Remittance advice serves as a detailed notification sent by the payer to the recipient, clarifying the amount and purpose of the payment, while a payment order is an instruction from the payer's bank to transfer funds to the beneficiary's account. Remittance advice helps businesses reconcile payments and match them with invoices, reducing errors and delays in accounting. Payment orders initiate the actual transfer of funds, ensuring secure and efficient processing of transactions between financial institutions.

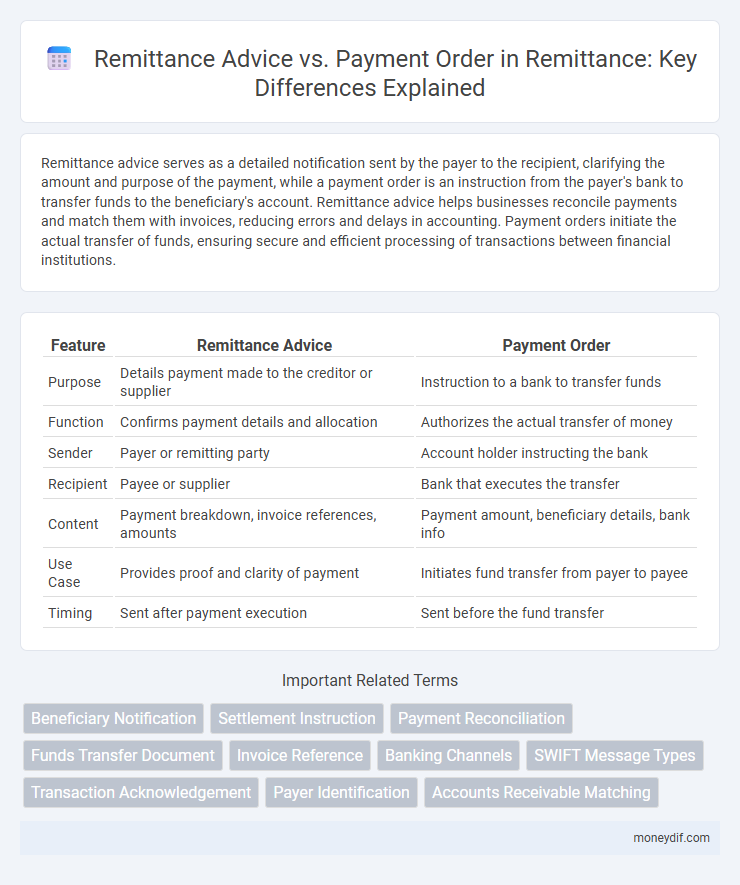

Table of Comparison

| Feature | Remittance Advice | Payment Order |

|---|---|---|

| Purpose | Details payment made to the creditor or supplier | Instruction to a bank to transfer funds |

| Function | Confirms payment details and allocation | Authorizes the actual transfer of money |

| Sender | Payer or remitting party | Account holder instructing the bank |

| Recipient | Payee or supplier | Bank that executes the transfer |

| Content | Payment breakdown, invoice references, amounts | Payment amount, beneficiary details, bank info |

| Use Case | Provides proof and clarity of payment | Initiates fund transfer from payer to payee |

| Timing | Sent after payment execution | Sent before the fund transfer |

Understanding Remittance Advice and Payment Orders

Remittance advice serves as a detailed notification sent by the payer to the payee, specifying the exact amount paid, invoice references, and payment date, ensuring accuracy in financial reconciliation. Payment orders are formal instructions issued by the payer to the financial institution to transfer funds from their account to the beneficiary's account, reflecting the intent to make a payment. Understanding the distinction between remittance advice and payment orders is crucial for efficient cash flow management and accurate bookkeeping in business transactions.

Key Differences Between Remittance Advice and Payment Orders

Remittance advice serves as a detailed notification sent by the payer to the payee, outlining the payment details such as invoice numbers, payment amount, and date, ensuring transparency and accurate reconciliation. Payment orders are instructions issued by the payer's bank to transfer funds to the payee's account, focusing solely on the execution of the payment rather than informational content. The key difference lies in remittance advice providing payment information for accounting purposes, while payment orders facilitate the actual transfer of funds.

The Role of Remittance Advice in Financial Transactions

Remittance advice plays a crucial role in financial transactions by providing detailed information about the payment, such as invoice numbers, amounts, and payer details, ensuring accurate reconciliation of accounts. Unlike payment orders, which are instructions to initiate funds transfer, remittance advices serve as confirmations and reference documents for both payers and recipients. This clarity minimizes disputes and enhances transparency in the payment process.

How Payment Orders Facilitate Fund Transfers

Payment orders streamline fund transfers by acting as formal instructions from a payer to a bank, directing the release of specified funds to a recipient. They provide essential details such as amount, beneficiary information, and payment date, ensuring accuracy and traceability in transactions. Unlike remittance advice, which notifies the recipient of payment, payment orders actively initiate and authorize the transfer of funds within banking systems.

Structure and Contents: Remittance Advice vs Payment Order

Remittance advice typically includes detailed information such as the payer's and payee's names, invoice numbers, payment amounts, and payment dates, providing clarity on which invoices are being settled. In contrast, a payment order is a financial instruction directed to a bank or payment processor, containing structured data like account numbers, payment amount, currency, and beneficiary details required to execute the payment. While remittance advice emphasizes transactional reconciliation, the payment order focuses on the authorization and instruction of funds transfer.

Benefits of Using Remittance Advice in Business

Remittance advice enhances business efficiency by providing clear, detailed records of payments received, which simplifies invoice reconciliation and reduces discrepancies. It facilitates accurate cash flow management and improves communication between payers and payees, minimizing errors in accounts payable and accounts receivable processes. Utilizing remittance advice also supports audit compliance and accelerates payment processing, contributing to stronger financial control and transparency.

Payment Order Methods and Their Efficiency

Payment order methods in remittance include electronic transfers, wire transfers, and automated clearing house (ACH) payments, each offering varying degrees of speed, security, and cost-effectiveness. Electronic transfers provide real-time processing and reduced transaction fees, enhancing operational efficiency for businesses and individuals. ACH payments, while slower, offer high reliability and lower costs for bulk transactions, making them ideal for recurring payments and payroll distributions.

Errors and Discrepancies: Resolving Payment Communication Issues

Remittance advice helps identify and resolve errors by providing detailed information about payments, such as invoice numbers and payment amounts, which facilitates accurate reconciliation. Payment orders, while instructing the transfer of funds, often lack the detailed transaction breakdown necessary for detecting discrepancies quickly. Addressing communication issues between remittance advice and payment orders reduces payment delays and improves financial accuracy in accounts receivable processes.

Digital Transformation: E-Remittance Advice and Electronic Payment Orders

E-Remittance Advice and Electronic Payment Orders streamline financial workflows by enabling real-time, automated transaction validation and reconciliation, reducing errors and operational costs. Digital transformation in remittance processes fosters enhanced transparency and auditability through standardized electronic data interchange (EDI) formats like ISO 20022. Integrating these digital tools accelerates cash flow, improves compliance, and supports seamless cross-border payment settlements in global financial ecosystems.

Choosing the Right Document: Best Practices for Businesses

Choosing the right document between remittance advice and payment order is essential for accurate financial reconciliation and smooth transaction tracking in business operations. Remittance advice provides detailed information about payments made, aiding suppliers in matching payments to invoices, while payment orders initiate the transfer of funds from payer to payee. Implementing clear protocols to distinguish these documents enhances cash flow management and reduces disputes in accounts payable and receivable processes.

Important Terms

Beneficiary Notification

Beneficiary Notification ensures the recipient is informed about the transaction details, distinguishing Remittance Advice, which provides an itemized list of invoices and payments, from Payment Order, which is the actual instruction to transfer funds. Accurate beneficiary notification improves transparency and reconciliation efficiency in financial transactions.

Settlement Instruction

Settlement instructions specify the details required to complete a financial transaction, ensuring accurate fund transfer between banks or accounts. Remittance advice accompanies payment orders by providing detailed information on the invoice or purpose of payment, facilitating reconciliation for the beneficiary.

Payment Reconciliation

Payment reconciliation involves matching payment transactions with remittance advice and payment orders to ensure accuracy and completeness. Remittance advice provides detailed information about the payment, facilitating the identification of invoices being paid, while payment orders instruct the transfer of funds, making both essential for effective financial reconciliation.

Funds Transfer Document

A Funds Transfer Document serves as a formal record facilitating the movement of funds between accounts, where a Remittance Advice provides detailed payment information to the recipient for reconciliation, while a Payment Order authorizes the financial institution to execute the transfer. Understanding the distinction enhances accurate tracking and verification in financial transactions and accounting processes.

Invoice Reference

Invoice Reference uniquely identifies the original invoice linked to a payment, ensuring accurate reconciliation between remittance advice and payment order. Remittance advice provides detailed transaction information for the payee, while payment order instructs the bank to transfer funds, both utilizing the invoice reference for precise payment matching.

Banking Channels

Banking channels facilitate the efficient transfer of funds by using remittance advice to provide detailed transaction information from the payer to the payee, ensuring accurate allocation of payments. Payment orders act as formal instructions sent through these channels to authorize fund transfers from the payer's account to the beneficiary's account, streamlining the settlement process.

SWIFT Message Types

SWIFT Message Types MT103 and MT202 are primarily used for payment orders where MT103 details individual customer credit transfers, serving as a payment order, while MT202 handles bank-to-bank funds transfers. Remittance advice, informing the beneficiary about payment details, is typically embedded within MT103 or conveyed separately using an MTn95 or related messaging standard.

Transaction Acknowledgement

Transaction Acknowledgement confirms the receipt and successful processing of a payment, while Remittance Advice provides detailed information about the payment, including invoice references and amounts paid. Payment Order initiates the transfer of funds from the payer to the payee, serving as the authorization for the transaction before the acknowledgment and remittance details are generated.

Payer Identification

Payer Identification in Remittance Advice clearly details the entity responsible for the payment, ensuring accurate allocation of funds, while Payment Order primarily focuses on the instruction to transfer funds without extensive payer details. Accurate Payer Identification enhances reconciliation processes by linking payment instructions from Payment Orders with corresponding Remittance Advice documentation in electronic funds transfers.

Accounts Receivable Matching

Accounts Receivable Matching involves reconciling incoming payments with outstanding invoices using Remittance Advice, which details the payer's invoice numbers and amounts, ensuring accurate application of funds. Payment Order provides the instruction for the transfer of funds, but Remittance Advice offers the specific information needed for precise matching and posting in the accounts receivable ledger.

Remittance Advice vs Payment Order Infographic

moneydif.com

moneydif.com