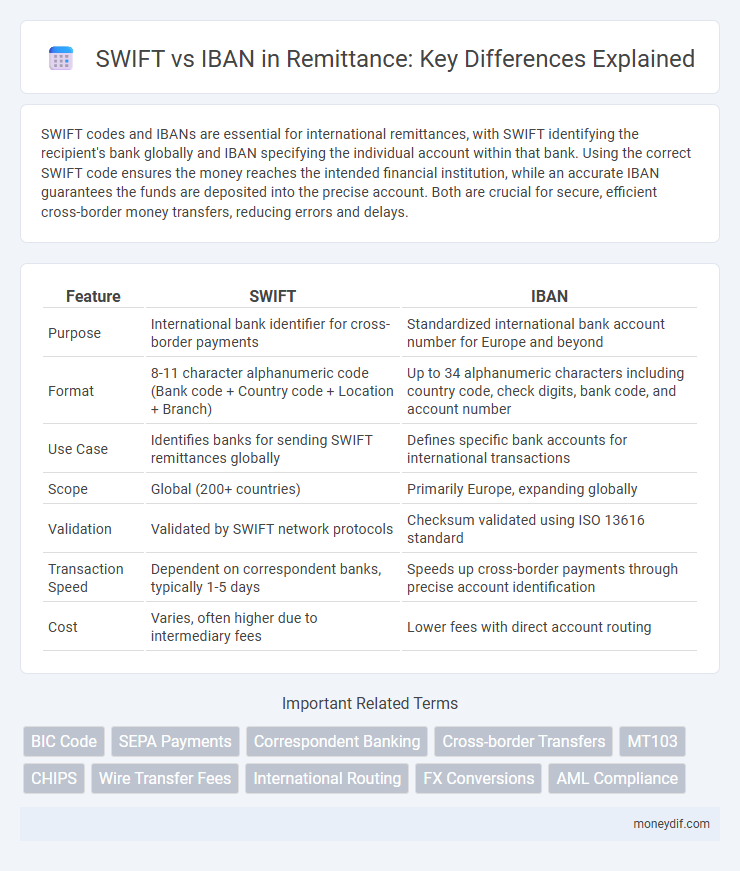

SWIFT codes and IBANs are essential for international remittances, with SWIFT identifying the recipient's bank globally and IBAN specifying the individual account within that bank. Using the correct SWIFT code ensures the money reaches the intended financial institution, while an accurate IBAN guarantees the funds are deposited into the precise account. Both are crucial for secure, efficient cross-border money transfers, reducing errors and delays.

Table of Comparison

| Feature | SWIFT | IBAN |

|---|---|---|

| Purpose | International bank identifier for cross-border payments | Standardized international bank account number for Europe and beyond |

| Format | 8-11 character alphanumeric code (Bank code + Country code + Location + Branch) | Up to 34 alphanumeric characters including country code, check digits, bank code, and account number |

| Use Case | Identifies banks for sending SWIFT remittances globally | Defines specific bank accounts for international transactions |

| Scope | Global (200+ countries) | Primarily Europe, expanding globally |

| Validation | Validated by SWIFT network protocols | Checksum validated using ISO 13616 standard |

| Transaction Speed | Dependent on correspondent banks, typically 1-5 days | Speeds up cross-border payments through precise account identification |

| Cost | Varies, often higher due to intermediary fees | Lower fees with direct account routing |

Understanding SWIFT and IBAN: Key Differences

SWIFT codes and IBANs serve distinct roles in international remittance: SWIFT codes identify specific banks worldwide, enabling secure and accurate routing of funds, while IBANs standardize bank account numbers across countries to ensure correct beneficiary account identification. A SWIFT code consists of 8 to 11 alphanumeric characters representing bank, country, location, and branch, whereas an IBAN varies in length, including country code, check digits, and basic bank account number. Understanding these differences is essential for efficient cross-border transfers and minimizing transaction errors.

How SWIFT Works in International Remittances

SWIFT operates as a global messaging network that securely transmits payment instructions between banks, ensuring accurate and reliable international remittances. Each financial institution is assigned a unique SWIFT code, which helps identify banks involved in cross-border transactions, facilitating efficient fund transfers. The system does not hold funds but acts as a communication platform to confirm transaction details and speed up settlement processes.

The Role of IBAN in Cross-Border Transfers

IBAN (International Bank Account Number) standardizes the identification of bank accounts across borders, reducing errors and processing time in international remittances. Unlike SWIFT codes, which identify specific banks, IBAN specifies the individual account, ensuring precise routing of funds in cross-border transfers. The use of IBAN enhances transparency and compliance, facilitating smoother, faster, and more accurate remittance transactions globally.

SWIFT vs IBAN: Which Ensures Faster Payments?

SWIFT codes facilitate international money transfers by identifying banks globally, ensuring secure and reliable routing, while IBANs primarily standardize account identification within countries. Payment speed often depends on the banking network and processing systems rather than the use of SWIFT or IBAN alone, but SWIFT transfers are generally faster in cross-border transactions due to direct bank communication protocols. Institutions leveraging SWIFT systems typically achieve quicker clearance compared to IBAN-based transfers confined to regional networks.

Security Features of SWIFT and IBAN Systems

SWIFT incorporates advanced encryption and authentication protocols to ensure secure international financial messaging, preventing fraud and unauthorized access. IBAN primarily standardizes bank account identification across countries, enhancing transaction accuracy but relies on the security measures of the underlying banking network rather than providing intrinsic encryption. The robust security framework of SWIFT makes it a trusted choice for confidential and high-value cross-border remittances.

Cost Comparison: SWIFT vs IBAN Remittance Fees

SWIFT remittance fees generally incur higher costs due to intermediary banks and cross-border transaction fees, often ranging from $15 to $50 per transfer. IBAN-based transfers, typically used within SEPA regions, offer lower fees or even free transactions, making them more cost-effective for Eurozone remittances. Comparing SWIFT and IBAN remittance fees highlights significant savings potential when choosing IBAN for intra-European transfers.

Geographic Coverage: Where SWIFT and IBAN Apply

SWIFT facilitates international money transfers worldwide, connecting over 200 countries and territories through its standardized messaging network, while IBAN is primarily used within Europe, the Middle East, and parts of the Caribbean and Africa for identifying bank accounts during cross-border transactions. Although IBAN enhances accuracy and reduces errors in regions where it is mandated, SWIFT remains the global backbone for secure communication between financial institutions across diverse banking systems. Understanding their geographic coverage ensures efficient remittance processing by selecting the appropriate protocol based on destination country requirements.

Common Errors with SWIFT and IBAN Codes

Common errors with SWIFT codes often include incorrect formatting or transposing digits, which can result in failed or delayed international remittances. IBAN mistakes typically involve missing characters, wrong country codes, or inaccurate check digits, causing transaction rejections. Ensuring accurate verification of both SWIFT and IBAN codes before submitting remittance payments minimizes costly errors and expedites fund transfers.

User Experience: Using SWIFT vs IBAN for Remittances

SWIFT enables global remittance by providing unique bank identification codes, facilitating cross-border transactions with widespread bank network compatibility, though it may involve longer processing times and higher fees. IBAN streamlines remittance within supported regions by standardizing account numbers, reducing errors and improving transaction speed, which enhances the user experience in countries adopting IBAN standards. Users benefit from faster, cost-effective transfers with IBAN in regional payments, while SWIFT remains essential for comprehensive international reach.

The Future of International Transfers: SWIFT, IBAN, and Beyond

SWIFT remains the backbone of international remittance networks, facilitating secure and standardized messaging across over 11,000 financial institutions globally. IBAN enhances this system by providing a standardized account identification format, especially dominant in Europe, reducing errors and processing times. Future innovations in international transfers aim to integrate blockchain technology and real-time payment solutions to complement SWIFT and IBAN, increasing transparency, speed, and cost-efficiency in cross-border transactions.

Important Terms

BIC Code

The BIC code (Bank Identifier Code) uniquely identifies banks globally during international transactions, serving as a key component in the SWIFT network for secure messaging between financial institutions. Unlike the IBAN (International Bank Account Number), which specifies an individual account within a country, the BIC focuses on identifying the bank itself to facilitate cross-border payments.

SEPA Payments

SEPA payments streamline euro transactions within the Single Euro Payments Area using IBAN for accurate beneficiary identification, in contrast to SWIFT payments that facilitate international transfers across multiple currencies employing BIC codes. IBAN ensures standardized, cost-effective euro payments inside SEPA countries, while SWIFT supports a broader global network for cross-border banking communication and currency exchanges.

Correspondent Banking

Correspondent banking relies on SWIFT networks for secure, standardized communication between international banks, enabling efficient cross-border payments and financial message exchange. While SWIFT provides messaging infrastructure, the IBAN standardizes bank account identification across countries, essential for accurate transaction routing and reducing errors in correspondent banking workflows.

Cross-border Transfers

Cross-border transfers utilizing SWIFT primarily depend on the SWIFT/BIC codes to identify banks globally, enabling secure international messaging for fund transfers across different currencies and countries. In contrast, IBAN standardizes bank account numbers for transfers predominantly within Europe and certain regions, enhancing accuracy and reducing errors by verifying account formats during cross-border transactions.

MT103

MT103 is a standardized SWIFT message format used for international wire transfers, detailing payment instructions between banks. Unlike IBAN, which serves as a unique identifier for individual bank accounts, MT103 provides comprehensive transaction data, enabling efficient cross-border payment processing and reconciliation.

CHIPS

CHIPS (Clearing House Interbank Payments System) is a U.S.-based large-value payment system used primarily for domestic and international wire transfers involving USD, contrasting with IBAN (International Bank Account Number), which standardizes bank account identification for international transfers primarily in Europe. SWIFT (Society for Worldwide Interbank Financial Telecommunication) provides a global messaging network essential for transmitting payment instructions, often incorporating both IBAN and CHIPS details to ensure accurate routing in cross-border transactions.

Wire Transfer Fees

Wire transfer fees vary significantly between SWIFT and IBAN systems, with SWIFT often incurring higher costs due to intermediary bank charges and international routing complexities. IBAN-based transfers typically offer lower fees and faster processing within SEPA regions due to standardized account identification and streamlined clearing mechanisms.

International Routing

International routing for cross-border payments relies on SWIFT codes to identify banks globally, ensuring secure and standardized message exchange, while IBAN provides a standardized format for account numbers that facilitates accurate and efficient transaction processing within participating countries. Together, SWIFT and IBAN streamline international financial transactions by combining bank identification and account verification to minimize errors and processing delays.

FX Conversions

FX conversions rely heavily on accurate SWIFT codes to identify correspondent banks during international transactions, ensuring proper routing and currency exchange between financial institutions. While IBANs provide standardized account details for cross-border payments, SWIFT codes are essential for network-level identification, facilitating seamless FX conversions in global banking systems.

AML Compliance

AML compliance mandates rigorous verification of SWIFT codes to ensure secure international wire transfers, while IBANs provide a standardized account identification that facilitates accurate cross-border transaction monitoring and reduces the risk of fraud. Financial institutions leverage SWIFT and IBAN data in anti-money laundering systems to enhance transaction traceability and comply with regulatory frameworks such as FATF and AMLD.

SWIFT vs IBAN Infographic

moneydif.com

moneydif.com