White label remittance solutions offer businesses a ready-made platform branded under their name, enabling quick market entry without developing technology from scratch. Proprietary remittance systems provide full control over features, security, and user experience but require significant investment in development and maintenance. Choosing between white label and proprietary remittance depends on the company's priorities for customization, speed to market, and resource allocation.

Table of Comparison

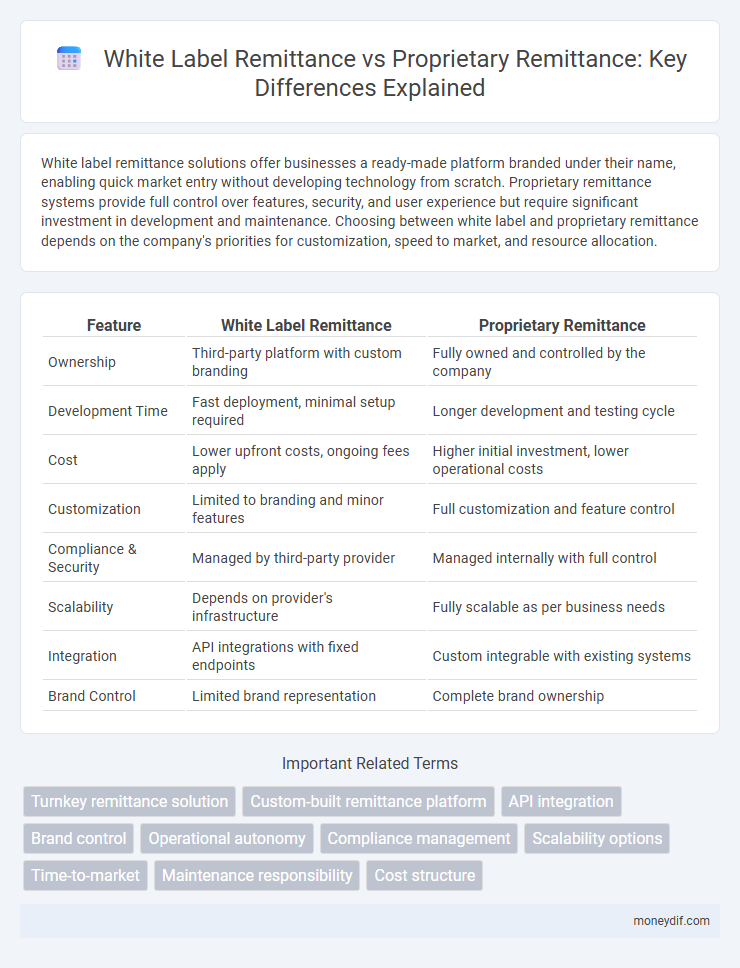

| Feature | White Label Remittance | Proprietary Remittance |

|---|---|---|

| Ownership | Third-party platform with custom branding | Fully owned and controlled by the company |

| Development Time | Fast deployment, minimal setup required | Longer development and testing cycle |

| Cost | Lower upfront costs, ongoing fees apply | Higher initial investment, lower operational costs |

| Customization | Limited to branding and minor features | Full customization and feature control |

| Compliance & Security | Managed by third-party provider | Managed internally with full control |

| Scalability | Depends on provider's infrastructure | Fully scalable as per business needs |

| Integration | API integrations with fixed endpoints | Custom integrable with existing systems |

| Brand Control | Limited brand representation | Complete brand ownership |

White Label Remittance vs Proprietary Remittance: A Comparative Overview

White label remittance solutions offer businesses customizable platforms to facilitate international money transfers without owning the underlying infrastructure, enabling faster market entry and reduced operational costs. Proprietary remittance systems, on the other hand, require significant investment in technology development and compliance, providing full control over transaction processes and customer experience. Choosing between white label and proprietary remittance depends on priorities such as scalability, control, cost-efficiency, and speed-to-market in the global remittance industry.

Key Differences Between White Label and Proprietary Remittance Solutions

White label remittance solutions offer customizable platforms developed by third parties, enabling businesses to quickly deploy without building technology from scratch, while proprietary remittance systems are internally developed, providing full control over features and data. White label platforms typically reduce time-to-market and initial investment costs but may limit differentiation, whereas proprietary solutions demand higher upfront resources but allow tailored innovation and enhanced security. Transaction scalability and compliance management also vary, with proprietary remittance systems often offering more robust governance aligned with company-specific policies.

Cost Implications of White Label vs Proprietary Remittance

White label remittance solutions often lower operational costs by leveraging existing infrastructure and technology, reducing the need for significant capital investment in development and maintenance. Proprietary remittance systems require substantial upfront expenses for platform creation, ongoing updates, and compliance management, which can drive higher total cost of ownership. Businesses choosing white label options benefit from predictable pricing models and faster deployment, while proprietary solutions may incur variable costs linked to customization and scalability.

Branding and Customization in Remittance Platforms

White label remittance platforms offer extensive branding flexibility, allowing businesses to customize logos, color schemes, and user interfaces to align with their corporate identity, enhancing customer trust and loyalty. In contrast, proprietary remittance solutions typically provide limited customization options, restricting brand differentiation and user experience personalization. Businesses prioritizing unique brand presence often prefer white label solutions to create a seamless and consistent remittance service that resonates with their target audience.

Time to Market: White Label vs Proprietary Remittance Systems

White label remittance systems offer significantly faster time to market, leveraging pre-built platforms that reduce development and regulatory approval timelines to weeks or months. Proprietary remittance solutions require extensive customization, rigorous compliance checks, and infrastructure development, extending time to market by several months or even years. Businesses prioritizing rapid deployment and market agility benefit from the streamlined integration and scalability of white label services compared to the longer launch cycles of proprietary systems.

Security Features: Evaluating White Label and Proprietary Approaches

White label remittance solutions often rely on third-party security protocols, which can introduce vulnerabilities if not rigorously vetted, whereas proprietary remittance systems allow for customized security features tailored to specific compliance and fraud prevention needs. Proprietary platforms tend to offer enhanced encryption methods, real-time fraud detection, and greater control over data privacy, reducing the risk of breaches. White label services may expedite market entry but require diligent ongoing security assessments to match the robustness of proprietary implementations.

Scalability and Flexibility: Which Remittance Model Wins?

White label remittance solutions offer greater scalability by leveraging established infrastructure, enabling rapid expansion into new markets with minimal upfront investment. Proprietary remittance models provide higher flexibility through full control over technology and customization, but scaling often requires significant resources and time. For businesses prioritizing fast market entry and expansion, white label models excel, while those seeking tailored features and long-term control benefit from proprietary systems.

Regulatory Compliance: White Label vs Proprietary Remittance Solutions

White label remittance solutions often provide built-in regulatory compliance frameworks, leveraging their parent company's licenses and adherence to international financial regulations, reducing the burden on smaller businesses. Proprietary remittance systems require extensive investment to obtain and maintain necessary licenses, ensuring direct control over compliance policies but increasing operational complexity and regulatory risk. Ensuring robust Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols is critical in both models to meet jurisdictional regulatory standards and avoid penalties.

Customer Experience: Impact of Platform Choice on Remittance Services

White label remittance platforms offer a standardized customer experience with quicker deployment and cost efficiency, enabling remittance providers to rapidly scale services while maintaining reliable transaction processing. Proprietary remittance platforms deliver customized interfaces and tailored user journeys that enhance customer engagement and loyalty by addressing specific needs and incorporating unique value-added features. The choice between white label and proprietary options directly influences service personalization, operational flexibility, and overall satisfaction in cross-border money transfer experiences.

Choosing the Right Remittance Model: Factors to Consider

When choosing between white label remittance and proprietary remittance models, factors such as cost efficiency, brand control, customization capabilities, and regulatory compliance play critical roles. White label solutions offer faster market entry and lower upfront investment by leveraging existing platforms, whereas proprietary models provide full customization and control but require significant development resources and ongoing maintenance. Assessing the target market's scale, desired user experience, and long-term business goals is essential to determine the most suitable remittance strategy.

Important Terms

Turnkey remittance solution

Turnkey remittance solutions offer fully developed platforms enabling businesses to launch money transfer services rapidly, contrasting with proprietary remittance systems that require significant in-house development. White label remittance solutions provide branding customization and faster time-to-market, while proprietary platforms grant greater control and flexibility over features and compliance.

Custom-built remittance platform

Custom-built remittance platforms offer full control, scalability, and tailored features, contrasting with white label remittance solutions that provide ready-made, branded services with faster deployment but limited customization. Proprietary remittance systems are designed and owned internally, ensuring data security and unique capabilities, whereas white label platforms rely on third-party infrastructure, impacting flexibility and competitive differentiation.

API integration

API integration streamlines white label remittance by enabling seamless third-party customization and branding, enhancing flexibility without the need for building proprietary infrastructure. Proprietary remittance systems rely on APIs for core functionalities but typically involve more rigid, in-house development, limiting scalability compared to white label solutions.

Brand control

Brand control in white label remittance allows businesses to leverage established remittance platforms while customizing branding elements, enhancing customer trust without managing the underlying technology. Proprietary remittance offers complete autonomy over user experience and compliance, enabling firms to tailor services extensively but requiring significant investment in development and regulatory management.

Operational autonomy

Operational autonomy in white label remittance enables third-party providers to customize and control transaction processes without direct oversight from the primary brand, contrasting with proprietary remittance systems that maintain centralized management and restricted flexibility. This autonomy allows white label services to quickly adapt to local market demands, streamline compliance, and enhance user experience while leveraging established technological infrastructures.

Compliance management

Compliance management in white label remittance requires rigorous oversight to ensure third-party providers adhere to regulatory standards, mitigating risks associated with anti-money laundering (AML) and know your customer (KYC) protocols. Proprietary remittance systems enable direct control over compliance processes, allowing for tailored risk management frameworks and real-time monitoring to meet jurisdiction-specific legal requirements.

Scalability options

White label remittance platforms offer extensive scalability through customizable APIs and modular integrations, enabling rapid expansion across multiple markets without heavy infrastructure investments. Proprietary remittance systems require significant development resources to scale, often limiting flexibility and increasing time-to-market compared to white label solutions.

Time-to-market

White label remittance solutions significantly reduce time-to-market by leveraging pre-built, scalable infrastructures, enabling businesses to quickly offer cross-border payment services without extensive development cycles. In contrast, proprietary remittance systems require longer development and integration periods due to customization and compliance complexities inherent in building from scratch.

Maintenance responsibility

Maintenance responsibility for white label remittance systems typically falls on the third-party provider, ensuring software updates, compliance, and infrastructure management, while proprietary remittance platforms require the originating company to handle all technical support, system upgrades, and regulatory adherence internally. This division impacts operational control, cost structure, and the speed of implementing new features or compliance changes.

Cost structure

White label remittance typically involves lower upfront costs due to leveraging existing platforms and reduced development expenses, while proprietary remittance demands significant investment in technology infrastructure, compliance, and ongoing maintenance. Operating costs for white label solutions often include licensing and transaction fees, contrasting with proprietary models where expenses focus on system optimization, customer acquisition, and regulatory adherence.

white label remittance vs proprietary remittance Infographic

moneydif.com

moneydif.com