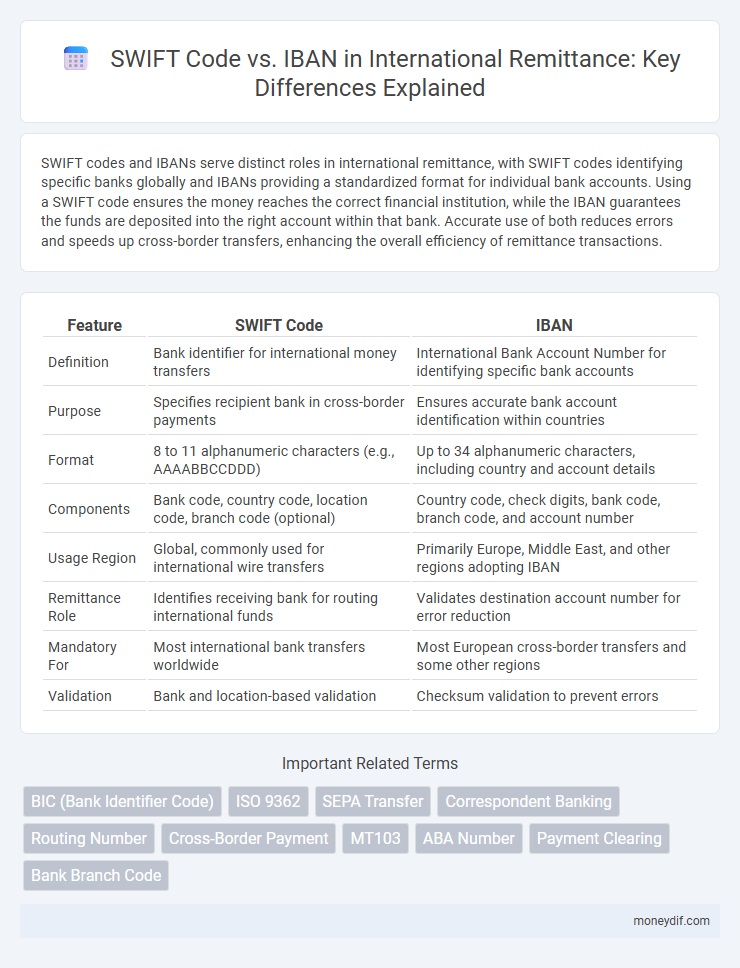

SWIFT codes and IBANs serve distinct roles in international remittance, with SWIFT codes identifying specific banks globally and IBANs providing a standardized format for individual bank accounts. Using a SWIFT code ensures the money reaches the correct financial institution, while the IBAN guarantees the funds are deposited into the right account within that bank. Accurate use of both reduces errors and speeds up cross-border transfers, enhancing the overall efficiency of remittance transactions.

Table of Comparison

| Feature | SWIFT Code | IBAN |

|---|---|---|

| Definition | Bank identifier for international money transfers | International Bank Account Number for identifying specific bank accounts |

| Purpose | Specifies recipient bank in cross-border payments | Ensures accurate bank account identification within countries |

| Format | 8 to 11 alphanumeric characters (e.g., AAAABBCCDDD) | Up to 34 alphanumeric characters, including country and account details |

| Components | Bank code, country code, location code, branch code (optional) | Country code, check digits, bank code, branch code, and account number |

| Usage Region | Global, commonly used for international wire transfers | Primarily Europe, Middle East, and other regions adopting IBAN |

| Remittance Role | Identifies receiving bank for routing international funds | Validates destination account number for error reduction |

| Mandatory For | Most international bank transfers worldwide | Most European cross-border transfers and some other regions |

| Validation | Bank and location-based validation | Checksum validation to prevent errors |

Understanding SWIFT Codes in Remittance

SWIFT codes are unique identification codes for banks used internationally to facilitate secure and accurate cross-border remittance transactions. They consist of 8 to 11 alphanumeric characters representing the bank, country, location, and branch, ensuring funds are directed correctly during transfers. Unlike IBAN, which identifies individual bank accounts primarily in Europe, SWIFT codes are essential for identifying financial institutions globally in remittance processes.

What is an IBAN?

An IBAN (International Bank Account Number) is a standardized international numbering system used to uniquely identify a bank account across borders, facilitating efficient cross-border transactions and minimizing errors. It consists of a country code, two check digits, and a basic bank account number (BBAN) that varies in length depending on the country. Unlike the SWIFT code, which identifies a specific bank branch, the IBAN specifies an individual account, ensuring accurate routing of funds in international remittances.

Key Differences Between SWIFT Codes and IBAN

SWIFT codes identify specific banks globally for international money transfers, typically consisting of 8 to 11 alphanumeric characters that specify the bank, country, and branch. IBAN (International Bank Account Number) standardizes bank account identification across countries, enabling seamless cross-border transactions by including country codes, check digits, and detailed bank and account information. While SWIFT codes facilitate the routing of payments between financial institutions, IBAN ensures the accurate identification of individual beneficiary accounts, reducing errors and processing delays in remittances.

When Do You Need a SWIFT Code for Remittances?

You need a SWIFT code for remittances when transferring money internationally between banks, especially to ensure precise identification of the recipient's bank in global transactions. The SWIFT code facilitates secure and standardized communication across international banking networks, making it essential for cross-border payments. Unlike IBAN, which identifies individual bank accounts primarily in Europe and a few other regions, the SWIFT code is crucial for routing funds through the international banking system.

Situations Requiring an IBAN in Money Transfers

Money transfers within Europe and many other regions require an IBAN to ensure accurate and efficient processing by identifying the recipient's bank account uniquely. While SWIFT codes identify the bank itself internationally, the IBAN specifies the exact account, which is crucial for cross-border transactions involving countries using the IBAN system. Situations such as transferring funds to European countries, complying with SEPA regulations, or sending money to banks in countries that mandate IBAN use all necessitate providing the IBAN for successful remittance.

How SWIFT Codes Facilitate International Payments

SWIFT codes streamline international payments by providing a standardized identification system for banks worldwide, ensuring accurate routing of funds across borders. These unique alphanumeric codes eliminate errors in transferring money by clearly specifying the recipient bank and branch in the global SWIFT network. Unlike IBANs, which identify individual bank accounts within specific countries, SWIFT codes enable seamless communication between financial institutions during cross-border remittances.

The Role of IBAN in Cross-Border Transactions

IBAN (International Bank Account Number) standardizes account identification across borders, reducing errors and processing delays in international remittance. Unlike SWIFT Codes, which identify banks globally, IBAN specifies the exact account within that bank, ensuring precise fund routing. Effective use of IBAN enhances transaction transparency and compliance with regulatory standards in cross-border payments.

Security Implications: SWIFT Code vs IBAN

SWIFT codes and IBANs play distinct roles in international remittances, with SWIFT codes acting as unique identifiers for banks in the global SWIFT network and IBANs providing standardized account number formats to ensure accurate routing of funds. Security implications arise as SWIFT codes facilitate encrypted message exchanges between financial institutions, reducing the risk of interception or fraud, while IBANs focus on validating account information to prevent misdirected payments. Combining both identifiers enhances remittance security by ensuring both the recipient bank and specific account details are accurately and securely verified during transactions.

Common Mistakes in Using SWIFT or IBAN for Remittance

Common mistakes in using SWIFT codes for remittance include entering incorrect bank identifiers or omitting essential branch codes, leading to failed or delayed transactions. Misuse of IBAN often involves incorrect format or missing characters, causing payment rejections or processing errors. Ensuring accuracy in both SWIFT and IBAN details is critical to avoid remittance delays and additional bank charges.

Tips for Smooth International Transfers: SWIFT Code and IBAN

Ensure accuracy when entering the SWIFT Code and IBAN to avoid delays and transaction errors during international transfers. Use the SWIFT Code to identify the recipient bank globally, while the IBAN provides a standardized account number for efficient routing within participating countries. Verify both codes with your recipient before initiating the remittance to guarantee a smooth and timely transfer.

Important Terms

BIC (Bank Identifier Code)

BIC (Bank Identifier Code), also known as SWIFT Code, uniquely identifies banks worldwide for international money transfers, ensuring precise routing of payments between financial institutions. Unlike IBAN, which standardizes individual bank account numbers across countries to facilitate cross-border transactions, BIC/SWIFT codes focus on identifying the bank itself within the SWIFT network.

ISO 9362

ISO 9362 specifies the SWIFT code format, a unique identifier used globally for bank-to-bank communications and international wire transfers, while IBAN (International Bank Account Number) standardizes individual bank account numbers across countries to facilitate cross-border payments. Both systems enhance financial transaction accuracy, with SWIFT codes identifying banks and IBANs specifying individual accounts within those institutions.

SEPA Transfer

A SEPA transfer requires the use of an IBAN to identify the recipient's bank account within the Single Euro Payments Area, ensuring seamless euro transactions between member countries. Unlike SWIFT codes, which identify specific banks globally for international wire transfers, the IBAN provides a standardized format essential for processing SEPA payments efficiently.

Correspondent Banking

Correspondent banking relies on SWIFT codes to identify financial institutions globally, enabling secure cross-border payment processing, while IBANs specify individual bank accounts within countries, ensuring accuracy in international transaction routing. Together, SWIFT codes facilitate interbank communication, and IBANs guarantee precise beneficiary account referencing, optimizing the efficiency of correspondent banking networks.

Routing Number

Routing numbers are nine-digit codes primarily used in the United States to identify financial institutions for domestic transactions, while SWIFT codes are international bank identifiers used globally for cross-border payments. Unlike SWIFT codes and IBANs, which facilitate international transfers and include country-specific formats and account details, routing numbers serve as local identifiers without standardized account information.

Cross-Border Payment

Cross-border payment efficiency relies heavily on accurate SWIFT codes and IBANs, where SWIFT codes identify the recipient bank globally and IBANs specify the beneficiary's bank account details within the international banking system. Using both SWIFT codes and IBANs reduces transaction errors, accelerates processing times, and ensures compliance with global payment standards.

MT103

MT103 is a SWIFT payment message used for international wire transfers, containing detailed transaction information including sender and beneficiary bank details identified by BIC (SWIFT Code). The IBAN (International Bank Account Number) complements the SWIFT Code by specifying the beneficiary's exact bank account, ensuring accurate cross-border payment routing and reducing errors.

ABA Number

The ABA Number, also known as the routing transit number (RTN), is a nine-digit code used in the United States to identify banks for domestic wire transfers, while the SWIFT Code (or BIC) is an international standard that identifies banks globally for cross-border transactions. The IBAN (International Bank Account Number) complements the SWIFT Code by providing a standardized format for bank account identification primarily in Europe, enhancing the accuracy and efficiency of international payments.

Payment Clearing

Payment clearing relies on both SWIFT codes and IBANs to ensure accurate international fund transfers; SWIFT codes identify the recipient's bank, while IBANs specify the exact account within that bank. Using the correct combination of SWIFT code and IBAN minimizes transaction errors and accelerates the clearing process across global payment networks.

Bank Branch Code

A Bank Branch Code identifies a specific branch within a banking institution, facilitating localized transaction routing, whereas a SWIFT Code (or BIC) is an international identifier used for cross-border payments and communications between banks. IBAN (International Bank Account Number) standardizes domestic account numbers for international use by combining country codes, bank codes, and branch codes, ensuring accurate global account identification.

SWIFT Code vs IBAN Infographic

moneydif.com

moneydif.com