Cut-off time determines the latest moment a remittance instruction must be received to process the transaction on the same day, affecting the value date, which is the date the funds become available to the beneficiary. Transactions submitted after the cut-off time are processed on the next business day, delaying the value date accordingly. Understanding the relationship between cut-off time and value date is crucial for timely fund transfers and effective financial planning.

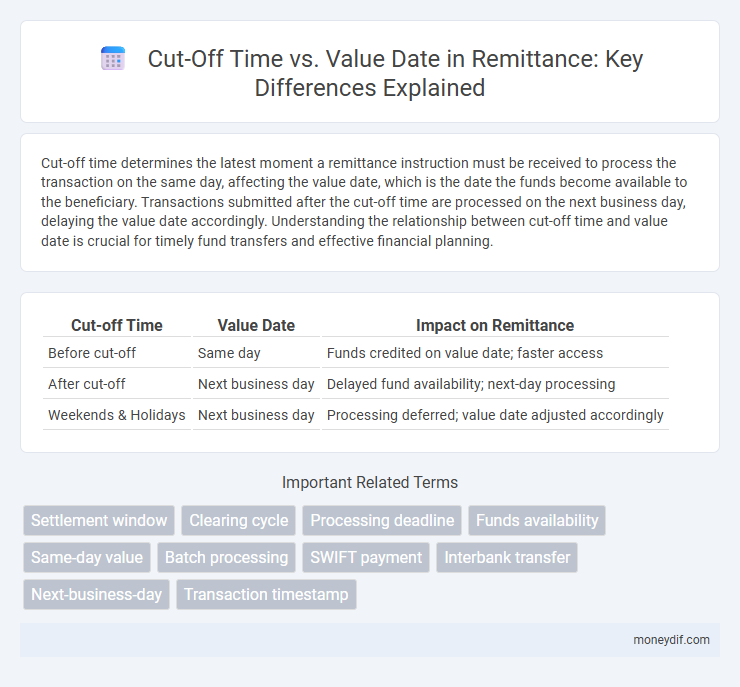

Table of Comparison

| Cut-off Time | Value Date | Impact on Remittance |

|---|---|---|

| Before cut-off | Same day | Funds credited on value date; faster access |

| After cut-off | Next business day | Delayed fund availability; next-day processing |

| Weekends & Holidays | Next business day | Processing deferred; value date adjusted accordingly |

Understanding Remittance Cut-off Times

Remittance cut-off times determine the latest point at which a transaction can be processed on the same business day, directly impacting the value date when funds become available to the recipient. Understanding these cut-off times is crucial for optimizing liquidity management and ensuring timely delivery of payments in cross-border transfers. Delays beyond the cut-off result in value dates being pushed to the next business day, affecting cash flow and financial planning.

What Is a Value Date in Remittances?

A value date in remittances refers to the specific date on which the transferred funds become available to the recipient, impacting interest calculation and transaction finality. Unlike the cut-off time, which is the deadline for submitting transactions to be processed the same day, the value date determines when the beneficiary can actually access the money. Understanding the distinction between cut-off time and value date is crucial for managing cash flow and ensuring timely availability of funds in international money transfers.

Key Differences: Cut-off Time vs. Value Date

Cut-off time determines the latest moment a remittance instruction must be submitted for processing on the same business day, directly impacting settlement timing. The value date represents the actual date when funds are credited or debited in the beneficiary's account, reflecting when the money becomes available. Understanding the distinction ensures accurate planning of fund availability and transaction execution in cross-border payments.

How Cut-off Times Affect International Transfers

Cut-off times determine the processing day for international remittances, directly impacting the value date when funds become available to the recipient. Transfers initiated after cut-off times are processed on the next business day, causing delays in currency conversion and settlement. Banks and remittance services set specific cut-off schedules based on time zones and correspondent banking hours, affecting the speed and predictability of cross-border payments.

The Impact of Value Date on Fund Availability

The value date directly influences the timing of fund availability in remittance transactions, determining when recipients can access transferred funds. A later value date means funds may be debited from the sender's account but not yet credited to the beneficiary, delaying liquidity. Understanding the cut-off time is crucial as transactions processed after this point will have a subsequent value date, affecting when funds become accessible.

Common Cut-off Time Policies by Major Banks

Major banks typically enforce cut-off times between 2:00 PM and 5:00 PM local time for same-day processing of remittances, ensuring funds are credited on the value date or the following business day depending on the transaction time. Transactions initiated after the cut-off time are processed on the next business day, which can delay the value date by 1-2 days. Common cut-off policies aim to synchronize processing deadlines with interbank settlement systems, minimizing fund transfer delays and optimizing liquidity management for corporate and retail clients.

Value Date Considerations for Currency Exchange

Value date plays a crucial role in currency exchange during remittance, as it determines when the funds are effectively available for the recipient's use. Understanding the cut-off time ensures that transactions posted before this deadline use the same business day's value date, minimizing delays and optimizing foreign exchange rates. Processing remittances after cut-off times typically results in next business day value dates, impacting the exchange rates applied and the remittance's overall cost efficiency.

Timely Remittance: Avoiding Delays Due to Cut-off Times

Timely remittance requires adhering to bank cut-off times to ensure the transaction is processed on the intended value date, preventing delays that could affect fund availability. Missing cut-off times often results in the value date being pushed to the next business day, impacting cash flow and financial planning. Understanding specific cut-off schedules of sending and receiving banks is crucial for accurate timing and efficient cross-border payments.

Maximizing Transfer Efficiency: Cut-off Time Strategies

Cut-off time strategies are critical in maximizing transfer efficiency by determining the latest moment a remittance can be processed for the same value date. Financial institutions set cut-off times based on operational capabilities and interbank settlement schedules, directly impacting the speed and timing of fund availability. Optimizing cut-off times reduces delays, ensuring recipients receive funds promptly within the intended value date, enhancing overall transaction reliability.

Regulatory Guidelines on Cut-off Time and Value Date

Regulatory guidelines on cut-off time and value date in remittance transactions ensure timely processing and compliance with anti-money laundering standards, requiring banks to set clear cut-off times before the value date is assigned. Central banks often mandate that remittances received after the cut-off time use the next business day as the value date to maintain transparency and prevent settlement delays. Compliance with these regulations enhances operational efficiency and customer trust by providing predictable fund availability and accurate transaction dating.

Important Terms

Settlement window

The settlement window defines the period between the cut-off time, when payment instructions must be submitted, and the value date, the actual date funds are transferred between accounts. Optimizing the settlement window ensures timely processing of transactions, reduces settlement risk, and aligns with banking cut-off times to improve liquidity management.

Clearing cycle

The clearing cycle determines the time between the cut-off time for transactions and their corresponding value date, impacting when funds become available or settle in customer accounts. Banks set specific cut-off times within the clearing cycle to ensure transactions processed before these deadlines reflect on the agreed value date, optimizing liquidity management.

Processing deadline

Processing deadlines determine the cut-off time by which transactions must be submitted to be executed on the intended value date, ensuring timely settlement and accurate financial accounting. Transactions received after the cut-off time are processed on the next business day, affecting the value date and potentially delaying funds availability.

Funds availability

Funds availability depends on the cut-off time, which determines if a transaction is processed on the same banking day, directly impacting the value date. Transactions received before the cut-off time typically post on the same day, setting the value date accordingly, while those after the cut-off are processed the next business day, delaying fund availability.

Same-day value

Same-day value ensures that transactions processed before the cut-off time reflect on the value date of the same day, enabling immediate availability of funds. Transactions submitted after the cut-off time are assigned the next business day's value date, delaying fund accessibility.

Batch processing

Batch processing systems execute transactions based on a predefined cut-off time, determining the processing cycle and ensuring that all transactions received before this deadline are included in the current batch; the value date then specifies the effective date when funds are actually available or settled, which may differ from the transaction date depending on processing schedules. Synchronizing cut-off times with value date requirements is crucial for accurate settlement, risk management, and compliance in financial services.

SWIFT payment

SWIFT payment cut-off times determine the processing deadline for transactions to be executed on the same value date, ensuring the funds are credited on the intended date without delay. Payments received after the cut-off time are typically processed on the next business day, impacting the value date and settlement timing.

Interbank transfer

Interbank transfer cut-off times determine the processing day, directly affecting the value date when funds become available to the recipient. Transfers initiated after the cut-off time are processed on the next business day, resulting in a delayed value date and potential impact on cash flow management.

Next-business-day

Next-business-day processing depends on the cut-off time, which is the deadline for transactions to be processed on the same day; transactions submitted after this cut-off time are typically assigned a value date on the following business day. The value date determines when funds become available and is crucial for accurate settlement and interest calculations in banking and financial services.

Transaction timestamp

Transaction timestamp marks the exact moment a financial transaction is recorded, directly influencing whether it falls before or after the cut-off time, which determines the effective value date credited to the account. Transactions timestamped after the cut-off time are processed on the next business day, thereby setting the subsequent value date for settlement and interest calculation purposes.

cut-off time vs value date Infographic

moneydif.com

moneydif.com