Pre-funded accounts offer immediate access to funds for remittances, reducing transaction delays compared to nostro accounts, which require bilateral reconciliation and can slow down the transfer process. While nostro accounts involve maintaining balances in foreign currencies at correspondent banks, pre-funded accounts mitigate liquidity risks and improve payment speed by holding funds in advance. Choosing pre-funded accounts enhances operational efficiency and provides more predictable cash flow management for cross-border payments.

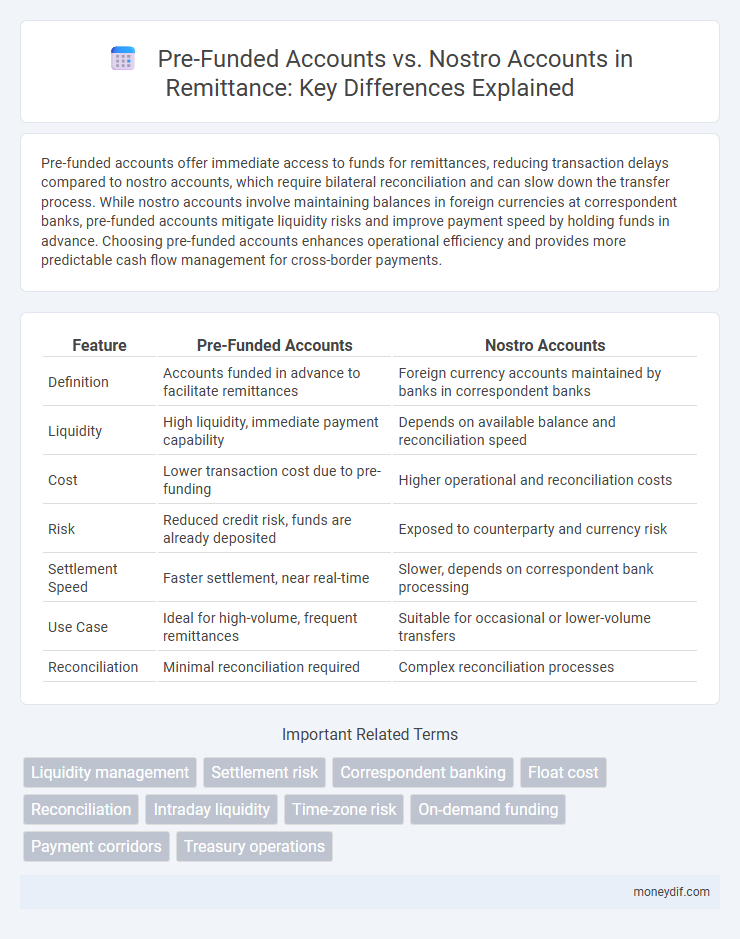

Table of Comparison

| Feature | Pre-Funded Accounts | Nostro Accounts |

|---|---|---|

| Definition | Accounts funded in advance to facilitate remittances | Foreign currency accounts maintained by banks in correspondent banks |

| Liquidity | High liquidity, immediate payment capability | Depends on available balance and reconciliation speed |

| Cost | Lower transaction cost due to pre-funding | Higher operational and reconciliation costs |

| Risk | Reduced credit risk, funds are already deposited | Exposed to counterparty and currency risk |

| Settlement Speed | Faster settlement, near real-time | Slower, depends on correspondent bank processing |

| Use Case | Ideal for high-volume, frequent remittances | Suitable for occasional or lower-volume transfers |

| Reconciliation | Minimal reconciliation required | Complex reconciliation processes |

Understanding Pre-Funded Accounts in Remittance

Pre-funded accounts in remittance enable faster and secure cross-border money transfers by holding funds in advance within recipient countries, reducing settlement delays and currency exchange risks. These accounts minimize counterparty risk compared to nostro accounts, which require real-time fund availability and involve complex reconciliation processes. Utilizing pre-funded accounts enhances liquidity management and ensures compliance with regulatory standards in international remittance operations.

What Are Nostro Accounts and How Do They Operate?

Nostro accounts are bank accounts held by a domestic bank in a foreign currency at a correspondent bank abroad, facilitating international transactions and currency exchange. They operate as a crucial component in remittance processes by enabling efficient cross-border fund transfers and real-time currency settlements. Compared to pre-funded accounts, nostro accounts reduce upfront capital requirements for banks while maintaining liquidity and transaction transparency.

Key Differences Between Pre-Funded and Nostro Accounts

Pre-funded accounts require customers to deposit funds in advance, enabling instant remittances, while nostro accounts involve banks holding foreign currency funds in correspondent banks to facilitate transactions. Pre-funded accounts reduce credit risk and improve liquidity management compared to nostro accounts, which may incur delays due to interbank settlement processes. Additionally, pre-funded accounts offer greater transparency and control over funds, whereas nostro accounts depend on synchronized accounting between banks.

Advantages of Pre-Funded Accounts for Remittance Providers

Pre-funded accounts enable remittance providers to offer faster transaction settlements by maintaining readily available funds, reducing reliance on correspondent banks' processing times associated with nostro accounts. These accounts minimize liquidity risk and lower operational costs by streamlining fund management and avoiding delays in cross-border money transfers. Enhanced customer satisfaction and increased transaction volume result from the improved efficiency and reliability of pre-funded account usage in remittance services.

The Role of Nostro Accounts in Cross-Border Payments

Nostro accounts play a critical role in cross-border payments by enabling banks to hold foreign currency deposits in correspondent banks, facilitating faster and more efficient currency exchange transactions. These accounts help reduce settlement risk and improve liquidity management compared to pre-funded accounts, which require funds to be deposited in advance. By providing real-time access to funds in foreign currencies, nostro accounts streamline remittance processes and enhance transactional transparency across international financial networks.

Cost Implications: Pre-Funded Accounts vs Nostro Accounts

Pre-funded accounts reduce transaction costs by minimizing reliance on intermediary banks and foreign exchange fees, leading to faster fund access. Nostro accounts incur higher operational expenses due to maintenance fees, liquidity requirements, and reconciliation processes across multiple currencies. Financial institutions must evaluate these cost implications to optimize remittance efficiency and profitability.

Liquidity Management in Pre-Funded and Nostro Models

Liquidity management in pre-funded accounts involves maintaining sufficient funds upfront in recipient banks to ensure smooth transaction settlements without delays. Nostro accounts require careful reconciliation and real-time monitoring to avoid liquidity shortfalls, as funds are transferred after transactions. Effective liquidity management in both models is crucial for minimizing operational risk and optimizing cash flow in cross-border remittance processes.

Risk Factors: Comparing Pre-Funded and Nostro Accounts

Pre-funded accounts minimize credit risk by holding funds upfront, reducing the likelihood of payment default, while nostro accounts expose banks to settlement risk due to delayed fund transfers. Nostro accounts require ongoing liquidity management and are vulnerable to operational and foreign exchange risks during transaction processing. Pre-funded accounts entail opportunity costs for capital but enhance transaction security and speed in cross-border remittances.

Speed and Efficiency in Remittance: Pre-Funded vs Nostro

Pre-funded accounts significantly enhance remittance speed and efficiency by eliminating the need for intermediary banks, enabling instant fund availability and real-time settlement. Nostro accounts, while widely used, often involve longer processing times due to cross-bank reconciliations and delayed confirmations. Utilizing pre-funded accounts reduces operational delays and minimizes transaction costs, ensuring faster and more reliable cross-border money transfers.

Future Trends: Evolving Remittance Settlements Beyond Traditional Accounts

Future trends in remittance settlements indicate a shift from traditional nostro accounts to innovative pre-funded accounts, enhancing transaction speed and transparency. Pre-funded accounts enable real-time liquidity management, reducing dependency on intermediary banks and lowering operational costs. Emerging blockchain integrations and decentralized finance solutions are expected to further disrupt conventional settlement methods, promoting efficiency and security in cross-border payments.

Important Terms

Liquidity management

Liquidity management involves optimizing cash flow and ensuring sufficient funds across pre-funded accounts, which are fully funded in advance to minimize payment delays, and nostro accounts, which serve as correspondent bank accounts holding foreign currency balances to facilitate international transactions. Efficient coordination between pre-funded and nostro accounts reduces liquidity risk by balancing immediate availability of funds with cost-effective currency transfers in cross-border payments.

Settlement risk

Settlement risk decreases with pre-funded accounts as funds are guaranteed, whereas nostro accounts expose parties to higher risk due to payment timing mismatches.

Correspondent banking

Correspondent banking utilizes nostro accounts to facilitate international transactions, while pre-funded accounts provide immediate settlement by holding funds in advance to mitigate credit risk.

Float cost

Float cost refers to the expenses incurred due to the time lag between the initiation and settlement of funds in pre-funded accounts, where liquidity is pre-allocated, versus nostro accounts, which rely on incoming settlements that can cause variable float durations. Pre-funded accounts typically reduce float cost by minimizing settlement risk and ensuring immediate availability of funds, while nostro accounts can increase float cost due to delays in international clearing and reconciliation processes.

Reconciliation

Reconciliation between pre-funded accounts and nostro accounts focuses on matching transaction records to ensure accuracy and prevent discrepancies in cross-border payments. Accurate reconciliation improves liquidity management and reduces operational risks by verifying that funds pre-funded in correspondent banks align with nostro account statements.

Intraday liquidity

Intraday liquidity management improves cash flow efficiency by utilizing pre-funded accounts to minimize credit risk compared to nostro accounts, which depend on end-of-day reconciliation.

Time-zone risk

Time-zone risk in pre-funded accounts arises from delayed fund availability across different market hours, whereas nostro accounts mitigate this risk by holding correspondent bank balances locally to enable faster settlement.

On-demand funding

On-demand funding enhances liquidity management by enabling instantaneous transfers between pre-funded accounts and nostro accounts, reducing settlement risk and improving operational efficiency.

Payment corridors

Payment corridors rely on pre-funded accounts for immediate settlements, while nostro accounts facilitate reconciliation and bilateral trust between correspondent banks.

Treasury operations

Treasury operations optimize liquidity management by utilizing pre-funded accounts for immediate settlement and nostro accounts for reconciliations and cross-border transactions.

pre-funded accounts vs nostro accounts Infographic

moneydif.com

moneydif.com