Payer institutions initiate the transfer of funds by verifying the sender's details and ensuring compliance with regulatory requirements. Payee institutions receive the payment instructions, credit the beneficiary's account, and notify the recipient of the incoming remittance. Effective coordination between payer and payee institutions is essential to ensure secure, timely, and accurate remittance processing.

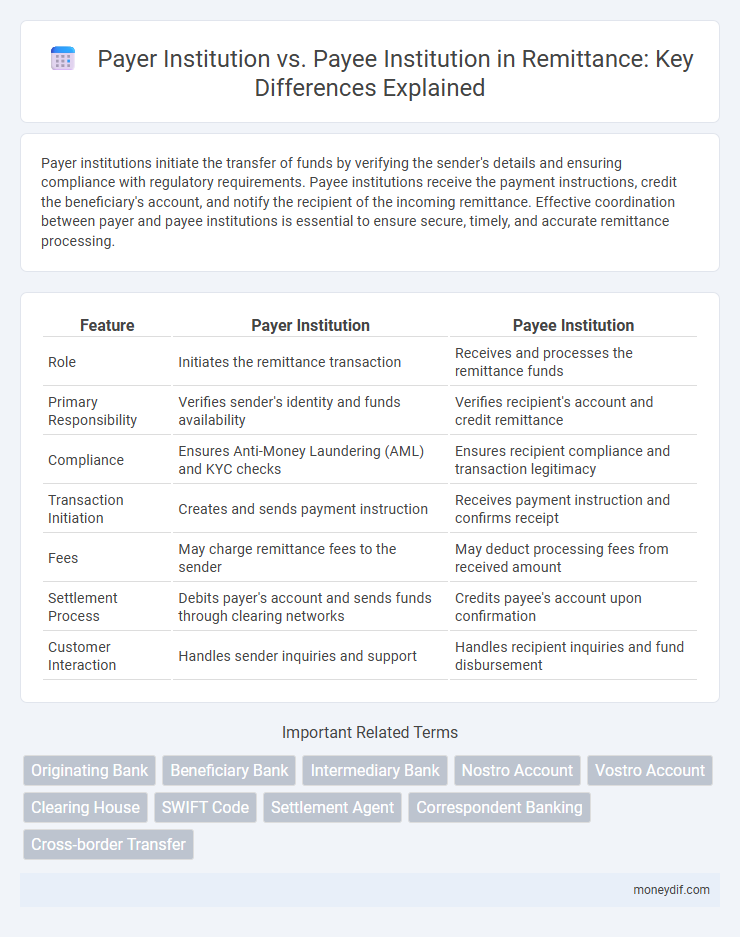

Table of Comparison

| Feature | Payer Institution | Payee Institution |

|---|---|---|

| Role | Initiates the remittance transaction | Receives and processes the remittance funds |

| Primary Responsibility | Verifies sender's identity and funds availability | Verifies recipient's account and credit remittance |

| Compliance | Ensures Anti-Money Laundering (AML) and KYC checks | Ensures recipient compliance and transaction legitimacy |

| Transaction Initiation | Creates and sends payment instruction | Receives payment instruction and confirms receipt |

| Fees | May charge remittance fees to the sender | May deduct processing fees from received amount |

| Settlement Process | Debits payer's account and sends funds through clearing networks | Credits payee's account upon confirmation |

| Customer Interaction | Handles sender inquiries and support | Handles recipient inquiries and fund disbursement |

Understanding Payer Institutions in Remittance

Payer institutions in remittance are financial entities responsible for initiating the transfer of funds on behalf of the sender, ensuring compliance with regulatory requirements and verifying the payer's identity. These institutions collaborate with intermediary banks and payee institutions to facilitate secure and timely transactions across borders. Understanding the operational role of payer institutions helps optimize transaction accuracy and prevent fraud in cross-border payments.

Defining Payee Institutions: Roles and Functions

Payee institutions are financial entities responsible for receiving and crediting funds to the beneficiary's account in a remittance transaction. Their primary functions include verifying the payee's identity, ensuring compliance with regulatory requirements, and facilitating the prompt transfer of funds. The efficiency and security of payee institutions directly impact the successful completion of cross-border payments and customer satisfaction.

Key Differences Between Payer and Payee Institutions

Payer institutions initiate remittance transactions by sending funds from the sender's account, while payee institutions receive and credit the funds to the recipient's account. Key differences include the responsibility for transaction authorization, with payer institutions verifying and debiting the sender, whereas payee institutions ensure accurate crediting and compliance with local regulations. Security protocols also differ, as payer institutions focus on fraud prevention during funding, and payee institutions emphasize verification of beneficiary identity before disbursing funds.

Regulatory Frameworks for Payer and Payee Institutions

Payer institutions must comply with anti-money laundering (AML) and know your customer (KYC) regulations to validate sender identities and transaction legitimacy before initiating remittances. Payee institutions enforce strict compliance with local financial regulations and sanctions screening to ensure recipients meet legal requirements and prevent illicit fund receipt. Both institutions coordinate under international frameworks such as FATF guidelines to maintain transparency and mitigate risks in cross-border money transfers.

Transaction Flow: From Payer Institution to Payee Institution

The transaction flow in remittance begins at the payer institution, which initiates the payment by debiting the sender's account and encoding transaction details into a secure message format, such as ISO 20022. This message is transmitted through intermediary networks or clearinghouses, ensuring compliance with anti-money laundering (AML) and know-your-customer (KYC) protocols before reaching the payee institution. Upon receipt, the payee institution credits the beneficiary's account and confirms transaction completion, providing real-time updates for transparency and settlement finality.

Security Measures in Payer and Payee Institutions

Security measures in payer institutions focus on robust authentication protocols, encryption of transaction data, and real-time fraud detection systems to prevent unauthorized access and ensure fund integrity. Payee institutions implement rigorous verification procedures, secure digital wallets, and end-to-end encryption to safeguard recipient information and confirm legitimacy of incoming remittances. Both institutions employ multi-factor authentication and compliance with regulatory standards such as AML and KYC to enhance overall transaction security in remittance processes.

Fees and Charges: Payer vs Payee Institutions

Payer institutions often incur fees related to transaction initiation, currency conversion, and compliance checks, which can increase the overall cost of remittance. Payee institutions may charge fees for receiving, processing, and disbursing funds, especially in cross-border transactions or different currency settlements. Transparent fee disclosure by both payer and payee institutions is essential to minimizing hidden charges and ensuring cost-efficiency in remittance services.

Impact of Technology on Payer and Payee Institutions

The impact of technology on payer and payee institutions has streamlined remittance processes by enabling faster transaction settlements and reducing operational costs. Advanced digital platforms and blockchain technology enhance security and transparency for both institutions, minimizing fraud risks and ensuring compliance with regulatory standards. Automation and real-time data analytics improve transaction accuracy and customer experience, driving efficiency across global payment networks.

Choosing the Right Payer and Payee Institution

Choosing the right payer institution involves assessing factors such as transaction fees, processing speed, and regulatory compliance to ensure efficient fund transfer. Selecting a payee institution requires evaluating its accessibility, customer support, and integration with international payment networks to guarantee timely receipt and optimal service. Prioritizing reputable financial entities with robust security protocols minimizes risks and enhances overall remittance reliability.

Challenges and Solutions for Payer and Payee Institutions

Payer institutions face challenges such as ensuring compliance with regulatory requirements and managing cross-border transaction fees, while payee institutions often struggle with verification of incoming funds and settlement delays. Implementing advanced fraud detection systems and real-time payment tracking can enhance security and transparency for both parties. Leveraging blockchain technology and standardized messaging protocols reduces processing times and operational risks, fostering smoother remittance flows between payer and payee institutions.

Important Terms

Originating Bank

The originating bank acts as the financial institution initiating a payment transaction on behalf of the payer institution, ensuring funds are debited from the payer's account. It communicates with the payee institution's bank to complete the transfer, guaranteeing the funds are credited to the payee's account efficiently.

Beneficiary Bank

The beneficiary bank is the financial institution that receives funds on behalf of the payee institution during a transaction. It acts as the final recipient bank, ensuring the payee institution's account is credited accurately within interbank payment systems.

Intermediary Bank

An intermediary bank facilitates international fund transfers by serving as a middle entity between the payer institution, which initiates the payment, and the payee institution, which receives the funds. This bank ensures secure processing and routing of transactions, especially when the payer and payee institutions do not have a direct correspondent banking relationship.

Nostro Account

A Nostro account is maintained by a payer institution in a foreign bank to facilitate international payments and settlements with the payee institution, enabling efficient currency exchange and reconciliation. This account ensures swift cross-border transactions by providing the payer institution direct access to the payee institution's banking network and currency.

Vostro Account

Vostro accounts are maintained by a bank (Payer Institution) on behalf of a foreign bank (Payee Institution) to facilitate cross-border transactions and liquidity management. These accounts enable the Payer Institution to process payments in local currency, ensuring efficient clearance and settlement between correspondent banks.

Clearing House

A Clearing House facilitates the secure and efficient exchange of payment instructions between Payer Institutions and Payee Institutions, ensuring accurate settlement and reconciliation of funds. It acts as an intermediary that validates transactions, reduces settlement risk, and accelerates the transfer process within banking and financial networks.

SWIFT Code

SWIFT Code uniquely identifies financial institutions during international transactions, ensuring accurate routing between the payer institution initiating the payment and the payee institution receiving the funds. This standardized alphanumeric code reduces errors and enhances the efficiency of cross-border money transfers by clearly specifying the sender's and receiver's banks.

Settlement Agent

A Settlement Agent facilitates the final transfer of funds between the payer institution and the payee institution, ensuring accurate reconciliation and confirmation of payment instructions. This entity verifies transaction details and manages clearing processes to guarantee timely and secure settlement of financial obligations.

Correspondent Banking

Correspondent banking facilitates international transactions by enabling payer institutions to access financial services through payee institutions in different jurisdictions, ensuring secure and efficient cross-border payments. This relationship bridges liquidity and compliance requirements, allowing payer institutions to send funds via payee institutions that hold correspondent accounts.

Cross-border Transfer

Cross-border transfers involve the movement of funds between the payer institution and the payee institution, often requiring currency conversion, compliance with international regulations, and coordination through correspondent banking networks. The payer institution initiates the transaction, ensuring accurate payment instructions and sufficient funds, while the payee institution is responsible for validating beneficiary details and crediting the recipient's account efficiently.

Payer Institution vs Payee Institution Infographic

moneydif.com

moneydif.com