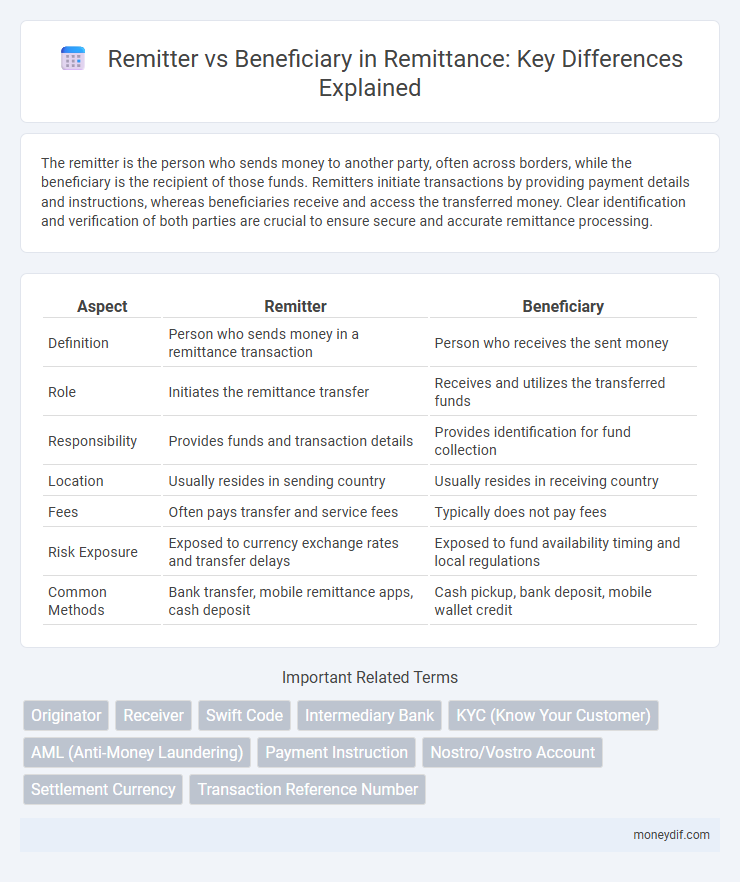

The remitter is the person who sends money to another party, often across borders, while the beneficiary is the recipient of those funds. Remitters initiate transactions by providing payment details and instructions, whereas beneficiaries receive and access the transferred money. Clear identification and verification of both parties are crucial to ensure secure and accurate remittance processing.

Table of Comparison

| Aspect | Remitter | Beneficiary |

|---|---|---|

| Definition | Person who sends money in a remittance transaction | Person who receives the sent money |

| Role | Initiates the remittance transfer | Receives and utilizes the transferred funds |

| Responsibility | Provides funds and transaction details | Provides identification for fund collection |

| Location | Usually resides in sending country | Usually resides in receiving country |

| Fees | Often pays transfer and service fees | Typically does not pay fees |

| Risk Exposure | Exposed to currency exchange rates and transfer delays | Exposed to fund availability timing and local regulations |

| Common Methods | Bank transfer, mobile remittance apps, cash deposit | Cash pickup, bank deposit, mobile wallet credit |

Understanding the Roles: Who is the Remitter and Who is the Beneficiary?

The remitter is the individual or entity sending money, initiating a transfer to another party, while the beneficiary is the recipient of those funds. In remittance transactions, the remitter authorizes the payment and provides the necessary details, whereas the beneficiary receives and can utilize the transferred amount. Clarifying these roles is essential for accurate processing and compliance within international and domestic payment systems.

Key Responsibilities of the Remitter in Remittance Transactions

The remitter holds the primary responsibility for initiating the remittance transaction by accurately providing the recipient's details and ensuring compliance with relevant regulatory requirements. They must verify the authenticity of the transfer amount and sender information to prevent errors or fraud during the transaction process. Timely fund availability and clear communication with the beneficiary are essential to facilitate seamless remittance delivery and confirmation.

Essential Rights of the Beneficiary in Remittance Transfers

The essential rights of the beneficiary in remittance transfers include timely receipt of funds, transparency regarding fees and exchange rates, and clear communication about transfer status. Beneficiaries have the right to receive accurate information on transaction terms and the ability to lodge complaints or seek redress if discrepancies arise. Ensuring these rights protects beneficiaries from financial loss and enhances trust in cross-border remittance systems.

Legal Implications: Remitter vs Beneficiary Obligations

The remitter holds legal responsibility for providing accurate transaction details and complying with anti-money laundering (AML) regulations, ensuring funds are legitimately sourced. The beneficiary must verify receipt of funds and report any discrepancies to financial institutions promptly to avoid legal disputes. Both parties share obligations under international remittance laws to prevent fraud, money laundering, and ensure transparent, compliant fund transfers.

Required Documentation for Remitter and Beneficiary

Remitters must provide valid government-issued identification, proof of address, and details of the recipient to initiate a remittance transaction securely. Beneficiaries typically need to present valid ID and transaction reference numbers to claim the funds, ensuring compliance with anti-money laundering regulations. Both parties' documentation verifies identities and protects against fraud in international money transfers.

Security Measures for Remitter and Beneficiary Protection

Security measures for remitters include multi-factor authentication, encryption protocols, and real-time transaction monitoring to prevent unauthorized access and fraud. Beneficiaries benefit from robust identity verification processes and secure payout channels that ensure funds are delivered safely and only to the intended recipient. Regulatory compliance, such as adherence to anti-money laundering (AML) and know-your-customer (KYC) standards, further protects both remitter and beneficiary throughout the remittance process.

Common Issues Faced by Remitters and Beneficiaries

Remitters often encounter issues such as high transfer fees, delayed transaction processing, and difficulties in navigating complex regulatory requirements. Beneficiaries may face challenges including receiving incorrect amounts, lack of access to funds due to limited local banking infrastructure, and unclear communication about transfer status. Both parties frequently struggle with exchange rate fluctuations and limited customer support from remittance service providers.

Remittance Fees: Impact on Remitter and Beneficiary

Remittance fees significantly affect both the remitter and beneficiary by reducing the net amount transferred and received, influencing financial decisions and transaction frequency. High fees burden the remitter through increased costs, often limiting the funds sent to support families or investments. For beneficiaries, these fees diminish the funds accessible for daily expenses, savings, or local investments, impacting overall economic well-being.

Cross-Border Regulations Affecting Remitters and Beneficiaries

Cross-border remittance regulations impose strict compliance requirements on remitters to verify identity and source of funds, ensuring anti-money laundering (AML) and counter-terrorism financing (CTF) measures are met. Beneficiaries face regulatory scrutiny related to receiving limits, currency controls, and taxation in their jurisdictions, impacting the timeliness and amount of funds accessible. Financial institutions and remittance service providers must navigate diverse country-specific laws, including reporting obligations and data privacy rules, that affect both remitters' ability to send money and beneficiaries' ability to receive it securely.

Best Practices for Remitters and Beneficiaries in International Money Transfers

Remitters should ensure accuracy in recipient details, including full name and bank information, to prevent transaction delays or errors in international money transfers. Beneficiaries must verify receipt of funds promptly and report discrepancies immediately to their financial institution. Both parties benefit from using secure transfer channels and keeping detailed records to facilitate tracking and dispute resolution.

Important Terms

Originator

An originator is the party who initiates a financial transaction, often synonymous with the remitter who sends funds, while the beneficiary is the recipient of the payment. In banking and payment systems, clear identification of the originator/remitter and beneficiary ensures secure and accurate fund transfers.

Receiver

The receiver, often synonymous with the beneficiary, is the party designated to accept funds or assets transferred by the remitter, who initiates the payment or transaction. In financial contexts, understanding the distinct roles of remitter as the sender and receiver as the final recipient is crucial for ensuring accurate and secure fund transfers.

Swift Code

Swift Code uniquely identifies banks during international money transfers, ensuring accurate routing between the remitter's and beneficiary's financial institutions. Accurate entry of the Swift Code by the remitter minimizes transaction delays and errors for the beneficiary receiving funds abroad.

Intermediary Bank

An intermediary bank facilitates the transfer of funds between the remitter's bank and the beneficiary's bank, ensuring smooth transaction processing in international wire transfers. This bank acts as a trusted conduit, especially when direct relationships between remitter and beneficiary banks do not exist, helping to verify and route payments accurately.

KYC (Know Your Customer)

KYC (Know Your Customer) processes require thorough verification of both remitter and beneficiary to prevent fraud and ensure regulatory compliance, with financial institutions collecting identity documents, proof of address, and transaction purpose for each party. Enhanced KYC measures focus on validating the legitimacy of remitters initiating funds transfers and beneficiaries receiving funds to mitigate money laundering and terrorist financing risks.

AML (Anti-Money Laundering)

AML (Anti-Money Laundering) regulations require thorough verification of both the remitter and beneficiary to prevent illicit fund transfers and money laundering activities. Financial institutions employ due diligence processes, including KYC (Know Your Customer) checks, to monitor transaction patterns and ensure compliance with global AML standards.

Payment Instruction

Payment instructions specify the exact details required for transferring funds from the remitter, who initiates the payment, to the beneficiary, the recipient of the funds. Accurate information about both parties, including bank account numbers, names, and payment references, is essential to ensure secure and timely transaction processing.

Nostro/Vostro Account

Nostro and Vostro accounts are critical in international banking, where the remitter uses a Nostro account to send funds in the beneficiary bank's currency, while the beneficiary receives funds through a Vostro account held by the correspondent bank. This system streamlines cross-border payments by ensuring accurate currency conversion and account reconciliation between remitter and beneficiary institutions.

Settlement Currency

Settlement currency refers to the specific currency used to complete a financial transaction between the remitter and the beneficiary, ensuring clarity and consistency in international payments. The selection of the settlement currency impacts exchange rates, transaction fees, and the timing of fund availability for the beneficiary.

Transaction Reference Number

The Transaction Reference Number (TRN) serves as a unique identifier linking the remitter's payment details to the beneficiary's account, facilitating accurate tracking and reconciliation of funds. This code ensures precise verification of transactions between sending and receiving parties across payment systems and financial institutions.

Remitter vs Beneficiary Infographic

moneydif.com

moneydif.com