Electronic Funds Transfer (EFT) offers a convenient and cost-effective method for sending money, utilizing digital networks to transfer funds between bank accounts with minimal fees and processing times. Wire transfers provide a faster, more secure option for high-value or international transactions, often involving manual processing and higher costs but ensuring immediate fund availability. Choosing between EFT and wire transfer depends on transaction urgency, cost considerations, and the geographical location of the sender and recipient.

Table of Comparison

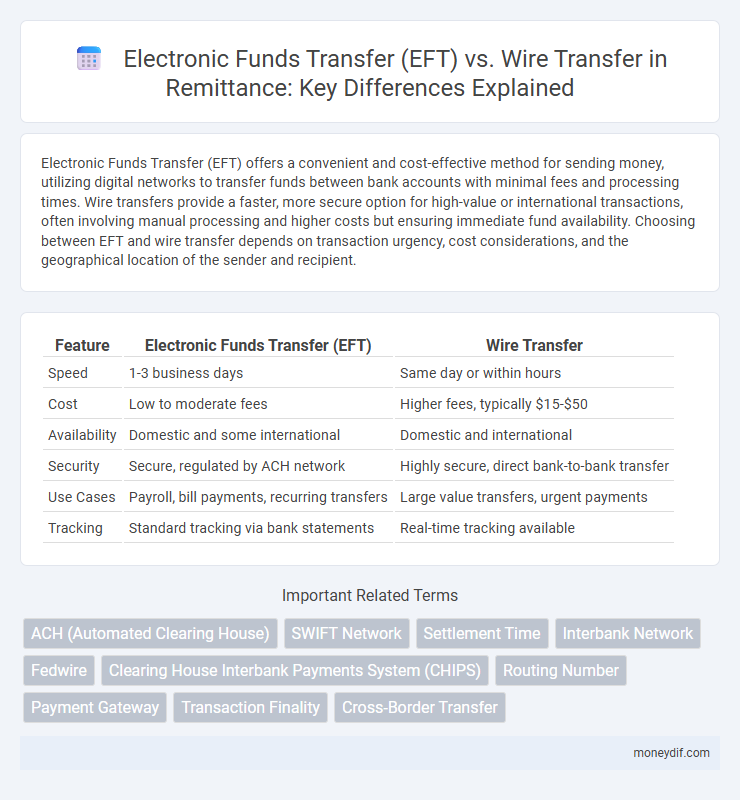

| Feature | Electronic Funds Transfer (EFT) | Wire Transfer |

|---|---|---|

| Speed | 1-3 business days | Same day or within hours |

| Cost | Low to moderate fees | Higher fees, typically $15-$50 |

| Availability | Domestic and some international | Domestic and international |

| Security | Secure, regulated by ACH network | Highly secure, direct bank-to-bank transfer |

| Use Cases | Payroll, bill payments, recurring transfers | Large value transfers, urgent payments |

| Tracking | Standard tracking via bank statements | Real-time tracking available |

Overview of Electronic Funds Transfer (EFT) and Wire Transfer

Electronic Funds Transfer (EFT) enables the digital movement of money between bank accounts through electronic networks, encompassing various methods such as direct deposits, ATM transactions, and online bill payments. Wire Transfer is a specific type of EFT that facilitates real-time, direct bank-to-bank transfers for domestic and international payments, typically settled the same day. While EFT covers a broad range of electronic payment systems, Wire Transfers are preferred for faster, high-value transactions requiring immediate confirmation.

Key Differences Between EFT and Wire Transfer

Electronic Funds Transfer (EFT) encompasses a broad range of digital payment methods, including direct deposits, ATM transfers, and online bill payments, characterized by batch processing and typically lower fees. Wire transfers are a specific type of EFT that provide real-time, direct bank-to-bank transfers, ideal for high-value or time-sensitive transactions, with higher fees and stricter verification processes. Key differences include speed, cost, and transaction scope, where EFTs are generally slower and cheaper, while wire transfers offer immediate funds availability and enhanced security measures.

Speed of Transaction: EFT vs Wire Transfer

Electronic Funds Transfer (EFT) typically processes transactions within 1-3 business days, making it a cost-effective option for non-urgent remittances. Wire transfers offer faster speed, often completing within a few hours to the same day, ideal for urgent, high-value international payments. Both methods ensure secure fund transfers, but wire transfers prioritize speed over cost efficiency.

Cost Comparison: EFT Fees vs Wire Transfer Fees

Electronic Funds Transfer (EFT) generally incurs lower fees compared to wire transfers, often ranging from $0.25 to $3 per transaction, making EFT more cost-effective for routine payments. Wire transfers typically charge between $20 and $50 per transaction, reflecting higher costs due to faster processing and international service capabilities. Businesses and consumers choosing between EFT and wire transfer should consider these fee structures alongside transaction speed and security requirements.

Security Features of EFT and Wire Transfers

Electronic Funds Transfer (EFT) employs advanced encryption protocols and multi-factor authentication to secure transactions and reduce fraud risk. Wire transfers utilize secure banking networks like the SWIFT system, which incorporates robust verification steps and traceable transaction records for enhanced security. Both methods prioritize confidentiality and integrity, but EFT often offers additional layers of protection through automated fraud detection and real-time monitoring.

Accessibility and Convenience for Remitters

Electronic Funds Transfer (EFT) offers greater accessibility for remitters through its integration with online banking platforms and mobile apps, enabling transfers anytime and anywhere. Wire transfers, while reliable and fast, typically require visiting a bank branch or using specific wire transfer services, limiting convenience for some users. EFT's lower fees and streamlined process further enhance convenience, making it a preferred method for everyday remittances.

Geographic Limitations: Domestic vs International Transfers

Electronic Funds Transfers (EFT) primarily facilitate domestic transactions within a single country, offering fast and cost-effective transfers through bank networks like ACH in the United States. Wire transfers support both domestic and international payments, enabling cross-border fund transfers with higher fees but enhanced security and speed for urgent overseas transactions. Geographic limitations make EFT ideal for local payments, while wire transfers remain the preferred method for international remittances due to global banking network connectivity.

Use Cases: When to Choose EFT or Wire Transfer

Electronic Funds Transfer (EFT) is ideal for routine, domestic payments such as payroll, bill payments, and vendor transactions due to its lower cost and convenience. Wire transfers are preferred for urgent, high-value or international transactions where speed and security are paramount, often used in real estate closings, international trade, or emergencies. Choosing EFT suits recurring, less time-sensitive transfers, while wire transfers excel in one-time, immediate fund movements requiring guaranteed delivery.

Regulatory Compliance and Safety Standards

Electronic Funds Transfer (EFT) systems adhere to stringent regulatory frameworks such as the Electronic Fund Transfer Act (EFTA) in the US, ensuring consumer protection through error resolution and fraud prevention measures. Wire transfers operate under strict guidelines set by financial authorities including the Financial Crimes Enforcement Network (FinCEN) and comply with Anti-Money Laundering (AML) regulations to secure high-value transactions. Both methods employ robust encryption protocols and authentication standards to safeguard funds and personal information during the remittance process.

Future Trends in Electronic Money Transfers

Future trends in electronic money transfers emphasize faster, more secure transactions powered by blockchain technology and digital wallets. Integration of artificial intelligence enhances fraud detection, ensuring higher protection in both EFT and wire transfers. The rise of real-time payment systems and cross-border interoperability facilitates seamless, low-cost remittances globally, transforming the electronic funds transfer landscape.

Important Terms

ACH (Automated Clearing House)

ACH (Automated Clearing House) facilitates electronic funds transfer (EFT) by batching transactions for cost-effective, secure, and standardized payments, suitable for payroll and bill payments. Wire transfers provide real-time, high-value transfers often used for urgent transactions, with higher fees and faster settlement compared to ACH payments.

SWIFT Network

SWIFT Network enables secure international Electronic Funds Transfer (EFT) by transmitting standardized financial messages between banks, ensuring seamless cross-border payments with enhanced speed and security. Unlike traditional wire transfers that rely on manual processes, SWIFT's automated messaging system reduces errors and improves tracking, making it the preferred infrastructure for global EFT transactions.

Settlement Time

Settlement time for Electronic Funds Transfer (EFT) typically ranges from one to three business days due to the batch processing used by Automated Clearing House (ACH) networks, whereas wire transfers usually settle within minutes to a few hours because they involve real-time processing through dedicated financial networks like SWIFT or Fedwire. EFT's delayed settlement is suitable for routine transactions with lower urgency, while wire transfers provide faster, nearly instantaneous fund availability essential for high-value or time-sensitive payments.

Interbank Network

Interbank networks streamline Electronic Funds Transfer (EFT) by enabling secure, real-time authorization and settlement of transactions across multiple financial institutions, enhancing convenience and speed. Wire transfers, often managed outside these networks, typically involve direct bank-to-bank communication for large, one-time transfers with higher fees and slower processing times compared to EFTs processed via interbank systems.

Fedwire

Fedwire operates as a real-time gross settlement system facilitating high-value Electronic Funds Transfers (EFT) between U.S. financial institutions, ensuring immediate finality and settlement. Unlike general wire transfers that may include consumer-initiated transactions, Fedwire specifically processes large-scale, wholesale EFT payments critical for interbank liquidity and central bank operations.

Clearing House Interbank Payments System (CHIPS)

CHIPS is a U.S.-based private clearing house that processes large-value bank-to-bank payments electronically, primarily facilitating Electronic Funds Transfers (EFT) in the form of a real-time net settlement system. Unlike traditional wire transfers that settle individually and immediately, CHIPS aggregates multiple transactions, optimizing liquidity and reducing settlement risk through netting prior to final settlement.

Routing Number

Routing numbers uniquely identify financial institutions in Electronic Funds Transfers (EFT), ensuring accurate and secure processing of automated payments and direct deposits. In contrast, wire transfers often use both routing and SWIFT codes to facilitate real-time, high-value transactions across domestic and international banks.

Payment Gateway

Payment gateways facilitate secure electronic funds transfers (EFT) by authorizing and processing online transactions directly from customers' bank accounts or credit cards, offering faster settlement and enhanced fraud protection compared to wire transfers. Wire transfers, typically used for larger, one-time transactions, involve direct bank-to-bank transfers with higher fees and longer processing times, making EFTs more efficient for routine e-commerce payments.

Transaction Finality

Transaction finality in Electronic Funds Transfer (EFT) ensures irreversible settlement once funds are debited from the sender's account, minimizing the risk of chargebacks or reversals. Wire transfers offer immediate transaction finality with guaranteed fund availability, making them ideal for high-value or time-sensitive payments.

Cross-Border Transfer

Cross-border transfers involve moving funds between banks in different countries and can be executed via Electronic Funds Transfer (EFT) or wire transfer, with wire transfers typically offering faster settlement times and higher security through encrypted messaging systems like SWIFT. EFT transactions often encompass a broader range of payment methods including Automated Clearing House (ACH) transfers, which may be slower and incur lower fees but lack the immediacy and far-reaching international network of wire transfers.

Electronic Funds Transfer (EFT) vs Wire Transfer Infographic

moneydif.com

moneydif.com