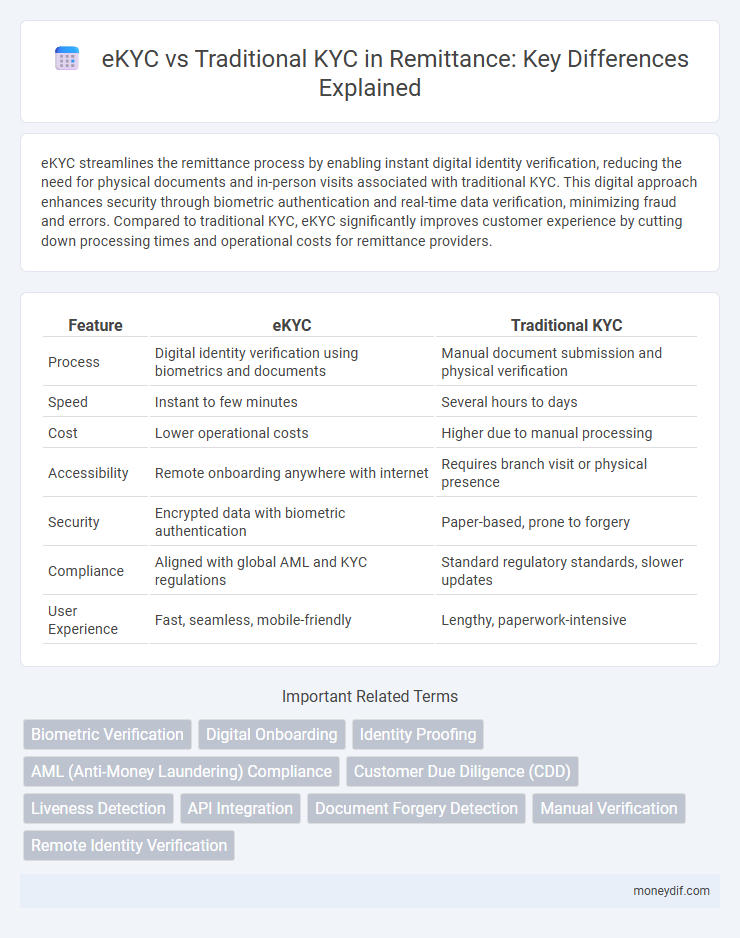

eKYC streamlines the remittance process by enabling instant digital identity verification, reducing the need for physical documents and in-person visits associated with traditional KYC. This digital approach enhances security through biometric authentication and real-time data verification, minimizing fraud and errors. Compared to traditional KYC, eKYC significantly improves customer experience by cutting down processing times and operational costs for remittance providers.

Table of Comparison

| Feature | eKYC | Traditional KYC |

|---|---|---|

| Process | Digital identity verification using biometrics and documents | Manual document submission and physical verification |

| Speed | Instant to few minutes | Several hours to days |

| Cost | Lower operational costs | Higher due to manual processing |

| Accessibility | Remote onboarding anywhere with internet | Requires branch visit or physical presence |

| Security | Encrypted data with biometric authentication | Paper-based, prone to forgery |

| Compliance | Aligned with global AML and KYC regulations | Standard regulatory standards, slower updates |

| User Experience | Fast, seamless, mobile-friendly | Lengthy, paperwork-intensive |

Understanding KYC in Remittance Services

Understanding KYC in remittance services is crucial for preventing fraud and ensuring regulatory compliance, with eKYC offering a faster, digital alternative to traditional KYC processes. Traditional KYC requires physical document verification and in-person identity checks, which can be time-consuming and prone to human error. eKYC leverages biometric data and AI-driven identity verification, enabling real-time customer onboarding and enhancing both security and customer experience.

What is Traditional KYC?

Traditional KYC (Know Your Customer) involves a manual verification process where customers submit physical documents such as passports, utility bills, and identification cards to verify their identity. This method requires in-person visits to branches or submission of paper copies, leading to longer processing times and increased risk of human error. Traditional KYC is widely used in remittance services to comply with anti-money laundering (AML) regulations and prevent fraud.

Introduction to eKYC: A Digital Evolution

eKYC revolutionizes customer identity verification in remittance by enabling instant, remote digital authentication using biometric data and government-issued IDs, eliminating the need for physical document submission typical of traditional KYC processes. This digital evolution enhances operational efficiency, reduces onboarding time from days to minutes, and improves compliance with anti-money laundering (AML) and know-your-customer regulations through automated data validation and real-time verification. Financial institutions and remittance service providers benefit from lower costs, reduced fraud risk, and increased customer convenience by adopting eKYC technologies.

Key Differences between eKYC and Traditional KYC

eKYC leverages digital identity verification technologies such as biometric authentication and instant document scanning, enabling faster and more accurate customer onboarding compared to the manual verification process of traditional KYC. Traditional KYC involves physical document verification and in-person identity checks, resulting in longer processing times and higher operational costs. eKYC supports real-time validation and remote access, enhancing customer convenience while maintaining compliance with regulatory standards essential for secure remittance services.

The Role of Technology in eKYC for Remittance

The role of technology in eKYC for remittance significantly streamlines customer verification by utilizing biometric authentication, AI-driven identity validation, and real-time data processing to enhance security and reduce onboarding time. Unlike traditional KYC, which relies on manual document checks and physical presence, eKYC leverages digital platforms and mobile apps to enable faster, contactless, and cost-efficient compliance with anti-money laundering (AML) regulations. This technological integration not only improves user experience but also expands access to remittance services for unbanked and underbanked populations worldwide.

Benefits of eKYC for Cross-Border Money Transfers

eKYC streamlines the onboarding process for cross-border money transfers by enabling instant identity verification through digital documents and biometric data, reducing the time and cost associated with traditional KYC methods. It enhances security and compliance by leveraging AI and blockchain technologies to detect fraud and ensure regulatory adherence in real-time. This digital approach also improves customer experience by providing convenient, paperless, and accessible verification across different jurisdictions.

Traditional KYC: Challenges and Limitations

Traditional KYC processes in remittance face significant challenges such as time-consuming manual verification and higher susceptibility to human errors, resulting in slower customer onboarding. Physical document submission often leads to increased operational costs and inconvenience for customers, especially in cross-border scenarios. Furthermore, stringent regulatory requirements impose difficulties in maintaining updated records, causing compliance risks and customer dissatisfaction.

Compliance and Security in eKYC vs Traditional KYC

eKYC enhances compliance by utilizing digital identity verification methods that adhere to regulatory standards, reducing manual errors and fraud risks commonly associated with traditional KYC processes. Traditional KYC relies heavily on physical document verification, which can be time-consuming and prone to manipulation, whereas eKYC integrates biometric authentication and real-time data validation to strengthen security measures. Financial institutions adopting eKYC benefit from faster onboarding, improved accuracy, and enhanced fraud detection, ensuring robust compliance with anti-money laundering (AML) and Know Your Customer (KYC) regulations.

Customer Experience: eKYC vs Traditional KYC in Remittances

eKYC enhances customer experience in remittances by enabling faster, paperless identity verification, reducing transaction times from days to minutes. Traditional KYC often involves physical document submission and in-person verification, leading to longer wait times and potential service disruptions. Integrating eKYC results in higher customer satisfaction through seamless onboarding and improved accessibility for cross-border money transfers.

Future Trends in KYC for Remittance Providers

The future of KYC for remittance providers is moving towards enhanced digital solutions such as eKYC, which utilize biometric verification, artificial intelligence, and blockchain technology to streamline identity validation while maintaining security and compliance. Traditional KYC processes often involve manual paperwork and in-person verification, causing delays and higher operational costs; in contrast, eKYC offers faster onboarding and real-time fraud detection. As regulators increasingly support digital identity frameworks, remittance services are adopting eKYC to improve customer experience and reduce compliance risks.

Important Terms

Biometric Verification

Biometric verification in eKYC enhances identity authentication by using unique physiological traits like fingerprints or facial recognition, significantly reducing fraud and processing time compared to traditional KYC methods reliant on physical document review. This digital approach improves accuracy, user convenience, and regulatory compliance, streamlining customer onboarding in financial services.

Digital Onboarding

Digital onboarding leverages eKYC technology, utilizing biometric verification and AI-driven identity checks to accelerate customer authentication while reducing fraud and operational costs. Traditional KYC relies on manual document verification and in-person checks, resulting in longer processing times and higher risk of human error.

Identity Proofing

Identity proofing in eKYC leverages digital technologies such as biometric verification, facial recognition, and real-time document authentication to validate user identities swiftly and accurately. Traditional KYC relies on physical document submission and manual verification processes, resulting in longer processing times and increased risk of human error compared to automated, secure eKYC methods.

AML (Anti-Money Laundering) Compliance

AML compliance ensures the detection and prevention of financial crimes by verifying customer identities through processes like eKYC and traditional KYC. eKYC leverages digital technologies such as biometric verification and AI to expedite identity checks and enhance accuracy, while traditional KYC relies on physical document verification and in-person validation, often resulting in slower onboarding and increased risk of human error.

Customer Due Diligence (CDD)

Customer Due Diligence (CDD) leverages eKYC technology to enhance the verification process by enabling real-time biometric authentication and digital document verification, significantly reducing fraud risks compared to traditional KYC methods reliant on physical document submission and manual review. eKYC integrates advanced AI and machine learning algorithms to ensure higher accuracy and faster onboarding, optimizing compliance with regulatory standards such as AML and GDPR.

Liveness Detection

Liveness detection in eKYC employs biometric verification techniques such as facial recognition and real-time video analysis to confirm the presence of a live user, significantly reducing the risk of identity fraud compared to traditional KYC methods that rely on manual document verification. This technology enhances security and accelerates onboarding processes by automating identity validation while maintaining compliance with regulatory standards.

API Integration

API integration streamlines eKYC by enabling real-time data verification and automated identity checks, reducing processing time from days to minutes compared to traditional KYC methods. Enhanced security protocols embedded in APIs ensure compliance with regulatory frameworks such as AML and GDPR, minimizing human error and fraud risks commonly associated with manual KYC processes.

Document Forgery Detection

Document forgery detection in eKYC leverages advanced AI and biometric verification techniques to enhance accuracy and reduce fraud compared to traditional KYC methods that rely on manual verification and physical document inspection. Integrating machine learning algorithms and optical character recognition (OCR) enables real-time validation of identity documents, significantly improving security and efficiency in customer onboarding processes.

Manual Verification

Manual verification in eKYC leverages digital identity documents and biometric data to authenticate users instantly, significantly reducing processing time compared to traditional KYC's reliance on physical document submission and in-person verification. This method enhances accuracy by cross-referencing multiple digital databases, minimizing fraud risks inherent in manual, paper-based processes.

Remote Identity Verification

Remote Identity Verification leverages digital technologies such as biometric authentication, AI-powered facial recognition, and document verification to securely confirm user identities online, enhancing the efficiency and scalability of eKYC processes. Compared to traditional KYC, which relies on in-person document checks and manual data entry, remote verification reduces fraud risk, accelerates customer onboarding, and complies with regulatory standards like AML and GDPR.

eKYC vs traditional KYC Infographic

moneydif.com

moneydif.com