Pre-funding in remittance requires senders to deposit funds in advance before the transfer is executed, ensuring immediate availability for recipients. Post-funding allows transfers to be completed first, with funds settled afterward, offering flexibility but potentially higher risk for service providers. Choosing between pre-funding and post-funding impacts transaction speed, risk management, and operational costs in remittance services.

Table of Comparison

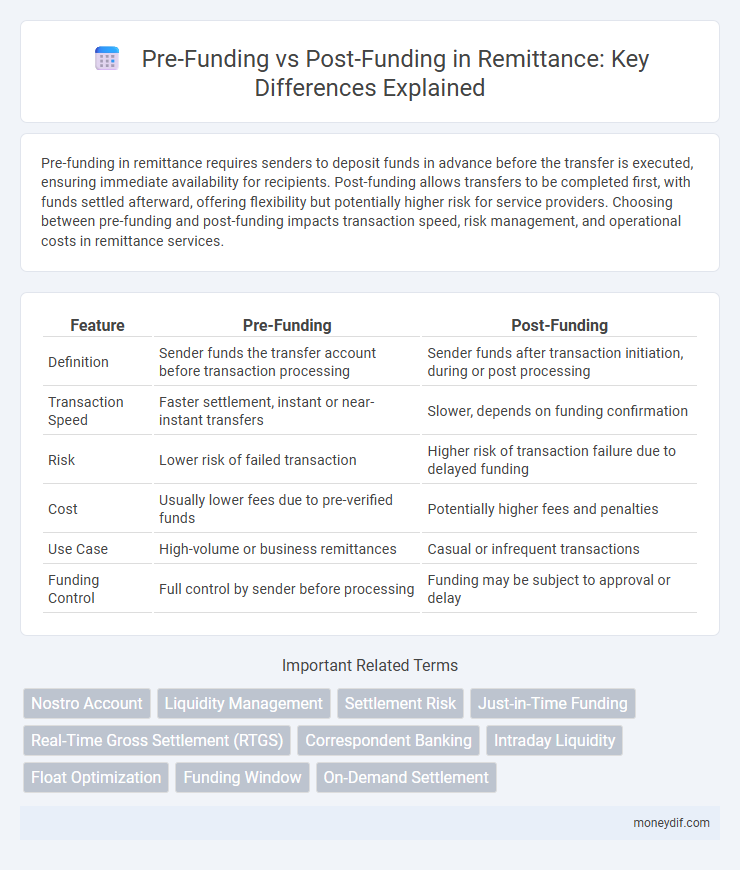

| Feature | Pre-Funding | Post-Funding |

|---|---|---|

| Definition | Sender funds the transfer account before transaction processing | Sender funds after transaction initiation, during or post processing |

| Transaction Speed | Faster settlement, instant or near-instant transfers | Slower, depends on funding confirmation |

| Risk | Lower risk of failed transaction | Higher risk of transaction failure due to delayed funding |

| Cost | Usually lower fees due to pre-verified funds | Potentially higher fees and penalties |

| Use Case | High-volume or business remittances | Casual or infrequent transactions |

| Funding Control | Full control by sender before processing | Funding may be subject to approval or delay |

Understanding Pre-Funding and Post-Funding in Remittance

Pre-funding in remittance involves transferring funds to the receiving agent's account before the beneficiary withdraws the money, ensuring immediate availability upon collection. Post-funding occurs after the beneficiary receives the funds, requiring reconciliation and settlement between sending and receiving institutions later. Understanding these models is crucial for optimizing liquidity management, reducing transaction risk, and enhancing customer experience in cross-border money transfers.

Key Differences Between Pre-Funding and Post-Funding

Pre-funding requires sending funds to the payment provider before the transaction occurs, ensuring immediate availability of money for remittances, while post-funding processes payments after the transaction is initiated, relying on credit arrangements. Pre-funding reduces the risk of failed transactions and increases transaction speed, but demands higher upfront liquidity from the sender or institution. Post-funding offers flexibility and lower upfront capital requirements but can introduce delays and higher credit risk for remittance service providers.

Advantages of Pre-Funding for Remittance Providers

Pre-funding offers remittance providers enhanced liquidity management by ensuring funds are readily available before transactions occur, reducing settlement risks. It enables faster transaction processing and improved customer experience by eliminating delays associated with post-funding verification. Furthermore, pre-funding supports better regulatory compliance and fraud prevention by maintaining transparent and controlled fund flows.

Benefits of Post-Funding in Cross-Border Transactions

Post-funding in cross-border transactions enhances liquidity management by eliminating the need for advance capital allocation, enabling financial institutions to optimize cash flow. This method reduces operational risk since transactions settle after funds are confirmed, decreasing the chance of failed payments and chargebacks. Benefiting from real-time settlement data, post-funding streamlines compliance monitoring and improves transparency in remittance processing.

Risks and Challenges of Pre-Funding vs. Post-Funding

Pre-funding in remittance involves sending funds ahead of the transaction, which reduces settlement risk but increases capital lock-up and potential liquidity constraints for the sender. Post-funding allows transactions to occur before funds are fully secured, posing higher counterparty risk and possible delays in recipient access to funds. Both models face regulatory compliance challenges, with pre-funding requiring robust capital controls and post-funding necessitating enhanced risk management frameworks to mitigate fraud and credit exposure.

Impact of Pre-Funding on Remittance Speed and Efficiency

Pre-funding significantly enhances remittance speed by enabling immediate fund transfers without waiting for recipient bank confirmation, reducing transaction settlement times from days to minutes. This approach improves efficiency by minimizing liquidity risks and ensuring smoother cross-border payment flows through pre-allocated funds held in localized accounts. Financial institutions leveraging pre-funding models experience higher customer satisfaction due to faster delivery and reduced operational complexities in remittance processing.

Post-Funding and Its Effect on Liquidity Management

Post-funding in remittance involves sending funds only after the recipient's transaction is confirmed, which can improve cash flow by reducing the need for large pre-funded balances. This approach minimizes capital tied up in transit, enhancing liquidity management for financial institutions. Effective post-funding strategies enable quicker reconciliation and optimize cash allocation, crucial for maintaining operational efficiency.

Regulatory Considerations for Pre-Funding and Post-Funding

Regulatory considerations for pre-funding require stringent compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations before transferring funds, ensuring transaction legitimacy and reducing fraud risk. Post-funding regulatory oversight focuses on transaction monitoring, reconciliation, and auditing to detect suspicious activities after funds are disbursed. Financial institutions must adhere to jurisdiction-specific regulations such as the Bank Secrecy Act (BSA) in the U.S. or the EU's Fifth Anti-Money Laundering Directive (5AMLD) to balance compliance with efficient fund transfer processes.

Technological Innovations Shaping Funding Models in Remittance

Technological innovations such as blockchain and real-time payment systems are revolutionizing pre-funding and post-funding models in remittance by enhancing transaction speed and transparency. Pre-funding benefits from distributed ledger technology to reduce liquidity requirements and mitigate settlement risk, while post-funding leverages AI-driven risk analytics to optimize cash flow management and compliance. Mobile wallets and APIs enable seamless integration with digital financial services, driving efficiency and reducing costs across cross-border money transfers.

Choosing the Right Model: Pre-Funding vs. Post-Funding for Remittance Businesses

Choosing the right remittance funding model significantly impacts liquidity management and transaction speed, with pre-funding requiring agents to maintain a funded float, thus reducing settlement risk and enabling instant payouts. Post-funding allows agents to transact first and settle later, which enhances working capital efficiency but may increase credit risk and delay final settlement. Optimal model selection depends on business scale, risk tolerance, and regulatory requirements within the remittance corridor.

Important Terms

Nostro Account

Nostro accounts require pre-funding to ensure sufficient funds are available for seamless cross-border transactions, reducing the risk of payment delays and enhancing liquidity management. Post-funding methods delay the transfer of funds until after the transaction is initiated, which can increase settlement risk and complicate reconciliation processes for financial institutions.

Liquidity Management

Liquidity management involves optimizing cash flow to ensure sufficient funds are available for operational needs, with pre-funding requiring capital to be secured before transactions occur, thereby minimizing settlement risk, while post-funding allows transactions to settle before funds are transferred, potentially increasing efficiency but risking liquidity shortfalls. Effective strategies balance pre-funding's risk reduction with post-funding's liquidity flexibility to maintain operational stability and meet regulatory requirements.

Settlement Risk

Settlement risk occurs when one party in a financial transaction fails to deliver the agreed-upon funds or securities at the expected time, often influenced by the choice between pre-funding, where funds are transferred before settlement, and post-funding, where payment occurs after. Pre-funding reduces settlement risk by ensuring funds are available prior to transaction completion, while post-funding increases exposure as delivery depends on future payment.

Just-in-Time Funding

Just-in-Time Funding minimizes capital holding by disbursing funds precisely when needed, reducing liquidity risks compared to traditional pre-funding, which requires upfront capital allocation. Post-funding models defer payment until after service delivery but may increase credit risk, making Just-in-Time Funding a balanced approach for efficient cash flow management.

Real-Time Gross Settlement (RTGS)

Real-Time Gross Settlement (RTGS) systems process high-value interbank transfers instantly on a gross basis without netting, requiring pre-funding to ensure sufficient liquidity for immediate settlement. Post-funding allows transactions to settle later but increases credit risk, making RTGS's pre-funded model essential for minimizing settlement risk and enhancing systemic stability.

Correspondent Banking

Correspondent banking involves intermediary banks facilitating cross-border transactions, where pre-funding requires the sender bank to deposit funds in advance before transaction execution, enhancing liquidity control but increasing capital lock-up. Post-funding allows transactions to be settled after funds transfer, reducing upfront capital demand but potentially increasing settlement risk and operational complexity.

Intraday Liquidity

Intraday liquidity management involves ensuring sufficient funds are available throughout the trading day to settle payments and transactions promptly, minimizing settlement risk. Pre-funding requires liquidity to be available in advance of payment obligations, enhancing certainty but increasing capital costs, whereas post-funding allows payments to occur with liquidity provided after settlements, potentially improving capital efficiency but raising intraday credit risk.

Float Optimization

Float optimization improves cash flow management by minimizing the time lag between when funds are available and when payments are processed, reducing the need for pre-funding. Post-funding strategies leverage real-time transaction settlements to enhance liquidity, allowing businesses to operate with lower cash reserves and optimize working capital efficiency.

Funding Window

Funding window defines the specific timeframe when capital allocation occurs, distinguishing pre-funding, which happens before project initiation to cover preliminary costs, from post-funding, allocated after project milestones to ensure continued financial support. Pre-funding mitigates early-stage financial risks, while post-funding enables performance-based budget adjustments and resource optimization.

On-Demand Settlement

On-Demand Settlement enables immediate transaction finality by allowing funds to be settled upon request, contrasting with pre-funding where capital is reserved in advance to cover transactions. Unlike post-funding, which settles transactions after execution and risks liquidity shortfalls, On-Demand Settlement optimizes cash flow and reduces credit exposure by aligning funding with transaction timing.

pre-funding vs post-funding Infographic

moneydif.com

moneydif.com