Cash pick-up remains a popular remittance option for recipients without access to banking services, providing immediate access to funds at physical locations worldwide. Mobile payout offers enhanced convenience by delivering money directly to the recipient's mobile wallet, enabling faster transactions and easy access via smartphones. Choosing between cash pick-up and mobile payout depends on the recipient's accessibility, technological comfort, and urgency of funds.

Table of Comparison

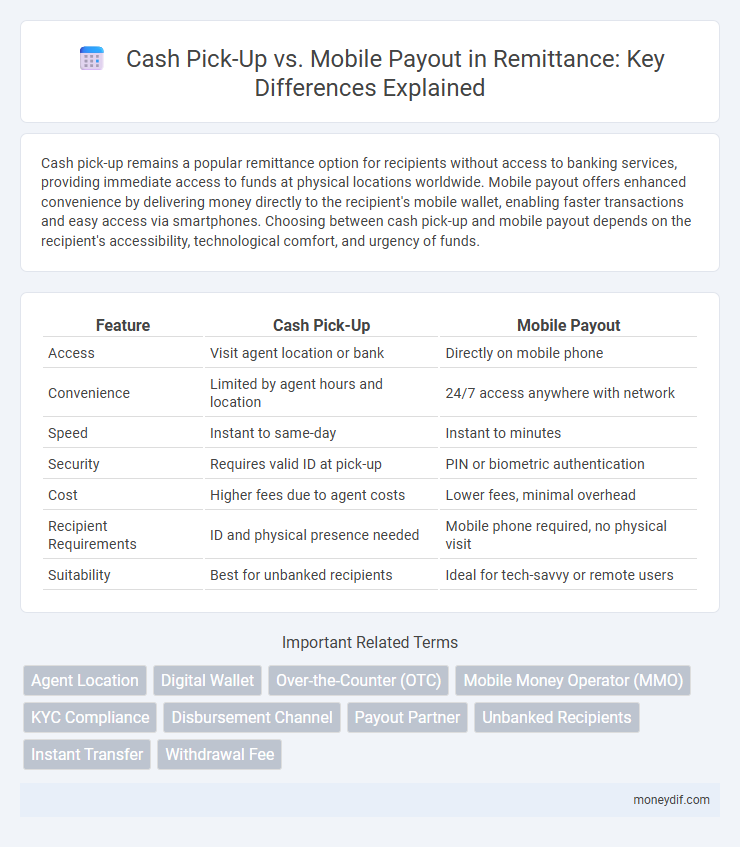

| Feature | Cash Pick-Up | Mobile Payout |

|---|---|---|

| Access | Visit agent location or bank | Directly on mobile phone |

| Convenience | Limited by agent hours and location | 24/7 access anywhere with network |

| Speed | Instant to same-day | Instant to minutes |

| Security | Requires valid ID at pick-up | PIN or biometric authentication |

| Cost | Higher fees due to agent costs | Lower fees, minimal overhead |

| Recipient Requirements | ID and physical presence needed | Mobile phone required, no physical visit |

| Suitability | Best for unbanked recipients | Ideal for tech-savvy or remote users |

Cash Pick-Up vs Mobile Payout: An Overview

Cash pick-up allows recipients to collect remittance funds in cash from physical locations such as agents and banks, offering immediate access without the need for a mobile device. Mobile payout delivers funds directly to the recipient's mobile wallet, enabling quick, contactless transactions and increased convenience for users with smartphone access. The choice between cash pick-up and mobile payout depends on factors like recipient location, technology adoption, and urgency of access to funds.

Accessibility: Which Remittance Method Reaches More Recipients?

Cash pick-up remains highly accessible in regions with limited internet connectivity and underbanked populations, allowing recipients to collect funds from physical locations without needing a smartphone. Mobile payout leverages growing smartphone penetration and provides quicker, direct access to funds, particularly in urban and semi-urban areas where mobile network coverage is robust. Assessing accessibility depends on recipient demographics and local infrastructure, with cash pick-up excelling in rural or low-tech environments while mobile payouts dominate in digitally connected regions.

Speed of Delivery: Cash Pick-Up or Mobile Payout?

Mobile payout offers faster delivery speeds by enabling instant fund transfers directly to the recipient's mobile wallet, often accessible within minutes. Cash pick-up requires recipients to visit physical agent locations, which can introduce delays due to travel time and agent availability. For urgent remittances, mobile payout significantly reduces the waiting period, enhancing convenience and immediate access to funds.

Security Concerns: Physical Collection vs Digital Transfer

Cash pick-up remittances expose recipients to risks such as theft, forgery, and human error during physical collection, requiring secure identification and verification processes. Mobile payouts leverage encrypted digital wallets and biometric authentication, significantly reducing vulnerabilities associated with cash handling and enabling real-time transaction tracking. Regulatory compliance around anti-money laundering (AML) and fraud prevention is more robust in digital transfers, enhancing overall security in cross-border remittance flows.

Cost Comparison: Fees in Cash Pick-Up and Mobile Payout

Cash pick-up services generally involve higher fees due to physical location maintenance and cash handling costs, often ranging from 3% to 7% of the transaction amount. Mobile payout options, leveraging digital wallets and mobile banking, typically charge lower fees, sometimes as low as 1% to 3%, benefiting from reduced operational expenses and faster processing times. Comparing average transaction fees reveals mobile payouts as the more cost-effective option for senders and recipients in the remittance market.

User Experience: Convenience for Senders and Receivers

Cash pick-up offers reliable access to funds without requiring a smartphone, appealing to receivers in areas with limited internet connectivity. Mobile payout streamlines the remittance process by enabling instant transfers directly to users' mobile wallets, enhancing convenience and reducing wait times. Senders benefit from mobile payouts through easy digital tracking and reduced need for physical locations, while cash pick-up provides security and familiarity that many receivers still prefer.

Required Documentation: What Do Users Need?

Cash pick-up requires users to present a valid government-issued ID such as a passport or national ID card, along with a transaction reference number to verify identity at the payout location. Mobile payout typically demands the recipient's registered mobile phone number and may also require PIN verification or biometric authentication depending on the service provider's security protocols. Both methods prioritize strict compliance with anti-money laundering regulations, ensuring that identity verification processes are robust and secure.

Geographic Coverage: Urban and Rural Service Availability

Cash pick-up services provide widespread geographic coverage, especially in urban areas with established agent networks, while also maintaining key rural locations for accessibility. Mobile payouts extend remittance reach to remote rural regions where physical agent presence is limited, leveraging mobile network penetration. This combination of cash pick-up and mobile payouts ensures comprehensive urban and rural service availability for diverse remittance needs.

Impact on Financial Inclusion

Cash pick-up services provide immediate access to funds for recipients without requiring bank accounts, promoting financial inclusion in regions with limited banking infrastructure. Mobile payout solutions leverage widespread mobile phone usage, enabling secure, convenient transactions and expanding access to financial services for unbanked populations. Both methods significantly reduce barriers to entry, but mobile payouts offer enhanced scalability and integration with digital financial ecosystems, accelerating inclusive economic participation.

Future Trends: The Evolution of Remittance Payout Methods

The evolution of remittance payout methods increasingly favors mobile payouts due to their enhanced accessibility, speed, and security compared to traditional cash pick-up options. Mobile wallets and digital payment platforms are projected to dominate future remittance flows, driven by expanding smartphone penetration and financial inclusion initiatives in emerging markets. Technological advancements such as blockchain and biometric authentication further accelerate the shift towards seamless, cashless remittance experiences worldwide.

Important Terms

Agent Location

Agent location plays a crucial role in determining the efficiency of cash pick-up services, as proximity to high-traffic areas or urban centers enhances accessibility and convenience for recipients. In contrast, mobile payout solutions leverage geographic locations with strong mobile network coverage, enabling seamless digital transactions even in remote or underserved regions.

Digital Wallet

Digital wallets enhance financial accessibility by enabling instant mobile payouts, reducing the need for physical cash pick-up locations. Mobile payout services integrated with digital wallets offer secure, contactless transactions, improving convenience and minimizing cash handling risks.

Over-the-Counter (OTC)

Over-the-Counter (OTC) cash pick-up enables recipients to collect funds directly from physical locations like banks or authorized agents, providing immediate access without the need for a mobile device. Mobile payout solutions deliver funds electronically to a recipient's mobile wallet, offering convenience and reducing reliance on physical cash handling.

Mobile Money Operator (MMO)

Mobile Money Operators (MMOs) facilitate secure and fast financial transfers by offering cash pick-up services where recipients collect funds physically from designated agents, ensuring accessibility in regions with limited digital infrastructure. Alternatively, mobile payouts enable direct deposit into users' mobile wallets, enhancing convenience and promoting cashless transactions within the digital economy.

KYC Compliance

KYC compliance ensures secure and verified identity checks for both cash pick-up and mobile payout methods, reducing fraud and enhancing transaction transparency. Mobile payout enhances accessibility and convenience, while cash pick-up relies on physical presence and strict KYC protocols to prevent identity theft and money laundering.

Disbursement Channel

Disbursement channels such as cash pick-up allow recipients to collect funds physically at designated locations, offering accessibility in areas with limited digital infrastructure. Mobile payout leverages mobile wallets and payment platforms to provide instant, secure transfers directly to users' devices, enhancing convenience and reducing transaction time.

Payout Partner

Payout Partner enhances transaction flexibility by offering both cash pick-up and mobile payout options, enabling recipients to choose the most convenient method based on their location and device accessibility. Cash pick-up provides immediate, physical access to funds at partnered locations, while mobile payout delivers seamless digital transfers directly to recipients' mobile wallets, optimizing speed and security.

Unbanked Recipients

Unbanked recipients often prefer cash pick-up services due to limited access to mobile banking infrastructure and digital wallets, making physical locations essential for receiving funds. Mobile payout options can increase convenience for those with mobile phones but remain less effective without reliable network coverage or smartphone capabilities.

Instant Transfer

Instant Transfer offers immediate fund availability, making cash pick-up ideal for recipients without mobile access who prefer collecting physical cash from agent locations. Mobile payout serves users with smartphones, enabling direct deposits to mobile wallets for faster, contactless transactions and enhanced convenience.

Withdrawal Fee

Withdrawal fees for cash pick-up transactions are generally higher than those for mobile payouts due to additional handling and processing costs at physical locations. Mobile payout withdrawals typically offer lower fees as digital transactions reduce operational expenses and enhance convenience for users.

cash pick-up vs mobile payout Infographic

moneydif.com

moneydif.com