Source of funds refers to the immediate origin of money involved in a remittance transaction, such as salary, savings, or sale proceeds. Source of wealth encompasses the broader financial background and accumulation of assets that legitimately support the origin of funds, including business ownership, inheritance, or investments. Verifying both source of funds and source of wealth is essential for ensuring compliance with anti-money laundering regulations and maintaining the integrity of remittance services.

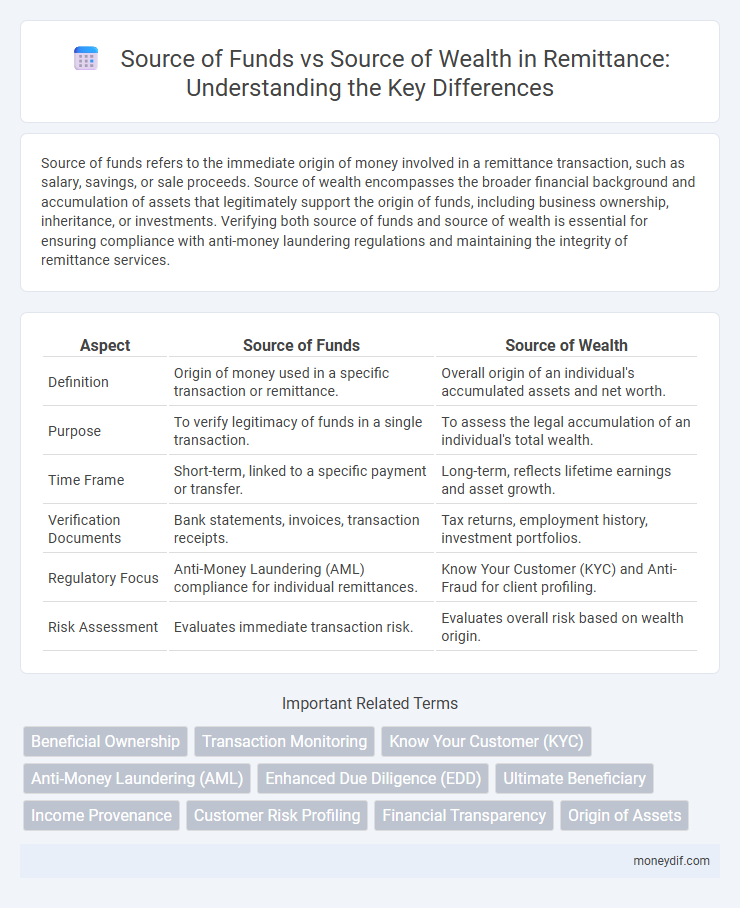

Table of Comparison

| Aspect | Source of Funds | Source of Wealth |

|---|---|---|

| Definition | Origin of money used in a specific transaction or remittance. | Overall origin of an individual's accumulated assets and net worth. |

| Purpose | To verify legitimacy of funds in a single transaction. | To assess the legal accumulation of an individual's total wealth. |

| Time Frame | Short-term, linked to a specific payment or transfer. | Long-term, reflects lifetime earnings and asset growth. |

| Verification Documents | Bank statements, invoices, transaction receipts. | Tax returns, employment history, investment portfolios. |

| Regulatory Focus | Anti-Money Laundering (AML) compliance for individual remittances. | Know Your Customer (KYC) and Anti-Fraud for client profiling. |

| Risk Assessment | Evaluates immediate transaction risk. | Evaluates overall risk based on wealth origin. |

Understanding the Concepts: Source of Funds vs Source of Wealth

Source of funds refers to the origin of the specific money used in a transaction, such as salary, savings, or loan disbursement, which helps verify the legitimacy of funds transferred in remittances. Source of wealth encompasses the broader economic background and overall financial standing of an individual or entity, including investments, inheritance, and business profits, providing a comprehensive view of their accumulated assets. Differentiating these concepts ensures compliance with anti-money laundering regulations by validating both the immediate funds and the long-term wealth behind international money transfers.

Defining Source of Funds in Remittance Transactions

Source of funds in remittance transactions refers to the specific origin of money being transferred, such as salary, business income, or investment proceeds, directly tied to the transaction amount. It involves identifying how the funds were acquired immediately before the transaction, ensuring compliance with anti-money laundering (AML) regulations. Differentiating source of funds from source of wealth, which encompasses the entire accumulation of assets, is critical for financial institutions to assess transaction legitimacy and detect potential fraud.

Exploring the Meaning of Source of Wealth

Source of wealth refers to the origin of an individual's accumulated assets over time, reflecting long-term financial history such as business ownership, inheritance, or investments. This contrasts with source of funds, which pertains to the immediate origin of the money used in a particular transaction or remittance, such as salary or loan proceeds. Understanding source of wealth is crucial for compliance with anti-money laundering regulations, ensuring that the overall financial background is legitimate and consistent with the funds being transferred.

Key Differences: Source of Funds and Source of Wealth

Source of funds refers to the origin of the specific money used in a transaction, such as salary, savings, or proceeds from a sale, while source of wealth encompasses the broader accumulation of assets and overall financial background over time. Source of funds is transactional and short-term, indicating where the immediate funds come from, whereas source of wealth provides a long-term perspective on how an individual or entity accumulated their total financial resources. Understanding both concepts is crucial in remittance compliance to prevent money laundering and ensure transparency in financial transactions.

Regulatory Requirements for Source of Funds and Wealth

Regulatory requirements for source of funds and source of wealth demand thorough verification to prevent money laundering and financial crimes, requiring detailed documentation such as bank statements, salary slips, sale deeds, and business income evidence. Source of funds refers to the origin of the actual money used in a transaction, while source of wealth encompasses the entire economic background that generated the funds over time. Compliance with anti-money laundering (AML) regulations mandates financial institutions to assess both, ensuring transparency and legitimacy in remittance activities.

Importance in Anti-Money Laundering (AML) Compliance

Accurate identification of source of funds and source of wealth is critical in Anti-Money Laundering (AML) compliance to detect and prevent financial crimes. Source of funds refers to the origin of the specific money involved in a transaction, while source of wealth encompasses the broader accumulation of an individual's total assets. Differentiating these concepts ensures effective risk assessment and strengthens due diligence processes in remittance operations.

How Remittance Providers Verify Source of Funds

Remittance providers verify the source of funds by collecting detailed transaction documentation such as pay slips, bank statements, or business invoices to ensure the money sent originates from legitimate activities. They employ automated systems and manual reviews aligned with anti-money laundering (AML) regulations to detect suspicious patterns, verifying that the funds come from recent income or savings. This process differs from source of wealth verification, which assesses the broader financial background and cumulative assets of the sender over time.

Assessing Source of Wealth in Large Remittance Transfers

Assessing source of wealth in large remittance transfers involves verifying the origin of accumulated assets to ensure legitimacy, distinct from the source of funds which refers to the immediate origin of the transfer amount. Regulatory frameworks require thorough documentation such as tax returns, business ownership records, or inheritance documents to validate long-term wealth generation. This process mitigates risks of money laundering by linking funds to verifiable economic activity over time rather than a single transaction.

Challenges in Identifying Source of Funds and Wealth

Challenges in identifying source of funds versus source of wealth arise from the complexity and opacity of financial transactions in remittance flows, where source of funds refers to the origin of the specific money being transferred, while source of wealth denotes the overall accumulation of assets over time. Financial institutions and regulatory bodies face difficulties in verifying legitimate sources due to diverse income streams, informal economies, and inconsistent documentation standards across jurisdictions. These challenges heighten the risk of money laundering and impede effective anti-financial crime compliance efforts within global remittance channels.

Best Practices for Remittance Customers and Providers

Remittance providers and customers should ensure thorough verification of both the source of funds and source of wealth to comply with Anti-Money Laundering (AML) regulations and prevent illicit financial flows. Source of funds pertains to the origin of the specific money being transferred, while source of wealth relates to the total accumulated assets and income of the customer over time. Best practices include enhanced due diligence procedures, continuous monitoring of transaction patterns, and maintaining detailed documentation to support transparency and regulatory compliance.

Important Terms

Beneficial Ownership

Beneficial ownership requires verifying the source of funds, which traces the origin of specific monies, and the source of wealth, which assesses the overall accumulation of assets over time.

Transaction Monitoring

Transaction monitoring distinguishes the source of funds as the origin of the specific money involved in a transaction, while the source of wealth encompasses the overall accumulation of an individual's or entity's assets and financial background.

Know Your Customer (KYC)

Know Your Customer (KYC) processes distinguish between source of funds, which refers to the origin of specific money used in a transaction, and source of wealth, which encompasses the total accumulation of an individual's assets and overall financial background. Accurate verification of both source of funds and source of wealth is essential to prevent money laundering, fraud, and ensure regulatory compliance in financial services.

Anti-Money Laundering (AML)

Anti-Money Laundering (AML) regulations require financial institutions to verify both the source of funds, which refers to the origin of the specific assets used in a transaction, and the source of wealth, which encompasses the overall accumulation of an individual's or entity's total assets and income over time. Accurate assessment of source of funds ensures each transaction is legitimate, while evaluating source of wealth helps detect broader patterns of illicit activity or unexplained wealth accumulation.

Enhanced Due Diligence (EDD)

Enhanced Due Diligence (EDD) requires thorough verification of both source of funds, which details the origin of specific transactions, and source of wealth, which explains the overall accumulation of a client's financial resources to ensure comprehensive risk assessment and regulatory compliance.

Ultimate Beneficiary

The ultimate beneficiary's source of funds refers to the origin of specific transaction money, while the source of wealth encompasses the overall accumulation of their assets and financial history.

Income Provenance

Income Provenance differentiates source of funds, which refers to the origin of specific transactions, from source of wealth, indicating the cumulative assets or economic background generating overall financial capacity.

Customer Risk Profiling

Customer risk profiling evaluates the consistency between a client's declared source of funds and the verified source of wealth to identify potential financial crimes and ensure compliance with anti-money laundering regulations.

Financial Transparency

Financial transparency requires clear documentation of both the source of funds--specific origins of individual transactions--and the source of wealth--the overall accumulation of assets over time.

Origin of Assets

The origin of assets refers to the specific transactions or activities that generate funds used to acquire those assets, directly linked to the source of funds, which details the immediate means of money flow. Source of wealth encompasses a broader context, including the overall accumulation of an individual's or entity's total net worth over time from various income streams, investments, and inheritances, providing a comprehensive view of financial standing.

source of funds vs source of wealth Infographic

moneydif.com

moneydif.com