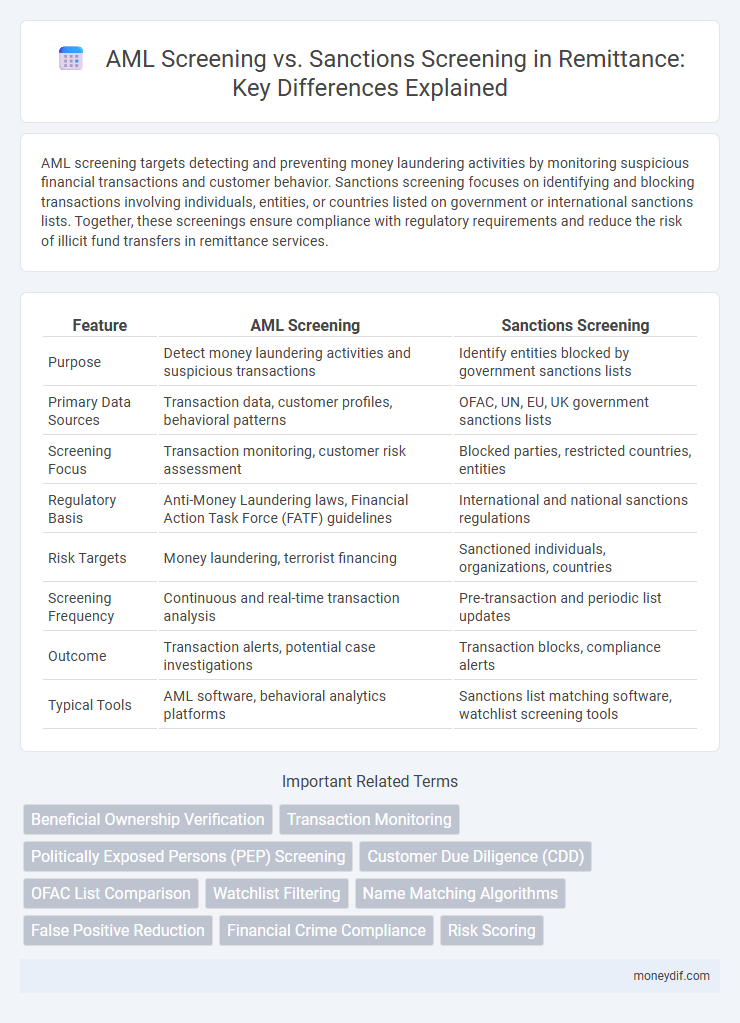

AML screening targets detecting and preventing money laundering activities by monitoring suspicious financial transactions and customer behavior. Sanctions screening focuses on identifying and blocking transactions involving individuals, entities, or countries listed on government or international sanctions lists. Together, these screenings ensure compliance with regulatory requirements and reduce the risk of illicit fund transfers in remittance services.

Table of Comparison

| Feature | AML Screening | Sanctions Screening |

|---|---|---|

| Purpose | Detect money laundering activities and suspicious transactions | Identify entities blocked by government sanctions lists |

| Primary Data Sources | Transaction data, customer profiles, behavioral patterns | OFAC, UN, EU, UK government sanctions lists |

| Screening Focus | Transaction monitoring, customer risk assessment | Blocked parties, restricted countries, entities |

| Regulatory Basis | Anti-Money Laundering laws, Financial Action Task Force (FATF) guidelines | International and national sanctions regulations |

| Risk Targets | Money laundering, terrorist financing | Sanctioned individuals, organizations, countries |

| Screening Frequency | Continuous and real-time transaction analysis | Pre-transaction and periodic list updates |

| Outcome | Transaction alerts, potential case investigations | Transaction blocks, compliance alerts |

| Typical Tools | AML software, behavioral analytics platforms | Sanctions list matching software, watchlist screening tools |

Understanding AML Screening in Remittance Services

AML screening in remittance services involves verifying the identity of clients and monitoring transactions to detect and prevent money laundering activities, complying with regulations such as the Bank Secrecy Act (BSA) and the USA PATRIOT Act. This process includes Customer Due Diligence (CDD) and transaction monitoring using databases that flag suspicious behavior based on patterns associated with money laundering. Unlike sanctions screening, which blocks transactions involving sanctioned parties or countries, AML screening aims to identify broader illicit financial activities to protect the integrity of the financial system.

What Is Sanctions Screening and Why It Matters

Sanctions screening identifies individuals, entities, and countries subject to international trade restrictions imposed by governments or regulatory bodies to prevent illicit financial activities. It is crucial in remittance services to ensure compliance with global regulations and avoid facilitating transactions with sanctioned parties, thereby mitigating legal and reputational risks. Effective sanctions screening helps maintain the integrity of the financial system by blocking prohibited funds and supporting anti-terrorism and anti-money laundering efforts.

Key Differences Between AML Screening and Sanctions Screening

AML screening focuses on identifying suspicious financial activities to prevent money laundering by analyzing transaction patterns and customer behavior. Sanctions screening targets individuals, entities, or countries listed on government or international sanctions lists to block prohibited transactions. The key difference lies in AML's broad focus on illicit financial behavior, whereas sanctions screening specifically enforces regulatory restrictions against sanctioned parties.

Regulatory Requirements for AML and Sanctions Screening

AML screening and sanctions screening are critical components of regulatory compliance in the remittance industry, mandated by global frameworks such as the Financial Action Task Force (FATF) recommendations and specific country laws like the USA PATRIOT Act. AML screening focuses on identifying suspicious transactions and preventing money laundering activities through continuous monitoring of customer behavior and transaction patterns. Sanctions screening involves verifying remittance recipients against updated lists from entities such as OFAC, UN, and EU to block or report transactions involving sanctioned individuals, entities, or countries, ensuring adherence to international sanctions regimes.

How AML Screening Protects Remittance Providers

AML screening protects remittance providers by identifying and preventing transactions involving illicit funds linked to money laundering activities. This process involves thorough customer due diligence, transaction monitoring, and risk assessment to ensure compliance with anti-money laundering laws and regulations. Effective AML screening reduces regulatory penalties, safeguards financial integrity, and enhances the trustworthiness of remittance services.

The Role of Sanctions Screening in Cross-Border Payments

Sanctions screening plays a critical role in cross-border payments by ensuring compliance with international regulations that prohibit transactions involving sanctioned entities or regions. This process helps financial institutions detect and block illicit funds linked to terrorism, money laundering, or geopolitical risks, safeguarding the global financial system. Effective sanctions screening enhances transparency and reduces legal and reputational risks associated with remittance flows across jurisdictions.

Common Challenges in AML and Sanctions Screening

AML screening and sanctions screening both aim to prevent financial crimes but face common challenges such as false positives, data quality issues, and regulatory compliance complexity. Effective screening requires maintaining updated watchlists, integrating advanced analytics, and balancing thoroughness with transaction flow efficiency. Ensuring accurate entity resolution across disparate databases remains critical to detecting illicit activities without disrupting legitimate remittance transactions.

Best Practices for Remittance AML and Sanctions Checks

Effective remittance AML and sanctions screening require integrating robust transaction monitoring systems with comprehensive, up-to-date watchlists from global regulatory bodies such as OFAC, UN, and EU. Utilizing artificial intelligence and machine learning enhances detection of suspicious patterns while minimizing false positives, ensuring compliance with regulatory standards and reducing operational risks. Regularly updating screening criteria and conducting risk-based due diligence contribute to a proactive approach in preventing money laundering and sanctions violations within remittance operations.

Technology Solutions for Enhanced Screening Compliance

Advanced technology solutions in remittance focus on integrating AML screening and sanctions screening within a unified platform, leveraging artificial intelligence and machine learning to detect suspicious activities in real-time. These solutions enable financial institutions to efficiently analyze vast datasets, ensuring compliance with global regulatory standards such as the Financial Action Task Force (FATF) recommendations and OFAC sanctions lists. Enhanced screening compliance is achieved through continuous updates, automated risk scoring, and seamless integration with existing transaction monitoring systems.

Future Trends in AML and Sanctions Screening for Remittances

Future trends in AML and sanctions screening for remittances emphasize the integration of advanced artificial intelligence and machine learning algorithms to enhance detection accuracy and reduce false positives. Real-time transaction monitoring powered by big data analytics enables faster identification of suspicious activities across cross-border payments. Enhanced collaboration between financial institutions and regulatory bodies will drive the development of unified global databases to improve screening efficiency and compliance with evolving international sanctions.

Important Terms

Beneficial Ownership Verification

Beneficial Ownership Verification enhances AML screening by accurately identifying the individuals who ultimately control or benefit from an entity, reducing risks of money laundering and terrorist financing. In contrast, sanctions screening focuses on flagging entities or individuals listed on international sanctions databases to prevent illicit financial transactions and comply with regulatory requirements.

Transaction Monitoring

Transaction monitoring involves continuously analyzing financial transactions to detect suspicious activity related to money laundering, whereas AML screening focuses on identifying customers and transactions linked to money laundering risks. Sanctions screening specifically targets transactions involving individuals or entities listed on government or international sanctions lists, ensuring compliance with regulatory restrictions.

Politically Exposed Persons (PEP) Screening

Politically Exposed Persons (PEP) screening focuses on identifying individuals with prominent public functions to assess risks linked to money laundering and corruption within AML screening frameworks. Sanctions screening complements this by cross-checking PEPs against international sanctions lists to prevent illicit financial activities and comply with regulatory requirements.

Customer Due Diligence (CDD)

Customer Due Diligence (CDD) involves verifying customer identity and assessing risk factors to prevent financial crimes, with AML screening focusing on detecting money laundering activities through transaction monitoring and suspicious activity reports. Sanctions screening complements CDD by checking customers against global sanctions lists to ensure compliance with legal restrictions on prohibited individuals or entities.

OFAC List Comparison

OFAC List Comparison is crucial for AML screening to identify individuals or entities involved in money laundering activities linked to sanctioned parties. Sanctions screening leverages OFAC lists to block or reject transactions associated with designated countries, organizations, or individuals, enhancing regulatory compliance and risk mitigation.

Watchlist Filtering

Watchlist filtering in AML screening involves analyzing customer data against comprehensive databases containing known financial crime entities to identify potential money laundering risks. Sanctions screening specifically targets lists issued by governments and international bodies to block transactions involving sanctioned individuals or countries, ensuring compliance with regulatory requirements.

Name Matching Algorithms

Name matching algorithms in AML screening prioritize detecting variations and aliases to identify potential financial crimes, enhancing the accuracy of Know Your Customer (KYC) processes. In sanctions screening, these algorithms focus on exact and fuzzy matching against global watchlists to ensure compliance with regulatory restrictions and prevent transactions involving sanctioned entities.

False Positive Reduction

False positive reduction in AML screening focuses on minimizing incorrect alerts related to suspicious financial activities by employing advanced algorithms and machine learning techniques. In sanctions screening, false positive reduction enhances the accuracy of identifying prohibited entities by refining matching logic and leveraging updated sanctions lists to prevent unnecessary blocking of legitimate transactions.

Financial Crime Compliance

Financial Crime Compliance (FCC) involves rigorous Anti-Money Laundering (AML) screening, which focuses on detecting suspicious transactions and customer behaviors to prevent money laundering activities, whereas sanctions screening specifically targets entities and individuals listed by global regulatory bodies to restrict illicit trade and financial flows. Effective FCC programs integrate both AML and sanctions screening to mitigate risks, ensure regulatory adherence, and protect institutions from financial penalties and reputational damage.

Risk Scoring

Risk scoring in AML screening prioritizes identifying potential money laundering activities by analyzing transaction patterns, customer behavior, and historical data to assign risk levels. In contrast, sanctions screening focuses on cross-referencing individuals and entities against global watchlists to prevent dealings with sanctioned parties, with risk scores highlighting matches that require further investigation.

AML screening vs sanctions screening Infographic

moneydif.com

moneydif.com