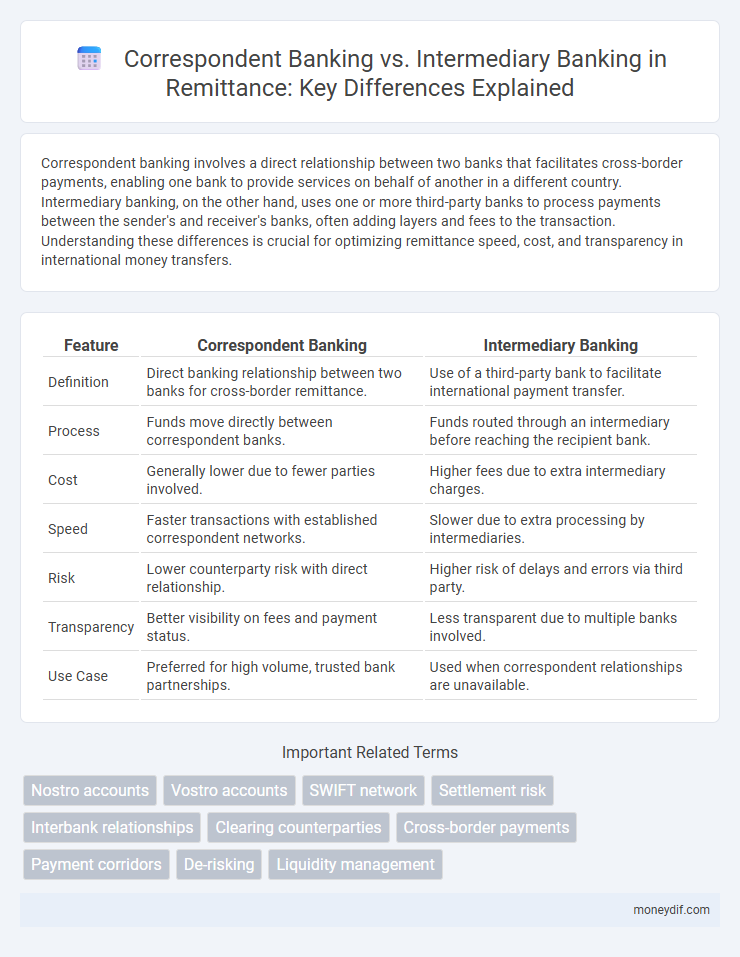

Correspondent banking involves a direct relationship between two banks that facilitates cross-border payments, enabling one bank to provide services on behalf of another in a different country. Intermediary banking, on the other hand, uses one or more third-party banks to process payments between the sender's and receiver's banks, often adding layers and fees to the transaction. Understanding these differences is crucial for optimizing remittance speed, cost, and transparency in international money transfers.

Table of Comparison

| Feature | Correspondent Banking | Intermediary Banking |

|---|---|---|

| Definition | Direct banking relationship between two banks for cross-border remittance. | Use of a third-party bank to facilitate international payment transfer. |

| Process | Funds move directly between correspondent banks. | Funds routed through an intermediary before reaching the recipient bank. |

| Cost | Generally lower due to fewer parties involved. | Higher fees due to extra intermediary charges. |

| Speed | Faster transactions with established correspondent networks. | Slower due to extra processing by intermediaries. |

| Risk | Lower counterparty risk with direct relationship. | Higher risk of delays and errors via third party. |

| Transparency | Better visibility on fees and payment status. | Less transparent due to multiple banks involved. |

| Use Case | Preferred for high volume, trusted bank partnerships. | Used when correspondent relationships are unavailable. |

Overview of Correspondent Banking and Intermediary Banking

Correspondent banking involves a direct relationship between two banks that enables cross-border payments and remittances by allowing one bank to provide services on behalf of another. Intermediary banking refers to the use of one or more financial institutions to facilitate transactions between the sender's bank and the recipient's bank when no direct correspondent relationship exists. Both models play essential roles in the global remittance infrastructure by ensuring secure and efficient funds transfer across international borders.

Key Differences Between Correspondent and Intermediary Banking

Correspondent banking involves a direct relationship between two financial institutions to provide services such as cross-border payments, while intermediary banking refers to the use of a third-party bank to facilitate the transaction between the sender's and receiver's banks. Key differences include the nature of the relationship, where correspondent banks maintain accounts for each other enabling more control and reduced costs, whereas intermediary banks act solely as facilitators, often increasing transaction time and fees. Correspondent banking supports a broader range of services including foreign exchange and settlements, contrasting with intermediary banking's narrower focus on payment routing.

How Correspondent Banking Works in Remittance

Correspondent banking in remittance involves a network of banks holding accounts with one another, enabling cross-border fund transfers through established financial partnerships. When a sender initiates a remittance, their bank uses the correspondent bank's account in the recipient's country to facilitate currency conversion and final delivery. This system ensures secure and efficient international payments by leveraging trusted interbank relationships and compliance with regulatory standards.

The Mechanism of Intermediary Banking in Cross-Border Payments

Intermediary banking in cross-border payments involves a third-party bank facilitating the transfer of funds between the sender's bank and the beneficiary's bank when no direct correspondent relationship exists. This mechanism relies on a network of intermediary banks holding accounts with both the originating and receiving banks, enabling the clearance and settlement of funds across different financial systems. The use of intermediary banks enhances global transaction reach but can increase processing time and costs due to multiple bank fees and regulatory compliance checks.

Pros and Cons of Correspondent Banking for Remittances

Correspondent banking facilitates remittances by enabling direct financial institutions partnerships, ensuring faster transaction settlement and broader geographic coverage. However, it poses risks such as high compliance costs, increased regulatory scrutiny, and potential delays due to anti-money laundering checks. Despite these challenges, correspondent banking remains essential for accessing remote markets and supporting cross-border money transfers efficiently.

Advantages and Disadvantages of Intermediary Banking in Remittances

Intermediary banking in remittances offers the advantage of expanding access to global financial networks, especially in regions with limited direct correspondent banking relationships. However, it often results in higher transaction costs and longer processing times due to multiple middlemen involved in the fund transfer. The lack of transparency and increased risk of delays or funds being held can disadvantage senders and recipients relying on timely remittance delivery.

Cost Implications: Correspondent vs Intermediary Banking

Correspondent banking often involves higher costs due to multiple layers of fees charged by each bank in the transaction chain, increasing the overall expense for remittance transfers. Intermediary banking typically reduces these fees by streamlining the process through fewer financial institutions, leading to lower transaction costs and faster processing times. Cost implications directly impact the efficiency and affordability of cross-border remittances, influencing customer choice between correspondent and intermediary banking channels.

Compliance and Regulatory Considerations

In remittance processes, correspondent banking involves direct relationships between financial institutions to facilitate cross-border payments, requiring stringent compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations to prevent illicit activities. Intermediary banking, which utilizes third-party banks to route transactions, often adds layers of complexity in regulatory adherence and increases risks related to compliance oversight and transparency. Both models demand robust monitoring systems and adherence to international standards such as FATF recommendations to ensure compliance and mitigate regulatory risks in cross-border remittances.

Impact on Speed and Efficiency of Remittance Transfers

Correspondent banking involves direct relationships between banks to facilitate cross-border remittance transfers, often enabling faster and more transparent transactions due to established networks and streamlined processes. Intermediary banking introduces additional middlemen, which can slow down transfer speeds and increase processing time owing to the need for multiple verifications and reconciliations. Consequently, correspondent banking generally enhances the efficiency of remittance transfers by reducing delays and lowering transaction costs compared to the intermediary banking model.

Future Trends in Remittance: Correspondent and Intermediary Banking

Future trends in remittance emphasize increased digital integration in correspondent and intermediary banking to enhance transaction speed and reduce costs. Correspondent banks leverage blockchain and API connectivity to streamline cross-border fund transfers, while intermediary banks focus on improving compliance and transparency through advanced fintech solutions. Enhanced collaboration between correspondent and intermediary banks is expected to drive a more efficient and secure remittance ecosystem globally.

Important Terms

Nostro accounts

Nostro accounts in correspondent banking facilitate direct foreign currency holdings between two banks, whereas in intermediary banking, they are used by a third-party bank to manage transactions between the correspondent and the ultimate beneficiary bank.

Vostro accounts

Vostro accounts are maintained by correspondent banks to facilitate intermediary banking by enabling seamless cross-border payments and currency exchange between domestic banks and foreign financial institutions.

SWIFT network

SWIFT network facilitates secure communication in correspondent banking by enabling direct financial messaging between banks, whereas intermediary banking involves third-party banks acting as middlemen in processing international transactions.

Settlement risk

Settlement risk in correspondent banking arises from direct bilateral transactions between banks, while in intermediary banking, it involves an additional third-party bank that increases complexity and potential delay in final fund settlement.

Interbank relationships

Interbank relationships in correspondent banking involve direct agreements where banks provide payment and settlement services on behalf of each other across different jurisdictions, facilitating international transactions. In contrast, intermediary banking relies on third-party banks to process payments between the originating and beneficiary banks, often adding layers that increase transaction time and costs.

Clearing counterparties

Clearing counterparties in correspondent banking primarily facilitate cross-border payment settlements by acting as trusted agents between domestic banks and foreign financial institutions, ensuring compliance with international regulations and reducing settlement risks. In intermediary banking, clearing counterparties serve as middlemen that process transactions through a chain of banks, enhancing payment efficiency but potentially increasing complexity and operational risk due to multiple entities involved.

Cross-border payments

Cross-border payments often leverage correspondent banking, where banks maintain mutual accounts to facilitate international transactions, enabling direct settlement but sometimes causing delays due to multiple intermediaries. Intermediary banking, by contrast, involves a third-party financial institution acting as a middleman, which can increase processing times and fees but helps bridge connections when direct correspondent relationships are unavailable.

Payment corridors

Payment corridors leveraging correspondent banking rely on established bilateral relationships between banks for cross-border transactions while intermediary banking uses third-party banks to facilitate payments, impacting cost, speed, and transparency in international money transfers.

De-risking

De-risking in correspondent banking involves banks terminating or restricting relationships with high-risk foreign counterparts to avoid regulatory scrutiny and compliance costs, often leading to reduced access to international financial services for certain regions. Intermediary banking, which uses third-party banks to facilitate cross-border transactions, can mitigate de-risking impacts by maintaining transaction flows through more trusted, lower-risk channels.

Liquidity management

Liquidity management in correspondent banking relies on maintaining sufficient funds across multiple foreign accounts, whereas intermediary banking focuses on optimizing liquidity through third-party financial institutions facilitating cross-border transactions.

correspondent banking vs intermediary banking Infographic

moneydif.com

moneydif.com