Standing instructions offer a reliable way to automate regular remittances by scheduling fixed transfers on specific dates, ensuring timely and consistent payments. In contrast, ad hoc transfers provide flexibility for one-time or irregular payments, allowing users to initiate transfers as needed without preset schedules. Choosing between these methods depends on the frequency and predictability of remittance requirements.

Table of Comparison

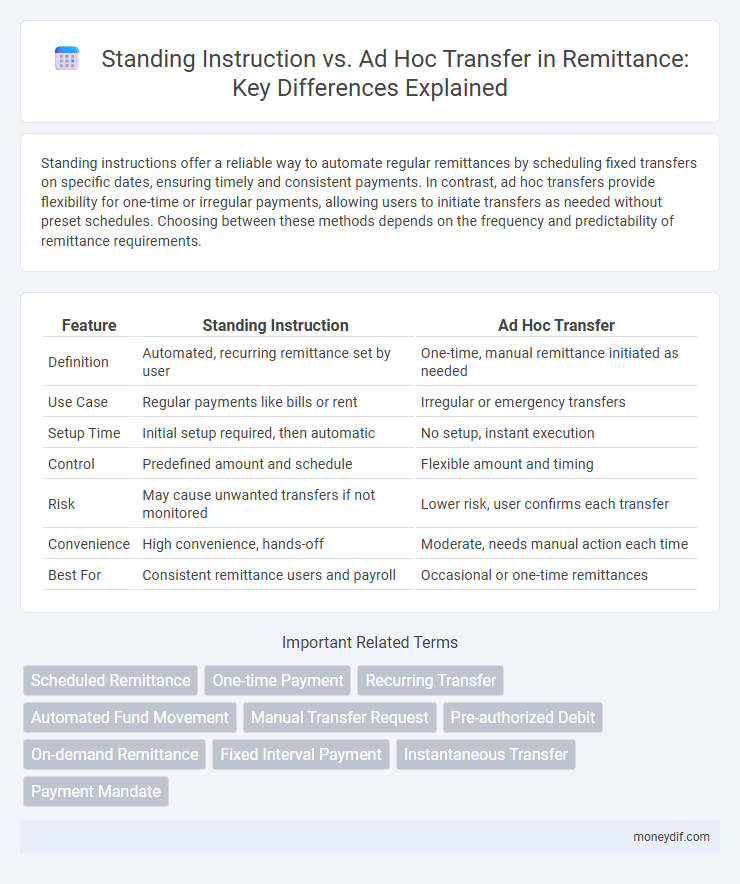

| Feature | Standing Instruction | Ad Hoc Transfer |

|---|---|---|

| Definition | Automated, recurring remittance set by user | One-time, manual remittance initiated as needed |

| Use Case | Regular payments like bills or rent | Irregular or emergency transfers |

| Setup Time | Initial setup required, then automatic | No setup, instant execution |

| Control | Predefined amount and schedule | Flexible amount and timing |

| Risk | May cause unwanted transfers if not monitored | Lower risk, user confirms each transfer |

| Convenience | High convenience, hands-off | Moderate, needs manual action each time |

| Best For | Consistent remittance users and payroll | Occasional or one-time remittances |

Understanding Standing Instructions in Remittances

Standing instructions in remittances enable automatic, scheduled transfers of funds to designated recipients, ensuring consistent and timely payments without manual intervention. These preset directives streamline recurrent transactions, reduce administrative errors, and offer convenience for users with regular remittance needs such as monthly support or bill payments. Compared to ad hoc transfers, standing instructions optimize cash flow management by providing predictable transfer patterns and minimizing delays in cross-border fund settlements.

What Are Ad Hoc Transfers?

Ad hoc transfers are single, non-recurring remittance transactions initiated without a predefined schedule or standing order, allowing senders flexibility for one-time payments. These transfers are commonly used for emergency funds, irregular bill payments, or spontaneous financial support. Ad hoc transfers typically involve higher fees and longer processing times compared to standing instructions, which are automated and scheduled.

Key Differences Between Standing Instructions and Ad Hoc Transfers

Standing instructions enable customers to automate recurring remittances by pre-authorizing fixed transfers on specified dates, ensuring timely and consistent payments. In contrast, ad hoc transfers are one-time, manually initiated transactions requiring the sender to specify transfer details each time, offering flexibility but lacking automation. Key differences include frequency, automation level, and convenience, where standing instructions are ideal for regular bills and recurring payments, while ad hoc transfers suit occasional or unpredictable remittance needs.

Advantages of Using Standing Instructions for Remittance

Standing instructions for remittance offer the advantage of automating regular payments, ensuring timely and consistent fund transfers without manual intervention. This method reduces the risk of missed deadlines and late fees, enhancing financial discipline and reliability. Furthermore, standing instructions enable efficient cash flow management and minimize administrative workload, making them ideal for recurring transactions like rent, loan repayments, or family support.

Benefits of Ad Hoc Transfers for International Payments

Ad hoc transfers offer flexibility for international payments by allowing users to send money instantly without pre-scheduling, accommodating urgent financial needs and fluctuating remittance amounts. This system eliminates the commitment to regular transfers, reducing the risk of unnecessary transactions and improving control over individual payments. Enhanced convenience and adaptability make ad hoc transfers ideal for recipients receiving variable support or one-time international payments.

Security Considerations: Standing Instruction vs Ad Hoc Transfer

Standing instructions offer enhanced security by automating regular remittances, reducing the risk of human error or fraud through consistent verification protocols. Ad hoc transfers require manual authorization for each transaction, increasing the likelihood of unauthorized access or mistakes due to irregular oversight. Financial institutions often implement multi-factor authentication and transaction monitoring for both methods, but standing instructions provide a more controlled and predictable security framework.

Cost Comparison: Fees Associated with Each Method

Standing instructions generally incur lower fees due to their automated, recurring nature, often benefiting from reduced transaction costs set by banks and remittance services. Ad hoc transfers typically involve higher charges per transaction, reflecting the added processing and manual input required. Cost efficiency in standing instructions makes them preferable for regular remittances, while ad hoc transfers suit occasional, flexible payments despite the higher fees.

When to Choose Standing Instruction Over Ad Hoc Transfer

Standing instructions are ideal for recurring remittances such as monthly rent, tuition fees, or regular debt repayments, providing automation and reducing the risk of missed payments. They offer consistent transfer amounts on preset dates, ensuring timely and predictable financial management. In contrast, ad hoc transfers are better suited for irregular or one-time payments where flexibility and varied amounts are required.

Impact on Beneficiary Experience and Satisfaction

Standing instructions provide beneficiaries with consistent, timely remittances, enhancing reliability and reducing anxiety about delayed funds. Ad hoc transfers offer flexibility, allowing senders to respond to beneficiaries' immediate needs, but may result in inconsistent timing that affects satisfaction. Overall, predictable standing instructions foster higher trust and financial stability for beneficiaries compared to the variability of ad hoc transfers.

Future Trends in Remittance: Automation vs Flexibility

Future trends in remittance reveal a shift towards automation through standing instructions, enabling seamless, scheduled transfers that reduce manual intervention and errors. Conversely, ad hoc transfers maintain flexibility by allowing users to send funds selectively, catering to spontaneous financial needs and diverse recipient scenarios. Innovations like AI-driven platforms aim to balance the efficiency of automation with the adaptability of ad hoc transfers, enhancing both user experience and operational precision.

Important Terms

Scheduled Remittance

Scheduled Remittance ensures consistent, automated payments by leveraging Standing Instructions, which set pre-defined intervals and amounts for transfers, compared to Ad Hoc Transfers that require manual initiation for each transaction. Standing Instructions optimize cash flow management and reduce processing errors, whereas Ad Hoc Transfers offer flexibility for irregular or one-time payments without preset schedules.

One-time Payment

One-time payment involves a single, non-recurring transaction authorized by the payer, differing from standing instructions that automate repetitive transfers on preset schedules; ad hoc transfers are manually initiated for one-off payments without preset scheduling. Standing instructions optimize financial management through automation, while one-time payments and ad hoc transfers offer flexibility for irregular or immediate fund movements.

Recurring Transfer

Recurring Transfer automates regular payments by scheduling fixed amounts on specific dates, optimizing cash flow management and reducing manual intervention. Standing Instructions establish these preset schedules for recurring transfers, whereas Ad Hoc Transfers are one-time, manual payments without recurring parameters.

Automated Fund Movement

Automated Fund Movement leverages Standing Instructions to enable scheduled, recurring transfers of funds between accounts without manual intervention, ensuring timely payments such as rent or loan installments. In contrast, Ad Hoc Transfers allow users to initiate one-time, unscheduled transactions on demand, providing flexibility for irregular or spontaneous fund movements.

Manual Transfer Request

Manual Transfer Requests enable users to initiate one-time, ad hoc transfers outside of Standing Instructions, which are pre-scheduled and recurring transactions ensuring regular payments or fund movements without repeated manual intervention. Choosing between a Manual Transfer Request and a Standing Instruction depends on the need for flexibility versus automated consistency in managing financial transfers.

Pre-authorized Debit

Pre-authorized Debit (PAD) enables automatic payments from a payer's bank account based on standing instructions, ensuring recurring bills are paid on schedule without manual intervention. In contrast, ad hoc transfers require payer authorization each time funds are moved, offering flexibility but less convenience compared to PAD's automated process.

On-demand Remittance

On-demand remittance offers flexibility by enabling users to execute ad hoc transfers instantly, while standing instructions automate recurring payments for regular transactions. Choosing between standing instruction and ad hoc transfer depends on whether the remittance requires predictable, scheduled disbursements or spontaneous, one-time fund transfers.

Fixed Interval Payment

Fixed interval payment involves scheduled transactions occurring at regular periods, typically managed through standing instructions to automate consistent fund transfers. Unlike ad hoc transfers, which are one-time and manually initiated, standing instructions ensure timely payments without user intervention, optimizing cash flow management and reducing payment delays.

Instantaneous Transfer

Instantaneous Transfer enables real-time fund movement between accounts, contrasting with Standing Instructions which automate recurring transfers on a preset schedule and Ad Hoc Transfers triggered manually for one-time payments. This technology enhances liquidity management by providing immediate fund accessibility, crucial for time-sensitive transactions compared to periodic or one-off transfers.

Payment Mandate

Payment mandates authorize recurring transactions under standing instructions, enabling automated and consistent fund transfers without repeated approvals. Ad hoc transfers require individual authorization for each transaction, offering flexibility but lacking the efficiency and predictability of standing instructions.

Standing Instruction vs Ad Hoc Transfer Infographic

moneydif.com

moneydif.com