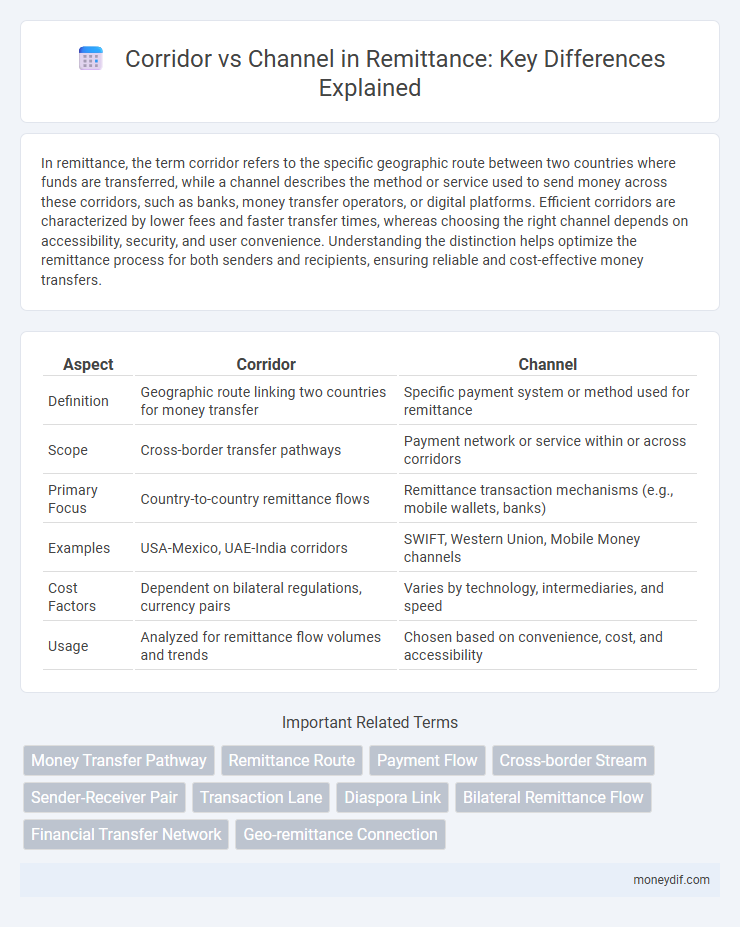

In remittance, the term corridor refers to the specific geographic route between two countries where funds are transferred, while a channel describes the method or service used to send money across these corridors, such as banks, money transfer operators, or digital platforms. Efficient corridors are characterized by lower fees and faster transfer times, whereas choosing the right channel depends on accessibility, security, and user convenience. Understanding the distinction helps optimize the remittance process for both senders and recipients, ensuring reliable and cost-effective money transfers.

Table of Comparison

| Aspect | Corridor | Channel |

|---|---|---|

| Definition | Geographic route linking two countries for money transfer | Specific payment system or method used for remittance |

| Scope | Cross-border transfer pathways | Payment network or service within or across corridors |

| Primary Focus | Country-to-country remittance flows | Remittance transaction mechanisms (e.g., mobile wallets, banks) |

| Examples | USA-Mexico, UAE-India corridors | SWIFT, Western Union, Mobile Money channels |

| Cost Factors | Dependent on bilateral regulations, currency pairs | Varies by technology, intermediaries, and speed |

| Usage | Analyzed for remittance flow volumes and trends | Chosen based on convenience, cost, and accessibility |

Corridor vs Channel: Defining Key Terms in Remittance

A remittance corridor refers to the geographic routes through which money is transferred, typically between two countries or regions with high migrant populations. In contrast, a remittance channel defines the specific method or service used to send money, such as banks, mobile money platforms, or informal networks. Understanding these distinctions helps optimize the transfer process by aligning the right channels with high-volume corridors for efficiency and compliance.

Structural Differences Between Remittance Corridors and Channels

Remittance corridors refer to the specific geographic routes connecting sender and receiver countries, characterized by unique regulatory environments, currency exchange frameworks, and banking infrastructures. Channels denote the various methods through which money is transferred, including banks, mobile money platforms, and informal systems, each differing in speed, cost, and accessibility. Structural differences arise because corridors are defined by cross-border factors influencing transaction feasibility, while channels represent the technological and institutional mechanisms facilitating fund transfers within those corridors.

How Corridors Facilitate Cross-Border Remittance

Corridors play a crucial role in facilitating cross-border remittance by linking specific origin and destination countries, optimizing transfer routes based on regulatory frameworks and currency exchange rates. These corridors ensure efficient fund flow by reducing transaction costs and enhancing speed through established banking partnerships and compliance protocols. By focusing on high-volume remittance flows, corridors improve service accessibility for migrant workers sending money to their home countries.

Remittance Channels: Digital Evolution and Impact

Remittance channels have rapidly evolved with digital innovation, transitioning from traditional corridors dominated by banks and money transfer operators to diverse platforms including mobile wallets, online services, and blockchain-based transfers. This digital transformation enhances speed, reduces costs, and increases accessibility for migrants sending money globally, particularly across high-volume corridors such as the US-Mexico and UAE-India routes. The integration of fintech solutions and regulatory advancements continues to disrupt conventional remittance corridors, fostering greater financial inclusion and economic connectivity.

Regulatory Compliance: Corridor vs Channel Challenges

Regulatory compliance in remittance corridors involves navigating complex cross-border laws and anti-money laundering (AML) requirements that vary by jurisdiction, making it more challenging than managing compliance within single channels confined to one regulatory environment. Corridors require coordinated adherence to multiple countries' financial regulations, including Know Your Customer (KYC) protocols and reporting standards, which increases the risk of non-compliance and operational delays. Channels benefit from streamlined processes and consistent regulatory frameworks, reducing compliance burdens compared to the multilayered oversight demanded in international remittance corridors.

Cost Comparison: Corridor vs Channel Efficiency

Corridor remittance systems typically offer lower transaction fees compared to channel-based transfers due to streamlined cross-border partnerships and reduced intermediaries. Channel efficiency often depends on established networks that can incur higher operational and compliance costs, impacting overall transfer price. Cost comparison reveals corridor methods are more economical for frequent, high-volume transfers, while channels may suit occasional transfers despite higher fees.

Security and Fraud Prevention in Remittance Pathways

Remittance corridors encompass the entire route money takes between countries, requiring robust security measures such as encryption and multi-factor authentication to prevent fraud. Channels refer to specific service providers or platforms within these corridors, leveraging technologies like biometric verification and real-time transaction monitoring to detect and deter fraudulent activities. Ensuring security in both remittance corridors and channels is critical to maintaining the integrity and trustworthiness of cross-border money transfers.

Customer Experience: Corridor Reliability vs Channel Flexibility

Corridor reliability in remittance ensures consistent delivery times and lower transaction failures, enhancing customer confidence and satisfaction. Channel flexibility offers diverse payment options and accessibility, catering to varying customer preferences and improving user convenience. Balancing corridor reliability with channel flexibility maximizes overall customer experience in cross-border money transfers.

Emerging Trends: Shifting from Traditional Corridors to Digital Channels

Emerging trends in remittance highlight a shift from traditional corridors, typically defined by physical routes between migrant-sending and receiving countries, to digital channels powered by fintech innovations and mobile platforms. Digital channels leverage blockchain technology, AI, and mobile wallets to offer faster, more cost-effective, and transparent cross-border money transfers, expanding access to underserved populations in emerging markets. This transition reshapes the remittance landscape by reducing dependency on cash-based corridors and enabling real-time digital transactions across multiple currencies and geographies.

Choosing the Right Path: Factors Influencing Corridor and Channel Selection

Choosing the right remittance corridor hinges on factors such as transaction volume, regulatory frameworks, and cost-efficiency, while channel selection depends on accessibility, user preferences, and technological infrastructure. High-volume corridors often benefit from established banking partnerships and competitive exchange rates, whereas channels must cater to recipient convenience, including mobile wallets, cash pickup, or bank transfers. Regulatory compliance and speed of transfer further influence the optimal combination of corridor and channel for seamless cross-border money transfers.

Important Terms

Money Transfer Pathway

Money transfer pathways define the routes through which remittances flow, with corridors referring to the specific origin-destination pairs between countries, while channels represent the various service providers or platforms facilitating the transfers within those corridors. Optimizing money transfer channels within high-volume corridors enhances efficiency, reduces costs, and improves speed for cross-border transactions.

Remittance Route

A remittance route defines the geographic and institutional path through which funds are transferred between countries, focusing on the corridor linking two specific locations. In contrast, a remittance channel refers to the method or medium--such as banks, money transfer operators, or mobile wallets--used to send money within that corridor, optimizing speed, cost, and accessibility.

Payment Flow

Payment flow efficiency varies significantly between corridor and channel approaches, with corridors focusing on specific geographic routes to streamline cross-border transactions, while channels leverage dedicated payment networks for faster, more secure fund transfers. Corridors often involve multiple intermediaries and regulatory checks, increasing complexity, whereas channels optimize transaction speed and reduce costs through direct connectivity and standardized protocols.

Cross-border Stream

Cross-border streams act as natural corridors facilitating ecological connectivity and water flow between countries, while channels refer to man-made or modified water passages designed for navigation or controlled irrigation. Efficient management of cross-border streams requires understanding their dual role as ecological corridors supporting biodiversity and engineered channels improving transnational water resource distribution.

Sender-Receiver Pair

A sender-receiver pair in communication systems refers to the transmitter and receiver linking through a corridor or channel, where a corridor denotes the physical or logical path facilitating signal propagation, while a channel represents the medium with specific characteristics affecting signal quality and bandwidth. Efficient data transmission depends on optimizing both corridor integrity and channel conditions to minimize noise, interference, and signal attenuation.

Transaction Lane

Transaction Lane refers to a specific path within a Corridor, which is a broader route designed for multiple purposes including transportation or data flow; unlike a Channel that typically denotes a single conduit or communication line, a Transaction Lane is optimized for discrete, high-efficiency exchanges or transactions within the larger Corridor framework. Understanding the distinction between Corridor as a multi-function pathway and Channel as a singular flow mechanism highlights the Transaction Lane's role in facilitating targeted interactions within complex systems.

Diaspora Link

Diaspora Link functions as a strategic corridor facilitating seamless cultural and economic exchanges between migrant communities and their homelands, optimizing connectivity and resource flow. Unlike a channel, which denotes a narrower communication path, a corridor encompasses a broader, multidimensional network enhancing long-term engagement and development.

Bilateral Remittance Flow

Bilateral remittance flow refers to the direct transfer of funds between two countries, typically structured within a specific corridor that defines the geographical and economic link between the sending and receiving nations. Unlike broader remittance channels that may involve multiple intermediaries and pathways, corridors focus on streamlined, cost-effective transactions that optimize regulatory compliance and currency exchange efficiency.

Financial Transfer Network

A Financial Transfer Network (FTN) facilitates the movement of funds across diverse payment systems, where a corridor represents the geographic or economic pathway connecting two regions, while a channel denotes the specific technical medium or protocol enabling the transfer of funds within that corridor. Optimizing corridor efficiency and channel security enhances transaction speed and reduces costs in international remittances and cross-border payments.

Geo-remittance Connection

Geo-remittance connection involves leveraging specific geographic corridors that facilitate efficient cross-border money transfers between countries or regions, optimizing speed and reducing costs. Unlike general payment channels, corridors represent targeted pathways with established financial infrastructure and regulatory frameworks enhancing transactional reliability and customer accessibility.

corridor vs channel Infographic

moneydif.com

moneydif.com