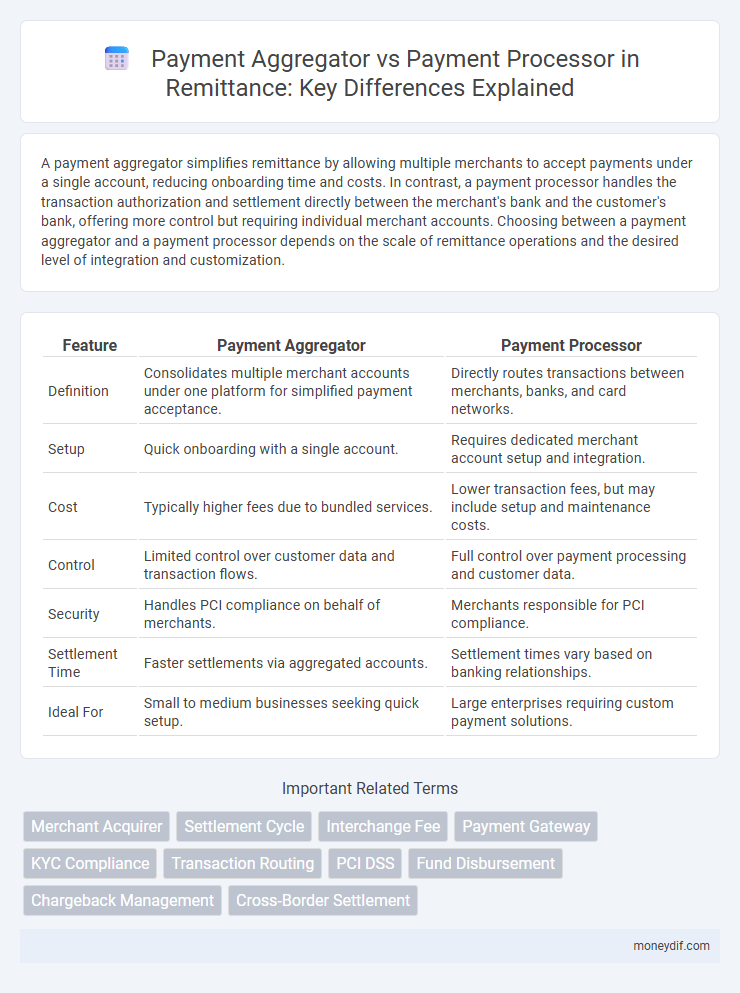

A payment aggregator simplifies remittance by allowing multiple merchants to accept payments under a single account, reducing onboarding time and costs. In contrast, a payment processor handles the transaction authorization and settlement directly between the merchant's bank and the customer's bank, offering more control but requiring individual merchant accounts. Choosing between a payment aggregator and a payment processor depends on the scale of remittance operations and the desired level of integration and customization.

Table of Comparison

| Feature | Payment Aggregator | Payment Processor |

|---|---|---|

| Definition | Consolidates multiple merchant accounts under one platform for simplified payment acceptance. | Directly routes transactions between merchants, banks, and card networks. |

| Setup | Quick onboarding with a single account. | Requires dedicated merchant account setup and integration. |

| Cost | Typically higher fees due to bundled services. | Lower transaction fees, but may include setup and maintenance costs. |

| Control | Limited control over customer data and transaction flows. | Full control over payment processing and customer data. |

| Security | Handles PCI compliance on behalf of merchants. | Merchants responsible for PCI compliance. |

| Settlement Time | Faster settlements via aggregated accounts. | Settlement times vary based on banking relationships. |

| Ideal For | Small to medium businesses seeking quick setup. | Large enterprises requiring custom payment solutions. |

Understanding Remittance: Key Terms and Concepts

Payment aggregators act as intermediaries, enabling multiple merchants to accept payments through a single platform, simplifying remittance processes by consolidating transactions and reducing merchant onboarding complexities. Payment processors handle the direct transfer of funds between payer and payee, facilitating authorization, settlement, and clearing in remittance flows. Understanding these roles clarifies how funds move efficiently across different payment systems and supports smoother cross-border remittance transactions.

What is a Payment Aggregator in Remittance?

A payment aggregator in remittance is a service provider that enables multiple merchants or businesses to accept payments without requiring individual merchant accounts, simplifying the process of receiving cross-border funds. It consolidates transactions from various sources, providing a single interface for payment acceptance and settlement, which enhances efficiency and reduces operational complexity. Payment aggregators manage compliance, risk, and transaction processing, offering a seamless solution for remittance service providers and their customers.

How Payment Processors Function in Remittance Transactions

Payment processors in remittance transactions serve as the critical link between senders and recipients, securely handling the authorization, verification, and settlement of funds across financial networks. They facilitate the seamless transfer of payments by communicating with banks and card networks to ensure compliance with regulatory standards and fraud prevention measures. By efficiently managing transaction data and currency conversions, payment processors enable timely and accurate delivery of cross-border remittances to beneficiaries.

Core Differences Between Payment Aggregators and Payment Processors

Payment aggregators act as intermediaries that allow merchants to accept multiple payment methods through a single platform, simplifying onboarding and compliance processes. Payment processors are responsible for the direct transmission of transaction data between the merchant, issuing banks, and acquiring banks, ensuring secure authorization and settlement of funds. The core difference lies in payment aggregators managing pooled merchant accounts and risk, while payment processors provide the essential infrastructure for transaction execution and fund transfer.

Security Measures: Aggregators vs Processors in Remittance

Payment aggregators enhance security in remittance by consolidating multiple merchants under one compliance umbrella, leveraging tokenization and robust encryption to protect transaction data. Payment processors implement direct, end-to-end encryption and secure socket layer (SSL) protocols to safeguard transactional information between merchants and acquiring banks. Both entities comply with PCI DSS standards, but aggregators typically offer layered fraud detection systems due to their multi-merchant infrastructure.

Transaction Fees Comparison: Aggregator vs Processor

Payment aggregators typically charge higher transaction fees, often ranging from 2.5% to 5%, due to bundled services and simplified onboarding. Payment processors offer lower fees, generally between 1.5% and 3%, but require direct merchant accounts and involve more complex setup processes. Comparing transaction fees reveals that businesses handling high volumes may benefit from payment processors, while small to medium enterprises prefer aggregators for their cost-inclusive convenience.

Regulatory Requirements in Remittance for Aggregators and Processors

Payment aggregators in remittance must comply with stringent regulatory requirements, including obtaining licenses, adhering to anti-money laundering (AML) and know your customer (KYC) protocols, and ensuring transaction monitoring across multiple payees. Payment processors, while also subject to AML and KYC regulations, generally operate under specific bank or financial institution licenses and focus more on technical transaction execution and settlement compliance. Both entities require robust data security measures and regular regulatory reporting to maintain transparency and prevent financial crimes within the remittance ecosystem.

User Experience: Which Solution is Better for Sending Remittances?

Payment aggregators streamline the remittance process by offering a single platform that supports multiple payment methods, enhancing convenience and reducing transaction times for users. Payment processors handle the backend transaction flow between banks and financial institutions but often require users to navigate multiple interfaces. For remittance senders, payment aggregators generally provide a smoother, more intuitive user experience by consolidating services and simplifying the payment journey.

Integration and Scalability for Remittance Businesses

Payment aggregators simplify integration for remittance businesses by offering a single gateway to multiple payment methods, enabling faster deployment and lower upfront costs. Payment processors provide more customized solutions with direct access to banking infrastructure, allowing higher scalability and control as transaction volumes grow. Choosing between the two depends on the remittance company's need for rapid market entry versus long-term operational scalability.

Choosing the Right Solution: Aggregator or Processor for Remittance

Selecting the right payment solution for remittance hinges on whether a business requires a payment aggregator or a payment processor. Payment aggregators consolidate multiple payment methods under a single platform, offering streamlined onboarding and simplified transaction management ideal for small to medium remittance services. In contrast, payment processors provide direct merchant accounts with greater control, enhanced customization, and typically lower transaction fees, making them suitable for larger remittance companies with high transaction volumes.

Important Terms

Merchant Acquirer

A Merchant Acquirer is a financial institution that processes credit and debit card transactions on behalf of merchants, ensuring secure fund transfers from cardholders' banks. Unlike Payment Aggregators who consolidate multiple merchants under a single account, Merchant Acquirers provide individual merchant accounts, offering direct transaction settlement and enhanced control over payment processing compared to Payment Processors that handle the technical routing of payment data.

Settlement Cycle

The settlement cycle for a payment aggregator typically involves batching multiple transactions from various merchants before transferring funds to individual accounts, often resulting in longer settlement times compared to payment processors, who directly handle transaction authorization and fund transfers with faster, real-time or near-real-time settlement. Understanding these differences is critical for businesses aiming to optimize cash flow management and reconcile their payment operations efficiently.

Interchange Fee

Interchange fee is a transaction cost paid by merchants to card-issuing banks, significantly impacting payment aggregators who bundle these fees within their service charges, while payment processors primarily facilitate the transaction flow without absorbing the interchange fee themselves. Understanding the distinct roles of payment aggregators and processors is crucial, as aggregators manage fee structures for multiple merchants whereas processors focus on the authorization and settlement of payment transactions.

Payment Gateway

A Payment Gateway securely transmits transaction data between a merchant's website and the acquiring bank, while a Payment Aggregator allows multiple merchants to process payments under a single merchant account, simplifying onboarding and reducing individual account setup. Payment Processors handle the back-end transaction approval and fund transfer by communicating between the acquiring bank and the card networks like Visa and MasterCard.

KYC Compliance

KYC compliance mandates stringent customer identity verification processes, which payment aggregators manage by onboarding multiple merchants under a unified compliance framework, whereas payment processors primarily focus on transaction handling without directly engaging in full KYC procedures. Effective KYC protocols mitigate fraud and regulatory risks, ensuring both payment aggregators and processors adhere to anti-money laundering (AML) laws and financial regulations.

Transaction Routing

Transaction routing determines the pathway a payment takes from the customer to the merchant's bank, significantly impacting transaction speed and cost. Payment aggregators handle transaction routing by bundling multiple merchants under a single account, while payment processors directly manage individual merchant accounts, offering more customized routing options and potentially lower fees.

PCI DSS

PCI DSS compliance mandates that payment aggregators implement stringent security measures to protect cardholder data across multiple merchants, while payment processors focus on securing transaction data within payment gateways and acquiring banks. Both entities must adhere to PCI DSS standards, but aggregators require broader scope controls due to their role in handling multiple merchant accounts simultaneously.

Fund Disbursement

Fund disbursement involves the transfer of collected payments to merchants or vendors, where payment aggregators handle multiple merchant accounts under a single platform, simplifying collection but often charging higher fees and offering limited control. Payment processors directly facilitate transaction authorization and fund transfers between banks, providing faster settlement and greater customization for businesses managing their own merchant accounts.

Chargeback Management

Chargeback management involves handling disputes and refund requests initiated by customers, where payment aggregators streamline this process by consolidating transactions from multiple merchants under one account, while payment processors execute individual payment transactions for merchants directly. Effective chargeback management requires integrating real-time transaction data from payment processors with the aggregated reporting systems provided by payment aggregators to quickly identify and resolve disputed charges.

Cross-Border Settlement

Cross-border settlement involves the conversion and transfer of funds across different currencies and regulatory environments, with payment aggregators providing a unified platform to manage multiple payment methods and merchants under one account. Payment processors, by contrast, focus on the technical infrastructure to authorize, route, and settle individual payment transactions between banks and card networks.

Payment Aggregator vs Payment Processor Infographic

moneydif.com

moneydif.com