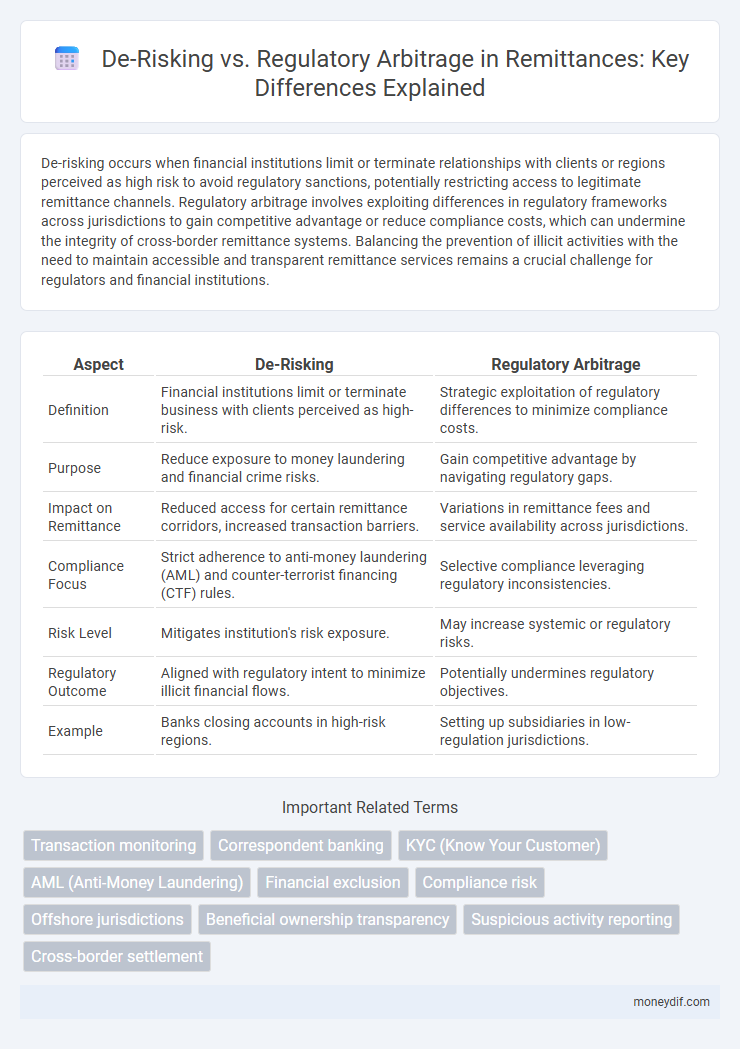

De-risking occurs when financial institutions limit or terminate relationships with clients or regions perceived as high risk to avoid regulatory sanctions, potentially restricting access to legitimate remittance channels. Regulatory arbitrage involves exploiting differences in regulatory frameworks across jurisdictions to gain competitive advantage or reduce compliance costs, which can undermine the integrity of cross-border remittance systems. Balancing the prevention of illicit activities with the need to maintain accessible and transparent remittance services remains a crucial challenge for regulators and financial institutions.

Table of Comparison

| Aspect | De-Risking | Regulatory Arbitrage |

|---|---|---|

| Definition | Financial institutions limit or terminate business with clients perceived as high-risk. | Strategic exploitation of regulatory differences to minimize compliance costs. |

| Purpose | Reduce exposure to money laundering and financial crime risks. | Gain competitive advantage by navigating regulatory gaps. |

| Impact on Remittance | Reduced access for certain remittance corridors, increased transaction barriers. | Variations in remittance fees and service availability across jurisdictions. |

| Compliance Focus | Strict adherence to anti-money laundering (AML) and counter-terrorist financing (CTF) rules. | Selective compliance leveraging regulatory inconsistencies. |

| Risk Level | Mitigates institution's risk exposure. | May increase systemic or regulatory risks. |

| Regulatory Outcome | Aligned with regulatory intent to minimize illicit financial flows. | Potentially undermines regulatory objectives. |

| Example | Banks closing accounts in high-risk regions. | Setting up subsidiaries in low-regulation jurisdictions. |

De-risking and Regulatory Arbitrage: Definitions and Differences

De-risking in remittance involves financial institutions limiting or terminating relationships with clients or jurisdictions considered high-risk to comply with anti-money laundering (AML) regulations, which can restrict access to essential financial services for legitimate remitters. Regulatory arbitrage occurs when entities exploit differences in regulatory frameworks across jurisdictions to circumvent stricter controls, often undermining AML efforts and increasing vulnerabilities in the remittance ecosystem. Understanding these concepts is crucial as de-risking prioritizes compliance risk reduction, while regulatory arbitrage seeks to exploit regulatory discrepancies for competitive or financial gain.

The Impact of De-risking on Global Remittance Flows

De-risking significantly disrupts global remittance flows by forcing financial institutions to terminate or restrict correspondent banking relationships with entities in high-risk countries, limiting access to formal remittance channels. This regulatory response, driven by anti-money laundering (AML) and counter-terrorist financing (CTF) measures, reduces available avenues for migrants to send funds home efficiently and securely, often pushing transactions into informal and less traceable networks. The resulting decline in formal remittance volume impairs financial inclusion and economic stability in remittance-dependent developing regions.

Regulatory Arbitrage: Strategies Used in the Remittance Industry

Regulatory arbitrage in the remittance industry involves exploiting differences in international financial regulations to minimize compliance costs and maximize profit margins. Companies often shift operations to jurisdictions with less stringent anti-money laundering (AML) and know-your-customer (KYC) requirements, enabling faster and cheaper cross-border transactions. This strategic relocation increases regulatory complexity and challenges global efforts to combat financial crimes while preserving the cost-effectiveness of remittances.

Drivers Behind De-risking in Remittance Services

The primary drivers behind de-risking in remittance services include stringent anti-money laundering (AML) regulations and the high cost of compliance for financial institutions. Banks often opt to sever relationships with correspondent remittance providers to mitigate risks associated with regulatory penalties and reputational damage. This cautious approach limits access to remittance corridors, disproportionately impacting migrant populations reliant on cross-border money transfers.

How Regulatory Arbitrage Shapes Remittance Market Dynamics

Regulatory arbitrage significantly shapes remittance market dynamics by enabling firms to exploit differences in international financial regulations to reduce compliance costs and hasten fund transfers. This practice encourages innovative cross-border payment solutions but also increases vulnerability to regulatory scrutiny and potential crackdown by authorities aiming to curb money laundering risks. Consequently, remittance providers balance efficient service delivery with navigating complex regulatory landscapes, influencing pricing, service accessibility, and market competition.

Compliance Challenges: Navigating De-risking and Arbitrage

Compliance challenges in remittance revolve around balancing risk management and regulatory arbitrage, with de-risking often leading to exclusion of legitimate clients due to stringent anti-money laundering (AML) policies. Financial institutions face increased scrutiny from regulators enforcing know-your-customer (KYC) and counter-terrorism financing (CTF) measures, complicating correspondent banking relationships. Navigating these compliance complexities requires robust due diligence frameworks and adaptive strategies to mitigate financial crime risks while ensuring continued access to essential remittance services.

The Role of Financial Institutions in De-risking vs Regulatory Arbitrage

Financial institutions play a pivotal role in de-risking by implementing stringent compliance measures to mitigate risks associated with money laundering and terrorism financing in remittance flows. In contrast, regulatory arbitrage occurs when entities exploit differences in financial regulations across jurisdictions to bypass stricter controls, often undermining the integrity of the remittance ecosystem. Effective collaboration between banks, regulators, and remittance service providers is essential to balance risk management and maintain lawful cross-border money transfers.

Policy Implications for Remittance Providers

Policy implications for remittance providers emphasize strengthening compliance frameworks to mitigate de-risking, ensuring continued access to correspondent banking services vital for cross-border money transfers. Regulatory arbitrage poses risks by encouraging providers to exploit less stringent jurisdictions, undermining global anti-money laundering (AML) and counter-terrorist financing (CTF) efforts. Effective policies must balance robust AML/CTF measures with practical safeguards to maintain remittance flows crucial for migrant workers and recipient economies.

Balancing Financial Integrity and Inclusion in Remittance Regulation

Balancing financial integrity and inclusion in remittance regulation requires addressing de-risking practices that limit access to formal channels for vulnerable populations. Regulatory arbitrage occurs when entities exploit inconsistent rules across jurisdictions, creating gaps that undermine both compliance and consumer protection. Effective frameworks must harmonize anti-money laundering standards with inclusive policies to ensure secure, accessible remittance flows without stifling financial participation.

Future Outlook: Mitigating Risks and Promoting Innovation in Remittances

Future outlook in remittances involves balancing de-risking measures to prevent financial crimes with regulatory arbitrage strategies that exploit legal gaps for competitive advantage. Emphasizing advanced compliance technologies, such as artificial intelligence and blockchain, can mitigate risks while enabling more transparent, efficient cross-border transactions. Enhanced global cooperation among financial regulators aims to harmonize standards, fostering innovation without compromising security in the remittance ecosystem.

Important Terms

Transaction monitoring

Transaction monitoring plays a critical role in de-risking by detecting suspicious activities and preventing financial crimes while limiting exposure to high-risk clients. It also helps identify regulatory arbitrage practices, ensuring compliance with evolving legal frameworks and mitigating the risk of penalties.

Correspondent banking

Correspondent banking faces significant challenges as de-risking practices reduce cross-border relationships while regulatory arbitrage exploits discrepancies in compliance standards to bypass strict oversight.

KYC (Know Your Customer)

KYC (Know Your Customer) procedures help financial institutions mitigate risks associated with de-risking while preventing regulatory arbitrage by ensuring comprehensive customer identification and compliance.

AML (Anti-Money Laundering)

AML compliance challenges increase as de-risking strategies reduce financial access for high-risk clients, leading some institutions to exploit regulatory arbitrage across jurisdictions with inconsistent enforcement.

Financial exclusion

Financial exclusion intensifies as de-risking practices reduce access for vulnerable populations while regulatory arbitrage enables institutions to bypass compliance without improving inclusion.

Compliance risk

Compliance risk increases when financial institutions engage in de-risking to avoid regulatory arbitrage, potentially leading to reduced market access for high-risk clients and unintended regulatory scrutiny.

Offshore jurisdictions

Offshore jurisdictions often attract businesses seeking regulatory arbitrage but face increased scrutiny and de-risking measures due to heightened anti-money laundering and compliance enforcement globally.

Beneficial ownership transparency

Beneficial ownership transparency strengthens anti-money laundering efforts by reducing de-risking practices and limiting opportunities for regulatory arbitrage among financial institutions.

Suspicious activity reporting

Suspicious activity reporting (SAR) serves as a crucial mechanism to identify illicit financial behaviors that may arise from de-risking practices, where financial institutions terminate or restrict services to high-risk clients, potentially pushing them toward non-regulated entities. Regulatory arbitrage occurs when firms exploit differences in regulations across jurisdictions to avoid compliance, increasing the challenges for SAR systems to detect and mitigate money laundering and terrorist financing risks effectively.

Cross-border settlement

Cross-border settlement faces challenges as de-risking practices increase compliance costs while regulatory arbitrage exploits differential national regulations to minimize those costs.

de-risking vs regulatory arbitrage Infographic

moneydif.com

moneydif.com