Agent banking leverages local businesses to offer basic financial services, making remittance access more convenient in remote areas compared to traditional branch banking. Branch banking requires customers to visit physical bank locations, which may be limited in rural regions, potentially delaying remittance receipt and increasing transaction costs. Utilizing agent banking enhances financial inclusion by providing faster, more accessible, and cost-effective remittance services.

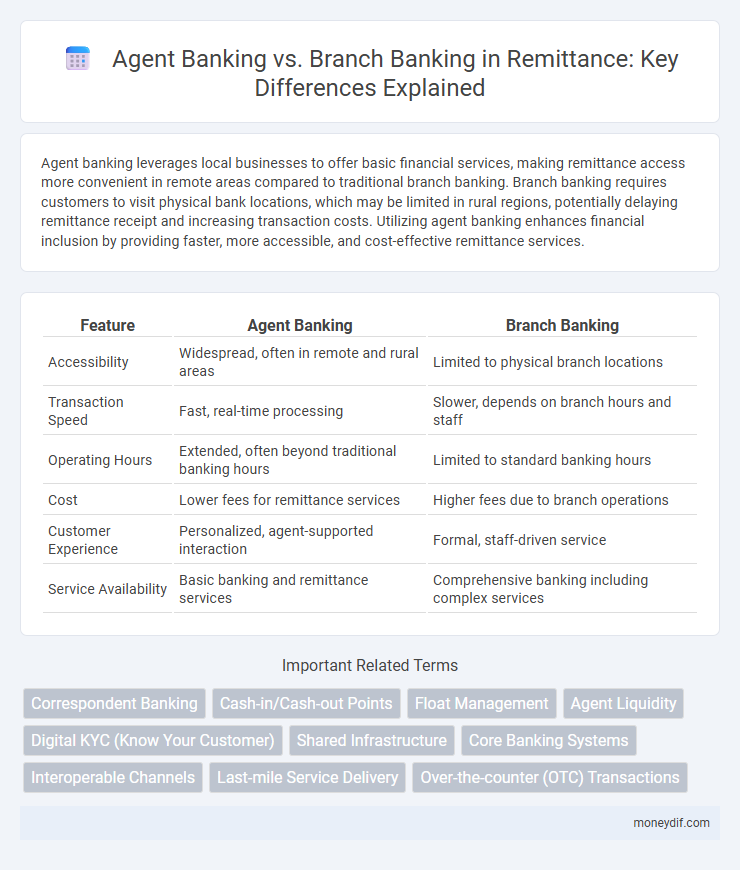

Table of Comparison

| Feature | Agent Banking | Branch Banking |

|---|---|---|

| Accessibility | Widespread, often in remote and rural areas | Limited to physical branch locations |

| Transaction Speed | Fast, real-time processing | Slower, depends on branch hours and staff |

| Operating Hours | Extended, often beyond traditional banking hours | Limited to standard banking hours |

| Cost | Lower fees for remittance services | Higher fees due to branch operations |

| Customer Experience | Personalized, agent-supported interaction | Formal, staff-driven service |

| Service Availability | Basic banking and remittance services | Comprehensive banking including complex services |

Understanding Agent Banking and Branch Banking in Remittance

Agent banking leverages local businesses or agents to offer remittance services, increasing accessibility for customers in remote or underserved areas. Branch banking involves traditional bank branches that provide remittance services through staffed locations with direct bank infrastructure. Agent banking reduces operational costs and enhances convenience, while branch banking offers greater security and a broader range of financial products.

Key Differences Between Agent Banking and Branch Banking

Agent banking leverages authorized third-party agents to provide financial services in remote or underserved areas, increasing accessibility and reducing operational costs. Branch banking operates through physical bank branches staffed by bank employees, offering a full range of financial products but with higher infrastructure and maintenance expenses. Key differences include the mode of service delivery, cost efficiency, and geographical reach, with agent banking emphasizing convenience and branch banking ensuring comprehensive service offerings.

Role of Agent Banking in Expanding Remittance Access

Agent banking plays a crucial role in expanding remittance access by providing convenient, low-cost financial services in remote and underserved areas where traditional branch banking is limited. Utilizing local agents, it enables faster, more accessible remittance transfers, reduces transaction costs, and supports financial inclusion for unbanked populations. The extensive agent networks significantly increase the reach and efficiency of remittance delivery, fostering economic growth in rural and marginalized communities.

Advantages of Branch Banking for Remittance Services

Branch banking offers direct access to personalized customer support, enhancing trust and reliability in remittance transactions. Physical branches provide secure environments for verifying identities and handling large cash remittances, reducing fraud risks. Additionally, branches facilitate instant fund transfers and cash pickups, improving convenience for both senders and recipients.

Cost Comparison: Agent Banking vs Branch Banking in Remittance

Agent banking reduces remittance costs by leveraging local agents, minimizing infrastructure and operational expenses compared to traditional branch banking. Branch banking requires substantial investments in physical locations, staff wages, and maintenance, often leading to higher transaction fees for remittance services. Studies show agent banking can lower remittance transaction costs by up to 40%, making it a more cost-effective solution for sending and receiving money.

Transaction Speed: Which is Faster for Remittances?

Agent banking offers faster transaction speeds for remittances compared to traditional branch banking due to its decentralized network of local agents and digital platforms that reduce processing time. Branch banking often involves longer queues and manual handling of transactions, which slows down the remittance process. The integration of mobile technology in agent banking further accelerates real-time fund transfers, making it the preferred choice for quick remittance services.

Security Measures in Agent Banking vs Branch Banking

Agent banking employs biometric verification, encrypted transactions, and limited cash handling to enhance security during remittance processes, reducing fraud risks compared to traditional branch banking. Branch banking relies on physical security measures such as secured vaults, surveillance systems, and in-person identity verification to safeguard remittance transactions. The integration of digital authentication in agent banking offers a scalable and secure alternative, particularly in remote areas where branch infrastructure is limited.

Customer Experience: Agent Banking vs Branch Banking in Remittance

Agent banking enhances customer experience in remittance by offering convenient access points closer to users' locations, reducing travel time and operational hours constraints compared to traditional branch banking. It leverages mobile technology and local agents to provide faster transaction processing and personalized service, especially in rural or underserved areas. Branch banking, while reliable and secure, often involves longer wait times and limited operational hours, which can hinder timely remittance transfers for customers.

Rural and Urban Reach: Impact on Remittance Flows

Agent banking extends remittance services to remote rural areas by leveraging local agents, significantly increasing accessibility for underbanked populations compared to traditional branch banking limited to urban centers. Branch banking's concentration in cities facilitates higher transaction volumes but restricts rural reach, resulting in uneven remittance flow distribution. Enhanced rural agent networks drive inclusive financial access, promoting balanced remittance inflows and stimulating economic activity in less connected communities.

The Future of Remittance: Integrating Agent and Branch Banking

The future of remittance lies in seamlessly integrating agent banking with traditional branch banking to enhance accessibility and convenience for users worldwide. Agent banking extends remittance services into remote and underserved areas using mobile and local agents, while branch banking offers robust infrastructure for complex transactions and compliance. Combining these models leverages the strengths of digital innovation and physical presence, driving financial inclusion and faster, cost-effective cross-border transfers.

Important Terms

Correspondent Banking

Correspondent banking facilitates international transactions by partnering with agent banking networks, which offer localized services without the infrastructure of traditional branch banking.

Cash-in/Cash-out Points

Cash-in/Cash-out points in agent banking offer extended financial access and convenience compared to traditional branch banking by enabling transactions in remote or underserved areas through authorized agents.

Float Management

Float management in agent banking optimizes cash inflows and outflows through decentralized agents, reducing liquidity risks compared to traditional branch banking's centralized cash handling.

Agent Liquidity

Agent liquidity management is crucial in agent banking to ensure seamless cash-in and cash-out transactions compared to branch banking, which relies on centralized cash reserves.

Digital KYC (Know Your Customer)

Digital KYC enhances agent banking by enabling remote customer verification through biometric authentication and real-time data validation, reducing the need for physical branch visits. Branch banking relies more on in-person KYC processes that involve manual document verification and face-to-face interactions, which can increase operational costs and processing time.

Shared Infrastructure

Shared infrastructure in agent banking leverages existing retail outlets and digital platforms to expand financial services access with lower operational costs compared to branch banking, which relies on dedicated physical locations and higher capital investment. This model enables rapid scaling and enhanced customer reach in underserved areas while maintaining regulatory compliance and security standards.

Core Banking Systems

Core banking systems enable seamless integration and real-time transaction processing for both agent banking and branch banking, enhancing financial accessibility and operational efficiency.

Interoperable Channels

Interoperable channels in agent banking enable seamless transactions across multiple financial service providers, offering greater accessibility and convenience compared to traditional branch banking limited by location and operating hours.

Last-mile Service Delivery

Last-mile service delivery in agent banking offers faster, more cost-effective access to financial services compared to traditional branch banking, especially in underserved rural areas.

Over-the-counter (OTC) Transactions

Agent banking expands financial access through third-party agents, enabling Over-the-Counter (OTC) transactions in underserved areas, while branch banking conducts OTC transactions within traditional bank premises.

agent banking vs branch banking Infographic

moneydif.com

moneydif.com