Proof of funds verifies the availability of financial resources for transactions, ensuring buyers or investors can complete payments. Source of funds identifies the original origin of the money, confirming its legality and compliance with anti-money laundering regulations. Understanding the distinction between proof of funds and source of funds is essential for transparent and secure remittance processes.

Table of Comparison

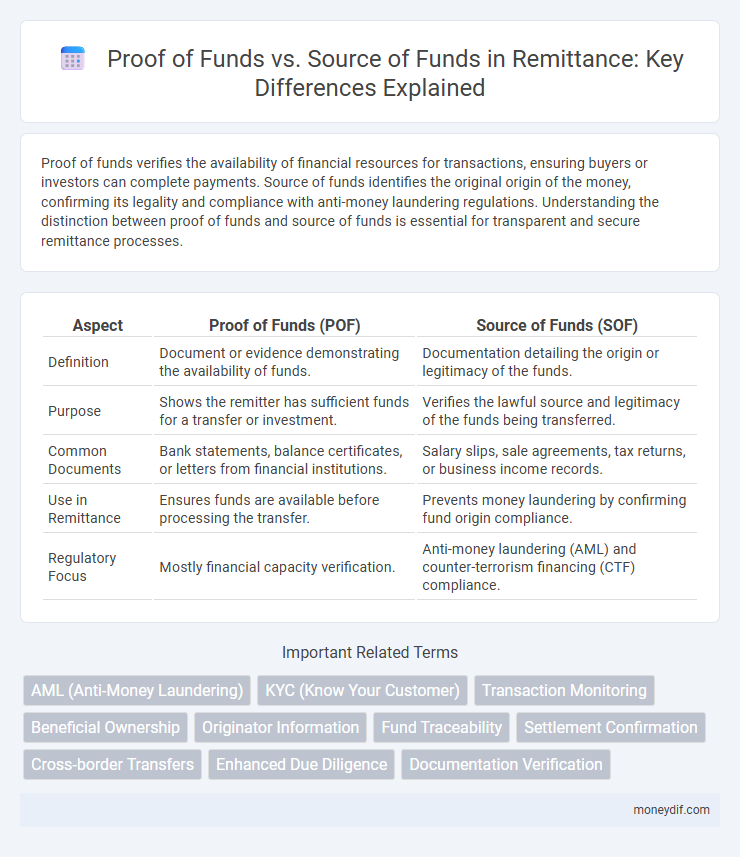

| Aspect | Proof of Funds (POF) | Source of Funds (SOF) |

|---|---|---|

| Definition | Document or evidence demonstrating the availability of funds. | Documentation detailing the origin or legitimacy of the funds. |

| Purpose | Shows the remitter has sufficient funds for a transfer or investment. | Verifies the lawful source and legitimacy of the funds being transferred. |

| Common Documents | Bank statements, balance certificates, or letters from financial institutions. | Salary slips, sale agreements, tax returns, or business income records. |

| Use in Remittance | Ensures funds are available before processing the transfer. | Prevents money laundering by confirming fund origin compliance. |

| Regulatory Focus | Mostly financial capacity verification. | Anti-money laundering (AML) and counter-terrorism financing (CTF) compliance. |

Understanding Proof of Funds in Remittance

Proof of Funds in remittance refers to the documentation or evidence that verifies the availability of the funds intended for transfer, such as bank statements, pay slips, or investment account details. This verification is essential to ensure compliance with anti-money laundering (AML) regulations and to build trust between remittance service providers and recipients. Understanding Proof of Funds helps streamline the transaction process by confirming that the sender possesses legitimate, accessible money for remittance purposes.

Defining Source of Funds in Money Transfers

Source of Funds in money transfers refers to the origin of the money being transferred, ensuring that the funds come from legitimate and verifiable activities such as salary, business income, or savings. This verification is critical for compliance with anti-money laundering (AML) regulations and helps prevent illegal activities like fraud or terrorism financing. Establishing a clear Source of Funds requires documentation such as bank statements, payslips, or tax records to confirm the legality and traceability of the transferred money.

Key Differences: Proof of Funds vs Source of Funds

Proof of Funds verifies the availability of financial assets to complete a transaction, typically through bank statements or financial guarantees. Source of Funds traces the origin of the money, ensuring legality and compliance by documenting income sources such as salary, investments, or business profits. Understanding these distinctions is crucial for remittance compliance and anti-money laundering (AML) regulations enforcement.

Why Banks Require Proof of Funds for Remittance

Banks require proof of funds for remittance to verify the legitimacy and availability of the sender's funds, ensuring compliance with anti-money laundering (AML) regulations and preventing fraudulent transactions. Proof of funds confirms that the remitter has sufficient balance or assets to cover the transfer amount, reducing the risk of financial crime and protecting both the bank and recipient. This requirement distinguishes from source of funds, which explains the origin of the money, whereas proof of funds confirms the actual presence of those funds at the time of remittance.

Importance of Source of Funds for Compliance and Security

Source of funds verification is crucial for compliance with anti-money laundering (AML) regulations and combating the financing of terrorism (CFT) laws in remittance transactions. Ensuring the legitimacy of the source of funds protects financial institutions from facilitating illicit activities and reduces the risk of fraud. This process enhances overall security by providing transparency and traceability in fund transfers, which is vital for regulatory adherence and maintaining trust in cross-border remittances.

Common Documents for Proof of Funds in Remittance

Common documents for proof of funds in remittance include bank statements, salary slips, tax returns, and certified financial statements, which verify the availability of funds for transfer. These documents demonstrate that the sender possesses sufficient financial resources and comply with regulatory requirements to prevent money laundering. Accurate proof of funds supports transparent and secure remittance transactions by providing verifiable evidence of money ownership.

How to Demonstrate Source of Funds Effectively

Demonstrating source of funds effectively requires presenting verifiable documentation such as bank statements, salary slips, tax returns, or business financial records that clearly trace the origin of the money. Detailed invoices, contracts, or investment portfolios also serve as strong evidence to substantiate the legality of the funds. Ensuring transparency and accuracy in these documents helps comply with anti-money laundering regulations and facilitates smoother remittance processes.

Regulatory Framework: Laws Governing Fund Verification

Proof of funds and source of funds are critical components in remittance compliance, governed by stringent regulatory frameworks such as the Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) laws enforced by financial authorities worldwide. Regulators require remittance service providers to verify both documents demonstrating availability of funds and the legitimate origin of those funds to prevent illicit activities and ensure transparency. These legal mandates are embedded in frameworks like the Financial Action Task Force (FATF) recommendations, which set global standards for verifying fund legitimacy through customer due diligence and ongoing transaction monitoring.

Risks of Inadequate Proof or Source of Funds

Inadequate proof of funds or source of funds in remittance transactions significantly increases the risk of money laundering, fraud, and regulatory non-compliance. Financial institutions may face severe penalties, reputational damage, and disrupted operations when obligations under anti-money laundering (AML) and counter-terrorism financing (CTF) regulations are not met. Thorough verification processes and robust documentation are essential to mitigate these risks and ensure transaction legitimacy.

Best Practices for Remittance Documentation

Best practices for remittance documentation emphasize providing both Proof of Funds and Source of Funds to ensure compliance and transparency. Proof of Funds verifies the availability of funds through bank statements or financial records, while Source of Funds clarifies the origin, such as salary, business income, or inheritance, supported by official documents like pay slips or contracts. Accurate and detailed documentation reduces the risk of money laundering and facilitates smooth transaction processing by financial institutions.

Important Terms

AML (Anti-Money Laundering)

AML protocols require thorough verification of both Proof of Funds, which confirms the existence of funds for a transaction, and Source of Funds, which traces the origin and legality of the money. Regulatory agencies emphasize the distinction to prevent financial crimes by ensuring funds are not only available but also derived from legitimate activities.

KYC (Know Your Customer)

KYC (Know Your Customer) processes require verification of both Proof of Funds and Source of Funds to ensure financial legitimacy and compliance with anti-money laundering regulations. Proof of Funds demonstrates the availability of financial resources, while Source of Funds explains the origin of those finances, enabling institutions to assess risk accurately.

Transaction Monitoring

Transaction monitoring distinguishes Proof of Funds as documentation verifying the availability of funds for a transaction, while Source of Funds identifies the origin and legitimacy of those funds to prevent money laundering. Effective monitoring integrates both elements to ensure compliance with regulatory standards and detect suspicious financial activities.

Beneficial Ownership

Beneficial ownership identifies the individuals who ultimately own or control assets, crucial for verifying Proof of Funds, which demonstrates that funds are legitimately available. Source of Funds further traces the origin of those funds to ensure compliance with anti-money laundering regulations and prevent financial crimes.

Originator Information

Originator Information includes detailed identifiers of the individual or entity initiating a transaction, crucial for compliance with anti-money laundering regulations. Proof of Funds verifies the availability of assets for a transaction, while Source of Funds traces the origin and legality of those assets to prevent illicit financial activities.

Fund Traceability

Fund traceability ensures transparency by linking Proof of Funds, which verifies the availability of money, to Source of Funds, identifying its legitimate origin. This process is critical in anti-money laundering protocols, enabling financial institutions to detect and prevent illicit financial activities.

Settlement Confirmation

Settlement confirmation requires clear documentation distinguishing between Proof of Funds, which verifies the availability of capital for a transaction, and Source of Funds, which traces the origin of the capital to ensure compliance with legal and regulatory standards. Accurate verification of both elements is critical for fraud prevention, anti-money laundering (AML) policies, and smooth financial settlement processes.

Cross-border Transfers

Cross-border transfers require accurate documentation of both proof of funds and source of funds to comply with international anti-money laundering (AML) regulations and financial transparency standards. Proof of funds verifies the availability of transfer funds, while source of funds details the lawful origin, ensuring legitimacy and reducing risks of fraud or illicit activities.

Enhanced Due Diligence

Enhanced Due Diligence (EDD) requires rigorous verification of both Proof of Funds (PoF) and Source of Funds (SoF) to mitigate risks of money laundering and financial fraud. PoF confirms the availability of funds for a transaction, while SoF provides a detailed explanation of how those funds were acquired, ensuring compliance with regulatory standards.

Documentation Verification

Documentation verification in financial compliance ensures the authenticity of Proof of Funds by validating bank statements or investment certificates, while Source of Funds requires detailed records of the origin of these finances, such as salary slips, sale agreements, or inheritance documents. Accurate verification helps prevent money laundering and supports regulatory adherence by confirming that funds are legitimate and traceable.

Proof of Funds vs Source of Funds Infographic

moneydif.com

moneydif.com