Hawala and hundi are traditional informal methods of transferring money, primarily used in South Asia and the Middle East, offering fast and secure remittance without relying on formal banking channels. While hawala operates through a network of brokers who settle debts based on trust and limited documentation, hundi functions similarly but often includes credit instruments resembling bills of exchange. Both systems bypass regulatory scrutiny, enabling efficient cross-border transfers but posing challenges for financial transparency and anti-money laundering efforts.

Table of Comparison

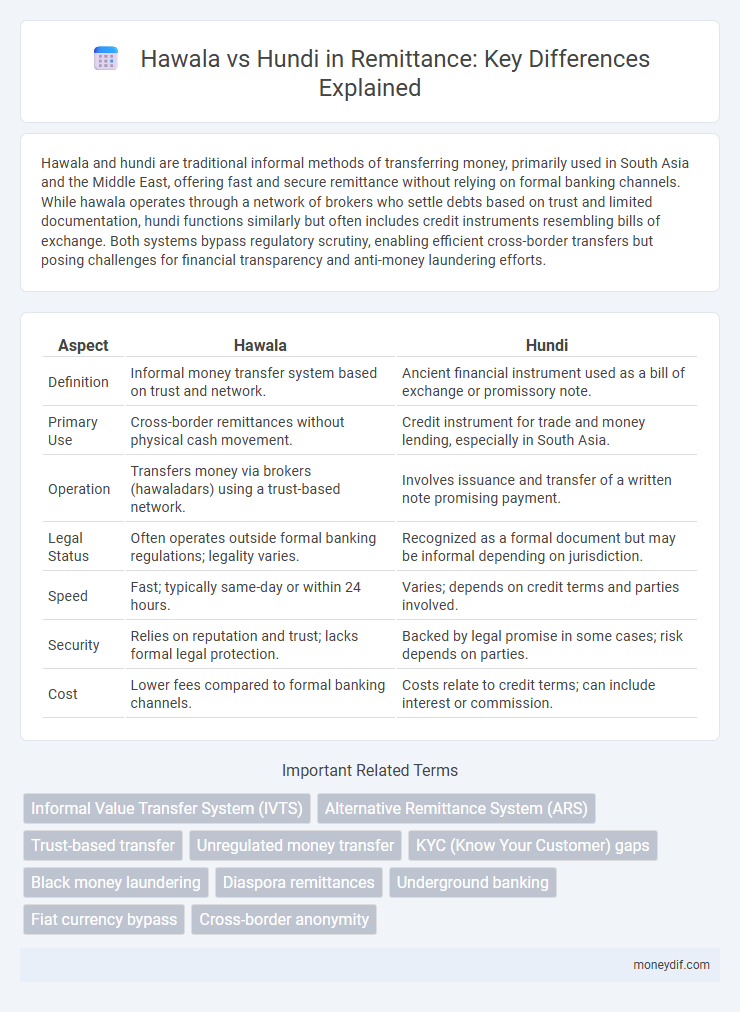

| Aspect | Hawala | Hundi |

|---|---|---|

| Definition | Informal money transfer system based on trust and network. | Ancient financial instrument used as a bill of exchange or promissory note. |

| Primary Use | Cross-border remittances without physical cash movement. | Credit instrument for trade and money lending, especially in South Asia. |

| Operation | Transfers money via brokers (hawaladars) using a trust-based network. | Involves issuance and transfer of a written note promising payment. |

| Legal Status | Often operates outside formal banking regulations; legality varies. | Recognized as a formal document but may be informal depending on jurisdiction. |

| Speed | Fast; typically same-day or within 24 hours. | Varies; depends on credit terms and parties involved. |

| Security | Relies on reputation and trust; lacks formal legal protection. | Backed by legal promise in some cases; risk depends on parties. |

| Cost | Lower fees compared to formal banking channels. | Costs relate to credit terms; can include interest or commission. |

Understanding Hawala and Hundi Systems

Hawala and hundi are informal value transfer systems widely used for remittances, primarily in South Asia and the Middle East, operating outside traditional banking channels. Hawala relies on a network of brokers who facilitate transactions based on trust and balancing accounts without physical money movement, while hundi functions as a financial instrument similar to a promissory note, often used for credit and trade purposes. Both systems provide quick, low-cost remittance options but face regulatory scrutiny due to challenges in tracking and preventing money laundering.

Historical Origins of Hawala and Hundi

Hawala and hundi trace their historical origins to ancient South Asia and the Middle East, with hundi documented in Indian financial practices dating back over a millennium as informal promissory notes facilitating trade and credit. Hawala developed as a parallel remittance system rooted in Arab and Persian merchant networks, relying on trust-based money transfers without physical movement of cash. Both systems evolved to circumvent formal banking restrictions, shaping informal financial channels crucial for cross-border commerce and migrant remittances.

How the Hawala Remittance System Works

The hawala remittance system operates through a network of trusted brokers who facilitate international money transfers without physical movement of cash, relying on a trust-based ledger rather than formal banking channels. Clients give money to a local hawala dealer who instructs a counterpart in the recipient's location to deliver the equivalent amount, creating a parallel system outside conventional financial institutions. This system leverages mutual trust, reputation, and minimal documentation, enabling fast, low-cost transactions often used in regions with limited banking infrastructure.

Operational Mechanisms of Hundi Transfers

Hundi transfers operate through an informal trust-based network where a sender approaches a local agent who issues a hundi note as a promise of payment. The local agent then communicates with a corresponding agent in the recipient's location, who disburses the equivalent amount in local currency without any physical movement of money across borders. This system bypasses formal banking channels, relying heavily on personal relationships and community trust to ensure transaction completion.

Key Differences Between Hawala and Hundi

Hawala and hundi are traditional informal remittance systems primarily used in South Asia and the Middle East, but they differ in structure and legal recognition. Hawala operates through a network of brokers or hawaladars who transfer money without physical movement by balancing accounts, while hundi is a financial instrument resembling a bill of exchange or promissory note used for credit and remittance purposes. The key difference lies in hawala's widespread use for fast, trust-based transfers across borders and hundi's formalized use in trade finance and credit with more documented transactions.

Legality and Regulatory Perspectives

Hawala operates as an informal value transfer system often outside formal banking regulations, making it susceptible to legal scrutiny and challenges related to anti-money laundering (AML) compliance. In contrast, hundi, historically used in South Asia as a traditional credit instrument, sometimes falls into a legal grey area but is increasingly subjected to regulation to curb illicit financial flows. Regulatory frameworks worldwide strive to formalize these systems to enhance transparency and ensure alignment with international financial laws.

Risks and Security Concerns in Informal Remittance

Hawala and hundi systems pose significant risks due to their lack of regulatory oversight, exposing users to potential fraud, money laundering, and funding of illicit activities. The informal nature of these remittance methods means transactions often lack transparency, making it difficult for authorities to track and verify funds. Security concerns also include the possibility of loss of funds without legal recourse and increased vulnerability to exploitation by criminal networks.

Hawala and Hundi in the Modern Financial Market

Hawala and Hundi are informal value transfer systems extensively used in the modern financial market, especially within South Asia and the Middle East, facilitating cross-border remittances without traditional banking intermediaries. Hawala operates on trust-based networks allowing quick and low-cost transfers, often bypassing regulatory scrutiny, while Hundi historically functioned as a financial instrument for trade credit and debt settlement, evolving into a parallel remittance channel. Both systems impact the global remittance ecosystem by offering alternative solutions for migrant workers and businesses in regions with limited formal banking infrastructure.

Impact of Hawala and Hundi on Global Remittances

Hawala and Hundi systems significantly influence global remittances by providing informal channels that bypass traditional banking infrastructures, enabling faster and often cheaper transfers, especially in regions with limited financial access. These networks impact regulatory frameworks and anti-money laundering efforts due to their decentralized nature and lack of formal documentation. Despite challenges, Hawala and Hundi facilitate vital economic support for millions through remittances, sustaining livelihoods in underserved communities worldwide.

The Future of Informal Remittance Channels

Hawala and hundi remain pivotal informal remittance channels, providing fast, low-cost money transfers across borders despite regulatory scrutiny. Their future hinges on integrating digital technologies to enhance transparency and compliance while preserving anonymity and accessibility for unbanked populations. As traditional banking systems evolve, these informal networks adapt, blending legacy trust mechanisms with modern fintech innovations to meet growing global remittance demands.

Important Terms

Informal Value Transfer System (IVTS)

Informal Value Transfer Systems (IVTS) like hawala and hundi enable rapid, trust-based cross-border money transfers without formal banking channels, primarily used in South Asia and the Middle East.

Alternative Remittance System (ARS)

Alternative Remittance Systems (ARS), such as hawala and hundi, facilitate informal, trust-based money transfers across borders without conventional banking channels, often used in regions with limited financial infrastructure.

Trust-based transfer

Trust-based transfer systems like hawala and hundi rely on informal networks to transfer money without physical movement of cash, bypassing formal banking channels. Hawala is widely used in South Asia and the Middle East, emphasizing anonymity and speed, while hundi historically served as a credit instrument within Indian trade, blending money transfer with debt acknowledgment.

Unregulated money transfer

Unregulated money transfer systems such as hawala and hundi operate outside formal banking channels, relying on trust-based networks for cross-border remittances without conventional documentation. These mechanisms enable quick, low-cost transfers but pose regulatory challenges due to their potential use in money laundering and financing illegal activities.

KYC (Know Your Customer) gaps

KYC gaps in hawala and hundi systems arise from their informal nature, lacking standardized customer verification processes that mitigate money laundering and terrorist financing risks. The absence of formal documentation and regulatory oversight in these alternative remittance methods creates challenges in tracing transaction origins and ensuring compliance with anti-money laundering (AML) regulations.

Black money laundering

Black money laundering exploits hawala and hundi systems by using informal, unregulated money transfer methods to evade legal scrutiny and obscure illicit financial flows.

Diaspora remittances

Diaspora remittances via hawala offer a secure, informal method for transferring funds internationally without relying on traditional banking systems, often favored for lower fees and faster transactions. In contrast, hundi serves as a traditional South Asian credit instrument enabling deferred payments and trade settlements, with remittances typically processed through documented financial channels.

Underground banking

Underground banking systems such as hawala and hundi enable informal, off-the-record money transfers that bypass formal financial institutions, facilitating rapid cross-border remittances without conventional documentation. Hawala operates on trust-based networks primarily in South Asia and the Middle East, while hundi, historically rooted in Indian subcontinent trade, functions similarly but often serves both remittance and credit purposes within informal economies.

Fiat currency bypass

Fiat currency bypass methods such as hawala and hundi operate as informal value transfer systems, enabling rapid, low-cost cross-border transactions outside conventional banking channels.

Cross-border anonymity

Cross-border anonymity in informal value transfer systems is exemplified by hawala's reliance on trust-based, undocumented transactions, contrasting with hundi's semi-formal paper documentation that partially reduces anonymity.

hawala vs hundi Infographic

moneydif.com

moneydif.com