Foreign correspondents facilitate cross-border remittance by partnering with international banks to ensure secure and timely fund transfers. Domestic correspondents operate within the sender's country, streamlining the initial collection and processing of funds before they are dispatched abroad. Both correspondents play essential roles in enhancing the efficiency and reliability of remittance services.

Table of Comparison

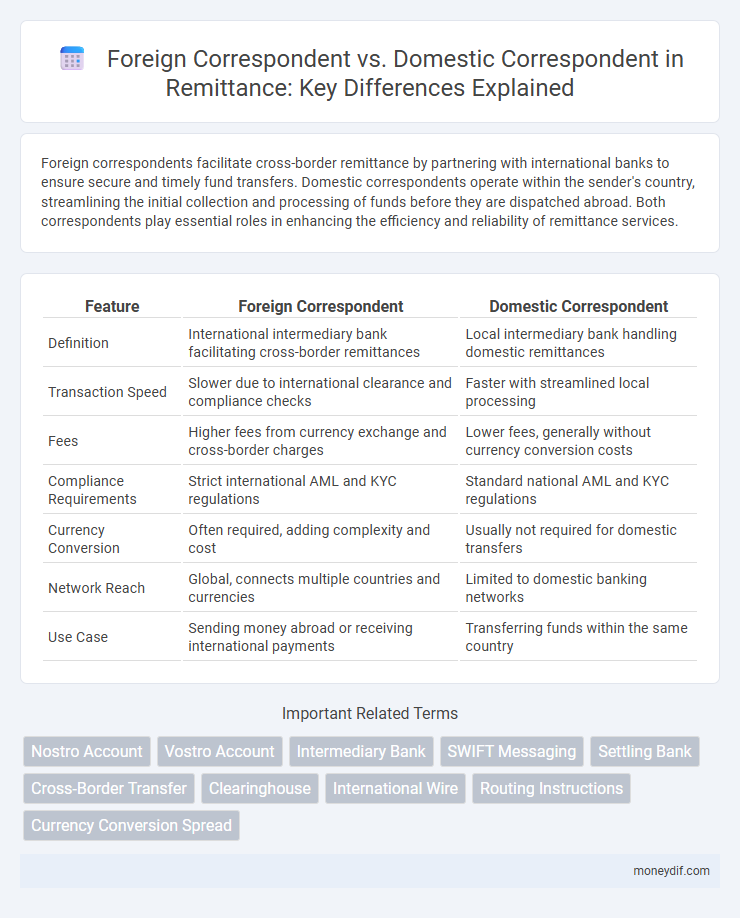

| Feature | Foreign Correspondent | Domestic Correspondent |

|---|---|---|

| Definition | International intermediary bank facilitating cross-border remittances | Local intermediary bank handling domestic remittances |

| Transaction Speed | Slower due to international clearance and compliance checks | Faster with streamlined local processing |

| Fees | Higher fees from currency exchange and cross-border charges | Lower fees, generally without currency conversion costs |

| Compliance Requirements | Strict international AML and KYC regulations | Standard national AML and KYC regulations |

| Currency Conversion | Often required, adding complexity and cost | Usually not required for domestic transfers |

| Network Reach | Global, connects multiple countries and currencies | Limited to domestic banking networks |

| Use Case | Sending money abroad or receiving international payments | Transferring funds within the same country |

Understanding Remittance: Foreign vs Domestic Correspondent Roles

Foreign correspondents in remittance facilitate international money transfers by partnering with banks and financial institutions abroad to ensure cross-border compliance and currency exchange management. Domestic correspondents handle the distribution and receipt of funds within a single country, optimizing local network efficiency and regulatory adherence. Understanding these roles helps enhance transaction speed, reduce costs, and ensure secure fund delivery in global and local remittance processes.

Key Differences Between Foreign and Domestic Correspondent Banking

Foreign correspondent banking involves cross-border partnerships where financial institutions maintain accounts with overseas banks to facilitate international transactions, while domestic correspondent banking operates within the same country to support local interbank activities. Key differences include regulatory compliance requirements, with foreign correspondent banks facing stricter anti-money laundering (AML) and know-your-customer (KYC) protocols due to higher risks associated with international remittances. Additionally, foreign correspondent relationships often incur higher transaction costs and longer processing times compared to domestic correspondent banking.

The Remittance Process: How Foreign Correspondents Operate

Foreign correspondents in the remittance process serve as intermediary banks located outside the sender's country, facilitating cross-border fund transfers by maintaining relationships with domestic correspondents. They handle currency conversions, compliance with international regulations, and ensure secure transmission through correspondent banking networks. This system enables efficient and reliable fund transfers by bridging local financial institutions and foreign banking systems.

Domestic Correspondent Banks: Functions in Local Remittance

Domestic correspondent banks play a crucial role in local remittance by facilitating fund transfers within the same country, ensuring faster and more efficient processing compared to foreign correspondents. They provide essential services such as liquidity management, settlement of transactions, and regulatory compliance aligned with domestic banking laws. These banks enhance transparency and reduce transfer costs by streamlining communication and settlement between local financial institutions.

Advantages of Using Foreign Correspondent Banks for Remittance

Foreign correspondent banks facilitate faster cross-border remittances by leveraging established international networks and local banking relationships, reducing transfer times significantly. They offer enhanced currency exchange rates and lower foreign transaction fees compared to domestic correspondents handling international payments. Access to diverse banking systems through foreign correspondents ensures better compliance with regional regulations and minimizes risks of transaction delays or blockages.

Cost Comparison: Foreign vs Domestic Correspondent Fees

Foreign correspondent fees in remittance transactions are generally higher due to cross-border processing, currency conversion, and intermediary banking costs, often ranging from 1% to 3% of the transaction value. Domestic correspondent fees are typically lower, averaging around 0.5% to 1%, as the payment stays within national banking networks with fewer intermediaries involved. Choosing domestic correspondents can significantly reduce overall remittance expenses, improving cost efficiency for senders and recipients.

Compliance and Regulatory Issues: Foreign vs Domestic Correspondents

Foreign correspondents in remittance face stricter compliance and regulatory scrutiny due to cross-border anti-money laundering (AML) and counter-terrorism financing (CTF) laws, requiring enhanced due diligence and reporting protocols. Domestic correspondents operate under a unified regulatory framework, streamlining verification processes and reducing the complexity of compliance requirements. Regulatory bodies impose higher documentation standards and transaction monitoring for foreign correspondent networks to prevent illicit financial flows across jurisdictions.

Security and Risk Management in Correspondent Remittance

Foreign correspondent remittance involves cross-border transactions that inherently carry higher security risks such as currency fluctuations, regulatory compliance challenges, and potential exposure to international fraud schemes. Domestic correspondent remittance typically benefits from more robust regulatory oversight, streamlined verification processes, and closer collaboration between financial institutions, thereby reducing the likelihood of operational risks and enhancing transaction security. Integrating advanced risk management systems, including real-time monitoring and multi-factor authentication, is critical in mitigating vulnerabilities associated with both foreign and domestic correspondent remittance networks.

Technology Impact on Correspondent Banking in Remittance Services

Technology advancements have significantly enhanced the efficiency of foreign correspondent banking by enabling real-time cross-border payments and reducing transaction costs through blockchain and APIs. Domestic correspondent banking benefits from improved digital platforms that streamline fund transfers within national borders, increasing speed and transparency. Integration of fintech solutions bridges both foreign and domestic correspondents, optimizing remittance services with faster settlement times and enhanced compliance monitoring.

Choosing the Right Correspondent: Factors for Remittance Senders

Choosing the right correspondent for remittance depends on factors like transaction speed, cost, currency exchange rates, and network accessibility. Foreign correspondents facilitate cross-border transfers with broader reach but may incur higher fees and longer processing times. Domestic correspondents offer faster settlements and lower costs within the same country, ideal for local currency transfers and urgent payments.

Important Terms

Nostro Account

A Nostro Account is a bank account held by a domestic bank in a foreign correspondent bank, facilitating international trade and foreign exchange transactions. It contrasts with a Domestic Correspondent Account, which is maintained between banks within the same country to settle local interbank payments efficiently.

Vostro Account

A Vostro account is a bank account held by a foreign bank in the domestic bank's currency, facilitating smooth foreign correspondent transactions by enabling accurate settlement and clearing of international payments. Unlike domestic correspondent accounts, which manage transactions within the same country and currency, Vostro accounts play a crucial role in cross-border financial operations by maintaining balances on behalf of foreign banks.

Intermediary Bank

An intermediary bank facilitates cross-border transactions by acting as a middle entity between the foreign correspondent bank and the domestic correspondent bank, ensuring smooth transfer of funds and currency exchange. Foreign correspondent banks maintain accounts for domestic banks abroad, enabling international payments, while domestic correspondent banks handle local clearing and settlement within the country.

SWIFT Messaging

SWIFT messaging enables secure, standardized communication between financial institutions, differentiating between foreign correspondent banks that facilitate international transactions and domestic correspondent banks that handle payments within the same country. Foreign correspondents manage cross-border currency exchanges and regulatory compliance, whereas domestic correspondents focus on local clearing, settlement processes, and compliance with national banking regulations.

Settling Bank

A Settling Bank acts as an intermediary to finalize international transactions between Foreign Correspondent banks and Domestic Correspondent banks, ensuring the secure transfer of funds across borders. It facilitates currency exchange, verifies payment details, and mitigates risks inherent in cross-border settlements, optimizing the efficiency of global banking networks.

Cross-Border Transfer

Cross-border transfer involves moving funds between banks in different countries, where foreign correspondents facilitate international transactions by maintaining accounts abroad, while domestic correspondents handle transfers within the same country. Foreign correspondent banks provide essential foreign exchange services and regulatory compliance for global payments, contrasting with domestic correspondents focused on local clearing and settlement systems.

Clearinghouse

A clearinghouse acts as a centralized intermediary facilitating transactions between foreign correspondents, who handle cross-border financial activities, and domestic correspondents that manage local banking operations. Efficient coordination through clearinghouses ensures seamless settlement, reduces risk exposure, and streamlines compliance with international banking regulations.

International Wire

International wire transfers involve moving funds across borders through foreign correspondents, banks located in a recipient country that facilitate currency exchange and compliance with local regulations. Domestic correspondents, on the other hand, are intermediary banks within the same country that support the transfer process by ensuring seamless communication and settlement between the sender's and recipient's banks.

Routing Instructions

Routing instructions for foreign correspondents require adherence to international banking protocols, including SWIFT codes and correspondent bank details, to ensure seamless cross-border fund transfers. Domestic correspondents utilize local clearing systems like ACH or Fedwire, focusing on routing numbers and intra-country compliance for efficient transaction processing.

Currency Conversion Spread

Currency conversion spread is the difference between buying and selling exchange rates applied by correspondents during international transactions; foreign correspondents typically impose wider spreads than domestic correspondents due to higher risks, operational costs, and regulatory complexities. Efficient management of conversion spreads by choosing domestic correspondents can minimize transaction costs and improve currency exchange value in cross-border financial operations.

Foreign Correspondent vs Domestic Correspondent Infographic

moneydif.com

moneydif.com