Money Transfer Operators (MTOs) specialize in fast, cross-border remittance services, offering convenient, low-cost transactions primarily for migrant workers sending money home. Microfinance Institutions (MFIs) provide remittance services alongside financial products like savings, credit, and insurance, targeting underserved populations to promote financial inclusion. While MTOs focus on efficient money transfer, MFIs integrate remittance into broader financial empowerment strategies.

Table of Comparison

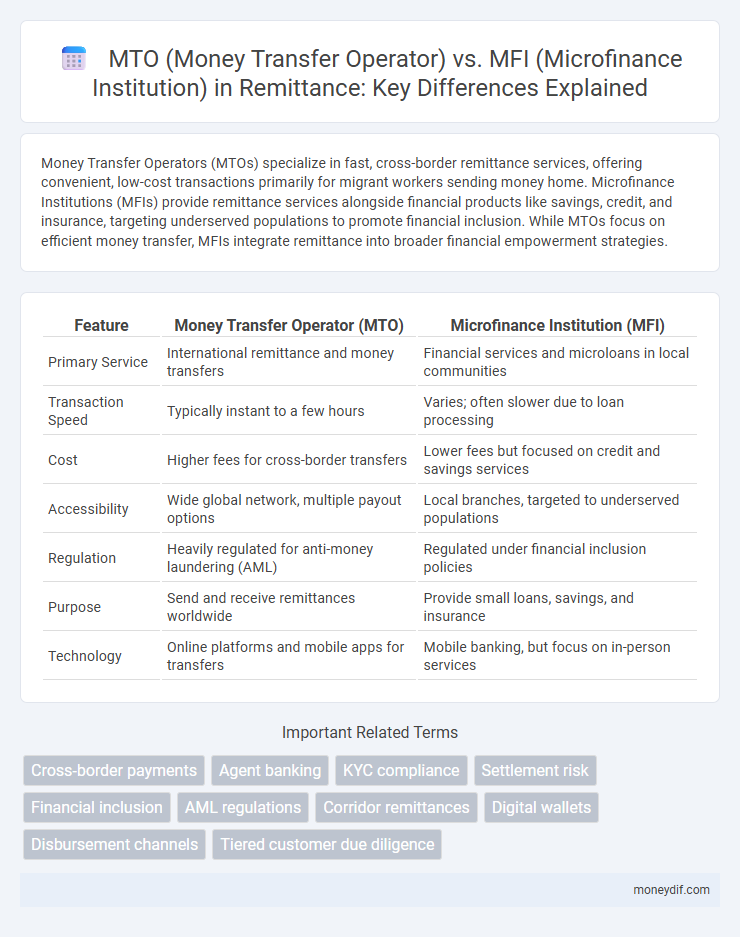

| Feature | Money Transfer Operator (MTO) | Microfinance Institution (MFI) |

|---|---|---|

| Primary Service | International remittance and money transfers | Financial services and microloans in local communities |

| Transaction Speed | Typically instant to a few hours | Varies; often slower due to loan processing |

| Cost | Higher fees for cross-border transfers | Lower fees but focused on credit and savings services |

| Accessibility | Wide global network, multiple payout options | Local branches, targeted to underserved populations |

| Regulation | Heavily regulated for anti-money laundering (AML) | Regulated under financial inclusion policies |

| Purpose | Send and receive remittances worldwide | Provide small loans, savings, and insurance |

| Technology | Online platforms and mobile apps for transfers | Mobile banking, but focus on in-person services |

Introduction to MTOs and MFIs in Remittance Services

Money Transfer Operators (MTOs) specialize in fast, cross-border remittance services, leveraging extensive global agent networks and digital platforms to facilitate instant money transfers. Microfinance Institutions (MFIs) primarily focus on providing financial services to underserved populations, integrating remittance services to enhance financial inclusion and support economic empowerment. Both entities play crucial roles in remittance ecosystems, with MTOs emphasizing speed and reach, while MFIs prioritize accessibility and community development.

Core Functions: How MTOs and MFIs Operate

Money Transfer Operators (MTOs) specialize in fast, cross-border remittance services by facilitating secure and efficient money transfers through digital platforms and agent networks. Microfinance Institutions (MFIs) primarily focus on providing small loans, savings, and financial services to low-income individuals, often integrating remittance services to support financial inclusion in underserved communities. While MTOs emphasize transaction speed and global reach, MFIs concentrate on long-term financial empowerment through credit and savings products.

Regulatory Frameworks: Compliance and Oversight

Money Transfer Operators (MTOs) operate under stringent regulatory frameworks focused on anti-money laundering (AML) and combating the financing of terrorism (CFT), often requiring licensing, transaction monitoring, and customer due diligence in multiple jurisdictions. Microfinance Institutions (MFIs) face regulatory oversight primarily aimed at financial inclusion, with compliance requirements centered on consumer protection and prudential norms but typically less intense AML/CFT scrutiny compared to MTOs. Both MTOs and MFIs must navigate complex local and international regulations, but MTOs encounter more rigorous compliance standards due to the cross-border nature of remittance flows.

Target Customers: Demographics and Market Reach

Money Transfer Operators (MTOs) primarily target a diverse global customer base, including migrant workers and expatriates requiring fast, cross-border remittances, often focusing on urban and international corridors. Microfinance Institutions (MFIs) concentrate on underserved low-income populations in rural and semi-urban areas, providing financial services like small loans alongside localized remittance options. MTOs excel in broad market reach and volume across countries, while MFIs emphasize community-driven access and financial inclusion within specific demographic segments.

Service Offerings: Comparing Product Portfolios

Money Transfer Operators (MTOs) primarily offer services focused on cross-border remittances, enabling fast and secure international funds transfers often paired with cash pickup and mobile wallet options. Microfinance Institutions (MFIs) provide a broader range of financial products including microloans, savings accounts, and insurance, with remittance services integrated to support clients' financial inclusion and economic empowerment. Both entities overlap in remittance facilitation, but MFIs emphasize holistic financial services while MTOs specialize in efficient and accessible money transfers.

Fees and Transaction Costs: A Comparative Analysis

Money Transfer Operators (MTOs) typically charge higher fees and transaction costs compared to Microfinance Institutions (MFIs) due to their extensive global networks and faster service delivery. MFIs often offer lower fees and more affordable transaction costs as part of their financial inclusion mission targeting underserved populations. Cost efficiency in remittance through MFIs can significantly benefit low-income recipients by maximizing received funds.

Speed and Accessibility of Remittance Transfers

Money Transfer Operators (MTOs) provide faster remittance transfers, often enabling instant or same-day delivery across multiple corridors, leveraging extensive digital platforms and global agent networks. Microfinance Institutions (MFIs) typically offer slower transfer speeds due to limited infrastructure and reliance on local banking partners but improve accessibility by operating in rural and underserved areas. The trade-off between MTOs' speed and MFIs' local accessibility shapes the choice of remittance channel for end-users in diverse economic regions.

Technology Integration: Digital Solutions in MTOs vs MFIs

Money Transfer Operators (MTOs) lead in deploying advanced digital solutions, utilizing mobile apps, real-time transaction tracking, and blockchain for secure, instant remittances. Microfinance Institutions (MFIs) integrate digital tools primarily to enhance client data management and facilitate microloans, with slower adoption of real-time transfer technologies. The technology gap affects speed, accessibility, and cost-effectiveness, positioning MTOs as more efficient digital remittance facilitators compared to MFIs.

Financial Inclusion: Impact on Underserved Communities

Money Transfer Operators (MTOs) provide rapid, accessible remittance services crucial for underserved communities lacking traditional banking facilities, enabling seamless cross-border money transfers. Microfinance Institutions (MFIs) complement this by offering tailored financial products, including small loans and savings accounts, fostering economic empowerment and financial inclusion at the grassroots level. Together, MTOs and MFIs drive financial inclusion by bridging the service gaps for low-income populations, promoting economic resilience and reducing poverty in marginalized regions.

Future Trends: Evolution of MTOs and MFIs in Remittances

The future of remittances sees Money Transfer Operators (MTOs) integrating advanced digital platforms and blockchain technology to enhance cross-border transaction speed and security. Microfinance Institutions (MFIs) are expanding their role by offering tailored financial products alongside remittance services, fostering financial inclusion in underserved communities. The convergence of MTOs and MFIs through strategic partnerships will drive innovation, blending efficient money transfer capabilities with localized financial empowerment solutions.

Important Terms

Cross-border payments

Cross-border payments facilitated by Money Transfer Operators (MTOs) offer rapid, low-cost remittances mainly for personal transfers, leveraging extensive agent networks and digital platforms to enhance accessibility. Microfinance Institutions (MFIs) integrate cross-border payments within broader financial services aimed at underserved populations, focusing on financial inclusion through small loans and savings products alongside remittance capabilities.

Agent banking

Agent banking leverages Money Transfer Operators (MTOs) to facilitate fast, secure cross-border remittances, while Microfinance Institutions (MFIs) focus on providing localized credit and savings services to underserved populations. MTOs excel in transactional efficiency and regulatory compliance for international money transfers, whereas MFIs prioritize financial inclusion by offering microloans and financial literacy within communities.

KYC compliance

KYC compliance for Money Transfer Operators (MTOs) focuses on verifying sender and receiver identities to prevent money laundering and fraud in cross-border transactions, leveraging digital ID verification and enhanced due diligence. Microfinance Institutions (MFIs) emphasize customer profiling and risk assessment to ensure financial inclusion while adhering to KYC norms, often adapting criteria for low-income or informal clients.

Settlement risk

Settlement risk in Money Transfer Operators (MTOs) primarily arises from cross-border currency fluctuations and delays in correspondent banking networks, increasing the chance of incomplete or failed transactions. Microfinance Institutions (MFIs) face settlement risk mainly due to limited liquidity and reliance on local clearing systems, which can delay fund availability and impact borrower repayment cycles.

Financial inclusion

Financial inclusion through Money Transfer Operators (MTOs) enhances access to quick, low-cost cross-border remittances, boosting liquidity for underserved populations, while Microfinance Institutions (MFIs) provide essential credit and savings products tailored to micro-entrepreneurs and low-income individuals. Combining MTOs' efficient payment networks with MFIs' financial services promotes comprehensive inclusion, facilitating economic empowerment and poverty reduction in marginalized communities.

AML regulations

AML regulations impose stringent customer due diligence and transaction monitoring requirements on Money Transfer Operators (MTOs) to prevent money laundering through high-frequency international remittances, while Microfinance Institutions (MFIs) face tailored AML obligations focused on localized lending activities and financial inclusion. Both entities must comply with Know Your Customer (KYC) protocols, suspicious activity reporting, and regulatory audits but differ in risk assessment frameworks due to their distinct operational scopes and clientele profiles.

Corridor remittances

Corridor remittances often involve Money Transfer Operators (MTOs) facilitating fast, cross-border money transfers, while Microfinance Institutions (MFIs) typically integrate remittance services with financial inclusion programs targeting underserved populations. MTOs prioritize speed and accessibility in urban and international corridors, whereas MFIs focus on leveraging remittance inflows to enhance local savings, credit, and economic development in rural or low-income areas.

Digital wallets

Digital wallets enhance the efficiency of Money Transfer Operators (MTOs) by facilitating real-time remittances and reducing transaction costs, while Microfinance Institutions (MFIs) leverage these wallets to expand financial inclusion by providing borrowers easier access to credit and savings products. Integration of digital wallets within MTOs and MFIs streamlines cross-border payments and supports collateral-free lending models, driving growth in underserved markets.

Disbursement channels

Disbursement channels for Money Transfer Operators (MTOs) primarily focus on real-time, cross-border fund transfers using agent networks, mobile wallets, or bank accounts to ensure rapid liquidity delivery. Microfinance Institutions (MFIs) emphasize localized, offline and digital disbursement through field agents, bank partnerships, or mobile banking to support small loans and financial inclusion in underserved communities.

Tiered customer due diligence

Tiered customer due diligence (CDD) frameworks for Money Transfer Operators (MTOs) often apply risk-based thresholds aligned with transaction volumes and amounts, enabling streamlined verification for low-risk customers while enforcing stricter checks on higher tiers. Microfinance Institutions (MFIs) adopt similar tiered approaches but emphasize ongoing monitoring and customer profiling tailored to small-scale lending risks, integrating financial inclusion goals with regulatory compliance.

MTO (Money Transfer Operator) vs MFI (Microfinance Institution) Infographic

moneydif.com

moneydif.com