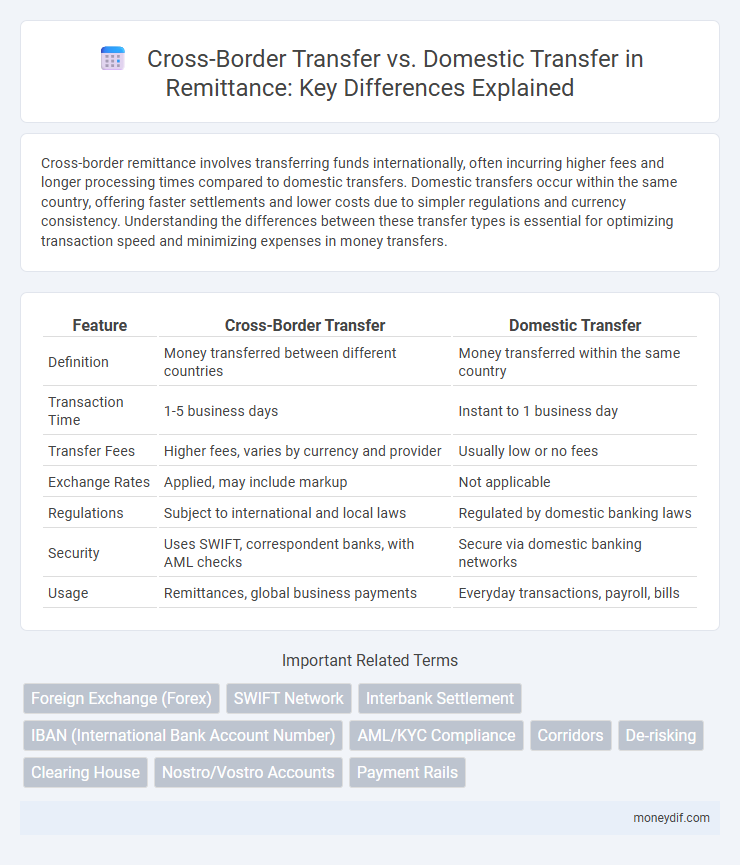

Cross-border remittance involves transferring funds internationally, often incurring higher fees and longer processing times compared to domestic transfers. Domestic transfers occur within the same country, offering faster settlements and lower costs due to simpler regulations and currency consistency. Understanding the differences between these transfer types is essential for optimizing transaction speed and minimizing expenses in money transfers.

Table of Comparison

| Feature | Cross-Border Transfer | Domestic Transfer |

|---|---|---|

| Definition | Money transferred between different countries | Money transferred within the same country |

| Transaction Time | 1-5 business days | Instant to 1 business day |

| Transfer Fees | Higher fees, varies by currency and provider | Usually low or no fees |

| Exchange Rates | Applied, may include markup | Not applicable |

| Regulations | Subject to international and local laws | Regulated by domestic banking laws |

| Security | Uses SWIFT, correspondent banks, with AML checks | Secure via domestic banking networks |

| Usage | Remittances, global business payments | Everyday transactions, payroll, bills |

Introduction to Cross-Border vs. Domestic Transfers

Cross-border transfers involve sending money between different countries, often requiring currency exchange and compliance with international regulations, leading to longer processing times and higher fees compared to domestic transfers. Domestic transfers occur within the same country, typically processed faster and at lower costs due to streamlined banking networks and regulatory frameworks. Understanding the differences in cost, speed, and regulatory requirements is crucial for selecting the appropriate remittance method based on sender and recipient locations.

Key Differences Between Cross-Border and Domestic Transfers

Cross-border transfers involve sending money between different countries, often incurring higher fees, longer processing times, and varying exchange rates compared to domestic transfers, which occur within the same country. Cross-border remittances require navigating international regulations, currency conversions, and potential compliance with anti-money laundering laws, whereas domestic transfers typically have standardized processes and lower regulatory complexity. The choice between cross-border and domestic transfers significantly impacts cost, speed, and transactional transparency due to differing financial infrastructures and regulatory frameworks.

Cost Comparison: Fees and Charges

Cross-border transfers typically incur higher fees and charges compared to domestic transfers due to intermediary banks, foreign exchange rates, and regulatory compliance costs. Domestic transfers generally have lower fees, faster processing times, and fewer hidden charges, making them more cost-effective for users. Understanding fee structures and exchange rate margins is essential for optimizing remittance costs in international money transfers.

Transfer Speed: International vs. Local

Cross-border transfers typically take 1 to 5 business days due to multiple intermediaries and compliance checks, whereas domestic transfers are often completed within minutes to hours because of streamlined banking networks and fewer regulatory hurdles. The use of digital wallets and fintech platforms can further accelerate local transfers, while international remittances depend heavily on correspondent banks and exchange rate processes. Faster transfer speeds in domestic transactions improve cash flow efficiency for individuals and businesses compared to the slower settlement times in cross-border payments.

Security and Regulatory Considerations

Cross-border transfers involve stringent regulatory compliance due to varying international laws and anti-money laundering (AML) standards, necessitating enhanced security protocols. Domestic transfers benefit from unified regulatory frameworks and established local oversight, reducing complexity and accelerating transaction verification. Security measures such as multi-factor authentication and end-to-end encryption are critical for both, but cross-border transfers demand advanced fraud detection systems to mitigate higher risks.

Exchange Rates and Currency Conversion

Cross-border remittances often involve exchange rates that fluctuate based on global currency markets, significantly impacting the final amount received compared to domestic transfers, which typically do not require currency conversion. Exchange rate margins and conversion fees in international transfers can raise the cost substantially, whereas domestic transfers are primarily subject to fixed or minimal fees. Understanding the spread between mid-market rates and offered exchange rates is crucial for minimizing losses during cross-border currency conversions.

Preferred Use Cases for Each Transfer Type

Cross-border transfers are preferred for sending money internationally, enabling remittances to family or payments for overseas business transactions with currency exchange considerations. Domestic transfers are best suited for quick, low-cost transactions within the same country, such as paying bills, salaries, or local purchases using national banking networks. Each transfer type optimizes convenience, speed, and cost based on geographic reach and regulatory environments.

Challenges in Cross-Border Remittances

Cross-border remittances face significant challenges such as high transaction fees, lengthy processing times, and regulatory complexities across different jurisdictions. Currency conversion risks and limited access to formal banking infrastructure in certain regions further impede efficient transfers. These obstacles often result in reduced transfer speeds and increased costs compared to domestic transfers.

Technological Innovations in Money Transfers

Technological innovations in money transfers have drastically improved the efficiency and security of cross-border transfers compared to domestic transfers. Blockchain technology and real-time payment systems enable faster settlement times and lower transaction fees for international remittances. Advanced encryption protocols and AI-driven fraud detection further enhance trust and transparency in global money transfers.

Future Trends in Remittance Services

Cross-border transfers are increasingly leveraging blockchain technology and digital currencies to reduce costs and enhance transaction speed, transforming the future of remittance services. Domestic transfers benefit from real-time payment systems and Open Banking APIs, enabling seamless integration with financial platforms and improving user convenience. Emerging trends predict a convergence of cross-border and domestic transfer capabilities through artificial intelligence-driven compliance and fraud detection, ensuring secure and efficient global money movement.

Important Terms

Foreign Exchange (Forex)

Foreign Exchange (Forex) significantly impacts cross-border transfers by determining currency conversion rates, which directly affect transaction costs and settlement times compared to domestic transfers conducted within the same currency zone. Efficient Forex markets enhance liquidity and transparency, enabling faster and more cost-effective international payments, whereas domestic transfers typically rely on local banking networks with fewer currency risks.

SWIFT Network

The SWIFT Network facilitates secure and standardized communication for international cross-border transfers, enabling financial institutions to send payment instructions across different countries efficiently. Unlike domestic transfers, which typically occur within a single country's banking infrastructure, cross-border transactions via SWIFT involve currency conversion, regulatory compliance, and multiple intermediary banks, impacting processing time and fees.

Interbank Settlement

Interbank settlement for cross-border transfers involves complex currency conversions, compliance with international regulations like SWIFT or CLS, and typically incurs higher fees and longer processing times compared to domestic transfers, which usually settle faster through national automated clearing houses like ACH or RTGS systems. Domestic transfers benefit from streamlined protocols and local banking networks, enabling near-instantaneous settlement within the same country's jurisdiction.

IBAN (International Bank Account Number)

The International Bank Account Number (IBAN) standardizes bank account identification across countries, significantly enhancing the accuracy and efficiency of cross-border transfers by reducing errors and processing times. In domestic transfers, banks typically rely on local account numbers and routing codes, where IBAN usage is minimal or unnecessary due to less complexity in account validation within the same country.

AML/KYC Compliance

AML/KYC compliance in cross-border transfers involves enhanced due diligence, including verifying customer identity through international databases and monitoring transactions across different jurisdictions to prevent money laundering and terrorist financing. Domestic transfers typically follow streamlined verification processes with localized regulatory frameworks, but still require robust KYC measures to ensure compliance and mitigate fraud risks.

Corridors

Corridors in cross-border transfers facilitate international money movement by connecting different countries' financial systems, requiring compliance with varying regulations and currency conversions, while domestic transfer corridors operate within a single country's banking network, allowing faster, simpler transactions without currency exchange complexities. Efficient cross-border corridors depend heavily on correspondent banking relationships and international payment infrastructures like SWIFT, contrasting with domestic corridors that often utilize localized payment systems such as ACH or FPS for rapid fund settlement.

De-risking

De-risking in financial services often involves heightened scrutiny and potential restrictions on cross-border transfers due to increased regulatory compliance and anti-money laundering (AML) concerns, whereas domestic transfers typically face fewer complexities and lower compliance burdens. This disparity can lead to reduced correspondent banking relationships internationally, limiting access to global financial networks and impacting international trade finance.

Clearing House

Clearing houses facilitate the settlement of cross-border transfers by managing foreign exchange risks, compliance with international regulations, and multi-currency settlements, ensuring seamless international fund movements. In contrast, domestic transfer clearing houses primarily focus on efficient processing, netting of payments, and maintaining liquidity within a single currency and jurisdiction.

Nostro/Vostro Accounts

Nostro and Vostro accounts facilitate cross-border transfers by enabling banks to hold foreign currency deposits and settle international transactions efficiently, reducing foreign exchange risk and transaction time. Domestic transfers typically use local currency accounts without the need for Nostro/Vostro arrangements, as they involve same-country banking systems and centralized clearinghouses.

Payment Rails

Payment Rails specializes in seamless cross-border transfers by leveraging multi-currency accounts and real-time foreign exchange rates, ensuring low-cost, fast international payments for businesses. Their platform optimizes global fund distribution compared to traditional domestic transfer systems, which focus on local currency settlements and regulatory frameworks.

cross-border transfer vs domestic transfer Infographic

moneydif.com

moneydif.com