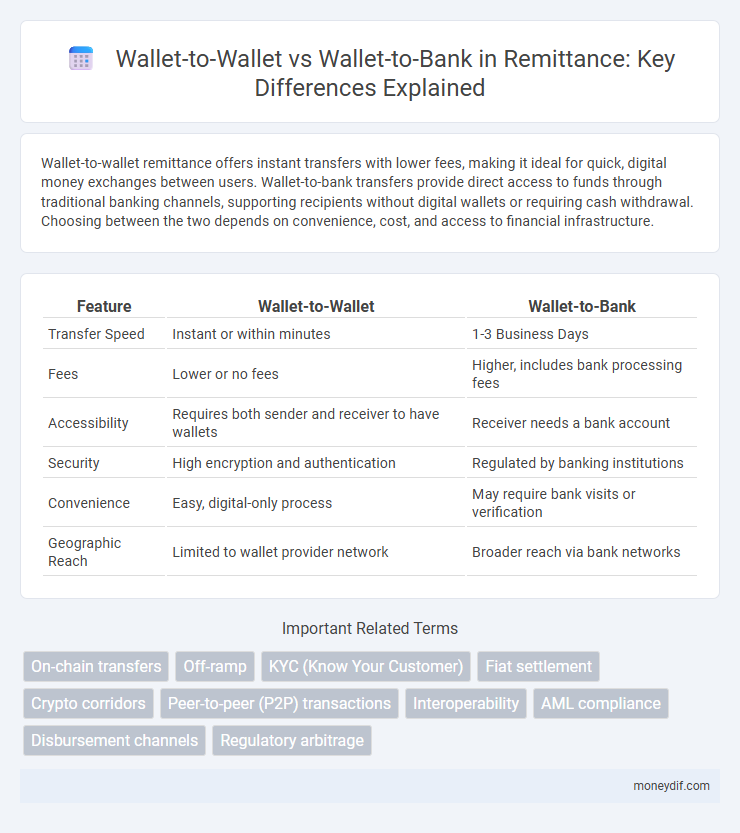

Wallet-to-wallet remittance offers instant transfers with lower fees, making it ideal for quick, digital money exchanges between users. Wallet-to-bank transfers provide direct access to funds through traditional banking channels, supporting recipients without digital wallets or requiring cash withdrawal. Choosing between the two depends on convenience, cost, and access to financial infrastructure.

Table of Comparison

| Feature | Wallet-to-Wallet | Wallet-to-Bank |

|---|---|---|

| Transfer Speed | Instant or within minutes | 1-3 Business Days |

| Fees | Lower or no fees | Higher, includes bank processing fees |

| Accessibility | Requires both sender and receiver to have wallets | Receiver needs a bank account |

| Security | High encryption and authentication | Regulated by banking institutions |

| Convenience | Easy, digital-only process | May require bank visits or verification |

| Geographic Reach | Limited to wallet provider network | Broader reach via bank networks |

Understanding Wallet-to-Wallet Remittance

Wallet-to-wallet remittance enables instant, secure transfers between digital wallets, eliminating the need for traditional banking infrastructure and reducing transaction costs significantly. This mode leverages blockchain and mobile technology, enhancing accessibility for unbanked populations while ensuring real-time fund availability. Compared to wallet-to-bank transfers, wallet-to-wallet transactions offer greater speed and lower fees, fostering a seamless digital payment ecosystem globally.

Explaining Wallet-to-Bank Transfers

Wallet-to-bank transfers enable users to seamlessly move funds from their digital wallets directly into traditional bank accounts, providing a secure and convenient way to access cash or pay bills. This method supports instant or same-day settlements, reducing delays associated with intermediaries, and often includes lower transaction fees compared to wire transfers. Wallet-to-bank services enhance financial inclusion by bridging digital finance platforms with established banking infrastructure, facilitating cross-border remittances and everyday transactions.

Speed Comparison: Wallet-to-Wallet vs Wallet-to-Bank

Wallet-to-wallet remittances typically complete within seconds to minutes, offering near-instant access to funds, whereas wallet-to-bank transfers can take from several minutes to multiple business days depending on the banking network and geographic location. The speed disparity is driven by the direct digital nature of wallet-to-wallet systems, which bypass traditional banking intermediaries and settlement processes. Consequently, wallet-to-wallet transfers provide superior efficiency for urgent transactions, while wallet-to-bank transfers maintain broader access to cash-out options despite slower processing times.

Transaction Fees: Which Option is Cheaper?

Wallet-to-wallet remittance transactions typically incur lower fees compared to wallet-to-bank transfers due to the absence of intermediary banking charges and reduced processing costs. Many digital wallets offer near-zero or fixed low transaction fees, making wallet-to-wallet the cost-effective choice for frequent money transfers. Conversely, wallet-to-bank transfers often involve higher fees as banks charge for account credits, especially in cross-border remittances.

Security Features: Wallet-to-Wallet vs Wallet-to-Bank

Wallet-to-wallet transfers provide enhanced security through end-to-end encryption and biometric authentication, minimizing risks of interception or fraud during transactions. Wallet-to-bank transfers involve additional layers of regulatory compliance and banking security protocols, offering strong fraud detection but potentially longer processing times. Both methods prioritize secure user verification but differ in their approach to safeguarding funds due to the nature of digital wallets versus traditional banking systems.

Accessibility: Reaching the Unbanked

Wallet-to-wallet remittance offers greater accessibility for the unbanked by eliminating the need for traditional bank accounts, enabling instant transfers via mobile devices. Wallet-to-bank transactions often require users to have a bank account, limiting access for those without formal banking relationships. Mobile wallets extend financial inclusion by providing a user-friendly platform for sending and receiving funds, especially in regions with low banking penetration.

User Experience: Simplicity and Convenience

Wallet-to-wallet remittances offer enhanced simplicity and convenience by enabling instant transfers within digital ecosystems, eliminating the need for bank details or lengthy verification processes. Users benefit from seamless peer-to-peer transactions and real-time notifications, fostering a more intuitive and accessible experience. In contrast, wallet-to-bank transfers, while widely used, often involve additional steps such as bank account linking and longer processing times, potentially complicating the user journey.

Cross-Border Transfers: Global Reach

Wallet-to-wallet transfers enable instant cross-border remittances by facilitating direct digital currency movement between users' mobile wallets, offering enhanced speed and lower transaction fees compared to traditional methods. Wallet-to-bank transfers provide broader financial inclusion by allowing recipients in different countries to access funds directly in their local bank accounts, supporting diverse currency conversions and regulatory compliance. Both methods leverage global digital infrastructure, but wallet-to-wallet excels in real-time transfers across multiple countries, while wallet-to-bank bridges the gap between digital and traditional banking systems for international remittances.

Compliance and Regulatory Considerations

Wallet-to-wallet remittance transactions demand stringent compliance with digital money transfer regulations, including anti-money laundering (AML) and know your customer (KYC) protocols, to prevent fraud and illicit activities. Wallet-to-bank transfers require adherence to both digital wallet regulations and traditional banking compliance frameworks, often involving more extensive due diligence and reporting standards imposed by central banks and financial authorities. Regulatory scrutiny intensifies for wallet-to-bank channels due to higher risks of money laundering, necessitating robust transaction monitoring and transparent record-keeping practices.

Future Trends in Digital Remittance Solutions

Future trends in digital remittance solutions emphasize the growing preference for wallet-to-wallet transfers due to their speed, lower transaction fees, and seamless user experience across global markets. Wallet-to-bank transfers remain essential for cash-out flexibility, but innovations in blockchain and digital identity verification are accelerating wallet interoperability. Enhanced security protocols and AI-powered fraud detection are also transforming remittance platforms, driving widespread adoption of digital wallets for cross-border money movement.

Important Terms

On-chain transfers

On-chain transfers enable direct wallet-to-wallet transactions using blockchain technology, ensuring transparency and security without intermediaries. Wallet-to-bank transfers involve converting cryptocurrency to fiat currency via exchanges or payment processors, facilitating real-world access but requiring compliance with regulatory frameworks.

Off-ramp

Off-ramp solutions facilitate converting cryptocurrency from wallet-to-wallet or wallet-to-bank, enabling seamless digital asset transfers or fiat withdrawals. Wallet-to-wallet off-ramps prioritize quick peer-to-peer crypto exchanges, while wallet-to-bank off-ramps focus on regulatory-compliant settlements converting crypto assets into traditional currency via bank accounts.

KYC (Know Your Customer)

KYC (Know Your Customer) processes are crucial in wallet-to-bank transactions to verify user identity and comply with financial regulations, reducing fraud and money laundering risks. Wallet-to-wallet transfers typically involve less stringent KYC requirements but still depend on platform policies to ensure secure peer-to-peer digital asset exchanges.

Fiat settlement

The Fiat settlement process enables seamless wallet-to-wallet and wallet-to-bank transactions, optimizing liquidity flow and reducing settlement times for digital payments. Wallet-to-wallet transfers facilitate instant peer-to-peer exchanges within digital ecosystems, while wallet-to-bank transactions integrate traditional banking networks for broader financial accessibility.

Crypto corridors

Crypto corridors facilitate cross-border transactions by enabling faster, cheaper wallet-to-wallet transfers compared to traditional wallet-to-bank methods, which often involve higher fees and longer processing times. Wallet-to-wallet transfers leverage decentralized blockchain networks for direct peer-to-peer payments, enhancing liquidity and reducing reliance on banking intermediaries within global crypto remittance corridors.

Peer-to-peer (P2P) transactions

Peer-to-peer (P2P) transactions enable direct wallet-to-wallet transfers, offering faster settlement times and lower fees compared to wallet-to-bank transactions, which often involve additional verification and processing delays. Wallet-to-wallet transactions leverage blockchain technology for enhanced security and transparency, whereas wallet-to-bank payments depend on traditional banking systems subject to regulatory constraints.

Interoperability

Wallet-to-wallet interoperability enables seamless peer-to-peer transactions across diverse digital currency platforms, enhancing user control and reducing reliance on centralized institutions. Wallet-to-bank interoperability bridges traditional banking systems with cryptocurrency wallets, facilitating fiat-to-crypto exchanges and broadening access to digital financial services.

AML compliance

AML compliance requires rigorous monitoring of wallet-to-bank transactions due to direct links with financial institutions and regulatory frameworks, whereas wallet-to-wallet transfers demand enhanced blockchain analytics and identity verification to detect illicit activities without traditional banking intermediaries. Emphasizing real-time transaction screening and employing machine learning algorithms improves detection of suspicious patterns across both channels, ensuring adherence to Anti-Money Laundering regulations.

Disbursement channels

Wallet-to-wallet disbursement channels enable instant peer-to-peer transfers within the same digital wallet ecosystem, enhancing transaction speed and user convenience. Wallet-to-bank channels facilitate funds transfer from digital wallets directly to bank accounts, providing broader financial access and integration with traditional banking systems.

Regulatory arbitrage

Regulatory arbitrage occurs when financial entities exploit differences in regulations between wallet-to-wallet and wallet-to-bank transactions to reduce compliance costs and avoid stricter banking oversight. Wallet-to-wallet transfers often face fewer regulatory constraints compared to wallet-to-bank transactions, enabling faster, less regulated movement of digital assets across jurisdictions.

wallet-to-wallet vs wallet-to-bank Infographic

moneydif.com

moneydif.com