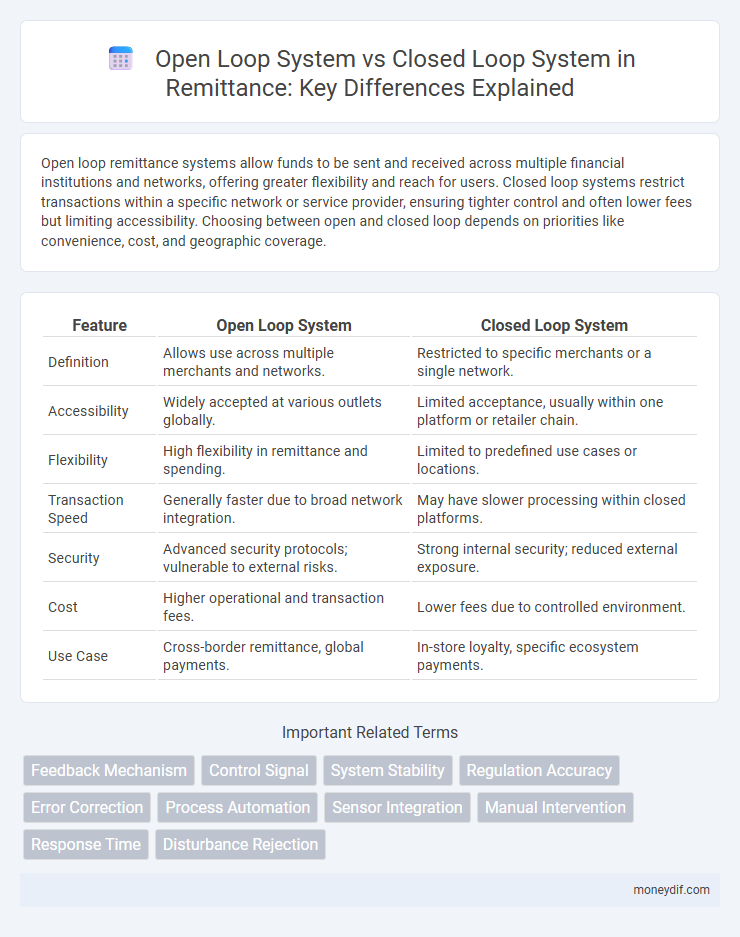

Open loop remittance systems allow funds to be sent and received across multiple financial institutions and networks, offering greater flexibility and reach for users. Closed loop systems restrict transactions within a specific network or service provider, ensuring tighter control and often lower fees but limiting accessibility. Choosing between open and closed loop depends on priorities like convenience, cost, and geographic coverage.

Table of Comparison

| Feature | Open Loop System | Closed Loop System |

|---|---|---|

| Definition | Allows use across multiple merchants and networks. | Restricted to specific merchants or a single network. |

| Accessibility | Widely accepted at various outlets globally. | Limited acceptance, usually within one platform or retailer chain. |

| Flexibility | High flexibility in remittance and spending. | Limited to predefined use cases or locations. |

| Transaction Speed | Generally faster due to broad network integration. | May have slower processing within closed platforms. |

| Security | Advanced security protocols; vulnerable to external risks. | Strong internal security; reduced external exposure. |

| Cost | Higher operational and transaction fees. | Lower fees due to controlled environment. |

| Use Case | Cross-border remittance, global payments. | In-store loyalty, specific ecosystem payments. |

Understanding Remittance: Open Loop vs Closed Loop Systems

Open loop remittance systems allow funds to be transferred through multiple financial institutions and can be used at various points worldwide, offering greater flexibility and wider acceptance. Closed loop systems restrict transactions within a specific network or platform, enhancing control and reducing fraud risks but limiting recipient options. Understanding these systems helps users select the best remittance method based on accessibility, cost, and security needs.

Key Differences Between Open Loop and Closed Loop Remittance

Open loop remittance systems enable funds to be sent and received across multiple financial networks, supporting broader accessibility and flexibility for users worldwide. Closed loop remittance systems operate within a single, proprietary network, restricting transactions to predefined participants or platforms, often resulting in faster processing times but limited reach. The key differences lie in interoperability, cost efficiency, transaction speed, and user convenience, where open loop offers extensive network coverage and closed loop prioritizes control and security.

How Open Loop Remittance Systems Work

Open loop remittance systems operate by allowing users to send money through a network of multiple third-party financial institutions, such as banks and payment service providers, enabling recipients to access funds via ATMs, bank accounts, or mobile wallets. These systems leverage extensive global partnerships and payment rails to offer flexibility and wide reach for international transfers. Transactions are processed in real-time or near real-time, ensuring efficient fund delivery across borders while maintaining regulatory compliance and security standards.

Closed Loop Remittance Systems: An Overview

Closed loop remittance systems operate within a controlled network where funds are transferred and redeemed exclusively among participating members or platforms, enhancing security and reducing transaction costs. These systems leverage proprietary wallets or cards, enabling real-time tracking and minimizing fraud risks inherent in open loop mechanisms. By restricting transactions to specific ecosystems, closed loop remittance ensures improved compliance with regulatory standards and fosters seamless user experiences.

Pros and Cons of Open Loop Remittance Systems

Open loop remittance systems offer broad accessibility by enabling transactions across multiple financial institutions and locations, enhancing convenience for users. These systems provide greater flexibility and interoperability compared to closed loop models, which are limited to specific merchants or platforms. However, open loop systems often face higher operational costs and increased regulatory scrutiny due to their extensive network reach and the complexity of managing diverse compliance requirements.

Advantages and Challenges of Closed Loop Remittance

Closed loop remittance systems offer advantages such as enhanced control over transaction security and reduced fraud risk due to predefined, limited networks. They facilitate faster fund transfers within the closed ecosystem, improving user experience and operational efficiency. However, challenges include limited accessibility since funds can only be used within the network, and potential scalability issues when expanding to new regions or merchant partners.

Security Comparison: Open vs Closed Loop Remittance

Closed loop remittance systems offer enhanced security by restricting transactions within predefined networks, reducing exposure to external fraud and unauthorized access. Open loop systems, while more flexible, expose funds to higher risks due to their interoperability with multiple banks and financial institutions, increasing vulnerability to cyberattacks and money laundering. Enhanced encryption protocols and multi-factor authentication are critical in both systems, but the closed loop's controlled environment inherently limits potential security breaches.

User Experience in Open Loop Versus Closed Loop Systems

Open loop remittance systems offer users greater flexibility by allowing transactions across multiple financial institutions and networks, enhancing convenience and accessibility. Closed loop systems provide a more controlled user experience with streamlined processes and reduced transaction times within a single platform. Users benefit from open loop systems through wider acceptance and interoperability, while closed loop systems excel in delivering faster service and tighter security.

Regulatory Considerations for Open and Closed Loop Remittance

Regulatory considerations for open loop remittance systems emphasize stringent anti-money laundering (AML) and know-your-customer (KYC) compliance due to their interoperability across multiple financial institutions and networks. Closed loop remittance systems face regulatory scrutiny primarily on transaction monitoring and consumer protection within a limited network, requiring adherence to specific licensing and reporting obligations. Both systems must comply with international financial regulations such as the Financial Action Task Force (FATF) recommendations to prevent illicit financial activities.

Choosing the Right Remittance System: Open Loop or Closed Loop?

Choosing the right remittance system involves understanding the key differences between open loop and closed loop systems. Open loop remittance systems enable funds to be used across multiple platforms and merchants, providing greater flexibility and wider acceptance, whereas closed loop systems restrict usage to a specific network or issuer, offering better control and reduced fraud risk. Evaluating factors such as user convenience, transaction costs, and fraud protection helps determine which system aligns best with your remittance goals.

Important Terms

Feedback Mechanism

A feedback mechanism in a closed loop system continuously monitors output to adjust inputs for desired performance, unlike an open loop system that operates without output feedback.

Control Signal

Control signals in open loop systems are predetermined and do not rely on feedback, making them suitable for processes with consistent conditions but prone to errors from disturbances. In contrast, closed loop systems utilize real-time feedback to continuously adjust the control signal, enhancing accuracy and stability in dynamic and unpredictable environments.

System Stability

Closed loop systems enhance system stability by continuously adjusting output based on feedback, whereas open loop systems lack feedback and are more susceptible to instability.

Regulation Accuracy

Closed loop systems achieve higher regulation accuracy by continuously correcting output errors through feedback, unlike open loop systems that lack real-time adjustments.

Error Correction

Error correction in closed loop systems continuously adjusts outputs based on feedback to minimize errors, whereas open loop systems lack feedback, preventing real-time error correction.

Process Automation

Process automation enhances efficiency by utilizing open loop systems for simple, non-feedback tasks and closed loop systems for dynamic processes requiring continuous feedback control.

Sensor Integration

Sensor integration in closed loop systems enhances real-time feedback and accuracy, unlike open loop systems that operate without sensor-based corrections.

Manual Intervention

Manual intervention in open loop systems is essential due to lack of feedback control, whereas closed loop systems minimize this need by continuously adjusting based on feedback.

Response Time

Closed loop systems achieve faster and more accurate response times than open loop systems by continuously monitoring and adjusting outputs based on feedback.

Disturbance Rejection

Disturbance rejection in closed loop systems is significantly improved compared to open loop systems due to the feedback mechanism that continuously monitors and corrects output deviations caused by external disturbances. Open loop systems lack this corrective feedback, resulting in poor ability to counteract disturbances and maintain desired performance.

open loop system vs closed loop system Infographic

moneydif.com

moneydif.com