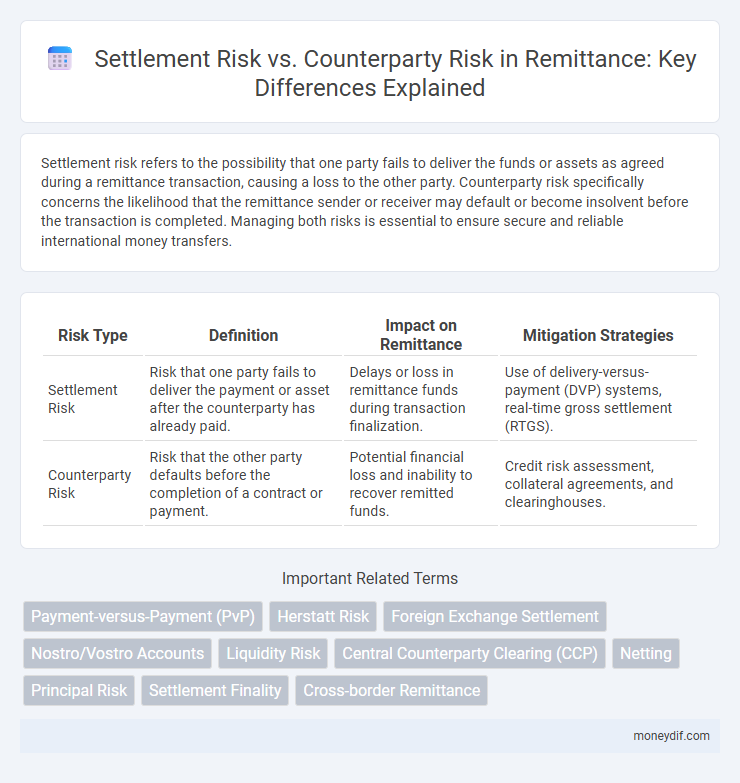

Settlement risk refers to the possibility that one party fails to deliver the funds or assets as agreed during a remittance transaction, causing a loss to the other party. Counterparty risk specifically concerns the likelihood that the remittance sender or receiver may default or become insolvent before the transaction is completed. Managing both risks is essential to ensure secure and reliable international money transfers.

Table of Comparison

| Risk Type | Definition | Impact on Remittance | Mitigation Strategies |

|---|---|---|---|

| Settlement Risk | Risk that one party fails to deliver the payment or asset after the counterparty has already paid. | Delays or loss in remittance funds during transaction finalization. | Use of delivery-versus-payment (DVP) systems, real-time gross settlement (RTGS). |

| Counterparty Risk | Risk that the other party defaults before the completion of a contract or payment. | Potential financial loss and inability to recover remitted funds. | Credit risk assessment, collateral agreements, and clearinghouses. |

Understanding Settlement Risk in Remittance Transactions

Settlement risk in remittance transactions refers to the possibility that one party fails to deliver the funds after the other party has already made the payment, potentially causing financial loss. This risk arises during the settlement process when funds and corresponding assets are exchanged, particularly in cross-border remittances involving multiple intermediaries and time zone differences. Understanding settlement risk helps in designing secure payment systems and choosing reliable financial institutions to minimize the likelihood of transaction failure.

What is Counterparty Risk in Remittance?

Counterparty risk in remittance refers to the possibility that the recipient or the intermediary involved in the transaction may fail to fulfill their payment obligations, leading to financial loss for the sender. This risk is critical in cross-border money transfers where reliance on multiple agents, banks, or platforms increases the chance of default or fraud. Managing counterparty risk involves rigorous due diligence, credit assessments, and the selection of reputable financial institutions to ensure secure and reliable remittance settlements.

Key Differences: Settlement Risk vs Counterparty Risk

Settlement risk arises when one party in a remittance transaction fails to deliver the agreed payment or currency at the time of settlement, potentially causing a loss despite the contract's validity. Counterparty risk refers to the possibility that the other party involved in the transaction will default on their financial obligations before the transaction is completed. The key difference lies in settlement risk being specifically tied to the timing and completion of the remittance transfer, while counterparty risk encompasses broader concerns about the financial stability and creditworthiness of the remitting party.

How Settlement Risk Impacts Remittance Services

Settlement risk in remittance services occurs when the transfer of funds between parties is not simultaneous, exposing one party to potential loss if the counterparty fails to fulfill their payment obligation. This risk directly affects the reliability and security of remittance transactions, often leading to delays, increased costs, and reduced trust among users and financial institutions. Mitigating settlement risk requires robust payment systems, real-time settlement mechanisms, and strong regulatory oversight to ensure timely and secure fund transfers.

Counterparty Risk: Implications for Remittance Providers

Counterparty risk in remittance services arises when the receiving party fails to fulfill their contractual obligations, leading to potential financial losses and delayed fund transfers. Remittance providers must implement rigorous due diligence, real-time transaction monitoring, and robust compliance frameworks to mitigate this risk effectively. Failure to manage counterparty risk can damage trust, increase operational costs, and expose remittance networks to fraud or insolvency vulnerabilities.

Managing and Reducing Settlement Risk in Remittances

Managing settlement risk in remittances involves implementing real-time gross settlement (RTGS) systems and utilizing central counterparties (CCPs) to ensure timely and final payment settlement. Enhancing transparency through blockchain technology and smart contracts reduces counterparty risk by automating verification and enforcing contractual obligations. Financial institutions also mitigate risks by conducting rigorous due diligence and maintaining robust credit limits for counterparties involved in cross-border transfers.

Strategies to Mitigate Counterparty Risk in Remittance

Effective strategies to mitigate counterparty risk in remittance include conducting thorough due diligence on counterparties, implementing robust credit assessment frameworks, and utilizing collateral or margin requirements to secure transactions. Utilizing real-time monitoring systems and strong compliance protocols further reduces exposure by detecting potential defaults early. Diversifying counterparties and establishing clear contractual agreements also enhance risk management by limiting reliance on any single entity.

Regulatory Measures Addressing Settlement and Counterparty Risk

Regulatory measures such as the Principles for Financial Market Infrastructures (PFMI) established by the Committee on Payments and Market Infrastructures (CPMI) and the International Organization of Securities Commissions (IOSCO) aim to mitigate settlement risk by enforcing robust risk management standards and promoting real-time gross settlement systems. Central banks and regulatory authorities implement capital adequacy requirements and standardized collateral frameworks to limit counterparty risk in remittance transactions, ensuring financial stability and protecting participants. Compliance with Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations further enhances transparency and reduces systemic vulnerabilities in cross-border settlement processes.

Technological Solutions for Risk Management in Remittance

Technological solutions for risk management in remittance enhance the mitigation of settlement risk by enabling real-time transaction tracking and automated reconciliation across multiple financial networks. Advanced blockchain platforms provide transparency and immutability, significantly reducing counterparty risk by ensuring all parties adhere to smart contract conditions before settlement occurs. Artificial intelligence algorithms analyze transaction patterns to detect anomalies, preventing fraud and operational errors that contribute to both settlement and counterparty risks.

Future Trends: Settlement and Counterparty Risk in Global Remittance

Future trends in global remittance highlight a shift towards blockchain technology and central bank digital currencies (CBDCs) to reduce settlement risk by enabling near-instantaneous transactions and improving transparency. Enhanced regulatory frameworks and real-time monitoring systems are designed to mitigate counterparty risk by ensuring stronger compliance and creditworthiness assessments. These innovations collectively aim to streamline cross-border payments, lowering costs while boosting security and trust in the remittance ecosystem.

Important Terms

Payment-versus-Payment (PvP)

Payment-versus-Payment (PvP) is a settlement mechanism that eliminates settlement risk by ensuring the simultaneous exchange of payments between two parties in different currencies, effectively mitigating counterparty risk in foreign exchange transactions. This system guarantees that one party's payment occurs only if the other party's payment is made, thereby reducing the risk of loss from a counterparty default during the settlement process.

Herstatt Risk

Herstatt Risk refers specifically to settlement risk arising from time zone differences in foreign exchange transactions, where one party delivers currency while the counterparty fails to do so. Unlike broader counterparty risk, which encompasses the possibility of any default by the other party, Herstatt Risk focuses on the exposure created during the settlement process in cross-border payments.

Foreign Exchange Settlement

Foreign Exchange Settlement involves the simultaneous exchange of currencies between counterparties to mitigate settlement risk, which arises from the potential failure of one party to deliver the agreed currency amount. Counterparty risk in this context refers to the possibility that the other party may default before the settlement is completed, emphasizing the importance of reliable mechanisms like Delivery versus Payment (DvP) or Payment versus Payment (PvP) systems to reduce financial exposure.

Nostro/Vostro Accounts

Nostro and Vostro accounts facilitate cross-border transactions by holding foreign currency deposits, reducing settlement risk through cleared payment processes. These accounts mitigate counterparty risk by ensuring funds are securely held and tracked within correspondent banking relationships, enhancing transactional transparency and trust.

Liquidity Risk

Liquidity risk arises when a party cannot meet settlement obligations on time, exacerbating settlement risk by delaying or failing transaction finality. Counterparty risk involves the possibility of the opposing party defaulting on their contractual obligation, directly impacting liquidity by increasing uncertainty in cash flow availability during settlement.

Central Counterparty Clearing (CCP)

Central Counterparty Clearing (CCP) mitigates counterparty risk by acting as the intermediary between buyers and sellers, ensuring the completion of trades even if one party defaults. This mechanism significantly reduces settlement risk by guaranteeing transaction finality and managing default funds to protect market participants.

Netting

Netting reduces settlement risk by consolidating multiple payment obligations into a single net amount owed between counterparties, minimizing the total exposure during settlement. This process also lowers counterparty risk by decreasing the volume and value of transactions subject to default, enhancing overall financial stability in trading relationships.

Principal Risk

Principal risk arises when the full value of a transaction is paid out before receiving the corresponding asset or payment, distinguishing it from counterparty risk, which involves the possibility of a party failing to fulfill contractual obligations. Settlement risk specifically refers to the risk that one party delivers the asset or payment while the counterparty fails to do so, often occurring in cross-border transactions due to time zone differences.

Settlement Finality

Settlement finality ensures a transaction is irrevocably completed, eliminating settlement risk by preventing payment reversals and system disruptions. This certainty contrasts with counterparty risk, which concerns the possibility of a trading party defaulting before settlement completion.

Cross-border Remittance

Cross-border remittance involves transferring funds internationally, where settlement risk arises from the potential failure to receive funds after payment instructions are sent, while counterparty risk refers to the possibility that the remittance receiver fails to fulfill their obligations. Mitigating these risks requires robust verification processes, secure payment channels, and adherence to international compliance standards such as SWIFT and correspondent banking frameworks.

settlement risk vs counterparty risk Infographic

moneydif.com

moneydif.com