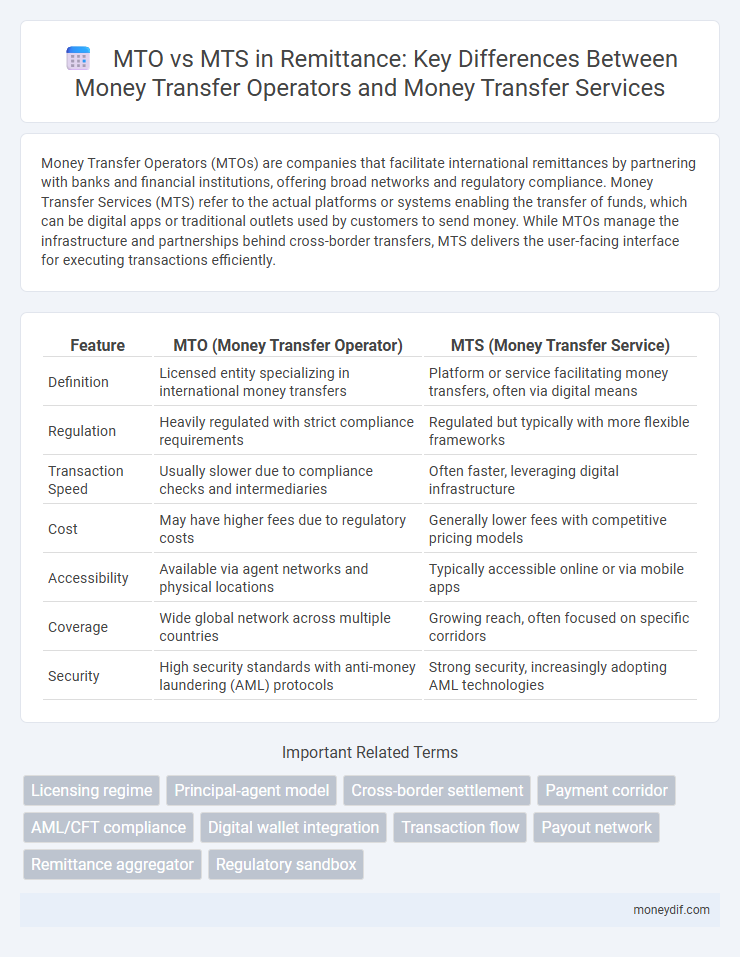

Money Transfer Operators (MTOs) are companies that facilitate international remittances by partnering with banks and financial institutions, offering broad networks and regulatory compliance. Money Transfer Services (MTS) refer to the actual platforms or systems enabling the transfer of funds, which can be digital apps or traditional outlets used by customers to send money. While MTOs manage the infrastructure and partnerships behind cross-border transfers, MTS delivers the user-facing interface for executing transactions efficiently.

Table of Comparison

| Feature | MTO (Money Transfer Operator) | MTS (Money Transfer Service) |

|---|---|---|

| Definition | Licensed entity specializing in international money transfers | Platform or service facilitating money transfers, often via digital means |

| Regulation | Heavily regulated with strict compliance requirements | Regulated but typically with more flexible frameworks |

| Transaction Speed | Usually slower due to compliance checks and intermediaries | Often faster, leveraging digital infrastructure |

| Cost | May have higher fees due to regulatory costs | Generally lower fees with competitive pricing models |

| Accessibility | Available via agent networks and physical locations | Typically accessible online or via mobile apps |

| Coverage | Wide global network across multiple countries | Growing reach, often focused on specific corridors |

| Security | High security standards with anti-money laundering (AML) protocols | Strong security, increasingly adopting AML technologies |

Understanding MTO: Definition and Scope

A Money Transfer Operator (MTO) is a company or entity that provides the infrastructure and network enabling cross-border money transfers, facilitating secure and efficient fund movements globally. MTOs often partner with banks, retailers, and agents to expand their reach and ensure compliance with financial regulations. Their scope includes handling transaction processing, currency exchange, fraud prevention, and maintaining liquidity for timely remittances.

What is MTS? Key Features Explained

Money Transfer Service (MTS) refers to the platform or system enabling the electronic transfer of funds between individuals or entities, often through digital channels or mobile apps. Key features of MTS include speed of transaction, accessibility via various devices, low-cost transfers, and integration with multiple payment methods such as bank accounts, e-wallets, and cash pick-up points. Unlike Money Transfer Operators (MTOs), which are entities facilitating the transfers, MTS emphasizes the service technology and user experience enabling seamless cross-border remittances.

Regulatory Differences: MTO vs MTS

Money Transfer Operators (MTOs) are typically licensed entities subject to stringent regulatory frameworks, including anti-money laundering (AML) and counter-terrorism financing (CTF) requirements, whereas Money Transfer Services (MTS) often operate with more flexible or limited regulatory oversight depending on jurisdictional classifications. MTOs must comply with comprehensive know-your-customer (KYC) protocols and maintain robust transaction monitoring systems, while MTS providers may face fewer compliance obligations, impacting risk management and legal accountability. Regulatory authorities impose strict licensing procedures and periodic audits on MTOs to ensure consumer protection and financial system integrity, contrasting with the relatively lighter regulatory mandates governing MTS operations.

Licensing Requirements for MTOs and MTSs

Money Transfer Operators (MTOs) require comprehensive licensing from financial regulatory authorities to ensure compliance with anti-money laundering (AML) and counter-terrorism financing (CTF) laws, often necessitating rigorous background checks, capital requirements, and operational audits. Money Transfer Services (MTSs) typically operate under less stringent licensing regimes or as sub-licenses or agents of MTOs, focusing primarily on service delivery with fewer direct regulatory obligations. Regulatory frameworks vary by jurisdiction, but MTOs face more robust licensing demands to maintain transparency and protect consumer funds compared to the relatively lighter regulatory oversight of MTSs.

Service Offerings: MTO vs MTS Comparison

Money Transfer Operators (MTOs) provide comprehensive cross-border remittance services with direct cash pickup, bank transfers, and mobile wallet integration, catering to global remittance corridors. Money Transfer Services (MTS) often operate as digital platforms or agents that facilitate money transfers primarily through online channels, emphasizing convenience and faster processing times. MTOs typically offer a broader network and physical presence, whereas MTS focuses on streamlined digital service offerings with competitive fees and real-time tracking.

Technology Infrastructure: MTOs vs MTSs

Money Transfer Operators (MTOs) typically leverage advanced, proprietary technology infrastructure to facilitate cross-border remittances, ensuring high scalability, enhanced security, and real-time transaction processing. Money Transfer Services (MTSs) often utilize more standardized or third-party platforms, which may limit customization but allow quicker deployment and integration with multiple financial networks. The technological sophistication of MTOs often translates to improved user experiences and compliance with global regulatory standards compared to the generally more accessible but less flexible infrastructure of MTSs.

Cost Structures: Fees and Charges Analyzed

Money Transfer Operators (MTOs) typically charge fixed fees and competitive exchange rates, impacting the overall cost of remittances, while Money Transfer Services (MTS) often apply variable fees based on transaction amount and speed of delivery. MTOs tend to invest in physical infrastructure, resulting in transparent yet sometimes higher upfront fees, whereas MTS leverage digital platforms to offer lower fees but can include hidden costs such as unfavorable exchange margins. Understanding the fee composition, including service charges, currency conversion rates, and intermediary costs, is crucial for optimizing remittance expenses.

Global Reach and Market Presence

Money Transfer Operators (MTOs) typically offer extensive global reach, leveraging established networks to provide cross-border remittance services in over 200 countries and territories. Money Transfer Services (MTS), while often more localized, focus on streamlined digital platforms that cater to niche markets with targeted solutions, sometimes limiting their global footprint. The market presence of MTOs is generally more robust due to regulatory compliance, partnerships with banks and financial institutions, and physical agent locations worldwide.

Customer Experience: MTO vs MTS

Money Transfer Operators (MTOs) typically offer extensive networks and regulated services ensuring secure and reliable cross-border transactions, enhancing customer trust and satisfaction. Money Transfer Services (MTS) often prioritize speed and convenience with digital platforms, providing users with real-time tracking and easy access via mobile apps. Customers benefit from MTOs' broad agent presence and compliance standards while enjoying MTS's seamless, technology-driven experience.

Choosing Between MTO and MTS: Key Considerations

Choosing between a Money Transfer Operator (MTO) and a Money Transfer Service (MTS) depends on factors like transfer speed, fees, and geographic coverage, as MTOs often provide global reach with regulated networks, while MTS may offer more localized, cost-effective solutions. Customer support quality and compliance with anti-money laundering regulations are critical for secure and reliable remittance transactions. Evaluating currency exchange rates and platform accessibility ensures the selection aligns with user convenience and affordability preferences.

Important Terms

Licensing regime

Licensing regimes for Money Transfer Operators (MTOs) and Money Transfer Services (MTS) differ primarily in regulatory requirements, where MTOs typically require comprehensive financial licenses including anti-money laundering (AML) compliance and capital adequacy standards. Money Transfer Services often operate under less stringent frameworks focusing on service facilitation and may be licensed as Payment Service Providers (PSPs) with specific operational and consumer protection mandates.

Principal-agent model

The Principal-agent model in the context of Money Transfer Operators (MTOs) and Money Transfer Services (MTS) highlights the challenges of aligning incentives and managing information asymmetry between MTOs, acting as principals, and MTS agents responsible for executing funds transfers. This model emphasizes optimizing contract design and monitoring mechanisms to mitigate risks such as moral hazard and adverse selection in cross-border remittance operations.

Cross-border settlement

Cross-border settlement involves the efficient transfer and reconciliation of funds across different countries, where Money Transfer Operators (MTOs) act as intermediaries facilitating remittances through multiple channels, while Money Transfer Services (MTS) provide the technological platforms enabling real-time transaction processing and compliance with regulatory standards. Leveraging blockchain technology and regulatory frameworks, MTOs rely on MTS infrastructure to reduce transaction costs, enhance transparency, and accelerate settlement times in international money transfers.

Payment corridor

Payment corridors define the specific routes through which Money Transfer Operators (MTOs) facilitate cross-border remittances, leveraging established networks and regulatory frameworks for secure, efficient transfers. Money Transfer Services (MTS) focus on the technological platforms and service delivery mechanisms within these corridors, enhancing transaction speed, compliance, and customer accessibility across diverse geographic regions.

AML/CFT compliance

AML/CFT compliance for Money Transfer Operators (MTOs) involves rigorous customer due diligence, transaction monitoring, and reporting suspicious activities to prevent money laundering and terrorist financing. Money Transfer Services (MTS) must also comply with regulatory frameworks but typically operate within established financial institutions, requiring integration with existing AML/CFT protocols to ensure transparency and regulatory adherence.

Digital wallet integration

Digital wallet integration with Money Transfer Operators (MTOs) enhances global remittance efficiency by enabling real-time fund transfers across borders, leveraging MTOs' licensed networks and compliance frameworks. In contrast, Money Transfer Services (MTS) primarily focus on domestic or localized transfers, where digital wallet integration facilitates seamless peer-to-peer payments and instant access to funds within regional markets.

Transaction flow

Transaction flow in Money Transfer Operators (MTOs) involves regulated intermediaries handling cross-border funds with compliance to financial authorities, ensuring secure and traceable transactions. In contrast, Money Transfer Services (MTS) often operate through platforms or apps that facilitate peer-to-peer transfers, focusing on speed and convenience but varying in regulatory oversight and transparency.

Payout network

Payout networks enable efficient fund disbursement for Money Transfer Operators (MTOs) and Money Transfer Services (MTS), with MTOs typically managing cross-border transfers through extensive partner agent networks, while MTS focus on localized or digital remittance solutions with streamlined payout mechanisms. Key entities like Western Union and MoneyGram exemplify MTOs leveraging global payout networks, whereas fintech platforms such as TransferWise (Wise) emphasize MTS models with direct bank transfers and digital wallets.

Remittance aggregator

Remittance aggregators streamline multiple Money Transfer Operators (MTOs) and Money Transfer Services (MTS) into a single platform, enhancing transaction efficiency and reducing operational costs. MTOs typically handle cross-border fund transfers through regulated networks, while MTS offers diverse payout options and localized services, allowing aggregators to provide comprehensive, competitive remittance solutions worldwide.

Regulatory sandbox

Regulatory sandboxes enable Money Transfer Operators (MTOs) and Money Transfer Services (MTS) to test innovative payment solutions under monitored conditions, facilitating compliance with financial laws while promoting technological advancements. These frameworks help MTOs, which typically act as intermediaries, and MTS providers, focused on the actual service delivery, to refine operational models and ensure secure, efficient cross-border money transfer processes.

MTO (Money Transfer Operator) vs MTS (Money Transfer Service) Infographic

moneydif.com

moneydif.com