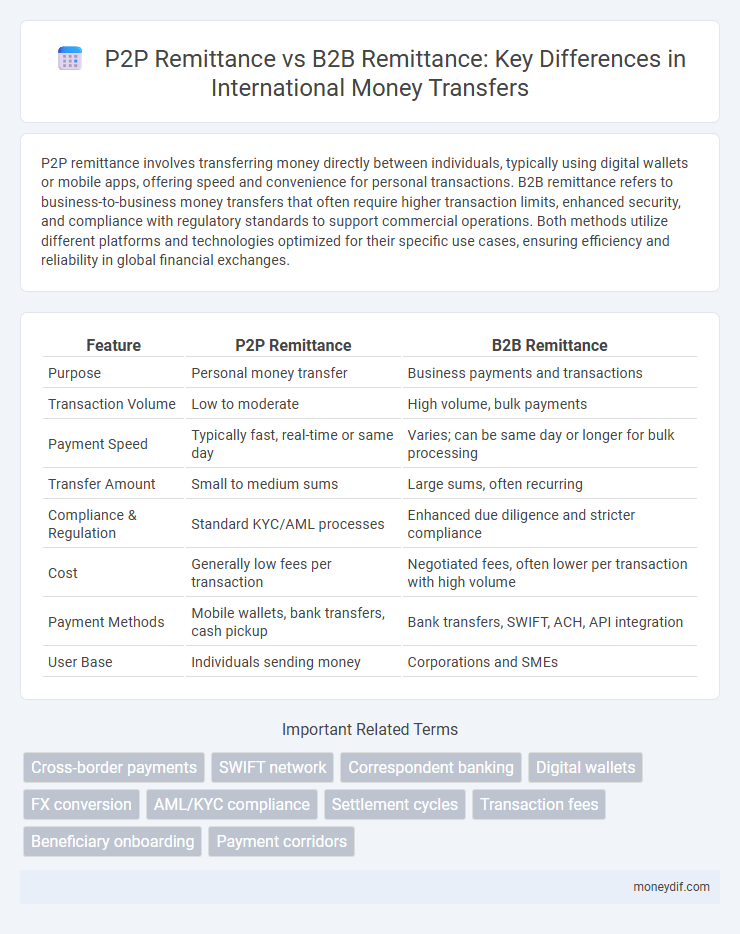

P2P remittance involves transferring money directly between individuals, typically using digital wallets or mobile apps, offering speed and convenience for personal transactions. B2B remittance refers to business-to-business money transfers that often require higher transaction limits, enhanced security, and compliance with regulatory standards to support commercial operations. Both methods utilize different platforms and technologies optimized for their specific use cases, ensuring efficiency and reliability in global financial exchanges.

Table of Comparison

| Feature | P2P Remittance | B2B Remittance |

|---|---|---|

| Purpose | Personal money transfer | Business payments and transactions |

| Transaction Volume | Low to moderate | High volume, bulk payments |

| Payment Speed | Typically fast, real-time or same day | Varies; can be same day or longer for bulk processing |

| Transfer Amount | Small to medium sums | Large sums, often recurring |

| Compliance & Regulation | Standard KYC/AML processes | Enhanced due diligence and stricter compliance |

| Cost | Generally low fees per transaction | Negotiated fees, often lower per transaction with high volume |

| Payment Methods | Mobile wallets, bank transfers, cash pickup | Bank transfers, SWIFT, ACH, API integration |

| User Base | Individuals sending money | Corporations and SMEs |

Understanding P2P vs B2B Remittance: Key Differences

P2P remittance involves individuals sending money directly to family or friends, typically utilizing mobile apps or digital wallets for quick, low-cost transfers. B2B remittance pertains to businesses transferring funds for operational expenses, supplier payments, or cross-border trade, often requiring higher transaction limits and compliance with stricter regulatory frameworks. Key differences include transaction volume, cost structure, security measures, and the complexity of payment processing tailored to individual versus corporate needs.

How P2P Remittance Works in Today’s Digital Economy

P2P remittance in today's digital economy operates through mobile apps and online platforms that enable individuals to send money directly to friends and family across borders with minimal fees and real-time transfers. Leveraging blockchain technology and integrated payment gateways, these services ensure secure, transparent, and fast transactions without relying on traditional banking infrastructure. User-friendly interfaces and instant currency exchange rates further streamline the process, making cross-border peer-to-peer payments accessible and efficient for global users.

B2B Remittance: Streamlining International Business Payments

B2B remittance simplifies global commerce by enabling secure, efficient international payments between businesses, reducing transaction times and costs compared to traditional methods. Utilizing blockchain technology and automated platforms, B2B remittance solutions offer transparency, lower fees, and improved compliance with cross-border regulations. Streamlined payment processes strengthen supplier relationships and enhance cash flow management for multinational companies operating in diverse markets.

Transaction Fees: P2P vs B2B Remittance

Transaction fees for P2P remittance typically range from 1% to 5% per transaction, reflecting the smaller amounts and individual nature of transfers. B2B remittance fees are often higher, ranging from 0.5% to 3%, but involve larger transaction volumes with more complex compliance and regulatory costs. Businesses may negotiate reduced fees based on transaction volume, while P2P users usually face fixed or tiered fee structures set by providers.

Speed and Efficiency: Comparing P2P and B2B Transfers

P2P remittance transactions typically offer faster processing times due to streamlined digital platforms and reduced regulatory complexities, enabling near-instantaneous fund transfers between individuals. In contrast, B2B remittances often involve larger sums and require extensive compliance checks, resulting in longer transaction times but ensuring rigorous security and accuracy. Efficiency in P2P transfers is driven by automation and simplified user interfaces, whereas B2B efficiency depends on integrated financial systems and customizable workflows tailored to corporate needs.

Security Measures in P2P and B2B Remittance Systems

P2P remittance systems employ end-to-end encryption and multi-factor authentication to ensure secure transfers between individuals, minimizing risks of fraud and unauthorized access. B2B remittance platforms incorporate advanced fraud detection algorithms, compliance with KYC and AML regulations, and real-time transaction monitoring to safeguard business payments. Both systems use blockchain technology and secure APIs to enhance data integrity and prevent cyber threats throughout the remittance process.

Regulatory Compliance: P2P Remittance vs B2B Remittance

P2P remittance typically involves lower transaction values and simpler regulatory requirements focused on anti-money laundering (AML) and customer identification (KYC) standards, streamlining individual transfers across borders. B2B remittance faces stricter regulatory scrutiny due to higher transaction volumes and complex cross-border trade compliance, including enhanced due diligence (EDD) and adherence to international trade sanctions. Financial institutions managing B2B remittances must implement robust compliance frameworks to mitigate risks linked to fraud, money laundering, and regulatory penalties.

Use Cases: When to Choose P2P or B2B Remittance

P2P remittance is ideal for individuals sending money to family or friends across borders, offering fast, low-cost transfers typically under $10,000. B2B remittance suits businesses making bulk payments to suppliers or partners, handling larger volumes with enhanced tracking, compliance, and currency hedging features. Choosing P2P or B2B depends on payment scale, recipient type, and the need for business-grade financial controls versus personal convenience.

Technological Innovations in P2P and B2B Remittances

Technological innovations in P2P remittances leverage mobile wallets, blockchain, and AI-driven fraud detection to enable instant, low-cost cross-border transfers for individuals. B2B remittances increasingly adopt API integrations, smart contracts, and real-time payment settlements to enhance transparency, compliance, and efficiency between enterprises. These advancements reduce transaction times and costs while improving security and traceability across both P2P and B2B financial ecosystems.

Future Trends: Evolving Landscapes in P2P and B2B Remittance

P2P remittance is expected to see increased integration with digital wallets and blockchain technology, enhancing speed and transparency for individual users. B2B remittance will likely focus on automation and API-driven platforms to streamline cross-border payments and reduce transactional costs for enterprises. Both segments are moving towards real-time settlements and AI-powered fraud detection to improve security and efficiency.

Important Terms

Cross-border payments

Cross-border payments in P2P remittance focus on fast, low-cost transfers between individuals, often leveraging digital wallets and mobile platforms to enhance user convenience. B2B remittance prioritizes larger transaction volumes with stringent compliance, security protocols, and integration with enterprise resource planning (ERP) systems to streamline international trade and supplier payments.

SWIFT network

The SWIFT network facilitates cross-border financial messaging, primarily supporting B2B remittance by enabling secure, standardized transactions between banks and financial institutions. In contrast, P2P remittance leverages emerging fintech platforms that bypass traditional SWIFT channels to offer faster, cost-effective, and user-friendly peer-to-peer money transfers.

Correspondent banking

Correspondent banking facilitates cross-border P2P remittance by providing intermediaries that enable individuals to send money internationally through established banking networks, ensuring compliance and currency exchange. In contrast, B2B remittance via correspondent banking involves larger transaction volumes with enhanced security measures and regulatory oversight to support corporate payments and trade finance.

Digital wallets

Digital wallets streamline P2P remittance by enabling instant, low-cost transfers between individuals through mobile apps with integrated payment systems. B2B remittance leverages digital wallets to facilitate cross-border transactions, improve cash flow management, and reduce intermediary fees for businesses engaging in international trade.

FX conversion

FX conversion for P2P remittance prioritizes low fees and quick execution to enhance user experience, often leveraging digital wallets and mobile platforms. In contrast, B2B remittance demands higher transaction limits, superior forex rates, and robust compliance protocols to support cross-border trade and large-scale financial operations.

AML/KYC compliance

AML/KYC compliance in P2P remittance demands strict identity verification and transaction monitoring to prevent fraud and money laundering, given the high volume of individual transfers. B2B remittance involves enhanced due diligence and stricter regulatory scrutiny due to larger transaction sizes and complex corporate structures, requiring comprehensive risk assessments and ongoing client monitoring.

Settlement cycles

Settlement cycles for P2P remittance typically range from a few seconds to a few minutes, leveraging real-time payment rails and digital wallets for instant or near-instant transfers. In contrast, B2B remittance settlement cycles often extend from same-day to several days due to larger transaction volumes, compliance checks, and involvement of multiple financial intermediaries.

Transaction fees

Transaction fees for P2P remittance typically range from 1% to 5% depending on the platform and payment method, focusing on smaller, personal transfers often via mobile apps. B2B remittance fees are generally lower in percentage but higher in absolute cost, structured as fixed fees or volume-based discounts to accommodate larger, frequent international payments between businesses.

Beneficiary onboarding

Beneficiary onboarding in P2P remittance focuses on quick, user-friendly verification processes to accommodate individual recipients, often leveraging mobile identity solutions and real-time KYC checks for seamless, small-value transfers. In contrast, B2B remittance onboarding involves complex due diligence, stringent compliance measures, and detailed financial documentation to ensure regulatory adherence and facilitate high-value, cross-border payments between businesses.

Payment corridors

Payment corridors for P2P remittance focus on fast, low-cost transfers between individuals across borders, leveraging mobile wallets and digital platforms to enhance accessibility. In contrast, B2B remittance corridors prioritize secure, high-value transactions with compliance features, supporting supply chain financing and cross-border trade settlements through established banking networks.

P2P remittance vs B2B remittance Infographic

moneydif.com

moneydif.com