De-risking in remittance involves financial institutions limiting or closing relationships with correspondent banks to avoid regulatory scrutiny and reduce exposure to illicit activities. This practice disrupts correspondent banking networks, leading to reduced access to cross-border payment channels and increased costs for remittance senders and recipients. Strengthening compliance measures and promoting transparency can help balance risk management while maintaining efficient correspondent banking services essential for global remittance flows.

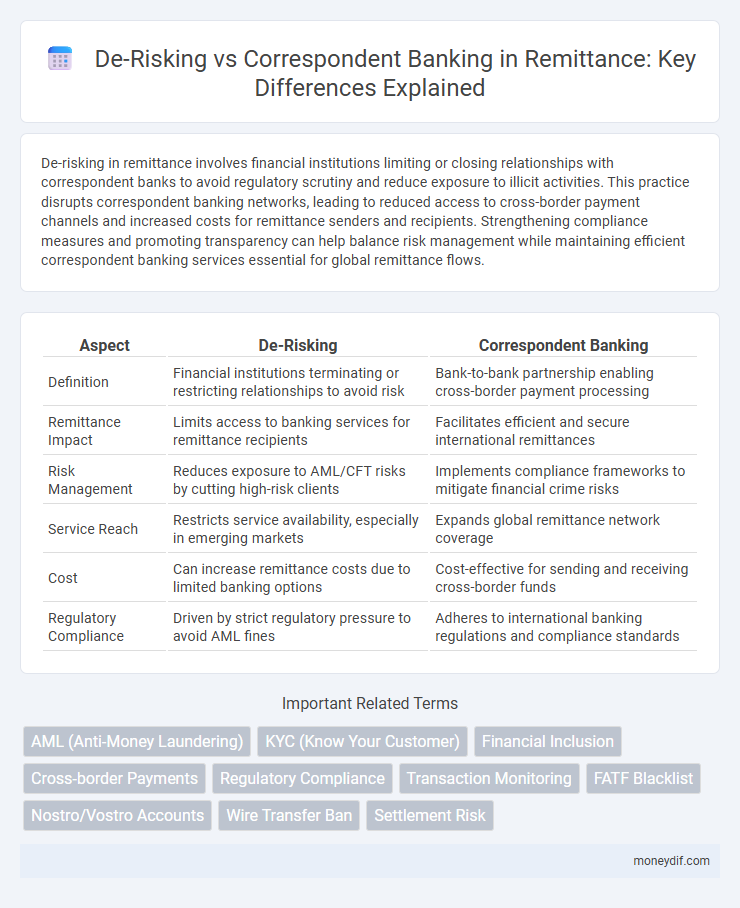

Table of Comparison

| Aspect | De-Risking | Correspondent Banking |

|---|---|---|

| Definition | Financial institutions terminating or restricting relationships to avoid risk | Bank-to-bank partnership enabling cross-border payment processing |

| Remittance Impact | Limits access to banking services for remittance recipients | Facilitates efficient and secure international remittances |

| Risk Management | Reduces exposure to AML/CFT risks by cutting high-risk clients | Implements compliance frameworks to mitigate financial crime risks |

| Service Reach | Restricts service availability, especially in emerging markets | Expands global remittance network coverage |

| Cost | Can increase remittance costs due to limited banking options | Cost-effective for sending and receiving cross-border funds |

| Regulatory Compliance | Driven by strict regulatory pressure to avoid AML fines | Adheres to international banking regulations and compliance standards |

Understanding De-risking in Remittance

De-risking in remittance involves financial institutions reducing or terminating relationships with clients or correspondent banks perceived to carry higher risks, especially related to money laundering or terrorism financing. This practice creates challenges in correspondent banking networks, limiting access to essential cross-border payment channels for remittance providers. Understanding de-risking's impact is crucial for developing policies that balance risk management with the need for efficient, accessible remittance services worldwide.

What is Correspondent Banking?

Correspondent banking is a financial arrangement where one bank provides services on behalf of another, enabling cross-border transactions and international payments. It facilitates remittance flows by offering access to foreign financial systems without the need for a physical presence. This system faces challenges due to de-risking, where banks limit or terminate relationships to avoid regulatory risks and compliance costs.

Key Differences: De-risking vs Correspondent Banking

De-risking involves financial institutions reducing exposure by terminating or restricting relationships with clients or sectors perceived as high risk, especially in remittance corridors prone to money laundering. Correspondent banking facilitates cross-border transactions by providing access to foreign financial systems, but it faces challenges such as regulatory compliance and increased scrutiny due to anti-money laundering (AML) and combatting the financing of terrorism (CFT) measures. Key differences include de-risking as a risk mitigation strategy impacting client access, while correspondent banking serves as an operational infrastructure enabling international remittance flows.

Impact of De-risking on Global Remittance Flows

De-risking practices have significantly reduced the number of correspondent banking relationships, limiting access for many financial institutions engaged in cross-border remittances. This reduction restricts the global remittance flows, especially impacting underbanked regions dependent on affordable and secure money transfers. Consequently, remittance costs increase, financial inclusion decreases, and vulnerable populations face greater obstacles in accessing essential funds from abroad.

Correspondent Banking’s Role in Cross-Border Payments

Correspondent banking plays a crucial role in facilitating cross-border payments by providing access to foreign financial markets where direct relationships are unavailable. This network of interbank relationships enables the smooth transfer of funds across jurisdictions, supporting remittance flows even in regions affected by de-risking. Despite challenges posed by regulatory pressures, correspondent banking remains essential for maintaining global payment connectivity and financial inclusion.

Regulatory Drivers Behind De-risking

Regulatory drivers behind de-risking in remittance services include stringent anti-money laundering (AML) and counter-terrorism financing (CTF) regulations imposed by global financial authorities such as the Financial Action Task Force (FATF). Correspondent banking relationships face increased compliance costs and risks due to enhanced customer due diligence and reporting requirements, prompting banks to sever ties with high-risk jurisdictions. This regulatory pressure significantly fuels de-risking, limiting access to correspondent banking channels for many remittance providers.

Challenges Facing Correspondent Banks in Remittance

Correspondent banks face significant challenges in remittance processing, including stringent regulatory compliance requirements such as anti-money laundering (AML) and counter-terrorist financing (CTF) measures that increase operational costs and complexity. Risk management concerns lead to de-risking practices, where banks limit or terminate relationships with certain remittance corridors perceived as high risk, reducing access to cross-border payment networks. Limited transparency, slow processing times, and high fees further complicate correspondent banking's role in efficient and affordable remittance services.

Financial Inclusion Risks from De-risking

De-risking in correspondent banking significantly limits access to financial services for remittance senders and recipients, disproportionately affecting underserved and migrant communities. This practice reduces the number of available channels for cross-border money transfers, exacerbating financial exclusion and hindering the flow of remittances crucial for economic stability in developing countries. Financial inclusion risks emerge as smaller banks and money transfer operators are often cut off, limiting affordable and reliable remittance options for low-income individuals.

Innovations Addressing De-risking in Remittance

Innovations addressing de-risking in remittance include blockchain technology and digital identity verification, which enhance transparency and reduce compliance costs. Fintech platforms leverage real-time transaction monitoring and advanced analytics to identify and mitigate risks without restricting access to correspondent banking networks. Regulatory sandboxes and API integration facilitate seamless cross-border payments, promoting financial inclusion while maintaining stringent anti-money laundering standards.

Future of Remittance: Balancing Risk and Accessibility

De-risking in remittances challenges correspondent banking by limiting financial institutions' exposure to high-risk regions, which can restrict access for underserved populations. Advances in regulatory frameworks and innovative technologies aim to balance stringent anti-money laundering measures with inclusive financial services. The future of remittance depends on harmonizing risk management with accessibility to ensure secure and affordable cross-border money transfers.

Important Terms

AML (Anti-Money Laundering)

AML frameworks are critical in managing risks associated with correspondent banking, as financial institutions implement de-risking strategies to mitigate exposure to illicit activities and comply with regulatory standards. De-risking involves terminating or restricting relationships with clients or jurisdictions perceived as high-risk, which can impact correspondent banks' access to global financial networks and challenge inclusive banking efforts.

KYC (Know Your Customer)

KYC (Know Your Customer) protocols are critical in correspondent banking to mitigate risks associated with money laundering and terrorist financing, thus reducing de-risking tendencies by promoting transparency and trust between financial institutions. Enhanced KYC procedures help correspondent banks assess and monitor client profiles more accurately, minimizing the withdrawal of services from legitimate customers due to perceived higher risks.

Financial Inclusion

De-risking in correspondent banking often leads to reduced access for smaller banks and underserved regions, hindering financial inclusion by limiting cross-border payment services. Enhancing risk management frameworks and regulatory clarity can mitigate de-risking impacts, enabling correspondent banks to support inclusive financial ecosystems effectively.

Cross-border Payments

Cross-border payments face challenges due to de-risking, where banks terminate or restrict correspondent banking relationships to avoid regulatory risk, leading to reduced access for certain jurisdictions and businesses. Correspondent banking remains essential for international transactions, but compliance costs and risk mitigation efforts increasingly strain these traditional networks, prompting a shift towards alternative payment infrastructures and fintech solutions.

Regulatory Compliance

Regulatory compliance in correspondent banking is critical for de-risking strategies, focusing on stringent customer due diligence, anti-money laundering (AML) measures, and ongoing transaction monitoring to prevent financial crimes. Effective compliance frameworks reduce exposure to regulatory fines and reputational damage while ensuring alignment with international standards such as FATF recommendations and Basel Committee guidelines.

Transaction Monitoring

Transaction monitoring plays a crucial role in identifying and mitigating risks associated with correspondent banking relationships, particularly in preventing de-risking practices that can disrupt financial inclusion. Effective monitoring systems leverage advanced analytics and real-time data to detect suspicious activities, ensuring compliance with anti-money laundering (AML) regulations while maintaining correspondent banking connectivity.

FATF Blacklist

The FATF Blacklist targets countries with significant deficiencies in anti-money laundering and counter-terrorism financing frameworks, prompting major global banks to implement de-risking strategies that reduce or sever correspondent banking ties with entities in these jurisdictions. This backlash against high-risk countries limits cross-border financial flows and complicates international trade, as correspondent banks avoid exposure to sanctioned or non-compliant entities to mitigate regulatory penalties and reputational damage.

Nostro/Vostro Accounts

Nostro and Vostro accounts are essential components of correspondent banking relationships, enabling financial institutions to manage cross-border transactions and liquidity efficiently. De-risking trends have prompted banks to reduce or terminate correspondent accounts with higher risk profiles, thereby impacting global payment networks and necessitating enhanced compliance and due diligence measures.

Wire Transfer Ban

Wire transfer bans often result from correspondent banks implementing stricter de-risking measures to avoid regulatory risks associated with high-risk jurisdictions. These restrictions limit cross-border payment flows by cutting off access to the global banking network, impacting financial inclusion and international trade.

Settlement Risk

Settlement risk in correspondent banking increases as de-risking strategies lead to reduced correspondent relationships, limiting transaction channels and impacting cross-border payments. Financial institutions mitigate settlement risk by enhancing due diligence and employing secure payment systems to maintain trust in correspondent banking networks.

de-risking vs correspondent banking Infographic

moneydif.com

moneydif.com