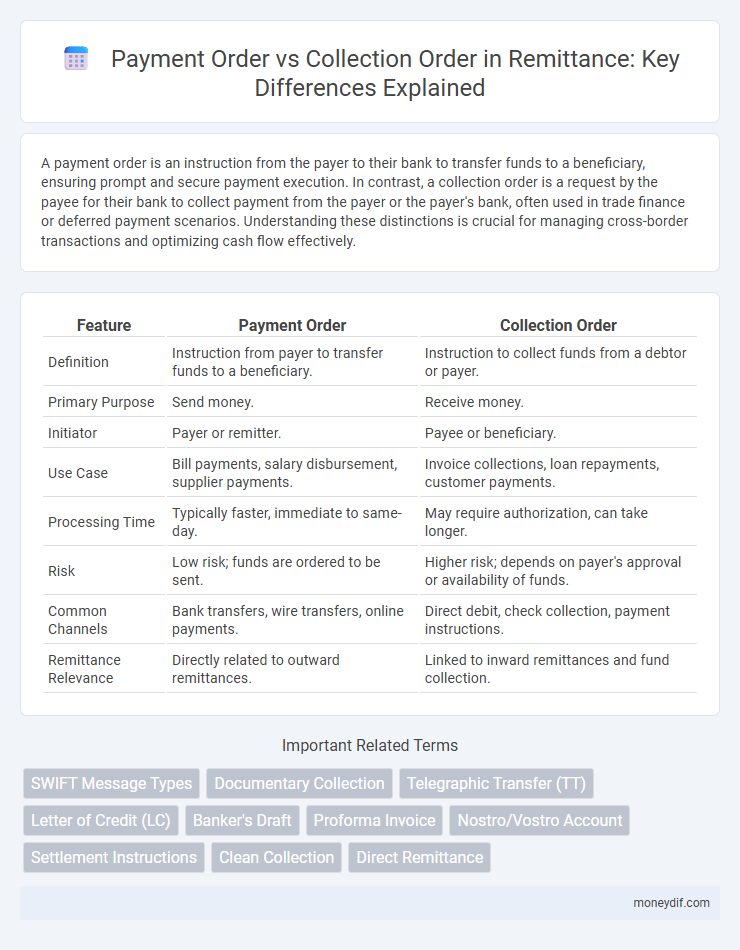

A payment order is an instruction from the payer to their bank to transfer funds to a beneficiary, ensuring prompt and secure payment execution. In contrast, a collection order is a request by the payee for their bank to collect payment from the payer or the payer's bank, often used in trade finance or deferred payment scenarios. Understanding these distinctions is crucial for managing cross-border transactions and optimizing cash flow effectively.

Table of Comparison

| Feature | Payment Order | Collection Order |

|---|---|---|

| Definition | Instruction from payer to transfer funds to a beneficiary. | Instruction to collect funds from a debtor or payer. |

| Primary Purpose | Send money. | Receive money. |

| Initiator | Payer or remitter. | Payee or beneficiary. |

| Use Case | Bill payments, salary disbursement, supplier payments. | Invoice collections, loan repayments, customer payments. |

| Processing Time | Typically faster, immediate to same-day. | May require authorization, can take longer. |

| Risk | Low risk; funds are ordered to be sent. | Higher risk; depends on payer's approval or availability of funds. |

| Common Channels | Bank transfers, wire transfers, online payments. | Direct debit, check collection, payment instructions. |

| Remittance Relevance | Directly related to outward remittances. | Linked to inward remittances and fund collection. |

Understanding Payment Order and Collection Order

Payment Order represents an instruction from the sender's bank to transfer funds to the beneficiary's account, facilitating outward remittance securely and efficiently. Collection Order, on the other hand, is a directive for the bank to collect funds from the payer and credit them to the beneficiary, often used in transactions involving drafts or bills of exchange. Understanding the distinction between Payment Order and Collection Order is crucial for managing remittance processes and ensuring the correct flow of funds in international or domestic transactions.

Key Differences Between Payment Order and Collection Order

Payment orders initiate fund transfers from the payer's account to the beneficiary, typically used in outgoing remittances and settlements. Collection orders request funds from the payer, serving as a mandate for debit transactions like invoices or loan repayments. The key differences lie in their direction of transaction flow and authorization roles: payment orders authorize disbursement, while collection orders authorize receipt of funds.

How Payment Orders Work in Remittance

Payment orders in remittance initiate the transfer of funds from the sender's account to the recipient's account by instructing the bank to debit the specified amount. These orders contain detailed information such as sender and receiver details, amount, currency, and payment instructions to ensure accurate processing. Unlike collection orders, payment orders guarantee immediate execution, enabling faster and more secure fund transfers across financial institutions.

The Process of Collection Orders in Cross-Border Payments

Collection orders in cross-border payments involve the remitting bank initiating a request to collect funds from the recipient's bank, where the beneficiary's bank acts on behalf of the remitting bank without guaranteeing payment. The process includes presenting shipping documents or payment instructions to the beneficiary's bank, which forwards them to the payee upon fulfilling certain conditions such as acceptance of a draft or payment. This method reduces upfront payment risk for the remitter but may involve longer processing times due to compliance checks and document verification in the beneficiary's country.

Advantages of Using Payment Orders for Remittances

Payment orders provide greater security and control over remittance transactions by allowing the sender to specify exact payment instructions and limiting unauthorized access. They offer faster processing times since payment orders initiate immediate fund transfers compared to collection orders that require beneficiary action. Additionally, payment orders reduce settlement risk by confirming funds upfront, ensuring reliable and timely international remittances.

Benefits and Limitations of Collection Orders

Collection orders streamline incoming payments by authorizing banks to collect funds directly from the payer, reducing the risk of non-payment and improving cash flow predictability. However, they rely heavily on the payer's compliance and bank cooperation, which can lead to delays or rejections if insufficient funds or disputes occur. The reduced control over timing and payment certainty contrasts with payment orders, where the sender initiates the transaction, offering greater assurance.

Payment Order vs Collection Order: Which Is Faster?

Payment orders generally process faster than collection orders because funds are immediately debited from the payer's account and credited to the beneficiary, often within the same or next business day. Collection orders require the beneficiary's bank to send a payment request to the payer's bank, which involves additional verification and can delay fund transfer by several days. The streamlined processing of payment orders makes them the preferred option for urgent remittances and time-sensitive transactions.

Security Considerations in Payment and Collection Orders

Payment orders require stringent authentication protocols and encryption methods to prevent unauthorized fund transfers, ensuring the integrity and confidentiality of the transaction. Collection orders emphasize verification of debtor consent and validation of payment instructions to mitigate the risk of fraud and unauthorized withdrawals. Both types of orders benefit from multi-factor authentication and real-time monitoring to enhance overall security in remittance processes.

Cost Comparison: Payment Order vs Collection Order

Payment orders generally incur higher fees than collection orders due to the sender assuming a majority of transaction costs, including processing and bank charges. Collection orders often result in lower expenses since the recipient bears the payment-related fees, reducing the upfront cost for the payer. Analyzing specific bank fee structures reveals that payment orders can cost up to 30% more than collection orders, influencing the choice based on cost efficiency.

Choosing the Right Remittance Method: Payment Order or Collection Order

Choosing the right remittance method between Payment Order and Collection Order depends on transaction control and risk management preferences. Payment Orders guarantee immediate funds transfer initiated by the payer, ideal for urgent and secure payments, while Collection Orders place the responsibility on the payee to collect funds, suitable for less time-sensitive transactions with lower risk tolerance. Understanding these distinctions ensures optimal financial flow and compliance with international banking standards.

Important Terms

SWIFT Message Types

SWIFT Message Types MT103 and MT202 are primarily used for Payment Orders, facilitating single customer credit transfers and bank-to-bank fund movements, respectively. Collection Orders are processed through SWIFT Message Types MT400 to MT499, designed for documentary and financial collections, enabling secure handling of receivables and payment instructions between banks.

Documentary Collection

Documentary Collection involves a financial transaction where the remitting bank sends shipping documents to the collecting bank, demanding payment or acceptance of a draft to release goods to the buyer. A Payment Order instructs the bank to pay a specific amount to a beneficiary, whereas a Collection Order directs the bank to collect funds under agreed-upon terms before releasing documents in the documentary collection process.

Telegraphic Transfer (TT)

Telegraphic Transfer (TT) involves the electronic movement of funds internationally, where a Payment Order instructs a bank to send funds from the payer's account to the beneficiary, while a Collection Order requests the bank to collect payment from the payer before releasing funds to the beneficiary. The Payment Order initiates immediate fund transfer, whereas the Collection Order depends on receiving payment first, impacting transaction speed and risk.

Letter of Credit (LC)

A Letter of Credit (LC) secures international trade payments by involving banks that guarantee buyer's payment upon document compliance; a Payment Order instructs immediate fund transfer, while a Collection Order authorizes banks to collect payment from the buyer without payment guarantee. Payment Orders in LCs ensure swift settlement, whereas Collection Orders depend on buyer's willingness to pay, increasing transaction risk.

Banker's Draft

A Banker's Draft is a secure payment instrument guaranteed by a bank, often used as a Payment Order to authorize immediate fund transfer to the beneficiary, ensuring faster and more reliable settlement. In contrast, a Collection Order directs the bank to collect funds from the payer's account upon presentation, involving a conditional process that may delay payment clearance.

Proforma Invoice

A Proforma Invoice serves as a preliminary bill of sale sent to buyers before the actual shipment of goods, outlining the agreed prices and terms. In payment processes, a Payment Order instructs the bank to transfer funds from the buyer to the seller, while a Collection Order authorizes the bank to collect payment from the buyer on behalf of the seller, both linked to the Proforma Invoice as documentation of the transaction terms.

Nostro/Vostro Account

Nostro accounts represent a bank's foreign currency deposits held in another bank, while Vostro accounts reflect the foreign currency balances a bank holds on behalf of its correspondent banks. Payment orders involve instructions to transfer funds from a Nostro account, whereas collection orders pertain to the receipt and processing of incoming payments credited to a Vostro account.

Settlement Instructions

Settlement instructions specify the detailed banking information required to process a payment or collection order, ensuring accurate fund transfer between the ordering and beneficiary banks. In a payment order, settlement instructions guide the debit and credit processes for outgoing payments, while in a collection order, they facilitate the receipt and processing of incoming funds or documents.

Clean Collection

Clean Collection involves the straightforward processing of payment where the Collection Order directs the exporter's bank to collect funds from the importer without accompanying shipping documents, while the Payment Order specifically instructs the bank to transfer funds according to agreed terms. This method reduces document handling risks compared to Document Collection, enabling smoother transaction flow in international trade.

Direct Remittance

Direct remittance involves the transfer of funds between banks based on payment instructions where a Payment Order instructs the sender's bank to debit its account and credit the beneficiary's account, ensuring immediate settlement. In contrast, a Collection Order authorizes the releasing bank to collect funds from the payer upon presentation of financial documents, typically used in trade finance for conditional payment.

Payment Order vs Collection Order Infographic

moneydif.com

moneydif.com