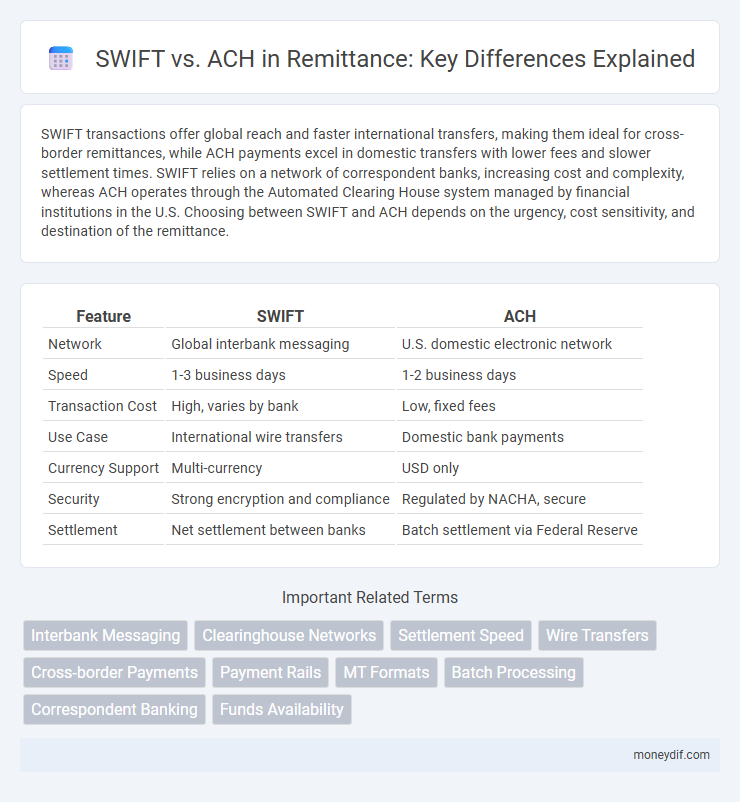

SWIFT transactions offer global reach and faster international transfers, making them ideal for cross-border remittances, while ACH payments excel in domestic transfers with lower fees and slower settlement times. SWIFT relies on a network of correspondent banks, increasing cost and complexity, whereas ACH operates through the Automated Clearing House system managed by financial institutions in the U.S. Choosing between SWIFT and ACH depends on the urgency, cost sensitivity, and destination of the remittance.

Table of Comparison

| Feature | SWIFT | ACH |

|---|---|---|

| Network | Global interbank messaging | U.S. domestic electronic network |

| Speed | 1-3 business days | 1-2 business days |

| Transaction Cost | High, varies by bank | Low, fixed fees |

| Use Case | International wire transfers | Domestic bank payments |

| Currency Support | Multi-currency | USD only |

| Security | Strong encryption and compliance | Regulated by NACHA, secure |

| Settlement | Net settlement between banks | Batch settlement via Federal Reserve |

Overview of SWIFT and ACH in Remittances

SWIFT (Society for Worldwide Interbank Financial Telecommunication) enables secure and standardized international remittance messaging across more than 11,000 financial institutions in over 200 countries, facilitating high-value cross-border payments. ACH (Automated Clearing House) processes electronic fund transfers primarily within domestic banking networks, supporting low-cost, batch-processed transactions for payroll, bill payments, and remittances. While SWIFT offers global reach with fast clearance and robust security protocols, ACH provides a cost-effective solution for high-volume, lower-value domestic transfers with settlement times ranging from same-day to multiple business days.

Key Differences Between SWIFT and ACH Transfers

SWIFT transfers enable international payments by connecting thousands of banks globally using a secure messaging system, supporting multiple currencies and typically processing transactions within 1-5 business days. ACH transfers facilitate domestic electronic payments within the United States, offering lower fees and batch processing but with longer settlement times of 2-3 business days. The key differences lie in geographical reach, processing speed, cost, and transaction purpose, with SWIFT suited for cross-border remittances and ACH optimized for domestic fund transfers.

Speed and Processing Times: SWIFT vs ACH

SWIFT transfers typically process within 1 to 5 business days, facilitating faster international remittances compared to ACH, which generally takes 3 to 5 business days for domestic transactions. ACH payments are often delayed by batch processing schedules and bank cut-off times, whereas SWIFT operates through a network of global banks enabling quicker fund settlement. For urgent cross-border payments, SWIFT remains the preferred method due to its expedited processing times and broader international reach.

Transaction Fees and Costs Comparison

SWIFT transactions typically incur higher fees due to cross-border processing, correspondent bank charges, and currency conversion costs, averaging between $30 to $50 per transfer. ACH payments, commonly used for domestic transfers in the US, offer significantly lower fees, often less than $1 per transaction or bundled in monthly service fees by banks. Businesses seeking cost-effective remittances should weigh SWIFT's global reach against ACH's affordability for local payments.

Geographic Reach: Global vs Domestic Transfers

SWIFT facilitates global remittances by connecting over 11,000 financial institutions across more than 200 countries, enabling seamless international money transfers. ACH networks primarily support domestic transfers within countries, offering cost-effective, batch-processed transactions ideal for local payments like payroll and bill settlements. The geographic reach disparity makes SWIFT the preferred choice for cross-border remittance, while ACH remains efficient for intra-country fund transfers.

Security and Compliance Standards

SWIFT transactions are governed by stringent security protocols such as SWIFT Customer Security Programme (CSP) and ISO 20022 messaging standards, ensuring high levels of encryption and compliance with global regulations like AML and KYC. ACH payments operate under NACHA rules in the U.S., emphasizing data protection and fraud detection, but generally have lower security barriers compared to SWIFT's international framework. Financial institutions prefer SWIFT for cross-border remittances demanding robust compliance and security, while ACH suits domestic transfers with faster settlement but comparatively less stringent security controls.

Currency Handling: Foreign Exchange Capabilities

SWIFT supports a wide range of currencies and enables seamless foreign exchange transactions across international borders, making it ideal for global remittances. ACH primarily processes domestic payments and lacks built-in foreign exchange capabilities, limiting its use for cross-currency transfers. Businesses relying on currency conversion efficiency prefer SWIFT for its robust multi-currency handling and real-time exchange integration.

Use Cases: When to Choose SWIFT or ACH

SWIFT is ideal for international remittances requiring secure, fast, and reliable cross-border transfers between banks globally, especially for large-value or time-sensitive payments. ACH is suited for domestic transactions, recurring payments, and low-cost electronic transfers within a country, providing efficient batch processing for payroll, bill payments, and person-to-person payments. Choosing SWIFT aligns with global reach and speed, while ACH offers cost-effective solutions for high-volume, local financial transactions.

Limitations and Challenges of Each System

SWIFT faces limitations such as higher transaction costs, longer processing times, and dependency on correspondent banks, which can delay cross-border remittances and reduce transparency. ACH systems are constrained by geographic boundaries, slower settlement cycles, and lower prioritization for international transfers, making them less efficient for global payments. Both systems struggle with regulatory compliance complexities and varying banking infrastructures that impact the speed and reliability of remittance services.

Future Trends in Remittance: SWIFT and ACH Evolution

SWIFT continues to evolve with initiatives like SWIFT gpi, enhancing speed and transparency for cross-border payments, while ACH networks are expanding to support real-time payments and increased transaction volumes domestically. Integration of blockchain and AI technologies is anticipated to drive future innovation in both systems, improving security and operational efficiency. The convergence of these advancements will facilitate seamless, cost-effective global and local remittance services, meeting growing demand for faster, transparent transactions.

Important Terms

Interbank Messaging

Interbank messaging systems such as SWIFT and ACH serve distinct financial transfer functions, with SWIFT primarily facilitating cross-border, secure, high-value payment instructions among global banks, while ACH handles bulk, low-value domestic transactions within a country. SWIFT's standardized messaging network supports real-time settlement across international financial institutions, whereas ACH operates on batch processing with longer settlement cycles for domestic clearing and automated payments like payroll and bill payments.

Clearinghouse Networks

Clearinghouse Networks facilitates secure electronic payments primarily through the Automated Clearing House (ACH) system, which processes large volumes of batch transactions within the United States at lower costs and slower speeds compared to SWIFT. SWIFT, by contrast, enables real-time, cross-border financial messaging for international wire transfers, supporting global banks with standardized communication protocols beyond the ACH's domestic network scope.

Settlement Speed

SWIFT transfers typically offer international settlement speeds ranging from 1 to 5 business days, depending on correspondent banks and currency corridors, while ACH transactions generally complete domestic settlements within 1 to 3 business days. The ACH network prioritizes batch processing and lower costs for domestic payments, whereas SWIFT provides a global messaging system for faster cross-border fund settlements.

Wire Transfers

Wire transfers use the SWIFT network for secure, international fund transfers with high speed and global reach, enabling transactions in multiple currencies. ACH transfers operate domestically within the United States, processing large volumes of low-value electronic payments efficiently, often with lower fees but slower settlement times compared to SWIFT.

Cross-border Payments

Cross-border payments often rely on SWIFT for secure, standardized international messaging, enabling financial institutions to exchange transaction information globally with low error rates. ACH (Automated Clearing House) networks primarily support domestic batch payments with limited cross-border capabilities, making SWIFT the preferred choice for complex international fund transfers.

Payment Rails

Payment Rails facilitates global money transfers by integrating both SWIFT and ACH networks, optimizing for speed and cost efficiency. SWIFT offers broad international reach with secure messaging for cross-border payments, while ACH enables fast, low-cost domestic transactions within the U.S. banking system.

MT Formats

MT formats, specifically MT103 messages, are standardized SWIFT payment instructions primarily used for international wire transfers ensuring secure and structured communication between banks. ACH payments, governed by NACHA rules, are typically employed for domestic, batch-processed transactions within the United States, characterized by lower costs and slower settlement compared to the instant and globally recognized SWIFT MT format.

Batch Processing

Batch processing in financial transactions enables efficient handling of large volumes of payments by grouping them into a single batch, optimizing processing speeds and reducing costs. SWIFT is predominantly used for international batch payment messaging with high security standards and extensive network reach, while ACH specializes in domestic batch transactions within the U.S., focusing on lower-cost, automated clearing of debit and credit payments.

Correspondent Banking

Correspondent banking facilitates international transactions by enabling banks to access financial services across borders, often relying on SWIFT for secure messaging and real-time payment processing. ACH systems, typically used for domestic transactions, offer cost-effective batch processing but lack the global reach and standardized communication protocols of SWIFT networks.

Funds Availability

Funds availability for international transfers via SWIFT typically takes 1 to 5 business days due to multiple correspondent banks, while ACH transactions, primarily used for domestic transfers in the United States, usually settle within 1 to 3 business days, offering faster access to funds. SWIFT enables cross-border payments with higher fees and slower processing, whereas ACH provides cost-effective, efficient domestic fund transfers with regulated clearing times.

SWIFT vs ACH Infographic

moneydif.com

moneydif.com