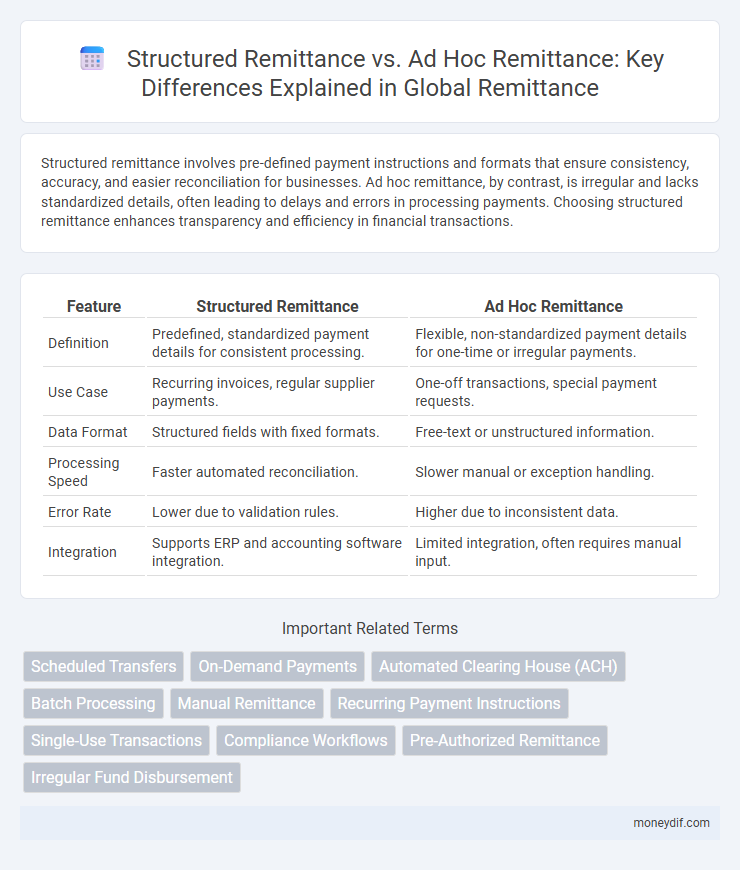

Structured remittance involves pre-defined payment instructions and formats that ensure consistency, accuracy, and easier reconciliation for businesses. Ad hoc remittance, by contrast, is irregular and lacks standardized details, often leading to delays and errors in processing payments. Choosing structured remittance enhances transparency and efficiency in financial transactions.

Table of Comparison

| Feature | Structured Remittance | Ad Hoc Remittance |

|---|---|---|

| Definition | Predefined, standardized payment details for consistent processing. | Flexible, non-standardized payment details for one-time or irregular payments. |

| Use Case | Recurring invoices, regular supplier payments. | One-off transactions, special payment requests. |

| Data Format | Structured fields with fixed formats. | Free-text or unstructured information. |

| Processing Speed | Faster automated reconciliation. | Slower manual or exception handling. |

| Error Rate | Lower due to validation rules. | Higher due to inconsistent data. |

| Integration | Supports ERP and accounting software integration. | Limited integration, often requires manual input. |

Understanding Structured Remittance: Key Features

Structured remittance involves predefined payment terms and schedules that enhance predictability and streamline reconciliation processes for businesses. Key features include fixed payment amounts, regular intervals, and detailed transaction data that enable efficient tracking and compliance. This contrasts with ad hoc remittance, which is irregular and lacks standardized formats, making financial management more complex.

What is Ad Hoc Remittance? A Quick Overview

Ad hoc remittance refers to the transfer of funds that is irregular, unplanned, or initiated spontaneously without a predefined schedule or structure. It often lacks standardized documentation or data formatting, making reconciliation and tracking more complex compared to structured remittances. This type of remittance is common in situations requiring immediate payment or infrequent transactions that do not fit into regular payment cycles.

Structured Remittance vs Ad Hoc Remittance: Core Differences

Structured remittance involves pre-defined payment formats with standardized data fields, ensuring consistent transaction details for easier reconciliation and compliance tracking. Ad hoc remittance lacks a fixed format, allowing flexibility but often resulting in inconsistent data that complicates automation and error reduction. Core differences include predictability, data standardization, and efficiency, with structured remittance enabling streamlined processing compared to the variable nature of ad hoc payments.

Advantages of Structured Remittance for Senders

Structured remittance offers senders enhanced transparency and accuracy by providing detailed information about each transaction, reducing errors and reconciliation time. This method ensures consistent and predictable payment formats, facilitating easier tracking and financial planning for businesses. Furthermore, structured remittance improves compliance with regulatory requirements by enabling better documentation and audit trails.

Flexibility and Limitations of Ad Hoc Remittance

Ad hoc remittance provides flexibility by allowing senders to transfer funds without predefined formats or strict protocols, accommodating unique or urgent payment scenarios. This method lacks the standardized data structure of structured remittance, which can lead to challenges in automated processing, reconciliation, and compliance tracking. While ad hoc remittance suits one-time or irregular transactions, its limitations include higher potential for errors, delayed payment matching, and increased manual intervention in financial workflows.

Cost Comparison: Structured vs Ad Hoc Remittance

Structured remittance transactions typically incur lower processing fees due to standardized formats and automation, reducing manual intervention and minimizing operational costs. In contrast, ad hoc remittances often require customized handling and manual verification, leading to higher administrative expenses and potential delays. Businesses benefit from cost efficiency and predictability with structured remittance solutions compared to the variable costs associated with ad hoc payments.

Security and Compliance in Remittance Methods

Structured remittance methods offer enhanced security by employing standardized transaction protocols that minimize fraud risks and ensure traceability, complying strictly with anti-money laundering (AML) regulations. Ad hoc remittance, lacking consistent frameworks, poses higher vulnerability to compliance breaches and often struggles with meeting international regulatory standards. Financial institutions and businesses prioritize structured remittance to guarantee transaction integrity and adherence to global security mandates.

Which Remittance Type Suits Your Needs?

Structured remittance offers predefined formats and standardized data fields, ideal for businesses requiring consistent, automated payment processing and reconciliation. Ad hoc remittance provides flexibility by allowing customized payment details, suitable for individuals or companies with irregular transactions and unique payment instructions. Evaluating transaction volume, data standardization needs, and integration capabilities helps determine which remittance type best suits your operational requirements.

Technology’s Role in Structured and Ad Hoc Remittance

Technology enables structured remittance by automating payment instructions through standardized data formats like ISO 20022, ensuring accuracy and compliance in cross-border transactions. In contrast, ad hoc remittance relies on flexible, often manual, communication channels such as email or messaging platforms, which can increase processing time and errors. Advanced fintech solutions incorporating AI and blockchain are bridging the gap by enhancing transparency, traceability, and efficiency in both structured and ad hoc remittance processes.

Future Trends in Global Remittance Solutions

Structured remittance solutions leverage standardized data formats like ISO 20022 to enhance transparency, compliance, and automation, driving efficiency in cross-border payments. Ad hoc remittance remains flexible for irregular, personalized transactions but faces challenges in integration and regulatory adherence. Future trends emphasize harmonizing structured frameworks with AI-driven analytics to optimize transaction validation and fraud detection in global remittance ecosystems.

Important Terms

Scheduled Transfers

Scheduled transfers enable automated, recurring payments with structured remittance data for consistent transaction details and improved reconciliation accuracy. Ad hoc remittance involves one-time payments with variable or unstructured remittance information, requiring manual processing and potentially leading to delays in payment matching.

On-Demand Payments

On-demand payments with structured remittance enable automated, accurate transaction processing by using standardized data formats, whereas ad hoc remittance relies on unstructured, manually interpreted payment information.

Automated Clearing House (ACH)

Automated Clearing House (ACH) transactions with structured remittance enhance payment automation and data accuracy compared to ad hoc remittance, which often requires manual intervention and increases processing time.

Batch Processing

Batch processing efficiently manages structured remittance by automating repetitive transactions, whereas ad hoc remittance requires manual intervention due to its unpredictable and irregular nature.

Manual Remittance

Manual remittance allows for flexible ad hoc remittance processing, contrasting with structured remittance which relies on predefined formats and automated reconciliation.

Recurring Payment Instructions

Structured remittance in recurring payment instructions ensures consistent, machine-readable payment references for automated reconciliation, while ad hoc remittance allows flexible, unstructured payment information tailored case-by-case.

Single-Use Transactions

Single-use transactions in structured remittance ensure precise payment matching by encoding specific invoice or contract details, contrasting with ad hoc remittance's flexible, less standardized payment information.

Compliance Workflows

Compliance workflows ensure accurate processing by distinguishing between structured remittance, which follows predefined formats, and ad hoc remittance, which requires flexible validation protocols.

Pre-Authorized Remittance

Pre-Authorized Remittance (PAR) enables automated, recurring payments with structured remittance information that allows for systematic reconciliation and predictable cash flow, whereas ad hoc remittance involves one-time, manually initiated payments without standardized data, often requiring additional processing for accurate allocation. Utilizing structured remittance in PAR optimizes financial operations by reducing errors and improving transaction traceability compared to the less consistent, variable nature of ad hoc remittances.

Irregular Fund Disbursement

Irregular fund disbursement often arises from the use of ad hoc remittance methods, which lack predefined structures and consistent scheduling, leading to inefficiencies and compliance risks. Structured remittance systems, by contrast, enable predictable, transparent fund transfers with standardized documentation that improve tracking, reconciliation, and regulatory reporting accuracy.

structured remittance vs ad hoc remittance Infographic

moneydif.com

moneydif.com