Fee-on-shared (OUR) remittance includes sender and intermediary fees, ensuring the beneficiary receives the full amount without deductions. In contrast, fee-on-beneficiary (BEN) means all transfer costs are deducted from the recipient's payment, reducing the final sum received. Choosing between OUR and BEN depends on whether the sender or recipient bears the transfer cost, affecting the total fees and net amount delivered.

Table of Comparison

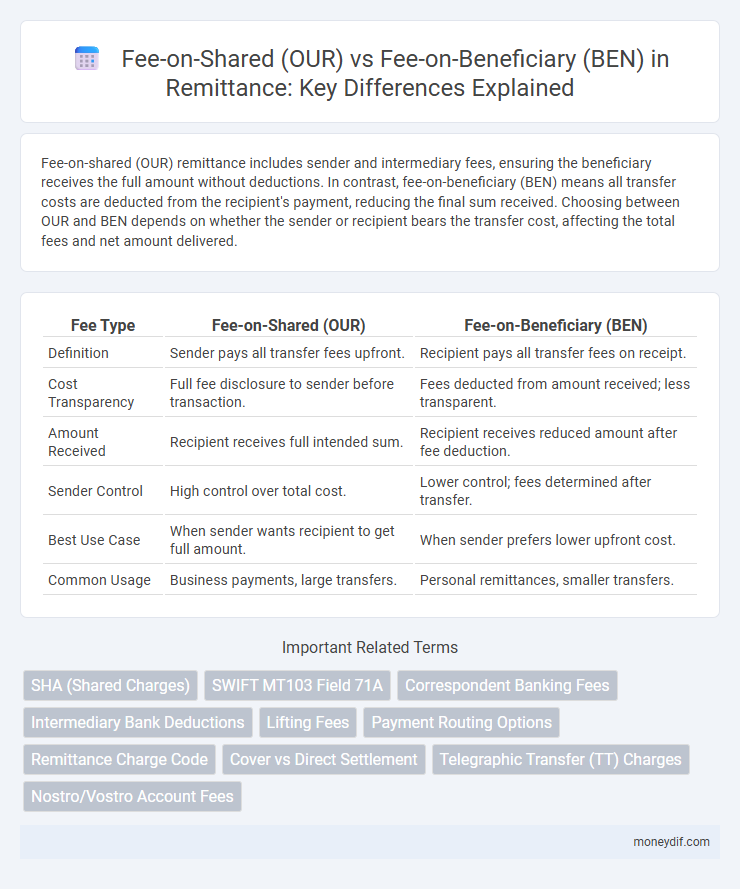

| Fee Type | Fee-on-Shared (OUR) | Fee-on-Beneficiary (BEN) |

|---|---|---|

| Definition | Sender pays all transfer fees upfront. | Recipient pays all transfer fees on receipt. |

| Cost Transparency | Full fee disclosure to sender before transaction. | Fees deducted from amount received; less transparent. |

| Amount Received | Recipient receives full intended sum. | Recipient receives reduced amount after fee deduction. |

| Sender Control | High control over total cost. | Lower control; fees determined after transfer. |

| Best Use Case | When sender wants recipient to get full amount. | When sender prefers lower upfront cost. |

| Common Usage | Business payments, large transfers. | Personal remittances, smaller transfers. |

Understanding Remittance Fee Structures: OUR vs. BEN

Remittance fee structures primarily differentiate between OUR and BEN methods, where OUR places the entire transfer fee on the sender, ensuring recipients receive full payment without deductions. BEN assigns all fees to the beneficiary, often resulting in the recipient receiving a reduced amount due to intermediary charges. Understanding these fee allocations is crucial for senders and recipients to manage transfer costs effectively and avoid unexpected shortfalls in funds.

Fee-on-Shared Explained: What Is OUR in Remittances?

Fee-on-shared, known as OUR, is a remittance fee structure where the sender covers all transfer charges, ensuring the beneficiary receives the full amount sent. This method eliminates deductions on the recipient's side, contrasting with fee-on-beneficiary (BEN), where fees are deducted from the received funds. OUR fees provide transparency and predictability in international money transfers, making it a preferred choice for sending exact amounts.

Fee-on-Beneficiary: Decoding BEN Charges

Fee-on-Beneficiary (BEN) charges place the entire transfer fee burden on the recipient, resulting in reduced received amounts in remittance transactions. This fee model impacts the beneficiary's net funds, often causing discrepancies between the sent and received sum due to service provider deductions. Understanding BEN charges is crucial for accurate financial planning and transparency in international money transfers.

Key Differences Between OUR and BEN Remittance Fees

OUR remittance fees require the sender to cover all transfer costs, ensuring the beneficiary receives the full sent amount without deductions. BEN remittance fees place the transfer charges on the recipient, reducing the received funds by the fee amount. Key differences include responsibility for payment, transparency of final received amount, and impact on transaction value, influencing sender and beneficiary preferences.

How Fee Structures Impact International Money Transfers

Fee-on-shared (OUR) transfers require the sender to cover all transaction costs, ensuring the beneficiary receives the full intended amount without deductions, which can increase upfront expenses for the sender but guarantees transparency. Fee-on-beneficiary (BEN) transfers deduct fees from the amount received, potentially reducing the net funds for the recipient but lowering initial costs for the sender, making it a common choice for cost-sensitive remitters. Understanding these fee structures is essential for optimizing international money transfers, as they directly affect transfer speed, total costs, and the final amount beneficiaries receive.

Pros and Cons of Using OUR vs. BEN Remittances

Fee-on-shared (OUR) remittances ensure the sender covers all transfer fees, resulting in the beneficiary receiving the full intended amount but often incurring higher upfront costs and potential hidden fees en route. Fee-on-beneficiary (BEN) remittances reduce the sender's expense by deducting transfer fees from the received amount, which may lower the funds available to the beneficiary and introduce recipient dissatisfaction. Choosing between OUR and BEN depends on balancing cost burden distribution and transparency, with OUR favored for full remittance value and BEN preferred for minimizing sender costs.

Cost Implications for Sender and Receiver: Making the Right Choice

Fee-on-shared (OUR) means the sender covers all transfer fees, resulting in higher upfront costs but ensuring the beneficiary receives the full amount. Fee-on-beneficiary (BEN) deducts fees from the received sum, lowering the sender's expense but reducing the final funds for the receiver. Choosing between OUR and BEN depends on whether the sender or recipient is better positioned to absorb remittance costs while minimizing overall financial impact.

Bank Policies on OUR and BEN Remittance Fees

Bank policies on OUR and BEN remittance fees vary significantly, impacting the total cost of international money transfers. OUR fees require the sender to pay all charges, ensuring the beneficiary receives the full amount but often increasing upfront costs, while BEN fees deduct transfer costs from the received amount, reducing the beneficiary's funds. Financial institutions implement these policies based on regulatory compliance, competitiveness, and customer preferences, influencing transparency and sender-beneficiary dynamics in cross-border transactions.

Tips for Reducing Remittance Fees with Optimal Choices

Choosing the fee-on-shared (OUR) option allows senders to control total costs by covering all transfer fees upfront, ensuring beneficiaries receive the full amount without deductions. Selecting the fee-on-beneficiary (BEN) option may lower initial send costs but can reduce the recipient's received amount due to withheld fees by intermediaries. To minimize remittance fees, compare transfer services' fee structures, use transparent pricing platforms, and consider fee-on-shared arrangements to avoid unexpected charges.

Choosing the Best Fee Structure for Your Remittance Needs

Selecting the optimal fee structure for remittances depends on cost transparency and recipient convenience. Fee-on-shared (OUR) ensures the sender covers all transaction fees, providing the beneficiary with the full amount but potentially increasing upfront costs. Fee-on-beneficiary (BEN) shifts all fees to the recipient, reducing sender expenses but possibly reducing the net received amount, making it vital to consider transfer amount, speed, and recipient preferences.

Important Terms

SHA (Shared Charges)

SHA (Shared Charges) splits transfer fees between sender and recipient, contrasting fee-on-shared (OUR) where the sender pays all fees, and fee-on-beneficiary (BEN) where fees are deducted from the recipient's amount.

SWIFT MT103 Field 71A

SWIFT MT103 Field 71A specifies the charges option, indicating fee-on-shared (SHA) where fees are divided between sender and beneficiary, fee-on-beneficiary (BEN) where the beneficiary pays all fees, or fee-on-sender (OUR) where the sender covers all charges.

Correspondent Banking Fees

Correspondent banking fees vary significantly between fee-on-shared (OUR) payments, where the sender covers all intermediary charges, and fee-on-beneficiary (BEN) payments, which deduct fees from the recipient's amount, impacting transaction cost transparency and beneficiary net receipt.

Intermediary Bank Deductions

Intermediary bank deductions typically occur when fee-on-beneficiary (BEN) payment terms are used, causing intermediary banks to deduct their fees from the transferred amount, whereas fee-on-shared (OUR) ensures all fees are paid upfront by the sender, preventing deductions.

Lifting Fees

Lifting fees are typically charged on a fee-on-shared (OUR) basis to distribute costs between sender and receiver, whereas fee-on-beneficiary (BEN) places the entire charge on the recipient, impacting international payment transparency and cost allocation.

Payment Routing Options

Payment routing options impact transaction costs, with fee-on-shared (OUR) distributing charges between sender and recipient, while fee-on-beneficiary (BEN) places all fees on the recipient, influencing cost allocation and processing speed.

Remittance Charge Code

Remittance Charge Code distinguishes between fee-on-shared (OUR), where the sender covers all transfer fees, and fee-on-beneficiary (BEN), where the recipient pays the transfer fees.

Cover vs Direct Settlement

Cover transactions involve the sender paying all fees (OUR), while direct settlement transactions assign all fees to the beneficiary (BEN), impacting final received amounts and fee transparency.

Telegraphic Transfer (TT) Charges

Telegraphic Transfer (TT) charges differ based on fee-on-shared (OUR), where sender and receiver share fees, versus fee-on-beneficiary (BEN), where the beneficiary bears all transfer costs.

Nostro/Vostro Account Fees

Nostro/Vostro account fees vary significantly based on fee-on-shared (OUR), where the sender pays all transfer fees, versus fee-on-beneficiary (BEN), where the recipient covers all charges, impacting the net amount received and overall transaction cost transparency.

fee-on-shared (OUR) vs fee-on-beneficiary (BEN) Infographic

moneydif.com

moneydif.com