Direct remittance involves sending money straight from the sender to the recipient without intermediaries, ensuring faster transaction times and lower fees. Indirect remittance passes funds through third-party agents or networks, which can increase costs and processing times but may provide wider access in regions with limited direct channels. Choosing between direct and indirect remittance depends on factors like speed, cost, accessibility, and the recipient's location.

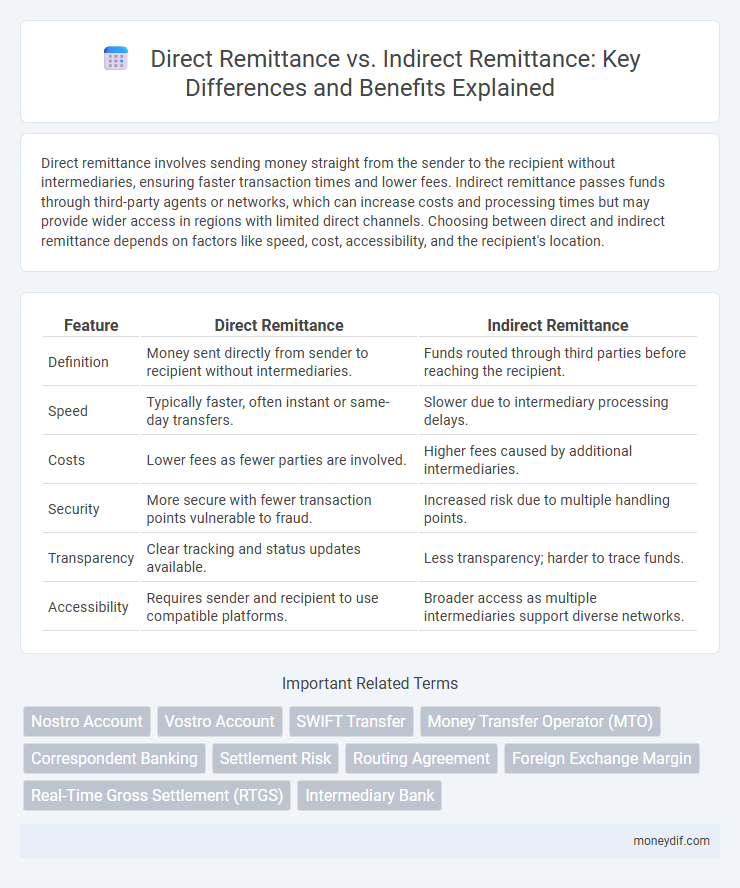

Table of Comparison

| Feature | Direct Remittance | Indirect Remittance |

|---|---|---|

| Definition | Money sent directly from sender to recipient without intermediaries. | Funds routed through third parties before reaching the recipient. |

| Speed | Typically faster, often instant or same-day transfers. | Slower due to intermediary processing delays. |

| Costs | Lower fees as fewer parties are involved. | Higher fees caused by additional intermediaries. |

| Security | More secure with fewer transaction points vulnerable to fraud. | Increased risk due to multiple handling points. |

| Transparency | Clear tracking and status updates available. | Less transparency; harder to trace funds. |

| Accessibility | Requires sender and recipient to use compatible platforms. | Broader access as multiple intermediaries support diverse networks. |

Understanding Remittance: Direct vs Indirect

Direct remittance involves sending money straight from the sender to the recipient's bank account or wallet, ensuring faster transactions and lower fees. Indirect remittance, on the other hand, routes funds through intermediaries such as agents or financial institutions, which may increase processing time and costs but offers wider accessibility. Understanding these differences helps in selecting the most efficient and cost-effective remittance method for international money transfers.

Key Differences Between Direct and Indirect Remittance

Direct remittance involves sending money straight from the sender to the recipient without intermediaries, ensuring faster transaction times and lower fees. Indirect remittance, on the other hand, routes funds through intermediaries such as agents or correspondent banks, which can increase processing time and costs. Key differences include transaction speed, cost-effectiveness, and the degree of transparency in tracking the remittance flow.

How Direct Remittance Works

Direct remittance involves sending money directly from the sender to the recipient without intermediaries, using platforms like bank transfers or digital wallets. This method ensures faster transactions and lower fees by eliminating third-party agents, enhancing cost efficiency and security. Tracking and confirmation are streamlined through the sending platform, providing real-time updates and proof of payment to both parties.

How Indirect Remittance Works

Indirect remittance operates through intermediaries such as banks, money transfer operators, or agents who facilitate the transfer of funds between sender and recipient. The sender deposits money with an agent or bank in their home country, which then sends the funds to a corresponding agent or financial institution in the recipient's country for disbursement. This network of partners ensures money reaches recipients without a direct transaction between the sender's and receiver's accounts, often involving additional fees and longer transfer times compared to direct remittance.

Advantages of Direct Remittance

Direct remittance offers faster transaction speeds by eliminating intermediaries, ensuring funds reach recipients promptly. It also reduces transfer costs significantly, optimizing the amount received by beneficiaries. Enhanced security and transparency are additional benefits, minimizing risks associated with multiple handling points.

Benefits of Indirect Remittance

Indirect remittance offers enhanced accessibility by allowing funds to be transferred through multiple intermediaries, thereby reaching remote or underserved regions where direct channels may not operate. It provides increased flexibility in payment options and currencies, accommodating varied recipient preferences and local financial systems. Cost efficiencies arise from competitive intermediary services, potentially lowering transaction fees and ensuring faster delivery times compared to some direct remittance methods.

Challenges in Direct and Indirect Remittance

Direct remittance faces challenges such as limited access to formal financial institutions and higher transaction costs, impacting efficiency and reach. Indirect remittance often involves intermediaries, resulting in increased processing time, risks of miscommunication, and potential regulatory compliance issues. Both methods must navigate security concerns, currency exchange fluctuations, and varying international regulations that affect remittance reliability and cost.

Cost Comparison: Direct vs Indirect Remittance

Direct remittance typically incurs lower fees and exchange rate margins compared to indirect remittance, as it eliminates intermediaries such as agents or correspondent banks. Indirect remittance often involves multiple parties, resulting in higher cumulative costs and longer processing times. Cost efficiency in direct remittance makes it a preferable option for transferring funds internationally.

Which Remittance Method Is More Secure?

Direct remittance offers enhanced security by eliminating intermediaries, reducing the risk of fraud and delays commonly associated with indirect remittance methods. Banks and regulated money transfer operators handling direct transfers implement stringent verification protocols and encryption technologies to protect sender and recipient information. Conversely, indirect remittance relies on multiple agents, increasing vulnerability to breaches and errors during transaction processing.

Choosing the Right Remittance Option for Your Needs

Direct remittance offers faster transfers and lower fees by sending funds straight from sender to receiver through a single financial institution, ideal for urgent and cost-effective international payments. Indirect remittance involves intermediary agents or banks, providing broader access to remote or less connected regions but often incurring higher costs and longer delivery times. Assess factors like transfer speed, network coverage, fees, and beneficiary accessibility to choose the remittance option that best fits your specific financial and geographic requirements.

Important Terms

Nostro Account

Nostro accounts facilitate direct remittance by allowing banks to hold foreign currency deposits for seamless cross-border payments, whereas indirect remittance involves intermediaries, increasing transaction complexity and time. Utilizing Nostro accounts enhances efficiency and reduces costs in international fund transfers compared to reliance on correspondent banks in indirect remittance.

Vostro Account

A Vostro Account is a type of bank account held by a foreign bank in a domestic bank, facilitating direct remittance by enabling seamless cross-border fund transfers between correspondent banks. Indirect remittance involves intermediary banks, often resulting in longer processing times and higher transaction costs compared to the efficiency and transparency of direct remittance via Vostro Accounts.

SWIFT Transfer

SWIFT Transfer enables secure international fund transfers through a global network of banks, with direct remittance involving a straightforward sender-to-receiver transaction via correspondent banks, enhancing speed and transparency. Indirect remittance utilizes intermediary financial institutions, which may increase processing time and fees due to additional transfer steps and currency conversions.

Money Transfer Operator (MTO)

Money Transfer Operators (MTOs) specialize in facilitating direct remittance by enabling customers to send funds instantly and securely to recipients without intermediaries, ensuring lower costs and faster transactions. In contrast, indirect remittance involves third-party agents or correspondent banks, which may increase transfer time and fees due to multiple handling points and regulatory compliance processes.

Correspondent Banking

Correspondent banking facilitates international money transfers through direct remittance, enabling financial institutions to send funds directly between banks without intermediaries, which reduces transaction costs and processing time. Indirect remittance involves multiple intermediary banks in the correspondent chain, increasing complexity, transfer time, and fees due to additional verification and compliance steps.

Settlement Risk

Settlement risk in direct remittance involves the possibility of payment failure between the sender and receiver without intermediaries, increasing exposure to counterparty default. Indirect remittance mitigates this risk by incorporating financial intermediaries or correspondent banks, providing additional layers of verification and security but potentially introducing delays and additional fees.

Routing Agreement

A Routing Agreement defines the terms and pathways for processing payments between banks, specifying whether collections are handled directly by the presenting bank (Direct Remittance) or routed through an intermediary bank (Indirect Remittance). Direct Remittance streamlines transactions by minimizing intermediaries, while Indirect Remittance involves additional banks, potentially increasing processing time and costs.

Foreign Exchange Margin

Foreign Exchange Margin represents the cost difference between the buying and selling rates in currency conversion during direct remittance, often resulting in a lower margin due to direct bank-to-bank transfers. Indirect remittance involves intermediaries such as money transfer operators, typically leading to higher foreign exchange margins caused by additional fees and less favorable exchange rates.

Real-Time Gross Settlement (RTGS)

Real-Time Gross Settlement (RTGS) systems facilitate immediate and irrevocable fund transfers, enhancing the efficiency of direct remittances by allowing funds to be sent straight from the sender's bank to the recipient's bank without intermediaries. Indirect remittances, in contrast, may involve multiple correspondent banks or intermediaries, which can delay the settlement time and increase transaction costs compared to the instantaneous settlement provided by RTGS.

Intermediary Bank

An intermediary bank facilitates the transfer of funds between the sender's and recipient's banks in indirect remittance, often adding processing time and fees compared to direct remittance, where funds move straight without intermediaries. The presence of an intermediary bank is crucial in cross-border transactions lacking direct correspondent banking relationships, impacting the speed and cost of international money transfers.

Direct Remittance vs Indirect Remittance Infographic

moneydif.com

moneydif.com