Outward remittance refers to the transfer of funds sent by an individual or business from their home country to a recipient in a foreign country, often for purposes like tuition fees, investments, or family support. Inward remittance is the receipt of money sent from abroad to a domestic account, commonly used for personal remittances or business transactions. Understanding the differences between outward and inward remittances is crucial for managing currency exchange, fees, and regulatory compliance effectively.

Table of Comparison

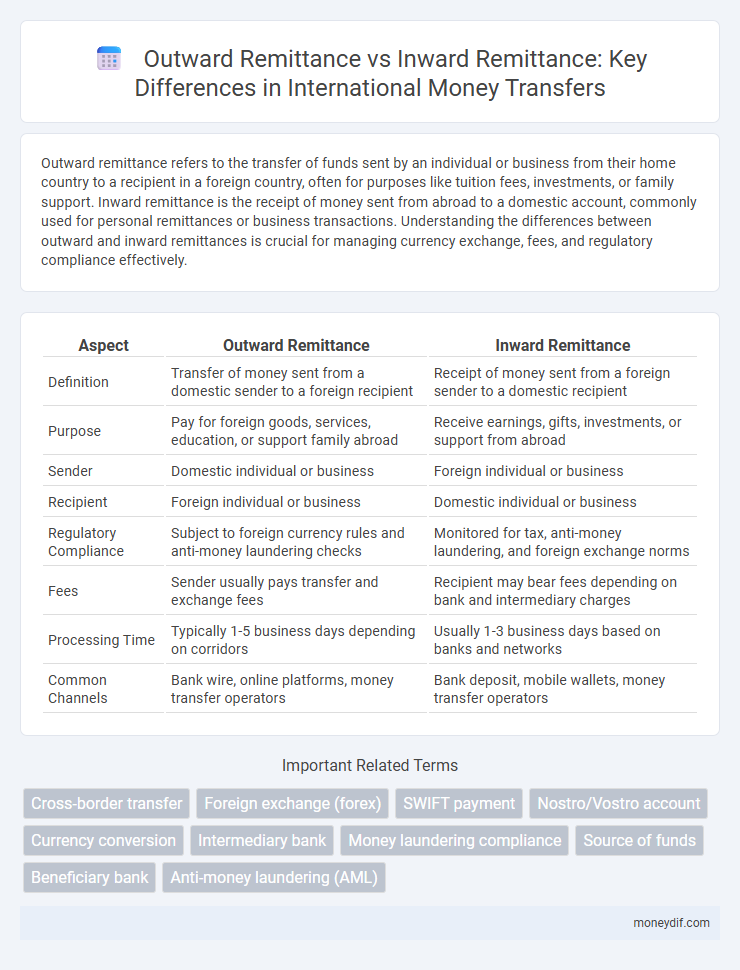

| Aspect | Outward Remittance | Inward Remittance |

|---|---|---|

| Definition | Transfer of money sent from a domestic sender to a foreign recipient | Receipt of money sent from a foreign sender to a domestic recipient |

| Purpose | Pay for foreign goods, services, education, or support family abroad | Receive earnings, gifts, investments, or support from abroad |

| Sender | Domestic individual or business | Foreign individual or business |

| Recipient | Foreign individual or business | Domestic individual or business |

| Regulatory Compliance | Subject to foreign currency rules and anti-money laundering checks | Monitored for tax, anti-money laundering, and foreign exchange norms |

| Fees | Sender usually pays transfer and exchange fees | Recipient may bear fees depending on bank and intermediary charges |

| Processing Time | Typically 1-5 business days depending on corridors | Usually 1-3 business days based on banks and networks |

| Common Channels | Bank wire, online platforms, money transfer operators | Bank deposit, mobile wallets, money transfer operators |

Understanding Outward Remittance: Definition and Process

Outward remittance involves transferring funds from a sender in one country to a recipient in another, typically for purposes like business payments, education fees, or family support. The process includes verifying the sender's identity, converting currency as per current exchange rates, and complying with regulatory requirements to ensure secure and legal transfers. Banks and financial institutions use secure channels like SWIFT to facilitate outward remittance, ensuring timely delivery and accurate transaction tracking.

What is Inward Remittance? Key Features Explained

Inward remittance refers to the transfer of funds received by an individual or entity from a foreign source, typically through banks or authorized financial institutions. Key features include its role in facilitating international money receipts for personal expenses, business transactions, or investments, and its compliance with regulatory frameworks ensuring secure and traceable fund flows. This process often involves currency conversion, transparent documentation, and adherence to anti-money laundering regulations to maintain financial integrity.

Outward vs Inward Remittance: Core Differences

Outward remittance refers to the transfer of funds sent by an individual or entity from their home country to a foreign beneficiary, often for purposes such as education, business, or family support. Inward remittance involves receiving money from abroad into the local country, typically from expatriates, international businesses, or overseas investments. Key differences lie in the direction of the transaction, regulatory compliance requirements, and associated fees charged by banks or remittance services.

Common Purposes for Outward Remittance Transactions

Outward remittance transactions commonly serve purposes such as payment of tuition fees for overseas education, remittance of family maintenance funds, and business-related transactions including import payments and investment abroad. Individuals also utilize outward remittances for travel expenses and medical treatments abroad, while businesses frequently make outward remittances for supplier payments and international trade settlements. These transactions are essential for cross-border fund transfers, facilitating economic activities and personal financial obligations globally.

Typical Use Cases of Inward Remittance

Inward remittance typically involves receiving funds from international sources for purposes such as salary payments from overseas employers, family support through foreign remittances, and returns on investments made abroad. Businesses often rely on inward remittance for payment of exports, global business transactions, and cross-border royalties. These transactions facilitate seamless financial integration and support economic activities in the recipient's country.

Regulatory Guidelines: Outward and Inward Remittance

Regulatory guidelines for outward remittance primarily focus on compliance with anti-money laundering (AML) and foreign exchange management regulations imposed by central banks, requiring detailed documentation and permissible transaction limits to prevent misuse. Inward remittance regulations emphasize the verification of the source of funds and adherence to tax and reporting norms to ensure transparency and legality of funds entering the country. Both outward and inward remittance processes mandate adherence to international financial standards and country-specific regulatory frameworks to safeguard the integrity of cross-border financial transactions.

Tax Implications: Outward Remittance vs Inward Remittance

Tax implications for outward remittance primarily involve compliance with foreign exchange regulations and potential reporting requirements for transferring funds abroad, often attracting scrutiny for anti-money laundering purposes. Inward remittance may have tax consequences depending on the source and nature of funds, with countries imposing taxes on income received from abroad or requiring detailed documentation to avoid fraud. Both types necessitate careful record-keeping to ensure adherence to international tax treaties and domestic tax laws governing cross-border financial transactions.

Documentation Required for Remittance Transactions

Outward remittance transactions require documents such as a completed remittance application form, valid identification, purpose of payment certificate, and foreign exchange declaration forms as mandated by regulatory authorities. Inward remittance processing involves verifying the sender's details, the beneficiary's bank information, and compliance with anti-money laundering (AML) guidelines, often requiring documents like an inward remittance receipt and identity proof. Accurate and complete documentation ensures smooth approval and compliance with international financial regulations for both outward and inward remittances.

Challenges in Outward and Inward Remittance Processing

Outward remittance processing faces challenges such as stringent regulatory compliance, fluctuating foreign exchange rates, and delays due to intermediary banks. Inward remittance often encounters issues like high transaction fees, beneficiary verification difficulties, and inconsistent processing times across jurisdictions. Both require robust anti-money laundering (AML) measures and advanced technology integration to ensure secure, timely, and transparent fund transfers.

Choosing the Right Remittance Service Provider

Selecting the right remittance service provider for outward versus inward remittance requires evaluating factors such as exchange rates, transfer fees, transaction speed, and regulatory compliance. Outward remittance providers often emphasize secure sending capabilities and global reach, while inward remittance services focus on accessibility and ease of funds withdrawal for recipients. Comparing customer reviews, digital platform efficiency, and support services ensures optimal choice tailored to specific cross-border money transfer needs.

Important Terms

Cross-border transfer

Cross-border transfer involves outward remittance sending funds abroad from a resident to a foreign recipient, while inward remittance refers to receiving funds from abroad into the recipient's domestic account.

Foreign exchange (forex)

Foreign exchange (forex) involves converting one currency into another for outward remittance, where funds are sent abroad for purposes like education, investment, or imports, while inward remittance refers to foreign currency received by a country, such as remittances from expatriates or foreign investments. Exchange rates, transaction fees, and regulatory compliance impact the cost and speed of both outward and inward remittances in the forex market.

SWIFT payment

SWIFT payment processes outward remittance by sending funds from the sender's bank to a foreign recipient's bank, while inward remittance involves receiving funds from an international sender into the beneficiary's local bank account.

Nostro/Vostro account

Nostro accounts represent a bank's foreign currency holdings held in another bank, facilitating outward remittances by enabling smooth debit transactions to transfer funds internationally. Vostro accounts reflect foreign banks' holdings within a domestic bank, supporting inward remittances by allowing seamless credit entries when receiving international payments.

Currency conversion

Currency conversion rates influence the cost-effectiveness of outward remittance transactions compared to inward remittance inflows, affecting international money transfers and exchange rate margins.

Intermediary bank

An intermediary bank facilitates the transfer of funds by acting as a middle entity in outward remittance, ensuring seamless routing and settlement of inward remittance transactions between sender and beneficiary banks.

Money laundering compliance

Effective money laundering compliance requires stringent monitoring of both outward remittance to detect illicit fund transfers abroad and inward remittance to identify suspicious money inflows.

Source of funds

Source of funds for outward remittance typically involves transferring personal or business funds abroad, while inward remittance refers to receiving funds into a country from foreign sources.

Beneficiary bank

The beneficiary bank in outward remittance acts as the receiving financial institution that credits funds to the beneficiary's account after money is sent from the originator's bank, ensuring accurate currency conversion and compliance with international regulations. In inward remittance, the beneficiary bank processes incoming funds from foreign senders, facilitating currency exchange and timely availability of funds to the recipient while adhering to anti-money laundering and verification protocols.

Anti-money laundering (AML)

Anti-money laundering (AML) regulations rigorously monitor both outward remittance, which involves funds sent abroad, and inward remittance, which requires scrutiny of incoming funds to prevent illicit financial activities.

outward remittance vs inward remittance Infographic

moneydif.com

moneydif.com