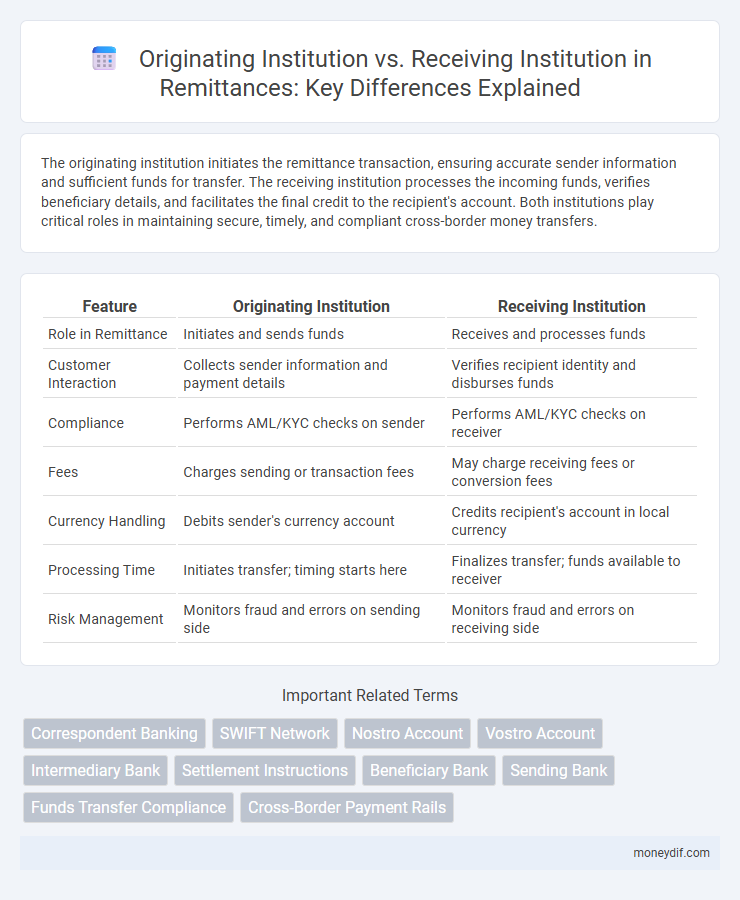

The originating institution initiates the remittance transaction, ensuring accurate sender information and sufficient funds for transfer. The receiving institution processes the incoming funds, verifies beneficiary details, and facilitates the final credit to the recipient's account. Both institutions play critical roles in maintaining secure, timely, and compliant cross-border money transfers.

Table of Comparison

| Feature | Originating Institution | Receiving Institution |

|---|---|---|

| Role in Remittance | Initiates and sends funds | Receives and processes funds |

| Customer Interaction | Collects sender information and payment details | Verifies recipient identity and disburses funds |

| Compliance | Performs AML/KYC checks on sender | Performs AML/KYC checks on receiver |

| Fees | Charges sending or transaction fees | May charge receiving fees or conversion fees |

| Currency Handling | Debits sender's currency account | Credits recipient's account in local currency |

| Processing Time | Initiates transfer; timing starts here | Finalizes transfer; funds available to receiver |

| Risk Management | Monitors fraud and errors on sending side | Monitors fraud and errors on receiving side |

Definition of Originating Institution in Remittance

The Originating Institution in remittance refers to the financial entity that initiates the transfer of funds on behalf of the sender. It is responsible for verifying the sender's identity, processing the payment instructions, and ensuring compliance with regulatory requirements before transmitting the funds. This institution plays a critical role in the secure and efficient movement of money from the sender to the receiving institution.

Role of Receiving Institution in Cross-Border Payments

The receiving institution in cross-border payments is responsible for validating and crediting funds to the beneficiary's account according to local regulations and compliance standards. It ensures accurate currency conversion, fraud detection, and timely delivery of remitted funds, maintaining transaction transparency and security. Efficient communication between the originating and receiving institutions is critical to minimizing delays and preventing payment failures in the remittance process.

Key Differences Between Originating and Receiving Institutions

Originating institutions initiate remittance transfers by collecting funds from the sender and validating transaction details, while receiving institutions handle the disbursement of funds to the recipient's account. Key differences include compliance responsibilities, where originating institutions verify sender identity and source of funds, and receiving institutions ensure proper delivery and recipient authentication. Transaction processing times and risk management strategies also vary, with originating banks managing fraud prevention before transfer and receiving banks focusing on final fund clearance and availability.

Compliance Responsibilities: Originating vs Receiving Institution

Originating institutions hold primary compliance responsibilities for verifying customer identity, conducting AML screening, and ensuring accurate transaction details before initiating remittances. Receiving institutions must comply with local regulatory frameworks, monitor incoming transactions for suspicious activity, and report any anomalies to relevant authorities. Both institutions collaborate to maintain transparency and prevent money laundering, fraud, and terrorism financing throughout the remittance process.

Regulatory Requirements for Both Institutions

Originating institutions must comply with strict regulatory requirements such as customer due diligence, anti-money laundering (AML) checks, and real-time transaction monitoring to prevent financial crimes. Receiving institutions are obligated to verify beneficiary information, ensure adherence to local AML and counter-terrorism financing (CTF) regulations, and report suspicious activities to regulatory authorities. Both institutions coordinate to maintain compliance with international standards like the Financial Action Task Force (FATF) recommendations and local legal frameworks.

Impact on Remittance Processing Time

The originating institution's efficiency in transaction verification and compliance checks directly affects the initial processing time, while the receiving institution's speed in fund validation and disbursement influences the total remittance delivery time. Differences in operational hours, technology infrastructure, and regulatory requirements between the originating and receiving institutions can cause delays or expedite the transfer process. Seamless coordination and advanced processing systems at both institutions minimize latency, ensuring faster remittance delivery.

Security Measures at Originating and Receiving Ends

Security measures at the originating institution typically involve multi-factor authentication, transaction monitoring, and encryption protocols to prevent unauthorized access and fraud. Receiving institutions implement verification processes, secure data transmission standards, and anti-money laundering (AML) checks to ensure remittance integrity and compliance. Both ends coordinate through secure communication channels and adherence to regulatory frameworks to safeguard funds throughout the transfer process.

Fees and Charges: Who Sets Them?

The originating institution typically sets the initial fees and charges for processing a remittance, which may include service fees, foreign exchange margins, and transaction costs. Receiving institutions may impose additional fees for handling incoming funds, conversion fees, or withdrawal charges, varying by country regulations and bank policies. Understanding the fee structure of both the originating and receiving institutions is crucial for senders to avoid unexpected costs and ensure cost-efficient remittance transfers.

Challenges Faced by Originating and Receiving Institutions

Originating institutions encounter challenges such as regulatory compliance, fraud prevention, and ensuring accurate beneficiary information to avoid transaction delays. Receiving institutions face issues including currency conversion, local regulatory adherence, and timely fund disbursement to maintain customer satisfaction. Both institutions must coordinate effectively to mitigate transaction errors and enhance the overall remittance experience.

Future Trends: Evolution of Remittance Institutions

Originating institutions are increasingly integrating blockchain technology to enhance transaction transparency and speed, while receiving institutions are adopting AI-powered fraud detection systems to secure cross-border payments. Future trends indicate a shift toward decentralized finance (DeFi) platforms enabling peer-to-peer remittances without traditional intermediaries. Collaboration between fintech startups and established banks will drive innovation, reducing costs and improving accessibility for global remittance users.

Important Terms

Correspondent Banking

Correspondent banking involves the relationship between the originating institution, which initiates a financial transaction, and the receiving institution, which processes and completes the payment on behalf of the sender's client. This relationship relies on established correspondent accounts and compliance protocols to ensure secure and efficient cross-border fund transfers.

SWIFT Network

The SWIFT network facilitates secure financial messaging between the Originating Institution, which initiates the transaction, and the Receiving Institution, which processes and credits the payment to the beneficiary. Accurate identification of both institutions using unique BIC codes ensures efficient and error-free international fund transfers through the SWIFT messaging system.

Nostro Account

A Nostro Account is a bank account held by one financial institution (Originating Institution) in the currency of another bank (Receiving Institution) to facilitate international transactions and currency exchange. This setup enables the Originating Institution to efficiently manage foreign currency liquidity and streamline cross-border payments through the Receiving Institution's local banking infrastructure.

Vostro Account

A Vostro Account represents funds held by the Originating Institution in the currency of the Receiving Institution, facilitating cross-border transactions by allowing the Receiving Institution to access local currency liquidity. This arrangement enhances international banking efficiency by enabling real-time settlements and reducing currency conversion risks between correspondent banks.

Intermediary Bank

An intermediary bank facilitates fund transfers between the originating institution, which initiates the payment, and the receiving institution, which ultimately credits the beneficiary's account. This bank acts as a correspondent to both financial entities, ensuring seamless transaction routing across different banking networks.

Settlement Instructions

Settlement instructions specify the details required to transfer funds between the originating institution and the receiving institution, ensuring accurate processing of financial transactions. These instructions include account numbers, bank identifiers such as SWIFT codes or IBANs, and intermediary banks when applicable to facilitate secure and timely settlements.

Beneficiary Bank

The Beneficiary Bank serves as the Receiving Institution responsible for crediting funds to the beneficiary's account, while the Originating Institution initiates the transaction by sending payment instructions. Efficient communication and compliance between these entities ensure secure and accurate processing of financial transfers.

Sending Bank

The Sending Bank, also known as the Originating Institution, initiates the transfer of funds or transaction requests, ensuring proper authorization and compliance with regulatory standards. The Receiving Institution, or Beneficiary Bank, processes the incoming transaction, crediting the recipient's account while verifying transaction details and adherence to anti-fraud measures.

Funds Transfer Compliance

Funds Transfer Compliance ensures that the originating institution adheres to regulatory standards such as the Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) requirements before sending funds, while the receiving institution is responsible for detecting suspicious activities upon receipt and verifying beneficiary information to prevent fraud and illicit transactions. Both institutions must maintain thorough transaction records and implement robust know-your-customer (KYC) protocols to facilitate accurate reporting and enhance overall transfer security.

Cross-Border Payment Rails

Cross-border payment rails facilitate international fund transfers by linking the originating institution, which initiates the payment, with the receiving institution responsible for disbursing funds to the beneficiary. Efficient interoperability between these institutions ensures reduced transaction times, lower costs, and enhanced transparency in cross-border settlements.

Originating Institution vs Receiving Institution Infographic

moneydif.com

moneydif.com