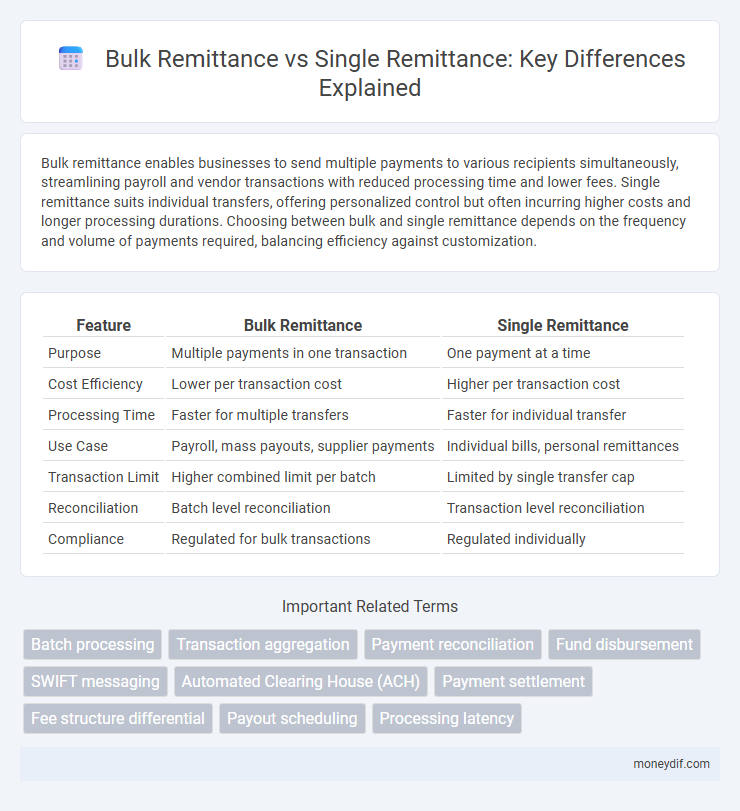

Bulk remittance enables businesses to send multiple payments to various recipients simultaneously, streamlining payroll and vendor transactions with reduced processing time and lower fees. Single remittance suits individual transfers, offering personalized control but often incurring higher costs and longer processing durations. Choosing between bulk and single remittance depends on the frequency and volume of payments required, balancing efficiency against customization.

Table of Comparison

| Feature | Bulk Remittance | Single Remittance |

|---|---|---|

| Purpose | Multiple payments in one transaction | One payment at a time |

| Cost Efficiency | Lower per transaction cost | Higher per transaction cost |

| Processing Time | Faster for multiple transfers | Faster for individual transfer |

| Use Case | Payroll, mass payouts, supplier payments | Individual bills, personal remittances |

| Transaction Limit | Higher combined limit per batch | Limited by single transfer cap |

| Reconciliation | Batch level reconciliation | Transaction level reconciliation |

| Compliance | Regulated for bulk transactions | Regulated individually |

Introduction to Bulk and Single Remittances

Bulk remittance involves transferring large sums of money to multiple recipients simultaneously, streamlining payroll, vendor payments, or social benefit distributions. Single remittance refers to the process of sending money to an individual recipient, typically used for personal transfers, bill payments, or specific single transactions. Choosing between bulk and single remittances depends on transaction volume, speed, and operational efficiency requirements.

Key Differences Between Bulk and Single Remittance

Bulk remittance involves transferring large sums of money to multiple recipients in one transaction, optimizing efficiency for payroll, vendor payments, or mass payouts, while single remittance processes payments to individual beneficiaries. Bulk remittance reduces transaction fees and processing time, leveraging automated systems and batch processing, whereas single remittance typically incurs higher costs and requires separate transaction handling. The choice between bulk and single remittance depends on the payer's volume, frequency, and operational needs, impacting overall financial management and cash flow.

Benefits of Bulk Remittance Solutions

Bulk remittance solutions streamline the process of transferring multiple payments simultaneously, significantly reducing transaction costs and processing time compared to single remittance methods. These solutions enhance operational efficiency for businesses by enabling automated payment scheduling and unified tracking across numerous recipients. Moreover, bulk remittances improve accuracy by minimizing manual errors and offer better compliance management through consolidated reporting and audit trails.

Situations Ideal for Single Remittance

Single remittance is ideal for individual transactions such as paying a single supplier invoice or sending money to a family member abroad. This method offers simplicity and speed, minimizing processing time and reducing administrative overhead compared to bulk remittance. It is especially beneficial in scenarios requiring immediate payment confirmation or when transaction amounts vary significantly.

Cost Comparison: Bulk vs Single Remittance

Bulk remittance typically offers lower per-transaction fees compared to single remittance, making it more cost-effective for businesses sending multiple payments simultaneously. Single remittance involves higher fees and administrative costs due to individual processing, which can accumulate significantly over time. Businesses optimize their remittance strategy by choosing bulk transfers to reduce overall expenses and improve transaction efficiency.

Security Considerations in Bulk and Single Transfers

Bulk remittance transactions often require enhanced security protocols such as multi-factor authentication and encryption to safeguard large volumes of funds transferred simultaneously. Single remittances, while involving smaller amounts, still demand secure transfer methods like tokenization and real-time fraud detection to prevent unauthorized access. Financial institutions prioritize compliance with anti-money laundering (AML) regulations and employ secure channels to minimize risks in both bulk and single remittance transfers.

Process Efficiency: Bulk Remittance vs Single Remittance

Bulk remittance streamlines the transfer of multiple payments in a single transaction, significantly reducing processing time and administrative overhead compared to handling each payment individually in single remittance. Financial institutions often utilize automated systems for bulk remittance, enhancing accuracy and minimizing manual errors. This collective approach optimizes resource allocation and accelerates fund settlement, making bulk remittance a more efficient option for businesses handling high transaction volumes.

Technology Requirements for Bulk Remittance

Bulk remittance requires advanced payment processing technologies capable of handling high transaction volumes simultaneously, ensuring efficiency and accuracy across multiple beneficiaries. Key technology components include automated data validation systems, batch processing software, and integration with banking APIs to streamline fund transfers and reconciliation. Robust security protocols and compliance tools are essential to protect sensitive data and meet regulatory standards in bulk payment operations.

Regulatory Compliance for Different Remittance Types

Bulk remittance transactions typically require enhanced regulatory compliance measures, including thorough client verification and detailed transaction reporting, to prevent money laundering and ensure adherence to financial regulations. Single remittance payments often involve simplified due diligence, but still must comply with anti-money laundering (AML) and know-your-customer (KYC) requirements specific to the jurisdiction. Financial institutions must tailor compliance frameworks to address the distinct risks and regulatory obligations associated with both bulk and single remittance types.

Choosing the Right Remittance Option for Your Needs

Bulk remittance offers cost-efficiency and streamlined processing for businesses sending multiple payments simultaneously, while single remittance suits individuals or small transactions requiring quick, one-off transfers. Assess factors like transaction volume, transfer frequency, and processing time to determine the optimal solution. Selecting the right remittance option maximizes convenience, reduces fees, and ensures timely delivery based on your unique sending requirements.

Important Terms

Batch processing

Batch processing enhances efficiency by handling bulk remittances simultaneously, reducing processing time and transaction costs compared to single remittance handling.

Transaction aggregation

Transaction aggregation combines multiple individual payments into a single bulk remittance, reducing processing costs and improving reconciliation efficiency for financial institutions. Bulk remittance streamlines transaction management and lowers operational risk compared to processing numerous single remittance payments separately.

Payment reconciliation

Payment reconciliation streamlines the matching of bulk remittance transactions by consolidating multiple payments into a single entry, reducing errors and processing time compared to single remittance reconciliation.

Fund disbursement

Fund disbursement through bulk remittance significantly reduces transaction costs and processing time compared to single remittance, enhancing efficiency for large-scale payments.

SWIFT messaging

SWIFT messaging supports bulk remittance by enabling the transmission of multiple payment instructions in a single message format (MT103+) compared to single remittance, which involves sending individual payment instructions separately.

Automated Clearing House (ACH)

Automated Clearing House (ACH) enables efficient bulk remittance processing by consolidating multiple payments into a single transaction, reducing costs and processing time compared to individual single remittance payments.

Payment settlement

Bulk remittance streamlines payment settlement by consolidating multiple transactions into a single payment, reducing processing costs and improving reconciliation efficiency compared to single remittance methods.

Fee structure differential

Bulk remittance transactions typically incur lower per-unit fees compared to single remittance payments due to economies of scale and reduced processing costs.

Payout scheduling

Payout scheduling for bulk remittance optimizes transaction efficiency and reduces processing costs by aggregating multiple payments into a single disbursement cycle, enhancing cash flow management for businesses. In contrast, single remittance offers flexibility and immediacy for individual payments but may increase operational overhead and processing fees when managing large volumes.

Processing latency

Processing latency is typically higher in bulk remittance compared to single remittance due to the aggregation and validation of multiple transactions before execution.

bulk remittance vs single remittance Infographic

moneydif.com

moneydif.com