KYC (Know Your Customer) and KYT (Know Your Transaction) are critical compliance processes in remittance services, ensuring the legitimacy of users and their transactions. KYC verifies the identity and background of customers to prevent fraud and money laundering, while KYT continuously monitors transaction patterns for suspicious activities. Effective integration of KYC and KYT enhances risk management and regulatory compliance in the remittance industry.

Table of Comparison

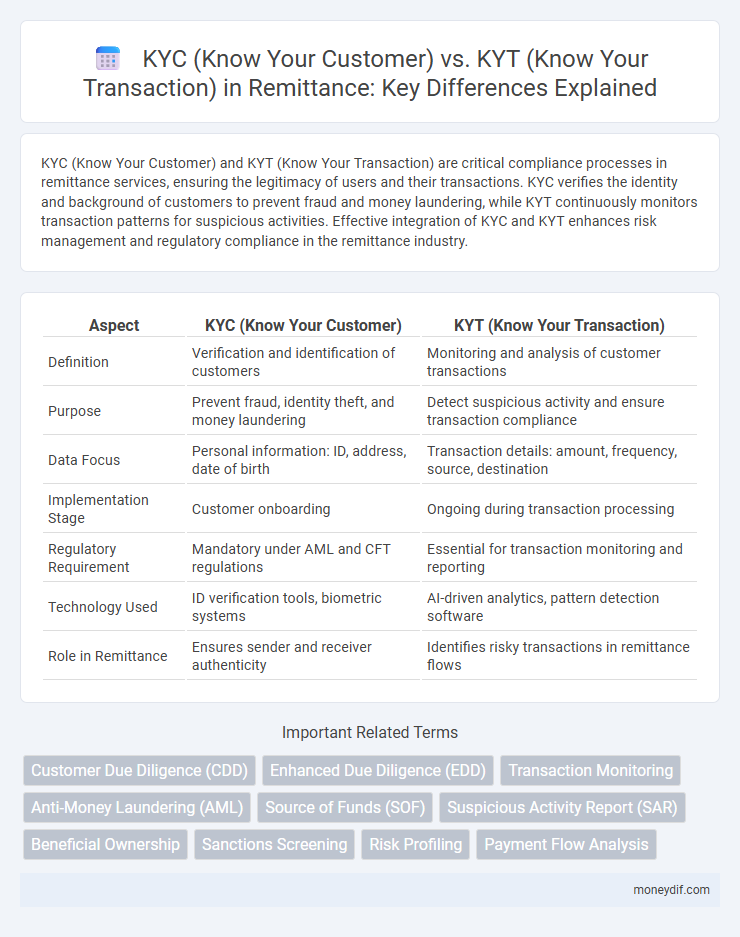

| Aspect | KYC (Know Your Customer) | KYT (Know Your Transaction) |

|---|---|---|

| Definition | Verification and identification of customers | Monitoring and analysis of customer transactions |

| Purpose | Prevent fraud, identity theft, and money laundering | Detect suspicious activity and ensure transaction compliance |

| Data Focus | Personal information: ID, address, date of birth | Transaction details: amount, frequency, source, destination |

| Implementation Stage | Customer onboarding | Ongoing during transaction processing |

| Regulatory Requirement | Mandatory under AML and CFT regulations | Essential for transaction monitoring and reporting |

| Technology Used | ID verification tools, biometric systems | AI-driven analytics, pattern detection software |

| Role in Remittance | Ensures sender and receiver authenticity | Identifies risky transactions in remittance flows |

Understanding KYC and KYT: Key Definitions in Remittance

KYC (Know Your Customer) refers to the process of verifying the identity of remittance customers to prevent fraud and ensure compliance with regulatory standards. KYT (Know Your Transaction) involves monitoring and analyzing transaction patterns to detect suspicious activities and maintain financial transparency. Both KYC and KYT are critical components in remittance services, enhancing security and mitigating risks associated with money laundering and terrorist financing.

The Evolution of Compliance: From KYC to KYT

KYC (Know Your Customer) processes establish customer identity to prevent fraud and money laundering, traditionally serving as the first line of defense in remittance compliance. KYT (Know Your Transaction) enhances this framework by continuously monitoring the transaction patterns and behaviors for suspicious activity, leveraging real-time data analytics and AI. The evolution from KYC to KYT signifies a shift towards dynamic, transaction-focused risk management that improves detection of illicit financial flows in remittances.

KYC vs KYT: Core Differences in Remittance Processes

KYC (Know Your Customer) focuses on verifying the identity of the customer to prevent fraud and comply with regulatory requirements, ensuring the legitimacy of the individual sending or receiving remittances. KYT (Know Your Transaction) concentrates on monitoring the transaction patterns and detecting suspicious activities within the money transfer process to identify potential money laundering or illicit behavior. In remittance processes, KYC establishes customer trustworthiness at the entry point, while KYT provides ongoing transaction-level scrutiny to enhance security and compliance.

Why KYC Alone Isn't Enough for Modern Remittance

KYC (Know Your Customer) verifies the identity of remittance senders but fails to track real-time transaction behavior and detect suspicious patterns, which is essential for preventing fraud and money laundering. KYT (Know Your Transaction) provides ongoing monitoring of transactions, enabling financial institutions to identify unusual activities and ensure compliance with anti-money laundering regulations. Relying solely on KYC leaves gaps in security, making the integration of KYT necessary for comprehensive risk management in modern remittance services.

The Role of KYT in Real-Time Transaction Monitoring

KYT (Know Your Transaction) plays a crucial role in real-time transaction monitoring by analyzing transactional data patterns to detect suspicious activities, such as money laundering or fraud, as they occur. Unlike KYC, which verifies customer identity at onboarding, KYT continuously evaluates transaction behavior to flag anomalies and ensure compliance with AML (Anti-Money Laundering) regulations. Implementing advanced KYT systems enhances the effectiveness of remittance services by providing timely risk assessment and preventing illicit financial flows.

Enhancing Remittance Security: The Synergy of KYC and KYT

KYC (Know Your Customer) verifies the identity of remittance senders to prevent fraud and comply with regulatory requirements, while KYT (Know Your Transaction) monitors transaction patterns in real-time to detect suspicious activities and money laundering attempts. Integrating KYC and KYT creates a robust security framework that enhances the transparency and integrity of cross-border money transfers. This synergy enables financial institutions to mitigate risks effectively and ensure compliance with anti-money laundering (AML) and counter-terrorism financing (CTF) laws.

Regulatory Requirements: KYC and KYT for Global Remittance

Regulatory requirements for global remittance emphasize stringent KYC (Know Your Customer) protocols to verify identities and prevent fraud, while KYT (Know Your Transaction) focuses on monitoring transaction patterns for suspicious activities. Financial institutions must implement KYC procedures to comply with anti-money laundering (AML) directives and ensure customer legitimacy across international borders. KYT systems leverage real-time transaction data analytics, enabling regulators to identify and flag illicit transactions, maintaining compliance with global financial security standards.

Implementing KYC and KYT: Best Practices for Remittance Providers

Implementing KYC and KYT in remittance services ensures enhanced compliance and fraud prevention by verifying customer identities and closely monitoring transactional patterns for suspicious activities. Best practices involve integrating advanced analytics and AI-driven tools to detect anomalies in real-time, combined with continuous updates to customer data and transaction monitoring systems. Remittance providers must maintain a balance between regulatory requirements and customer experience by streamlining verification processes while safeguarding against money laundering and financial crimes.

Technology Innovations in KYC and KYT for Remittance

Technology innovations in KYC and KYT for remittance leverage artificial intelligence, machine learning, and blockchain to enhance identity verification and transaction monitoring accuracy. Advanced biometric authentication and real-time data analytics streamline compliance with regulatory requirements while minimizing fraud risks. Integration of decentralized ledger technology improves transparency and traceability across cross-border remittance transactions, ensuring safer and faster fund transfers.

Future Trends: The Next Generation of KYC and KYT in Remittance

Future trends in remittance prioritize the integration of advanced KYC and KYT technologies powered by AI and blockchain for enhanced security and transparency. Real-time transaction monitoring through KYT systems enables quicker fraud detection, while dynamic KYC processes adapt continuously to evolving customer profiles and regulatory requirements. The convergence of these innovations is set to redefine compliance standards, reduce operational costs, and improve the overall customer experience in cross-border money transfers.

Important Terms

Customer Due Diligence (CDD)

Customer Due Diligence (CDD) involves verifying the identity and assessing the risk profile of clients as a critical component of KYC (Know Your Customer) processes, ensuring compliance with anti-money laundering (AML) regulations. KYT (Know Your Transaction) complements CDD by continuously monitoring and analyzing customer transactions to detect suspicious activities and prevent financial crimes in real time.

Enhanced Due Diligence (EDD)

Enhanced Due Diligence (EDD) in KYC focuses on verifying the identity and risk profile of high-risk customers through comprehensive background checks and ongoing monitoring. KYT (Know Your Transaction) complements EDD by analyzing transaction patterns and identifying suspicious activities to prevent money laundering and financial crime in real-time.

Transaction Monitoring

Transaction Monitoring enhances KYC processes by analyzing customer behavior and flagging suspicious activities indicative of fraud or money laundering, while KYT focuses specifically on scrutinizing individual transactions to detect unusual patterns or compliance breaches. Integrating KYC with KYT enables financial institutions to build comprehensive risk profiles, ensuring regulatory compliance and reducing financial crimes through continuous, real-time analytics.

Anti-Money Laundering (AML)

Anti-Money Laundering (AML) frameworks integrate Know Your Customer (KYC) protocols to verify client identities and prevent fraudulent activities, while Know Your Transaction (KYT) processes analyze transaction patterns to detect suspicious financial behavior. Combining KYC and KYT enhances AML effectiveness by enabling comprehensive monitoring of both customer profiles and transactional data for potential money laundering risks.

Source of Funds (SOF)

Source of Funds (SOF) verification is a critical component in KYC (Know Your Customer) processes, ensuring the legitimacy of the customer's financial background by validating the origin of their money through documents like bank statements, salary slips, or investment proofs. KYT (Know Your Transaction) complements this by monitoring transaction patterns in real time to detect suspicious activity or money laundering, thus providing a dynamic layer of financial security beyond the static identity verification of KYC.

Suspicious Activity Report (SAR)

Suspicious Activity Reports (SAR) play a critical role in anti-money laundering (AML) frameworks, leveraging Know Your Customer (KYC) data to verify client identities while integrating Know Your Transaction (KYT) systems to monitor and analyze transaction patterns for anomalies. The synergy between KYC and KYT enhances the detection of fraudulent activities by correlating customer profiles with transactional behaviors, enabling financial institutions to file timely and accurate SARs in compliance with regulatory standards.

Beneficial Ownership

Beneficial Ownership identifies the individual(s) who ultimately control or benefit from a legal entity or arrangement, playing a crucial role in KYC processes to verify customer identities and prevent financial crimes. KYT focuses on monitoring and analyzing transactional behavior to detect suspicious activities, complementing KYC by ensuring continuous transaction-level scrutiny and risk mitigation.

Sanctions Screening

Sanctions screening plays a crucial role in both KYC (Know Your Customer) and KYT (Know Your Transaction) processes by identifying and blocking transactions linked to sanctioned entities or individuals, thereby preventing financial crimes and regulatory violations. While KYC verifies customer identities against sanctions lists at onboarding, KYT continuously monitors transaction patterns in real-time to detect suspicious activities associated with sanctioned parties or regions.

Risk Profiling

Risk profiling integrates KYC (Know Your Customer) by assessing the identity, background, and behavior of clients to determine the level of risk they pose to financial institutions. KYT (Know Your Transaction) complements this process by monitoring and analyzing the patterns and anomalies in transactions to detect suspicious activities and prevent financial crimes effectively.

Payment Flow Analysis

Payment Flow Analysis integrates KYC (Know Your Customer) and KYT (Know Your Transaction) by verifying customer identities and continuously monitoring transaction patterns to detect suspicious activities. This dual approach enhances compliance with anti-money laundering regulations and improves the accuracy of risk assessment in financial operations.

KYC (Know Your Customer) vs KYT (Know Your Transaction) Infographic

moneydif.com

moneydif.com