The remitting bank initiates the transfer by sending the funds from the sender's account, while the beneficiary bank receives the funds and credits them to the recipient's account. Clear communication between the remitting and beneficiary banks ensures a smooth and timely remittance process. Differences in processing times and fees between the two banks can impact the overall speed and cost of the transaction.

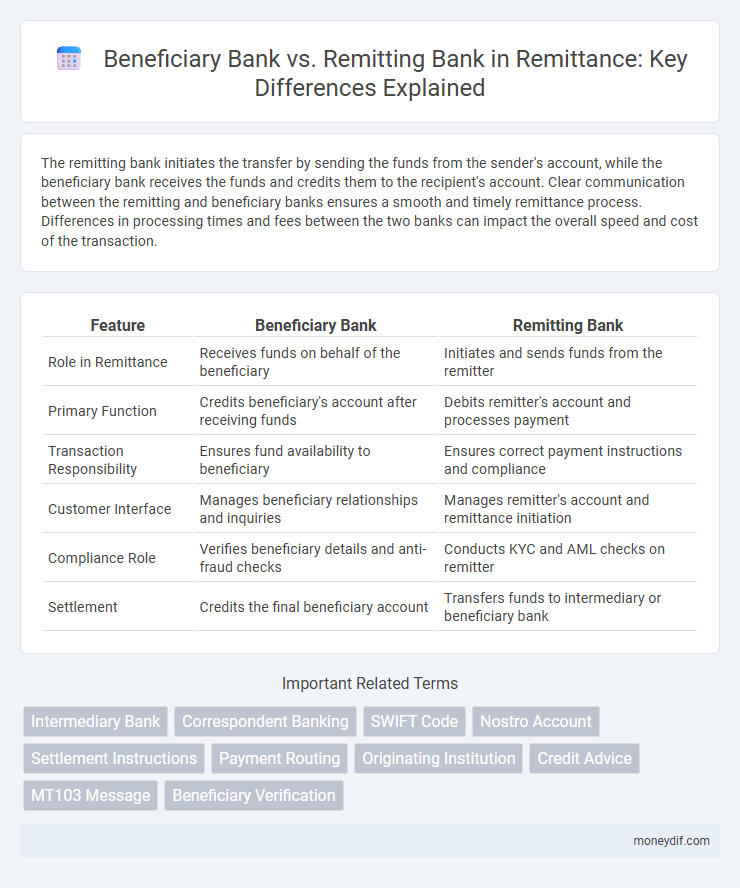

Table of Comparison

| Feature | Beneficiary Bank | Remitting Bank |

|---|---|---|

| Role in Remittance | Receives funds on behalf of the beneficiary | Initiates and sends funds from the remitter |

| Primary Function | Credits beneficiary's account after receiving funds | Debits remitter's account and processes payment |

| Transaction Responsibility | Ensures fund availability to beneficiary | Ensures correct payment instructions and compliance |

| Customer Interface | Manages beneficiary relationships and inquiries | Manages remitter's account and remittance initiation |

| Compliance Role | Verifies beneficiary details and anti-fraud checks | Conducts KYC and AML checks on remitter |

| Settlement | Credits the final beneficiary account | Transfers funds to intermediary or beneficiary bank |

Understanding Beneficiary Bank and Remitting Bank

The beneficiary bank is the financial institution where the recipient holds an account and receives the transferred funds, playing a crucial role in crediting the beneficiary accurately and promptly. The remitting bank, on the other hand, is the sender's bank responsible for initiating the remittance transaction, verifying the sender's details, and ensuring the secure transfer of funds. Understanding the distinction between these two banks is essential for efficient cross-border payments and reducing transaction errors.

Key Differences Between Beneficiary and Remitting Banks

The remitting bank initiates the transfer of funds on behalf of the sender, while the beneficiary bank receives and credits the funds to the recipient's account. Key differences include their roles in the transaction flow: the remitting bank verifies and debits the sender's account, whereas the beneficiary bank confirms account details and handles fund disbursement. Compliance responsibilities also differ, with the remitting bank focused on sender verification and the beneficiary bank ensuring the recipient's identity and account validity.

Roles and Responsibilities of Remitting Bank

The remitting bank is responsible for initiating the funds transfer, verifying the sender's account details, and ensuring compliance with regulatory requirements such as anti-money laundering (AML) and know your customer (KYC) protocols. It processes the remittance request by debiting the sender's account and forwarding the payment instructions to the beneficiary bank through secure channels like SWIFT or wire transfer systems. The remitting bank also handles any necessary currency conversions and provides transaction confirmation to the sender, facilitating a smooth and secure transfer process.

Functions of the Beneficiary Bank in Remittance

The Beneficiary Bank in remittance processes incoming funds by verifying transaction details and crediting the recipient's account accurately and securely. It ensures compliance with regulatory requirements and prevents fraud by conducting due diligence on the remittance transaction. The bank also provides transaction notifications to beneficiaries, facilitating timely access to transferred funds.

The Remittance Process: Step-by-Step Overview

The remittance process involves the remitting bank initiating the transfer by debiting the sender's account and transmitting payment instructions through the correspondent banking network. The beneficiary bank receives the funds, credits the recipient's account, and confirms receipt to complete the transaction. Each bank plays a critical role in ensuring secure, timely, and accurate fund transfer across international borders.

How Funds Are Transferred Between Banks

Funds are transferred from the remitting bank to the beneficiary bank through secure interbank payment networks, such as SWIFT or correspondent banking channels. The remitting bank initiates the transaction by debiting the sender's account and sending payment instructions to the intermediary or directly to the beneficiary bank. Upon receipt, the beneficiary bank credits the recipient's account, ensuring funds are securely and efficiently moved across borders.

Common Issues with Remitting and Beneficiary Banks

Common issues with remitting and beneficiary banks include delays in transaction processing caused by incompatible messaging formats or incomplete beneficiary details. Currency conversion discrepancies and unexpected fees often arise due to differing exchange rates and fee structures between remitting and beneficiary banks. Communication breakdowns and compliance challenges may lead to payment reversals or holds, impacting the timely delivery of remittances.

Choosing the Right Remitting Bank for International Transfers

Selecting the right remitting bank is crucial for international transfers to ensure lower fees, faster processing times, and robust security measures. The beneficiary bank's network compatibility and correspondent bank relationships directly influence transfer speed and reliability. Evaluating exchange rates, transfer limits, and customer service quality helps optimize remittance efficiency and recipient satisfaction.

Impact of Bank Charges on Remittance Recipients

Beneficiary banks often deduct fees from incoming remittances, significantly reducing the amount recipients receive compared to the original sent sum. Remitting banks may also impose charges during the transfer process, compounding the total cost borne by the sender and, indirectly, the beneficiary. Understanding these combined bank charges is crucial for senders aiming to maximize the funds delivered to recipients.

Regulatory Compliance for Remitting and Beneficiary Banks

Regulatory compliance for remitting and beneficiary banks ensures adherence to anti-money laundering (AML) and counter-terrorism financing (CTF) laws, safeguarding international remittance flows. Remitting banks must conduct thorough customer due diligence and monitor transactions for suspicious activity before initiating transfers, while beneficiary banks verify the legitimacy of incoming funds and report any anomalies to regulatory authorities. Both institutions are required to implement robust compliance frameworks aligned with global standards such as those set by the Financial Action Task Force (FATF) to maintain the integrity of cross-border remittances.

Important Terms

Intermediary Bank

An intermediary bank acts as a third-party financial institution facilitating the transfer of funds between the remitting bank, which initiates the payment, and the beneficiary bank, which receives the funds on behalf of the recipient. This intermediary bank ensures secure and efficient cross-border transactions by bridging the gap between the sending remitting bank and the receiving beneficiary bank, often handling currency conversions and compliance checks.

Correspondent Banking

Correspondent banking establishes a network where the remitting bank initiates the transaction and the beneficiary bank receives the funds on behalf of the final recipient, ensuring seamless cross-border payments. This relationship leverages intermediary financial institutions to facilitate currency exchange, compliance checks, and settlement processes between geographically separated banks.

SWIFT Code

SWIFT codes uniquely identify banks involved in international wire transfers, with the beneficiary bank code specifying the receiver's institution and the remitting bank code identifying the sender's bank. Accurate use of these codes ensures seamless transaction routing and timely settlement between the remitting and beneficiary banks.

Nostro Account

A Nostro Account is held by a bank (remitting bank) in a foreign currency with another bank (beneficiary bank) to facilitate international transactions and settlements. This account enables the remitting bank to efficiently manage funds and currency risks while ensuring smooth cross-border payment processing between both financial institutions.

Settlement Instructions

Settlement instructions specify the payment details the remitting bank must follow to transfer funds accurately to the beneficiary bank, ensuring compliance with regulatory and correspondent banking requirements. Precise settlement instructions minimize errors and delays by clearly identifying intermediary banks, account numbers, currency, and payment references between the beneficiary bank and remitting bank.

Payment Routing

Payment routing involves directing funds from the remitting bank, which initiates the payment, to the beneficiary bank, where the recipient holds an account, ensuring secure and efficient transaction processing. Accurate routing depends on factors such as SWIFT codes, IBANs, and intermediary banks to facilitate cross-border payments and minimize delays or errors.

Originating Institution

The Originating Institution refers to the financial entity initiating a transaction, often synonymous with the Remitting Bank responsible for sending funds. The Beneficiary Bank is the receiving financial institution where the beneficiary holds an account, completing the transfer initiated by the Originating Institution.

Credit Advice

Credit advice is a financial notification sent by the beneficiary bank to inform the recipient of funds credited to their account, ensuring accuracy and transparency in international transactions. The remitting bank initiates the payment and communicates with intermediary banks to transfer funds, while the beneficiary bank confirms receipt and credits the beneficiary's account accordingly.

MT103 Message

MT103 messages are standardized SWIFT payment instructions used in international wire transfers, clearly specifying the roles of the Beneficiary Bank and the Remitting Bank to ensure accurate fund settlement. The Remitting Bank initiates the payment, while the Beneficiary Bank receives the funds on behalf of the beneficiary, with detailed fields in the MT103 ensuring transparency and traceability throughout the transaction process.

Beneficiary Verification

Beneficiary verification ensures the accuracy of recipient details by cross-checking information between the beneficiary bank and the remitting bank to prevent fraud and transaction errors. This process involves validating account numbers, bank identification codes (BIC or SWIFT), and beneficiary names to ensure funds are securely transferred to the intended party.

Beneficiary Bank vs Remitting Bank Infographic

moneydif.com

moneydif.com