Cross-border remittance involves transferring funds between individuals or entities across different countries, often incurring higher fees and longer processing times compared to domestic remittance, which occurs within the same country and typically offers faster settlement and lower costs. Currency exchange rates and regulatory compliance add complexity to cross-border remittances, while domestic transfers benefit from more streamlined financial infrastructure. Choosing the right remittance method depends on factors like transaction urgency, cost sensitivity, and geographic location.

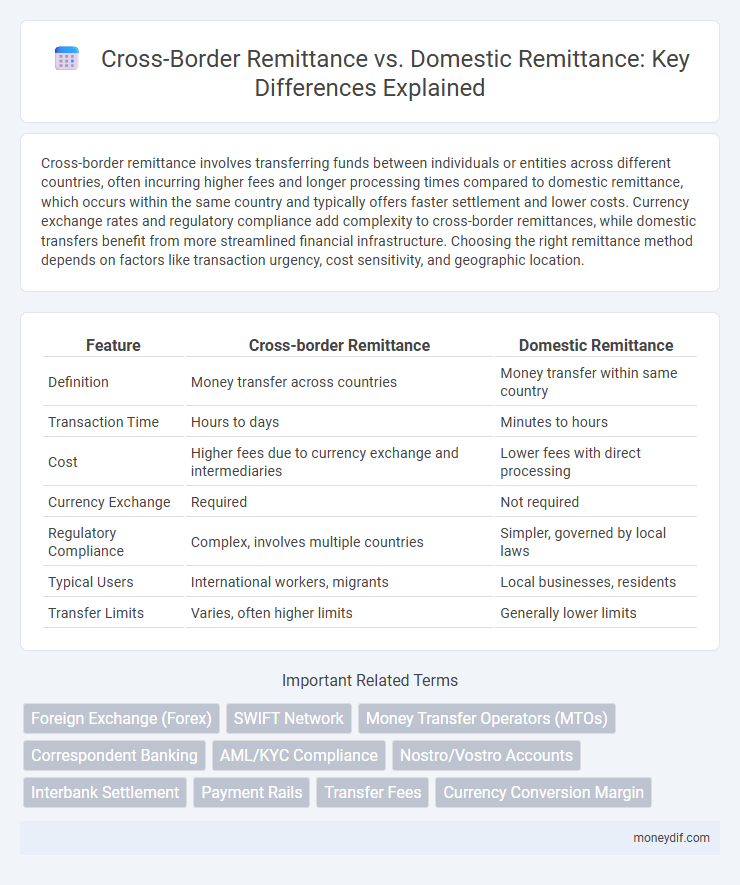

Table of Comparison

| Feature | Cross-border Remittance | Domestic Remittance |

|---|---|---|

| Definition | Money transfer across countries | Money transfer within same country |

| Transaction Time | Hours to days | Minutes to hours |

| Cost | Higher fees due to currency exchange and intermediaries | Lower fees with direct processing |

| Currency Exchange | Required | Not required |

| Regulatory Compliance | Complex, involves multiple countries | Simpler, governed by local laws |

| Typical Users | International workers, migrants | Local businesses, residents |

| Transfer Limits | Varies, often higher limits | Generally lower limits |

Introduction to Cross-border and Domestic Remittance

Cross-border remittance involves transferring funds between different countries, often requiring currency conversion and navigating international regulations, which can result in longer processing times and higher fees. Domestic remittance refers to money transfers within the same country, typically offering faster transactions with lower costs due to simpler regulatory frameworks and the absence of currency exchange. Both types of remittance play crucial roles in supporting global and local economies by facilitating financial inclusion and enabling timely monetary support.

Key Differences Between Cross-border and Domestic Remittance

Cross-border remittance involves transferring funds internationally, subject to currency exchange rates, international regulations, and higher transaction fees, whereas domestic remittance occurs within the same country with faster processing times and lower costs. Cross-border transactions often require compliance with multiple legal frameworks and anti-money laundering measures, while domestic transfers typically follow a single national regulatory system. The difference in infrastructure and financial institutions between countries impacts speed, cost, and security, distinguishing international remittance from domestic fund transfers.

Regulatory Frameworks: International vs. Local Transfers

Cross-border remittances face complex regulatory frameworks involving multiple jurisdictions, requiring compliance with international laws such as AML (Anti-Money Laundering) and CFT (Counter Financing of Terrorism) regulations. Domestic remittances operate under localized financial regulations with simpler compliance requirements and faster processing times due to fewer legal barriers. Understanding regulatory differences is crucial for financial institutions to mitigate risks and ensure seamless transfer of funds across borders.

Cost Comparison: Fees and Charges Explained

Cross-border remittances often incur higher fees due to currency conversion, international transfer charges, and intermediary bank fees, making them more expensive than domestic remittances. Domestic remittances typically offer lower costs, with fewer intermediaries and no currency exchange involved, resulting in reduced fees and faster processing times. Consumers seeking cost-effective transfers should compare exchange rates, fixed fees, and percentage-based charges before choosing between cross-border and domestic remittance options.

Speed of Transactions: Local vs. Global Perspective

Cross-border remittance transactions typically experience longer processing times, ranging from several hours to multiple business days, due to international banking networks, currency conversions, and regulatory compliance. In contrast, domestic remittances leverage local payment infrastructures like automated clearing houses and mobile money, often completing within seconds to a few hours. The disparity in transaction speed highlights the complexity of global financial systems compared to streamlined local networks optimized for rapid settlements.

Security and Fraud Risks in Remittance Types

Cross-border remittances face higher security and fraud risks due to complex regulatory environments and multiple intermediaries, increasing vulnerability to money laundering and identity theft. Domestic remittances generally benefit from stricter oversight and faster transaction verification, reducing exposure to fraudulent activities. Advanced encryption and real-time monitoring are critical for enhancing security in both remittance types, but cross-border transactions require more robust anti-fraud measures due to jurisdictional challenges.

Technology and Methods for Sending Remittances

Cross-border remittance relies heavily on blockchain technology, digital wallets, and online payment platforms to reduce transaction costs and increase transfer speed across international borders. In contrast, domestic remittance primarily uses traditional banking systems, mobile money services, and local clearinghouses, optimizing for convenience and accessibility within the same country. Both methods increasingly adopt API integrations and real-time payment systems to enhance user experience and operational efficiency.

Accessibility and Inclusivity in Remittance Services

Cross-border remittance services often face challenges related to accessibility due to regulatory hurdles and higher transaction costs, limiting inclusivity for underbanked populations across different countries. Domestic remittance networks typically offer more streamlined access through localized banking systems and mobile money platforms, enhancing financial inclusion. Leveraging digital wallets and agent networks in domestic transfers can bridge gaps in underserved regions, promoting broader participation in formal financial services.

Impact on Economies: International vs. Domestic Remittance

Cross-border remittances significantly boost developing economies by increasing foreign exchange reserves and supporting household consumption, while domestic remittances primarily circulate wealth within national borders, enhancing local economic stability and poverty reduction. International remittances contribute to global financial integration but often face higher transaction costs and regulatory complexities compared to domestic transfers, which benefit from streamlined networks and lower fees. The scale and frequency of domestic remittances generally exceed cross-border flows, directly stimulating grassroots economic activities and regional development.

Future Trends in Cross-border and Domestic Remittance

Future trends in cross-border remittance emphasize blockchain technology adoption, reducing transaction costs and increasing transparency across international payments. Domestic remittance is moving towards real-time processing powered by advanced payment infrastructures and mobile wallets, enhancing convenience and accessibility. Both markets are expected to leverage AI-driven fraud detection and personalized financial services, boosting security and user experience.

Important Terms

Foreign Exchange (Forex)

Foreign Exchange (Forex) plays a crucial role in cross-border remittance by enabling currency conversion and minimizing transaction costs for international money transfers, whereas domestic remittance typically involves transactions within the same currency zone with lower fees and faster settlement times. Forex volatility directly impacts exchange rates, making cross-border remittance more complex compared to the relatively stable pricing of domestic remittance services.

SWIFT Network

The SWIFT network facilitates secure cross-border remittance by enabling standardized financial messaging between international banks, significantly reducing transaction errors and enhancing global fund transfer efficiency. In contrast, domestic remittance typically relies on local interbank networks or payment systems that offer faster processing times and lower fees due to the absence of currency conversion and international compliance requirements.

Money Transfer Operators (MTOs)

Money Transfer Operators (MTOs) facilitate cross-border remittances by enabling secure and efficient international fund transfers, often navigating complex regulatory environments and currency exchange processes. In contrast, domestic remittances handled by MTOs focus on faster, lower-cost transactions within national borders, leveraging localized payment systems and infrastructure for immediate fund availability.

Correspondent Banking

Correspondent banking facilitates cross-border remittances by enabling financial institutions to transact and settle payments internationally through interconnected networks, while domestic remittances rely on local banking systems for faster and lower-cost transfers within the same country. The correspondent banking model involves intermediary banks that manage currency exchange, compliance, and regulatory requirements, crucial for seamless cross-border fund transfers.

AML/KYC Compliance

AML/KYC compliance for cross-border remittances involves stringent identity verification and monitoring of international transaction patterns to prevent money laundering and terrorist financing across multiple jurisdictions. In contrast, domestic remittance AML/KYC processes focus more on national regulatory requirements with localized risk assessments and real-time transaction screening to detect suspicious activity within the same country.

Nostro/Vostro Accounts

Nostro and Vostro accounts facilitate cross-border remittances by enabling banks to hold foreign currency balances, streamlining international fund transfers and reducing currency exchange risks. Domestic remittances typically do not require Nostro/Vostro accounts as transactions occur within the same national currency system, relying instead on interbank clearing mechanisms and local payment networks.

Interbank Settlement

Interbank settlement for cross-border remittance involves multi-currency processing, foreign exchange conversion, and adherence to international compliance standards, often resulting in longer settlement times and higher fees. In contrast, domestic remittance settles within a single currency and regulatory framework, enabling faster, lower-cost transactions through direct interbank connections or centralized payment systems.

Payment Rails

Payment Rails offers efficient solutions for cross-border remittance by enabling seamless international money transfers with lower fees and faster settlement times compared to traditional domestic remittance methods. Their platform supports multi-currency transactions, compliance with global regulatory standards, and real-time tracking, making it a preferred choice for businesses and individuals managing both cross-border and domestic payments.

Transfer Fees

Transfer fees for cross-border remittance typically exceed those for domestic remittance due to currency conversion, international regulatory compliance, and intermediary bank charges. Domestic remittance fees are generally lower and more transparent, benefiting from shorter processing times and fewer compliance hurdles.

Currency Conversion Margin

Currency conversion margin significantly impacts the cost differential between cross-border remittances and domestic remittances, with cross-border transactions typically incurring higher margins due to fluctuating exchange rates and additional processing fees. Domestic remittances generally have lower or negligible currency conversion margins, as they operate within a single currency zone, resulting in reduced transaction costs and more predictable amounts received.

Cross-border Remittance vs Domestic Remittance Infographic

moneydif.com

moneydif.com